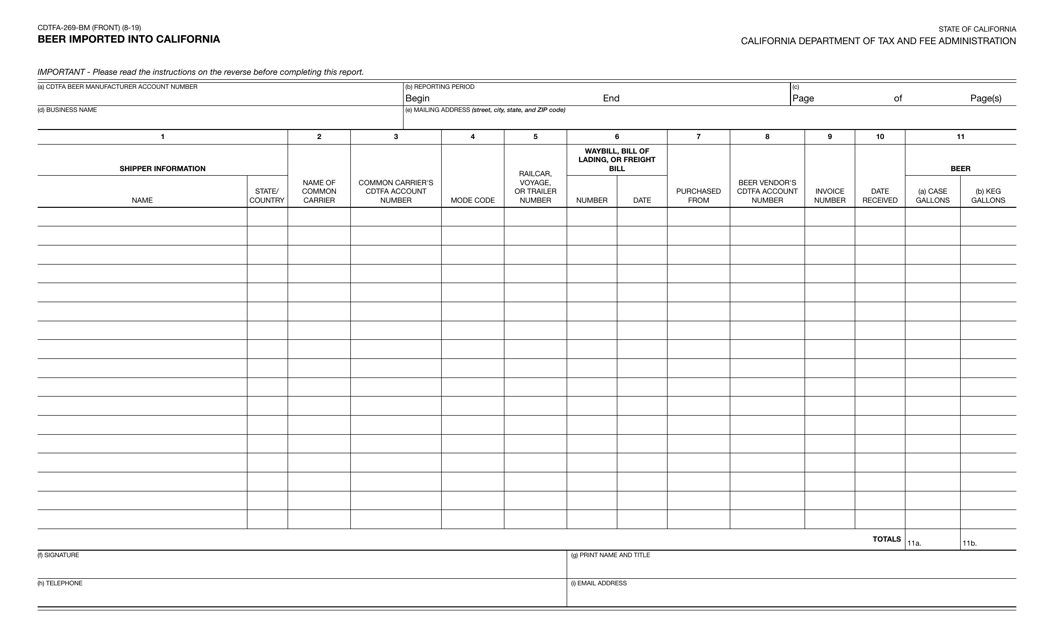

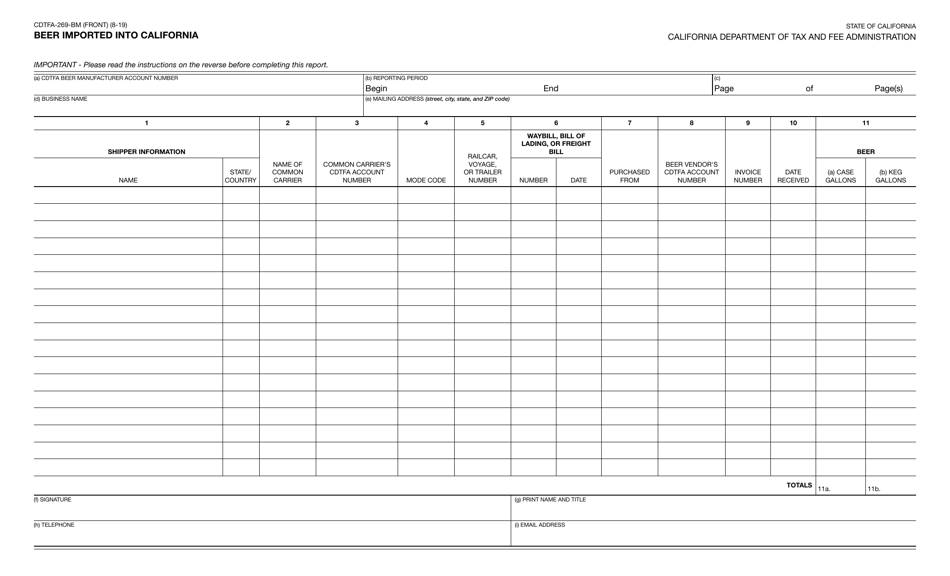

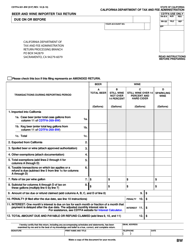

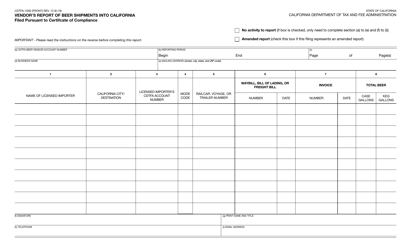

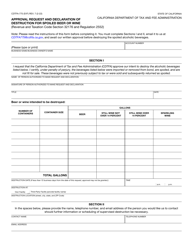

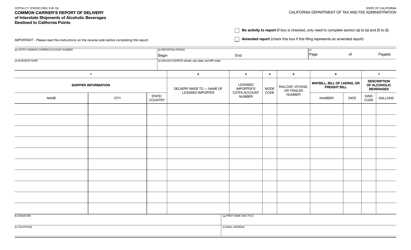

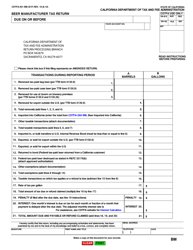

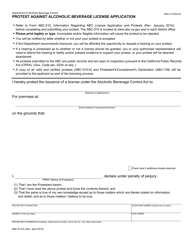

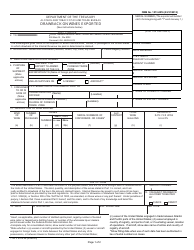

Form CDTFA-269-BM Beer Imported Into California - California

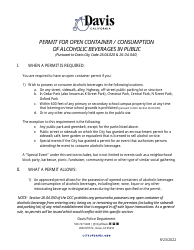

What Is Form CDTFA-269-BM?

