This version of the form is not currently in use and is provided for reference only. Download this version of

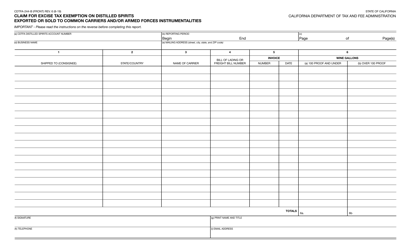

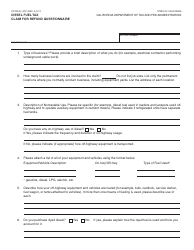

Form CDTFA-243-B

for the current year.

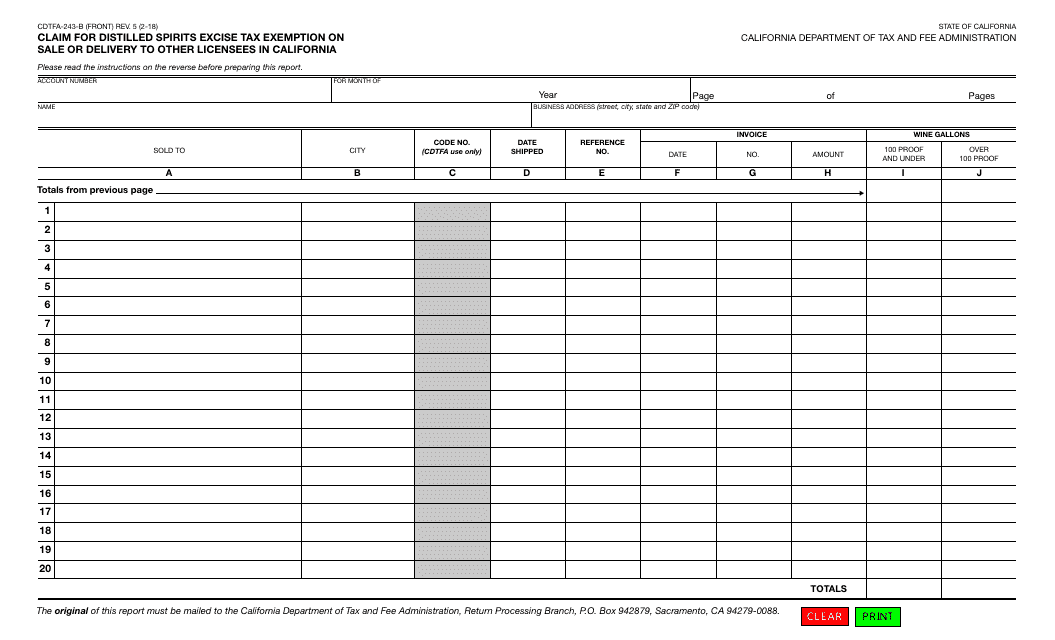

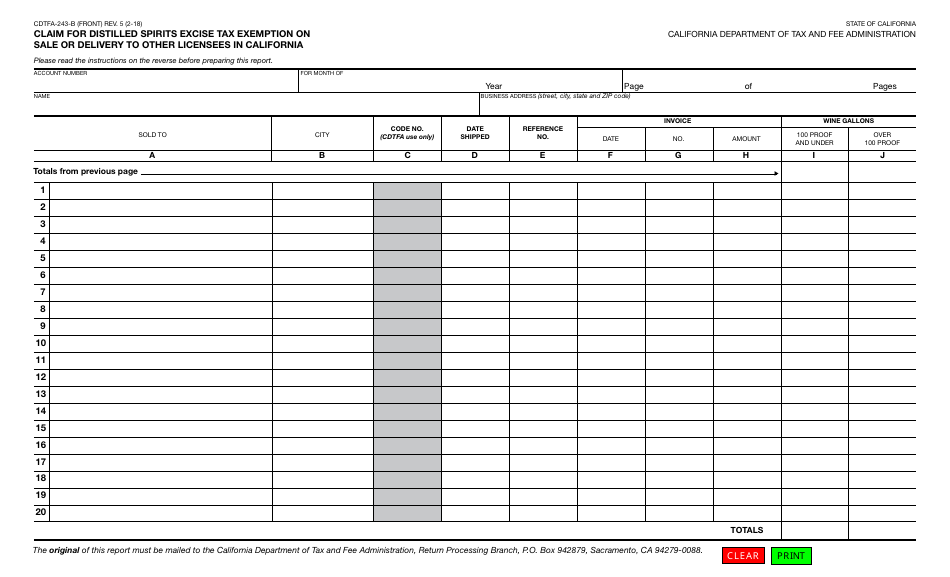

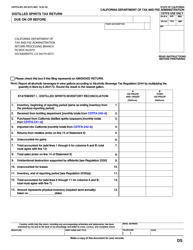

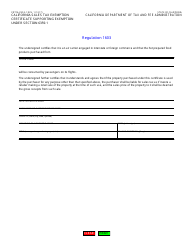

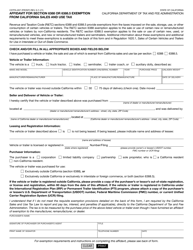

Form CDTFA-243-B Claim for Distilled Spirits Excise Tax Exemption on Sale or Delivery to Other Licensees in California - California

What Is Form CDTFA-243-B?

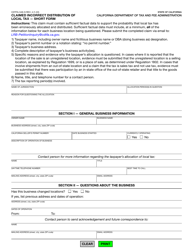

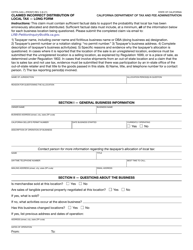

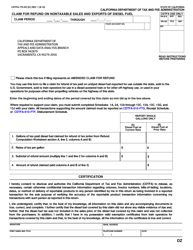

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is form CDTFA-243-B?

