This version of the form is not currently in use and is provided for reference only. Download this version of

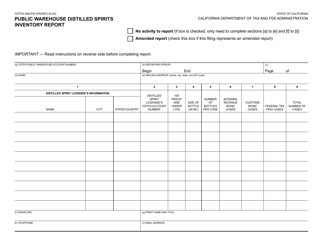

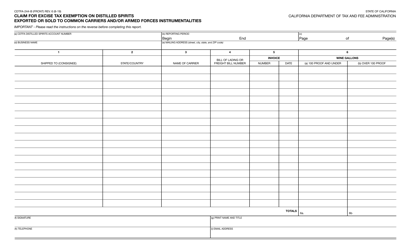

Form CDTFA-242-A

for the current year.

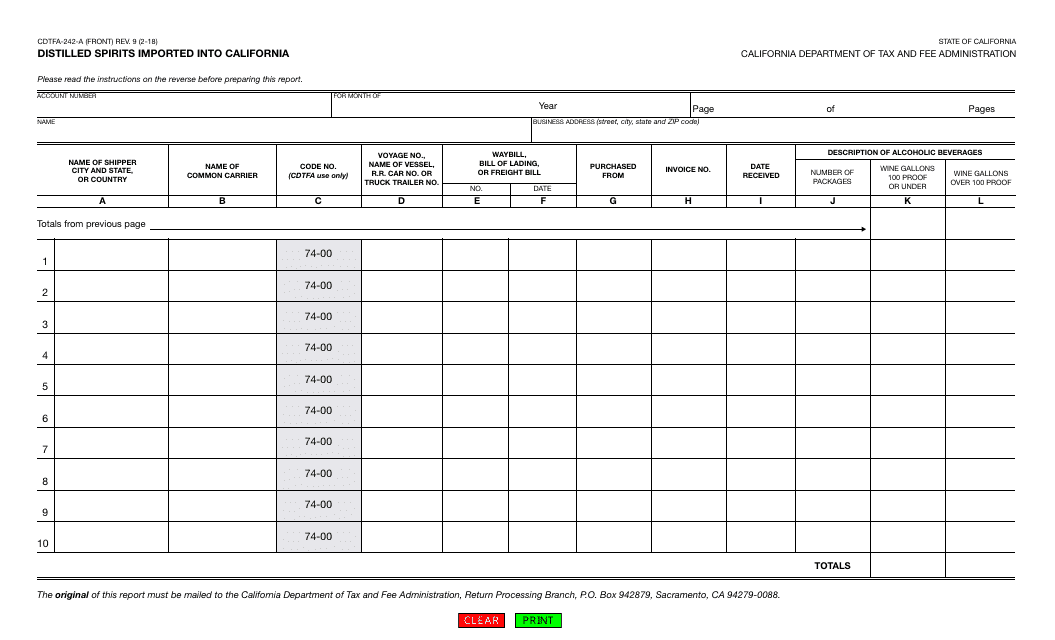

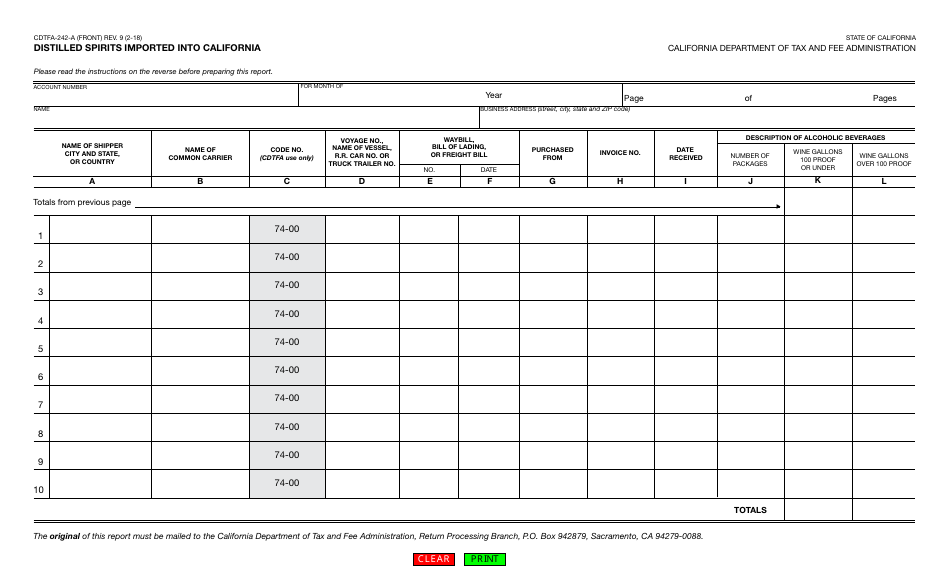

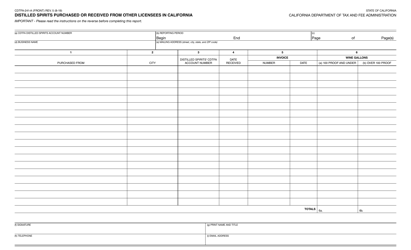

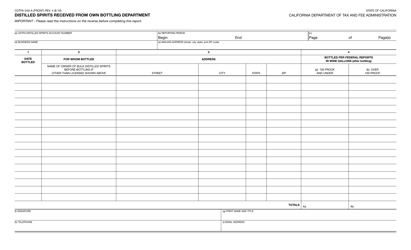

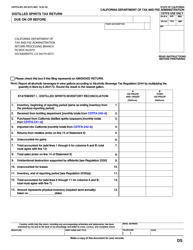

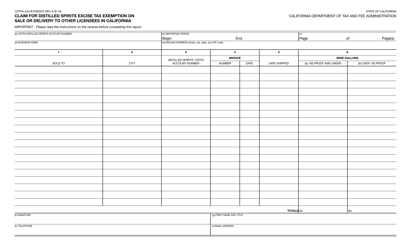

Form CDTFA-242-A Distilled Spirits Imported Into California - California

What Is Form CDTFA-242-A?

