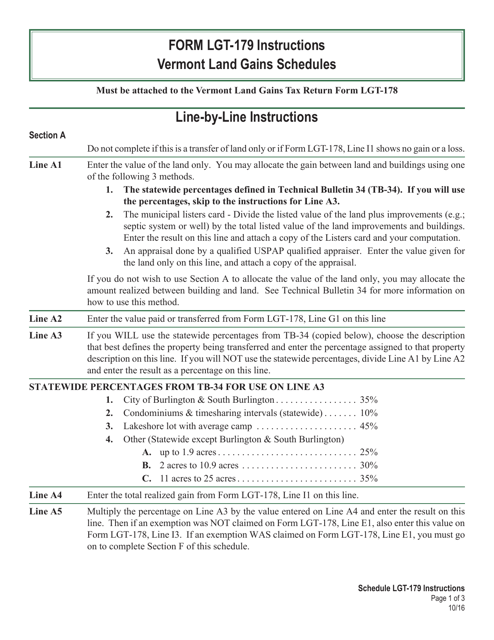

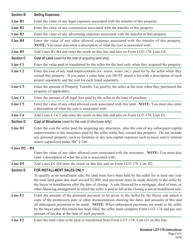

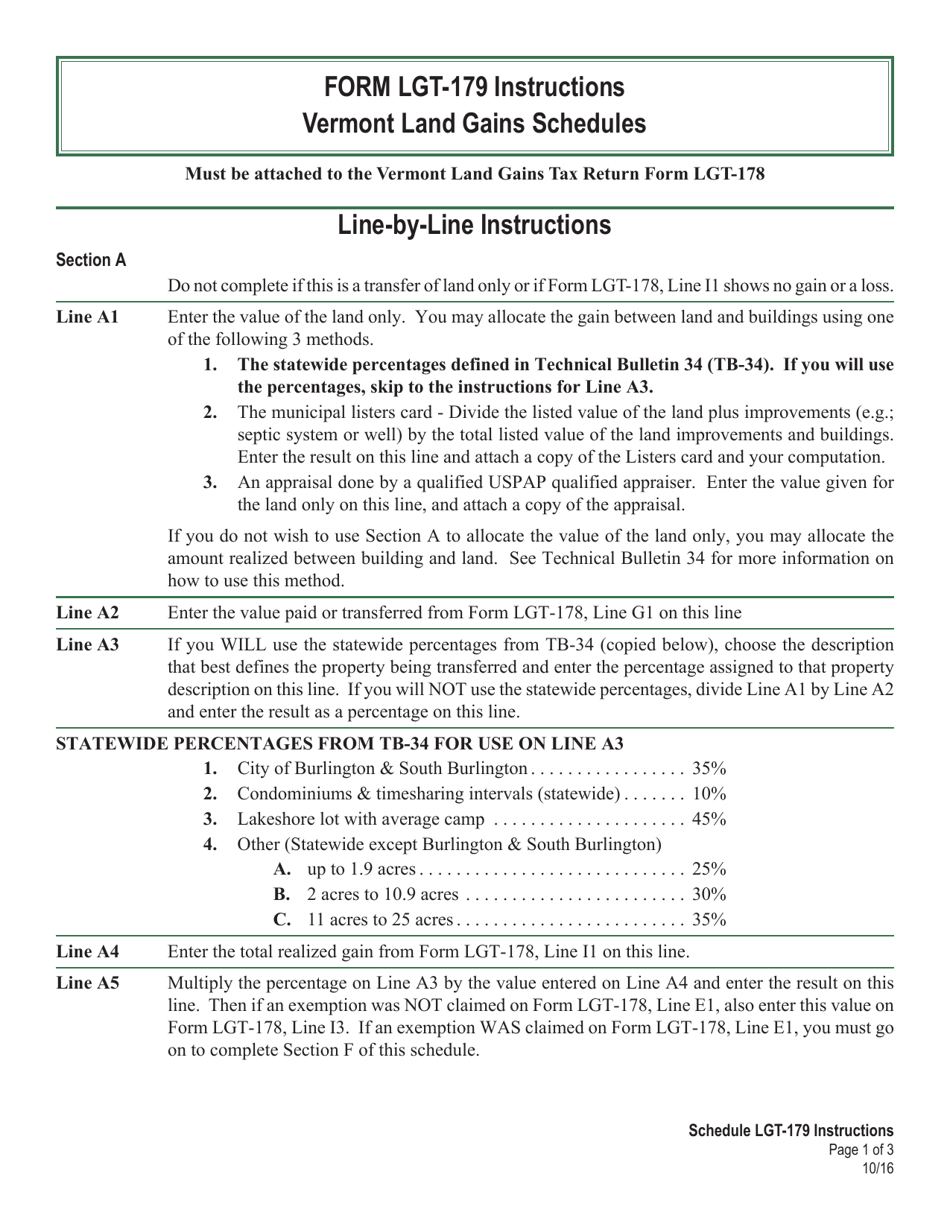

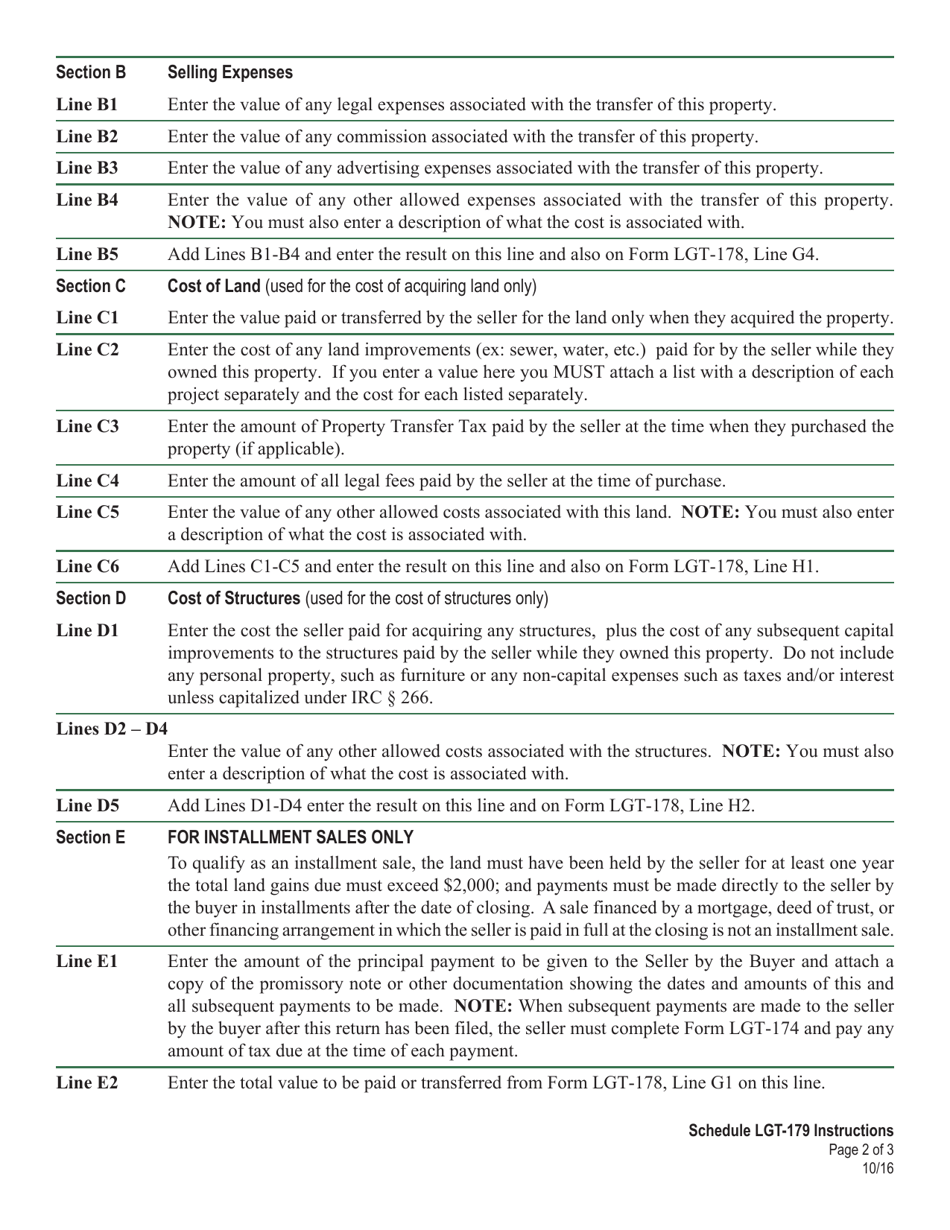

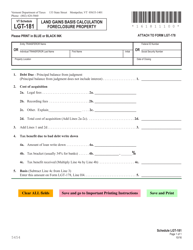

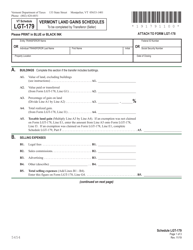

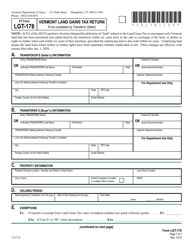

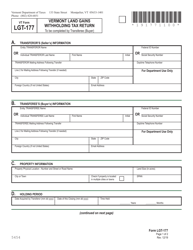

Instructions for VT Form LGT-179 Vermont Land Gains Schedules - Vermont

This document contains official instructions for VT Form LGT-179 , Vermont Land Gains Schedules - a form released and collected by the Vermont Department of Taxes.

FAQ

Q: What is VT Form LGT-179?

A: VT Form LGT-179 is the Vermont Land Gains Schedules form.

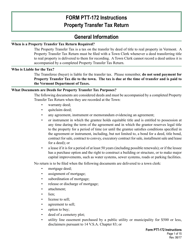

Q: What are the Vermont Land Gains Schedules used for?

A: The Vermont Land Gains Schedules are used to report the gains or losses from the sale or transfer of real property in Vermont.

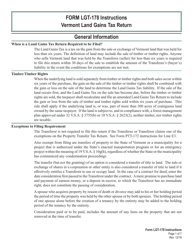

Q: Who needs to file VT Form LGT-179?

A: Anyone who has made a gain or loss from the sale or transfer of real property in Vermont needs to file VT Form LGT-179.

Q: What information is needed to complete VT Form LGT-179?

A: To complete VT Form LGT-179, you will need information such as the date of sale or transfer, description of the property, and the amount of gain or loss.

Q: When is the deadline to file VT Form LGT-179?

A: The deadline to file VT Form LGT-179 is usually April 15th of the year following the sale or transfer of the property, or within 30 days of the transaction if it occurred after April 15th.

Q: Are there any penalties for not filing VT Form LGT-179?

A: Yes, there can be penalties for not filing VT Form LGT-179, such as late filing penalties and interest on any unpaid taxes.

Q: Can I e-file VT Form LGT-179?

A: No, VT Form LGT-179 cannot be e-filed at this time. It must be filed by mail or delivered in person to the Vermont Department of Taxes.

Q: Is there a fee to file VT Form LGT-179?

A: There is no fee to file VT Form LGT-179.

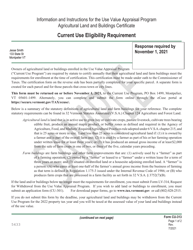

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.