This version of the form is not currently in use and is provided for reference only. Download this version of

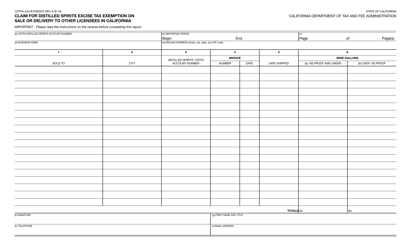

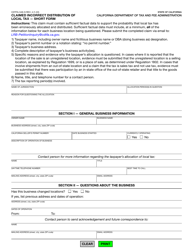

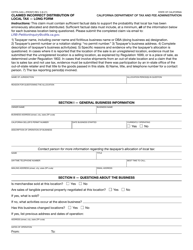

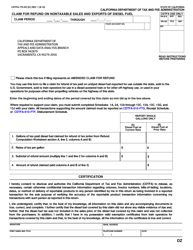

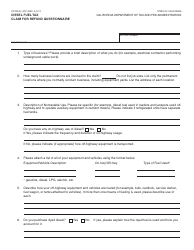

Form CDTFA-244-B

for the current year.

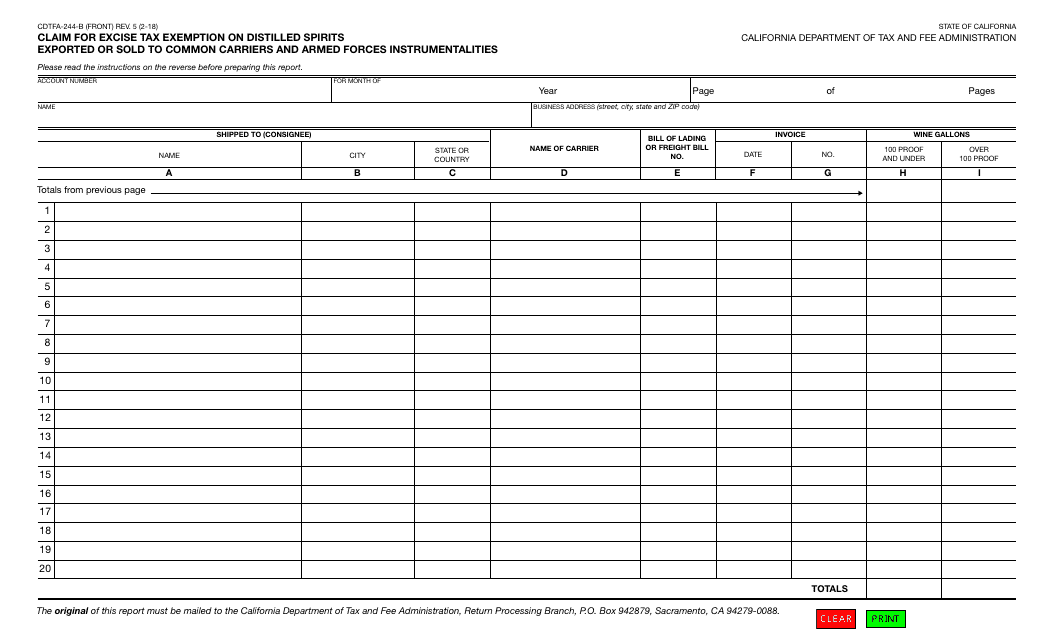

Form CDTFA-244-B Claim for Excise Tax Exemption on Distilled Spirits Exported or Sold to Common Carriers and Armed Forces Instrumentalities - California

What Is Form CDTFA-244-B?

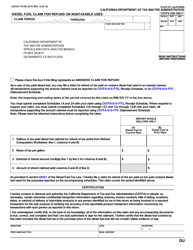

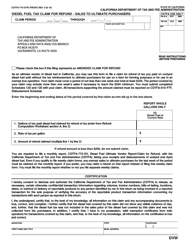

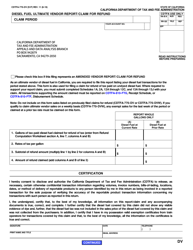

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is form CDTFA-244-B?

A: Form CDTFA-244-B is a claim for excise tax exemption on distilled spirits exported or sold to common carriers and armed forces instrumentalities in California.

Q: Who can use form CDTFA-244-B?

A: Distilled spirits manufacturers and importers who intend to export or sell distilled spirits to common carriers or armed forces instrumentalities in California can use form CDTFA-244-B.

Q: What is the purpose of form CDTFA-244-B?

A: The purpose of form CDTFA-244-B is to claim an exemption from excise tax on distilled spirits that are exported or sold to common carriers or armed forces instrumentalities in California.