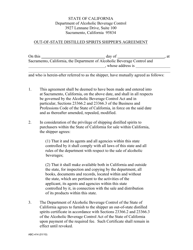

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is form CDTFA-242-A?

A: Form CDTFA-242-A is a form used for reporting distilled spirits imported into California.

Q: Who needs to file form CDTFA-242-A?

A: Any person or business that imports distilled spirits into California needs to file form CDTFA-242-A.

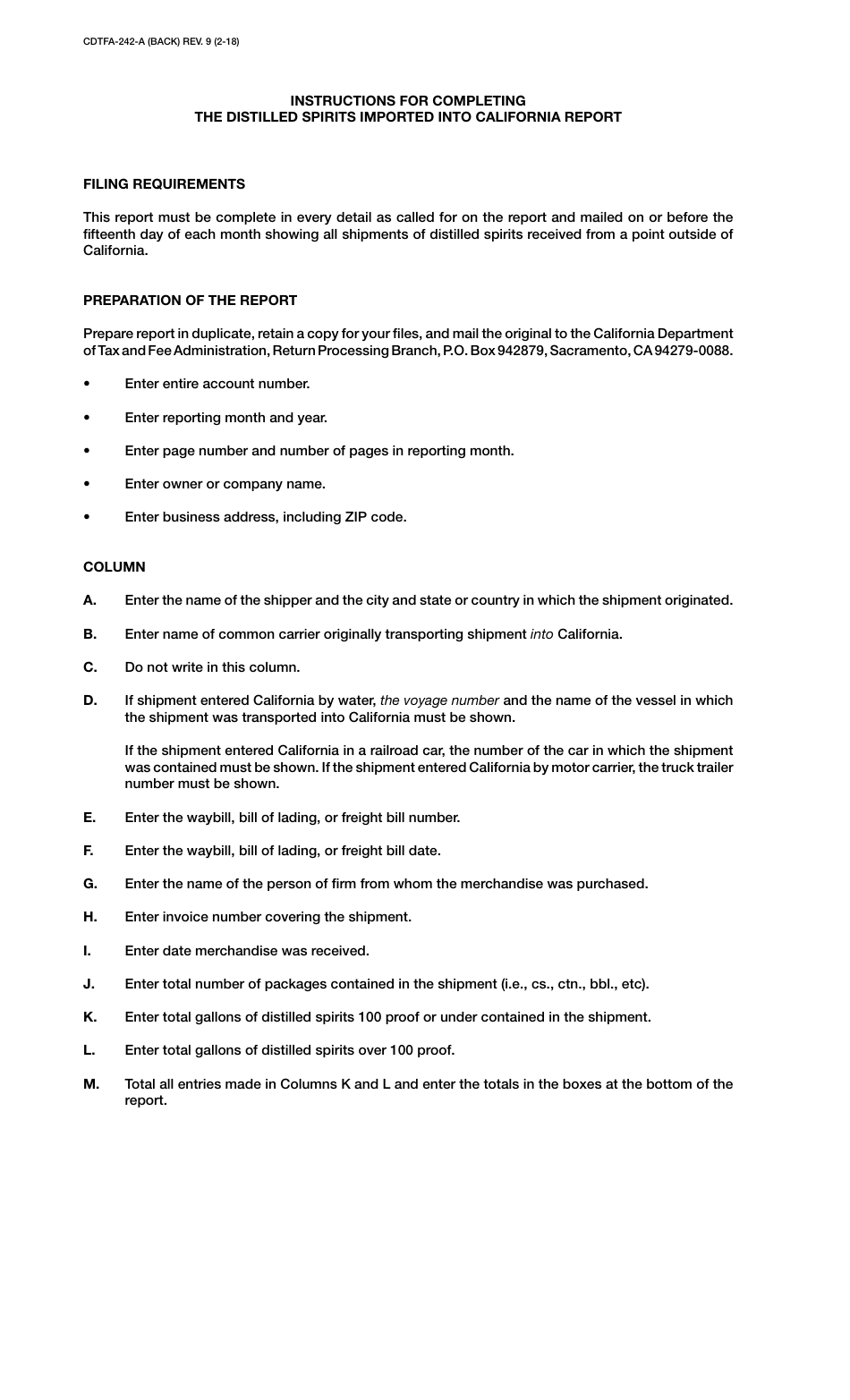

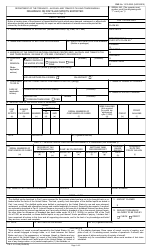

Q: What information is required on form CDTFA-242-A?

A: Form CDTFA-242-A requires information such as the name and address of the importer, the type and quantity of distilled spirits imported, and the source of the spirits.

Q: When is form CDTFA-242-A due?

A: Form CDTFA-242-A is due on or before the 15th day of the month following the month in which the distilled spirits were imported.

Q: Is there a fee for filing form CDTFA-242-A?

A: No, there is no fee for filing form CDTFA-242-A.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-242-A by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.