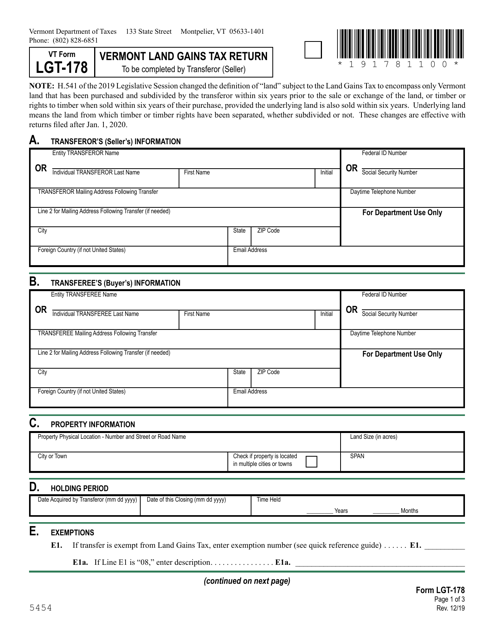

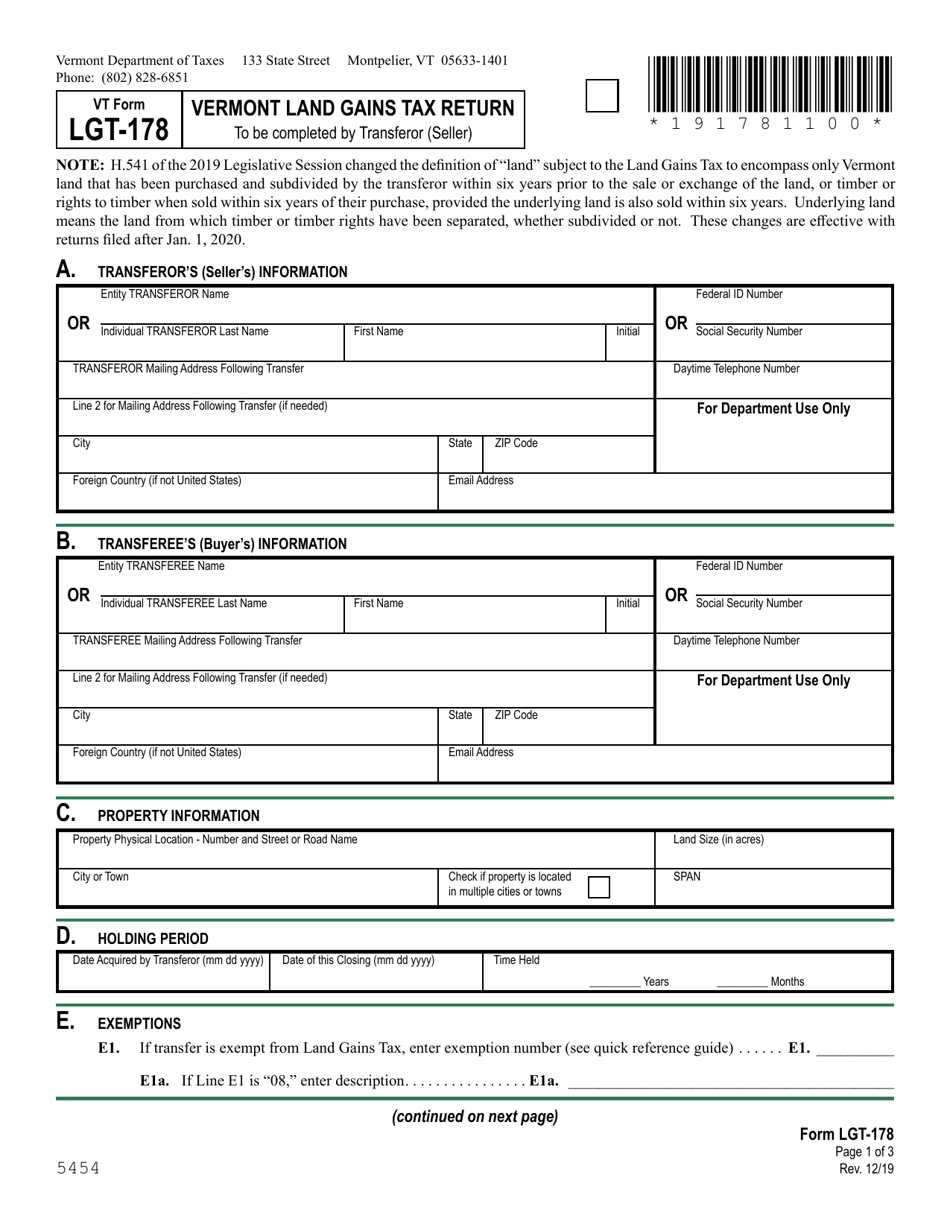

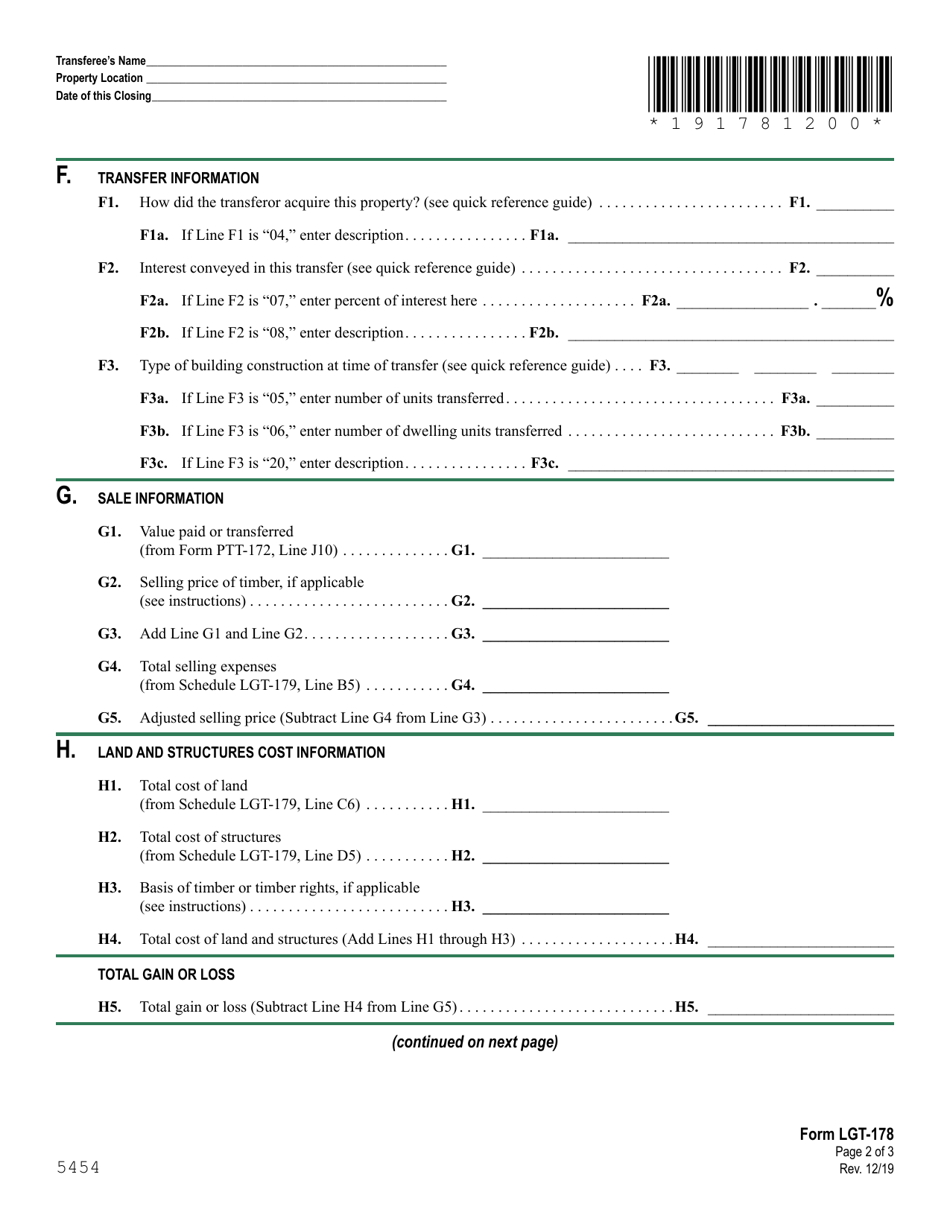

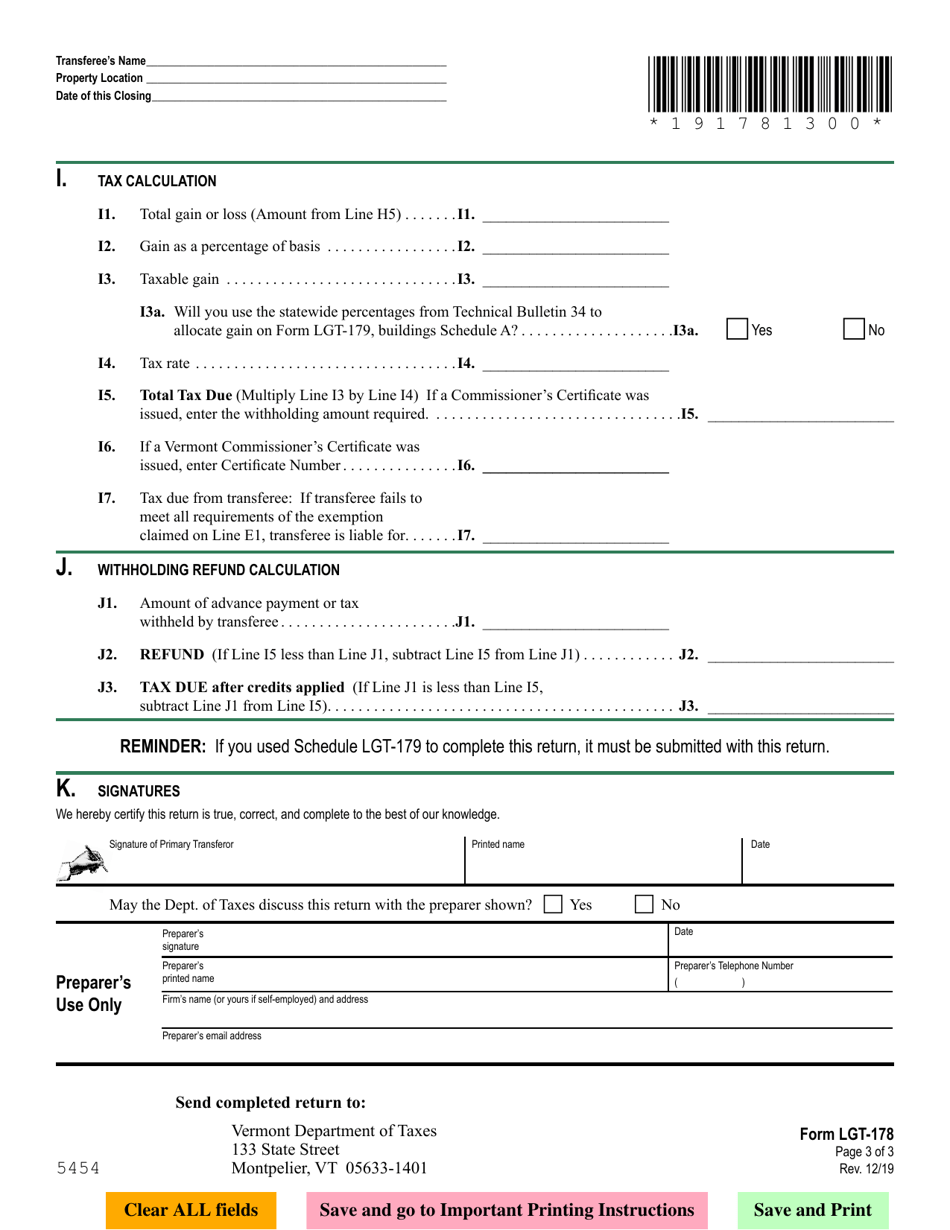

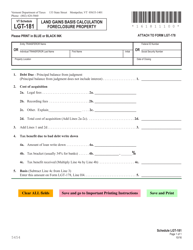

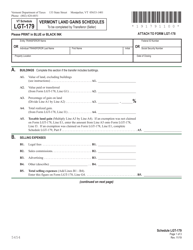

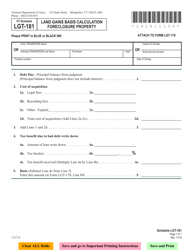

VT Form LGT-178 Vermont Land Gains Tax Return - Vermont

What Is VT Form LGT-178?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. Check the official instructions before completing and submitting the form.

FAQ

Q: What is VT Form LGT-178?

A: VT Form LGT-178 is the Vermont Land Gains Tax Return.

Q: What is the purpose of VT Form LGT-178?

