This version of the form is not currently in use and is provided for reference only. Download this version of

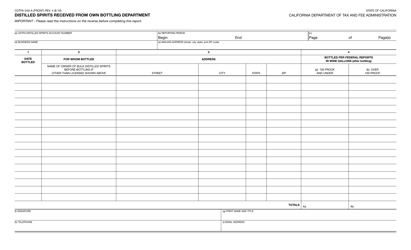

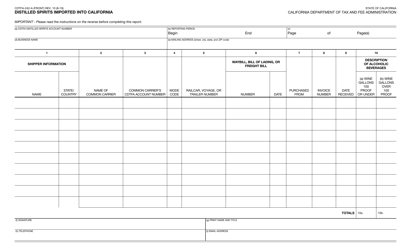

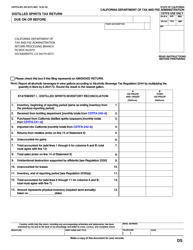

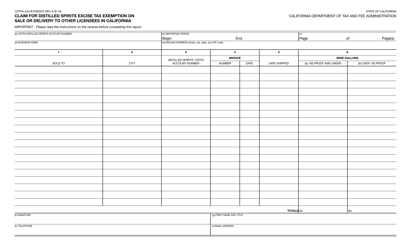

Form CDTFA-241-A

for the current year.

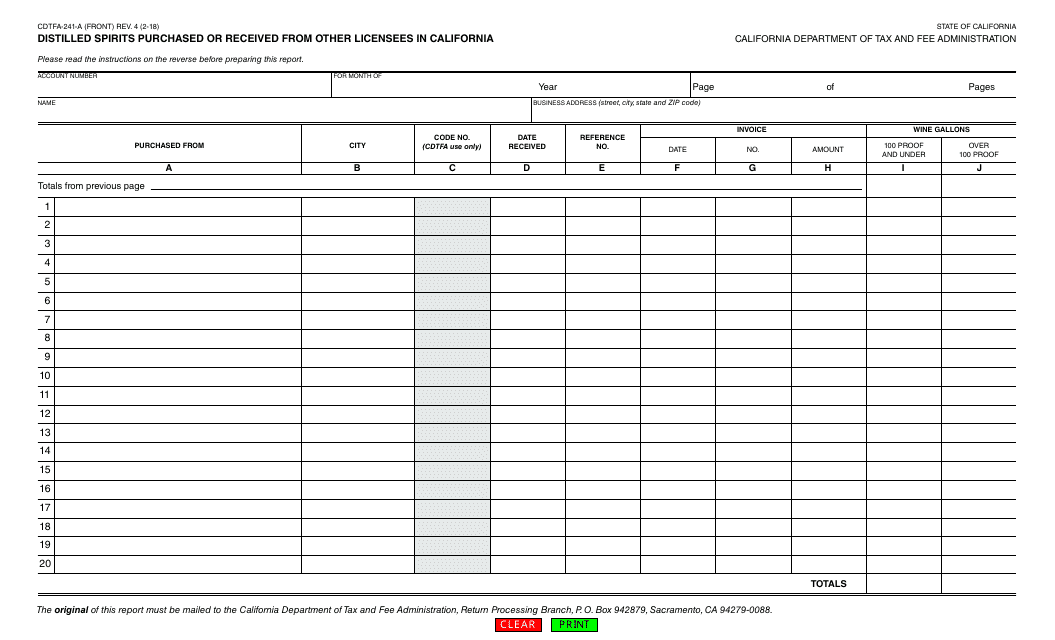

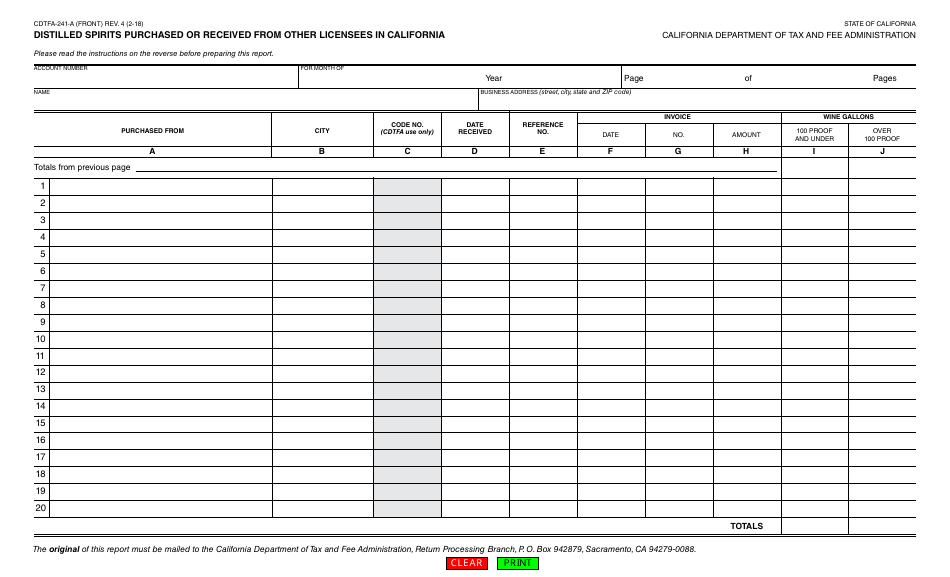

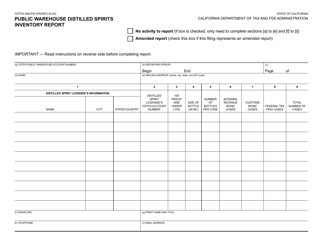

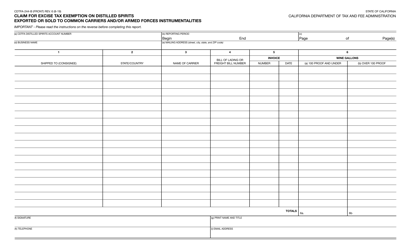

Form CDTFA-241-A Distilled Spirits Purchased or Received From Other Licensees in California - California

What Is Form CDTFA-241-A?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CDTFA-241-A used for?