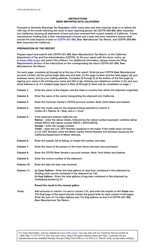

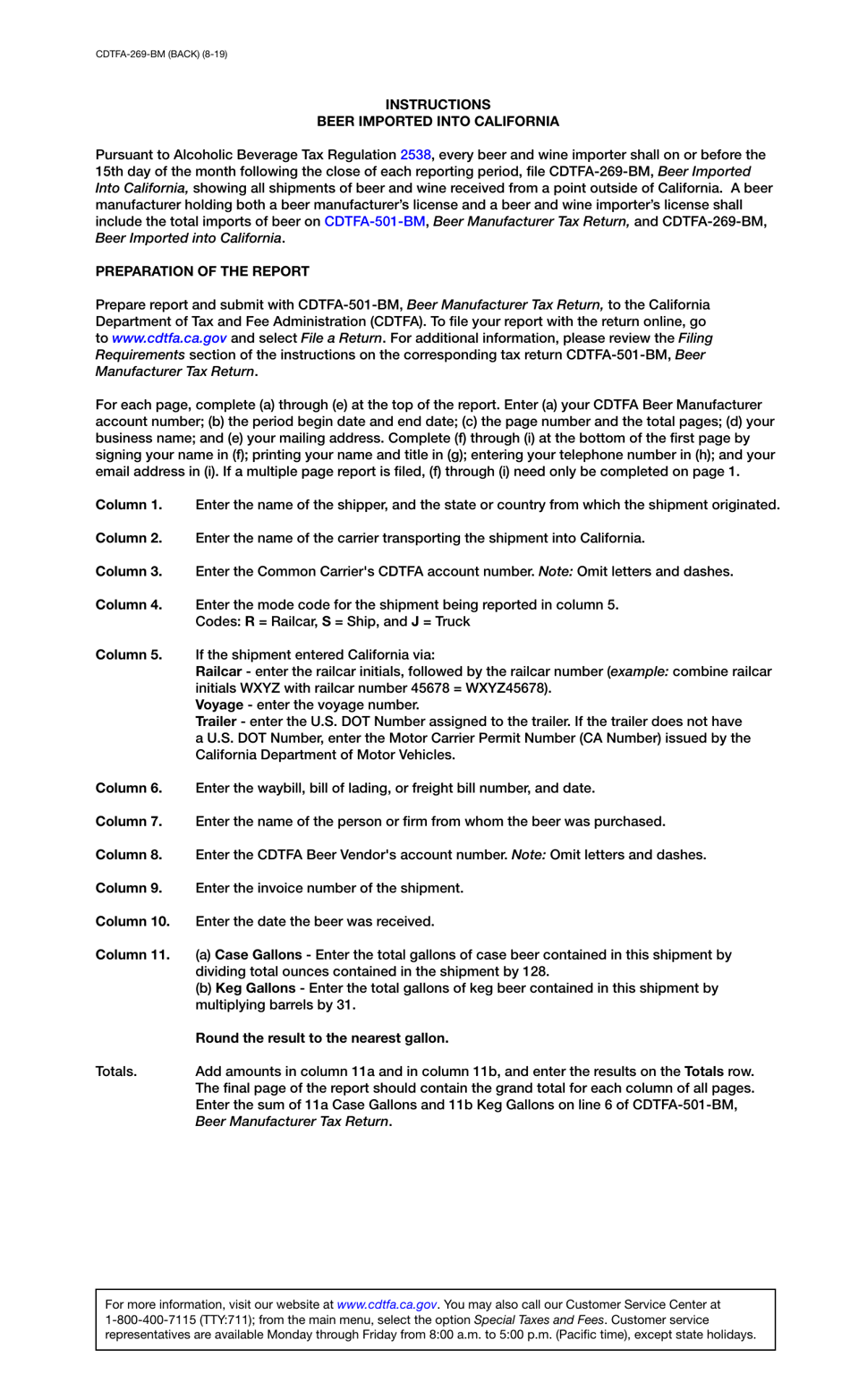

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is CDTFA-269-BM?

A: CDTFA-269-BM is a form used for reporting the importation of beer into California.

Q: Who needs to use form CDTFA-269-BM?

A: Any individual or business that imports beer into California needs to use form CDTFA-269-BM.

Q: Why do I need to report the importation of beer into California?

A: Reporting the importation of beer into California is required to comply with the state's tax and regulatory laws.

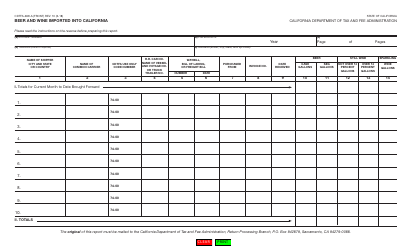

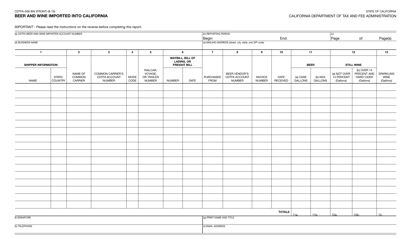

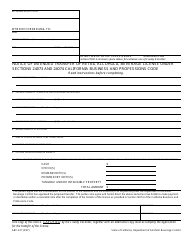

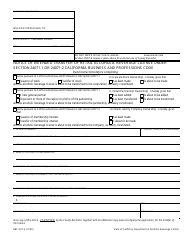

Q: What information is required on form CDTFA-269-BM?

A: Form CDTFA-269-BM requires information such as the name and address of the importer, details of the beer being imported, and the amount of tax due.

Q: Is there a deadline for filing form CDTFA-269-BM?

A: Yes, form CDTFA-269-BM must be filed on a quarterly basis, and the deadlines for filing are specified by the CDTFA.

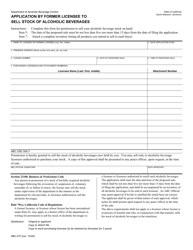

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-269-BM by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.