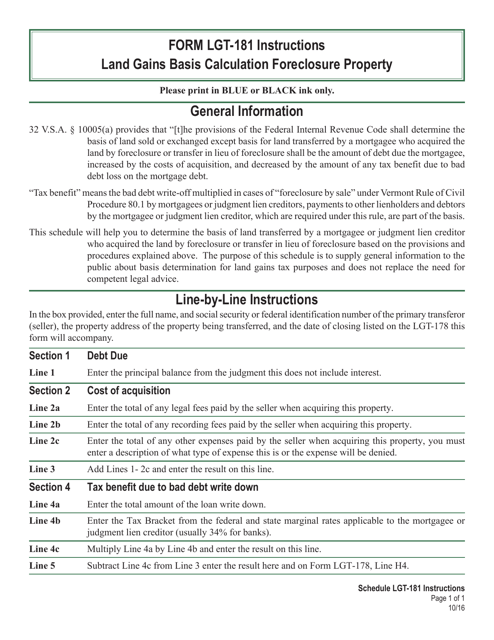

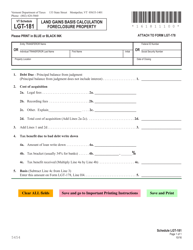

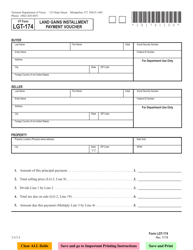

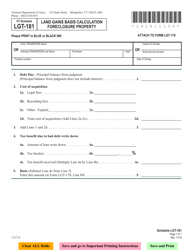

Instructions for VT Form LGT-181 Land Gains Basis Calculation Foreclosure Property - Vermont

This document contains official instructions for VT Form LGT-181 , Land Gains Basis Calculation Foreclosure Property - a form released and collected by the Vermont Department of Taxes. An up-to-date fillable VT Form LGT-181 is available for download through this link.

FAQ

Q: What is Form LGT-181?

A: Form LGT-181 is a document used in Vermont for land gains basis calculation for foreclosure properties.

Q: Who needs to fill out Form LGT-181?

A: Anyone who has acquired foreclosure property in Vermont and wants to calculate their land gains basis needs to fill out Form LGT-181.

Q: What is land gains basis?

A: Land gains basis is the original purchase price of the property, adjusted for certain factors such as improvements and depreciation.

Q: What information do I need to complete Form LGT-181?

A: You will need information about the foreclosure property, including the date of acquisition, purchase price, and any improvements made.

Q: Are there any filing deadlines for Form LGT-181?

A: Yes, Form LGT-181 must be filed with the Vermont Department of Taxes within 30 days after the foreclosure property is acquired.

Q: What happens after I submit Form LGT-181?

A: After submitting Form LGT-181, the Vermont Department of Taxes will review the information and determine the land gains basis for the foreclosure property.

Q: Are there any penalties for not filing Form LGT-181?

A: Yes, failure to file Form LGT-181 or filing it late may result in penalties imposed by the Vermont Department of Taxes.

Q: Can I amend my Form LGT-181 if I make a mistake?

A: Yes, if you make a mistake on your Form LGT-181, you can file an amended form to correct the error.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.