A: Form CDTFA-243-B is a form used to claim a distilled spirits excise tax exemption on sales or deliveries to other licensees in California.

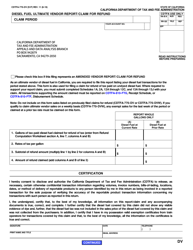

Q: Who can use form CDTFA-243-B?

A: Licensed sellers or manufacturers of distilled spirits in California can use form CDTFA-243-B.

Q: What is the purpose of form CDTFA-243-B?

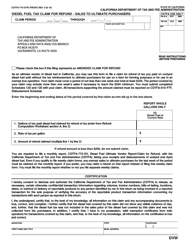

A: The purpose of form CDTFA-243-B is to claim an exemption from excise tax on distilled spirits when selling or delivering to other licensees in California.

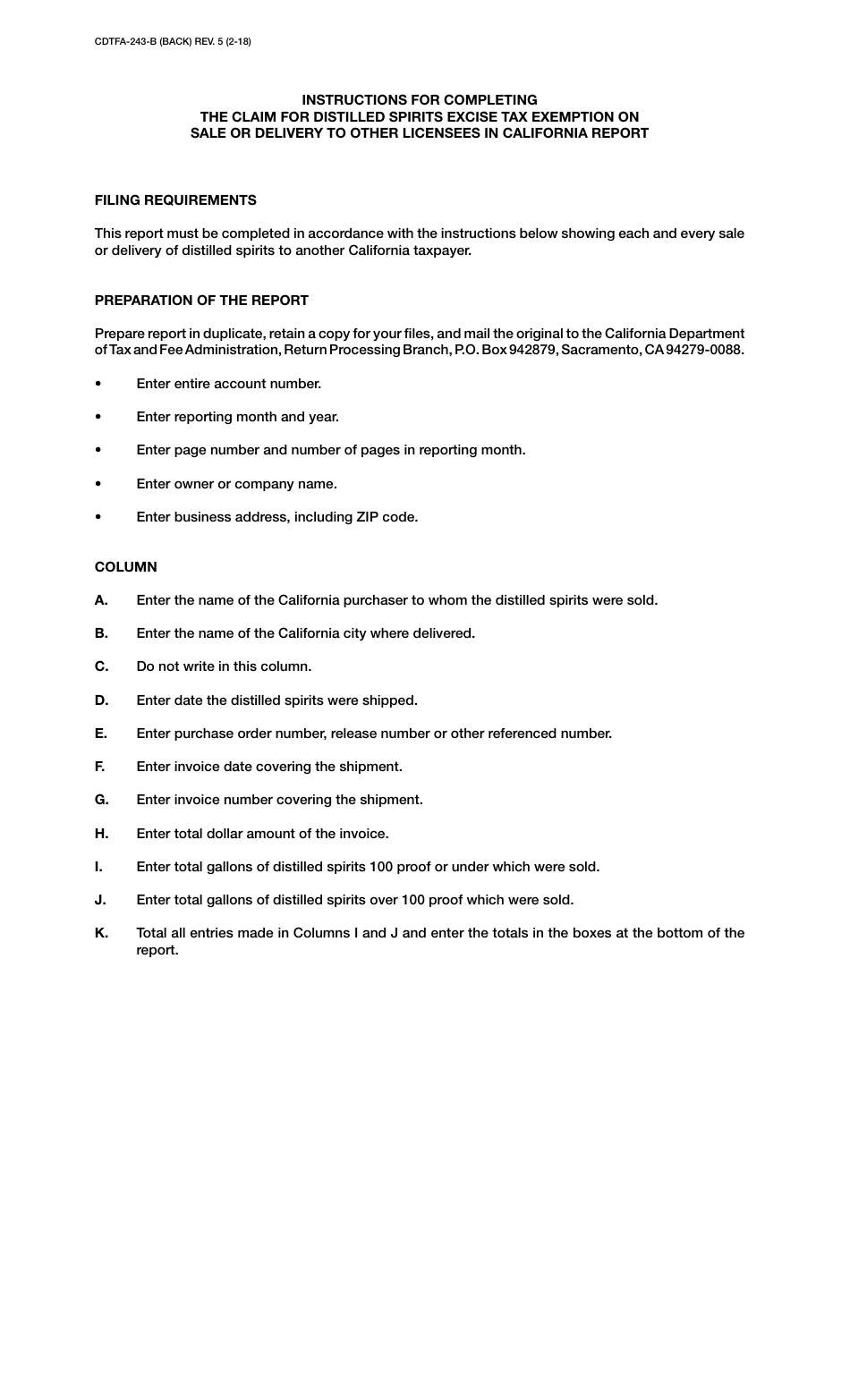

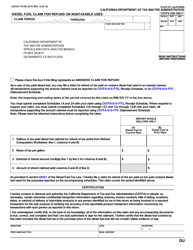

Q: How do I fill out form CDTFA-243-B?

A: To fill out form CDTFA-243-B, you will need to provide your license number, the buyer's license number, the date of sale or delivery, the type and quantity of distilled spirits, and other related information.

Q: Are there any fees associated with submitting form CDTFA-243-B?

A: No, there are no fees associated with submitting form CDTFA-243-B.

Q: Is there a deadline for submitting form CDTFA-243-B?

A: Form CDTFA-243-B should be submitted within 30 days of the sale or delivery of the distilled spirits.

Q: What should I do if I need help with form CDTFA-243-B?

A: If you need assistance with form CDTFA-243-B, you can contact the California Department of Tax and Fee Administration for guidance.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-243-B by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.