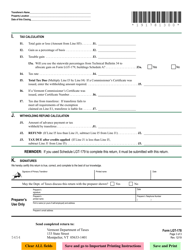

A: The purpose of VT Form LGT-178 is to report and pay the Vermont Land Gains Tax.

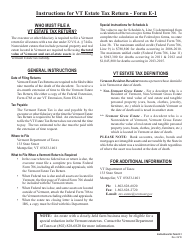

Q: Who needs to file VT Form LGT-178?

A: Anyone who has incurred a gain from the sale of Vermont land may need to file VT Form LGT-178.

Q: What is Vermont Land Gains Tax?

A: Vermont Land Gains Tax is a tax imposed on the gains from the sale of Vermont land.

Q: How often do I need to file VT Form LGT-178?

A: VT Form LGT-178 is filed annually.

Q: Are there any exemptions or deductions available for Vermont Land Gains Tax?

A: Yes, there are certain exemptions and deductions available for the Vermont Land Gains Tax. It is recommended to consult the instructions for VT Form LGT-178 for more information.

Q: What happens if I fail to file VT Form LGT-178?

A: Failing to file VT Form LGT-178 may result in penalties and interest charges.

Q: Can I e-file VT Form LGT-178?

A: No, currently VT Form LGT-178 cannot be e-filed. It must be filed by mail.

Q: Is VT Form LGT-178 specific to Vermont?

A: Yes, VT Form LGT-178 is specific to Vermont and should be filed only if you have incurred a gain from the sale of Vermont land.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form LGT-178 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.