A: Form CDTFA-241-A is used to report distilled spirits purchased or received from other licensees in California.

Q: Who should file Form CDTFA-241-A?

A: Any licensee who purchases or receives distilled spirits from other licensees in California should file Form CDTFA-241-A.

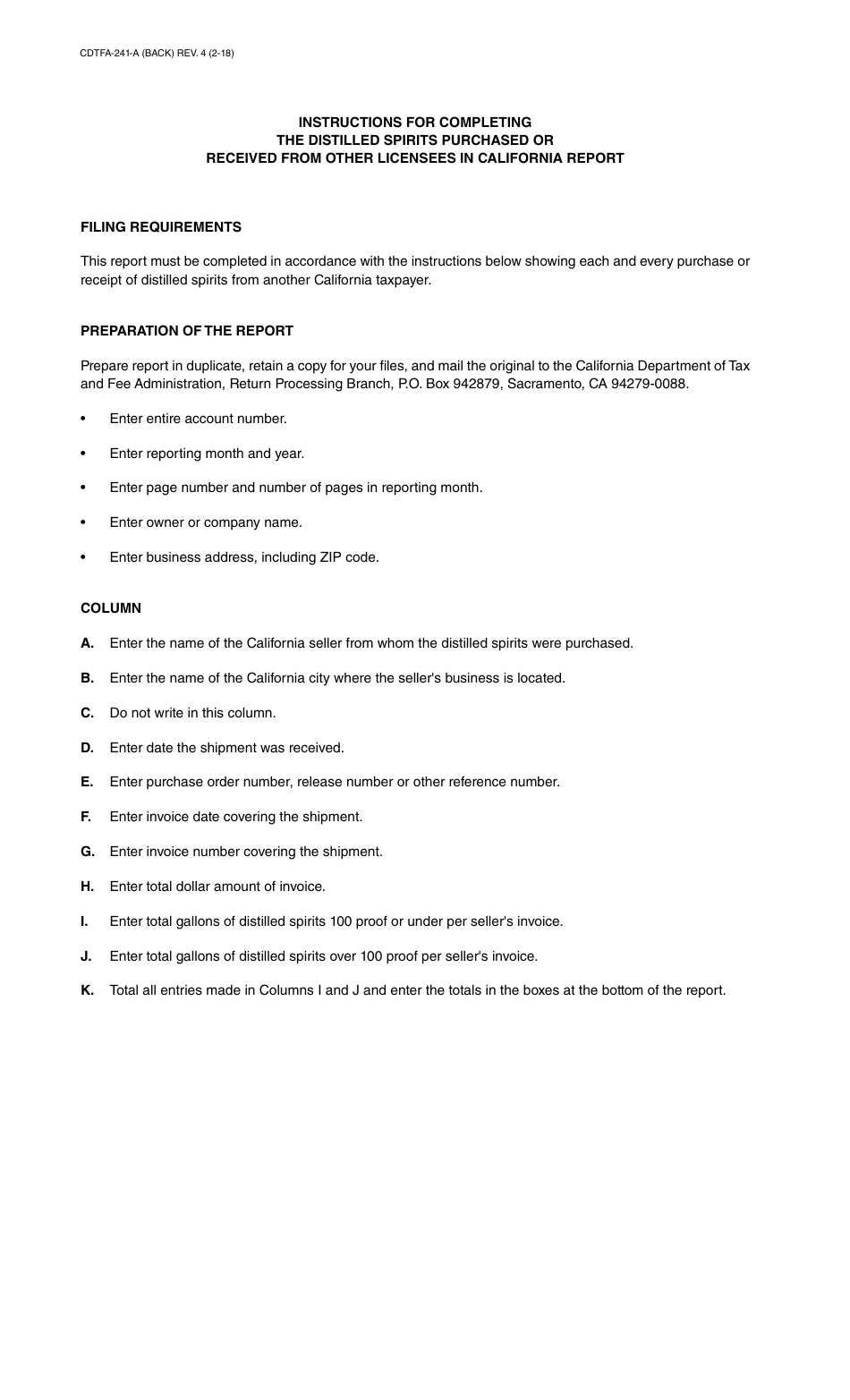

Q: What information is required on Form CDTFA-241-A?

A: Form CDTFA-241-A requires information about the licensee, the distilled spirits purchased or received, and the seller or transferor.

Q: When is Form CDTFA-241-A due?

A: Form CDTFA-241-A is due on the 20th day of the month following the close of the reporting period.

Q: Are there any penalties for late filing of Form CDTFA-241-A?

A: Yes, there are penalties for late filing of Form CDTFA-241-A. It is important to file the form on time to avoid any penalties or interest charges.

Q: Can I claim a credit for taxes paid on purchases of distilled spirits on Form CDTFA-241-A?

A: No, Form CDTFA-241-A is only used to report distilled spirits purchased or received. Any taxes paid on those purchases should be claimed on your sales and use tax return.

Q: What should I do if I made an error on my Form CDTFA-241-A?

A: If you made an error on your Form CDTFA-241-A, you should file an amended form as soon as possible to correct the error.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-241-A by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.