Q: How can I use form CDTFA-244-B?

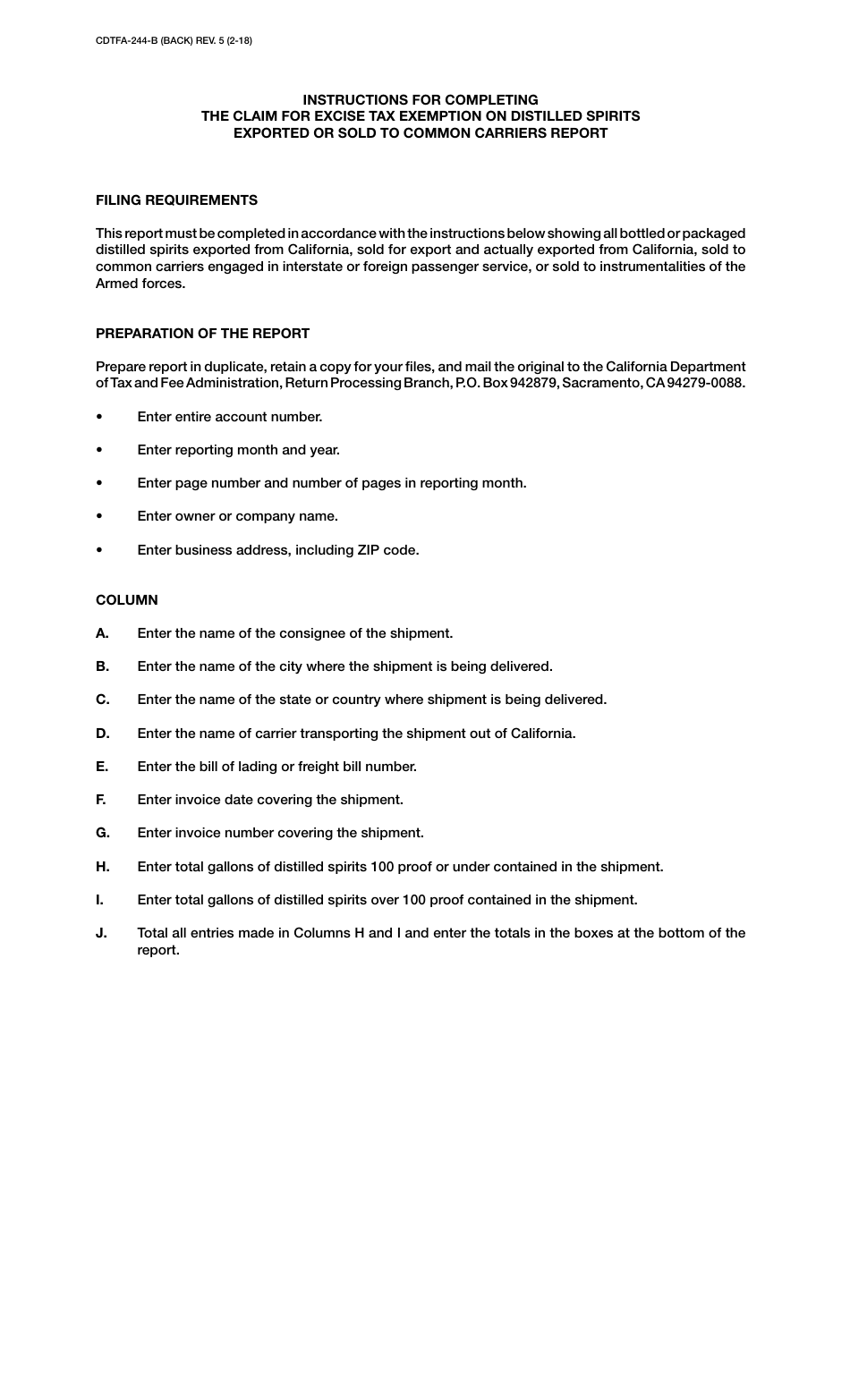

A: You can use form CDTFA-244-B by completing it with the required information and submitting it to the California Department of Tax and Fee Administration (CDTFA).

Q: Are there any fees associated with form CDTFA-244-B?

A: No, there are no fees associated with form CDTFA-244-B.

Q: Are there any specific requirements for using form CDTFA-244-B?

A: Yes, there are specific requirements for using form CDTFA-244-B. These requirements include providing the necessary documentation and meeting the eligibility criteria for the excise tax exemption.

Q: What should I do after submitting form CDTFA-244-B?

A: After submitting form CDTFA-244-B, you should keep a copy of the form and any supporting documents for your records.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-244-B by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.