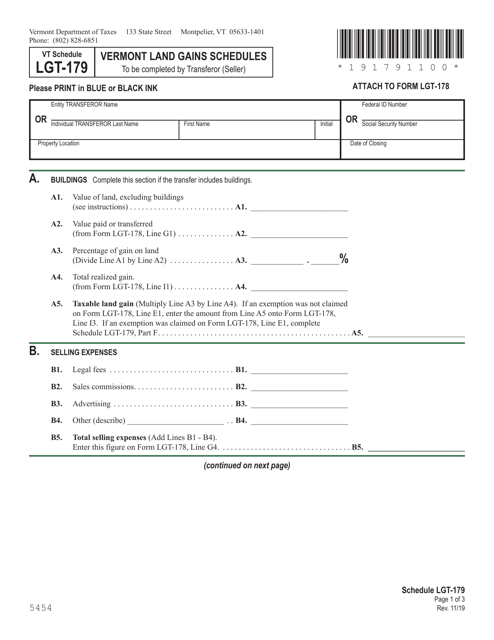

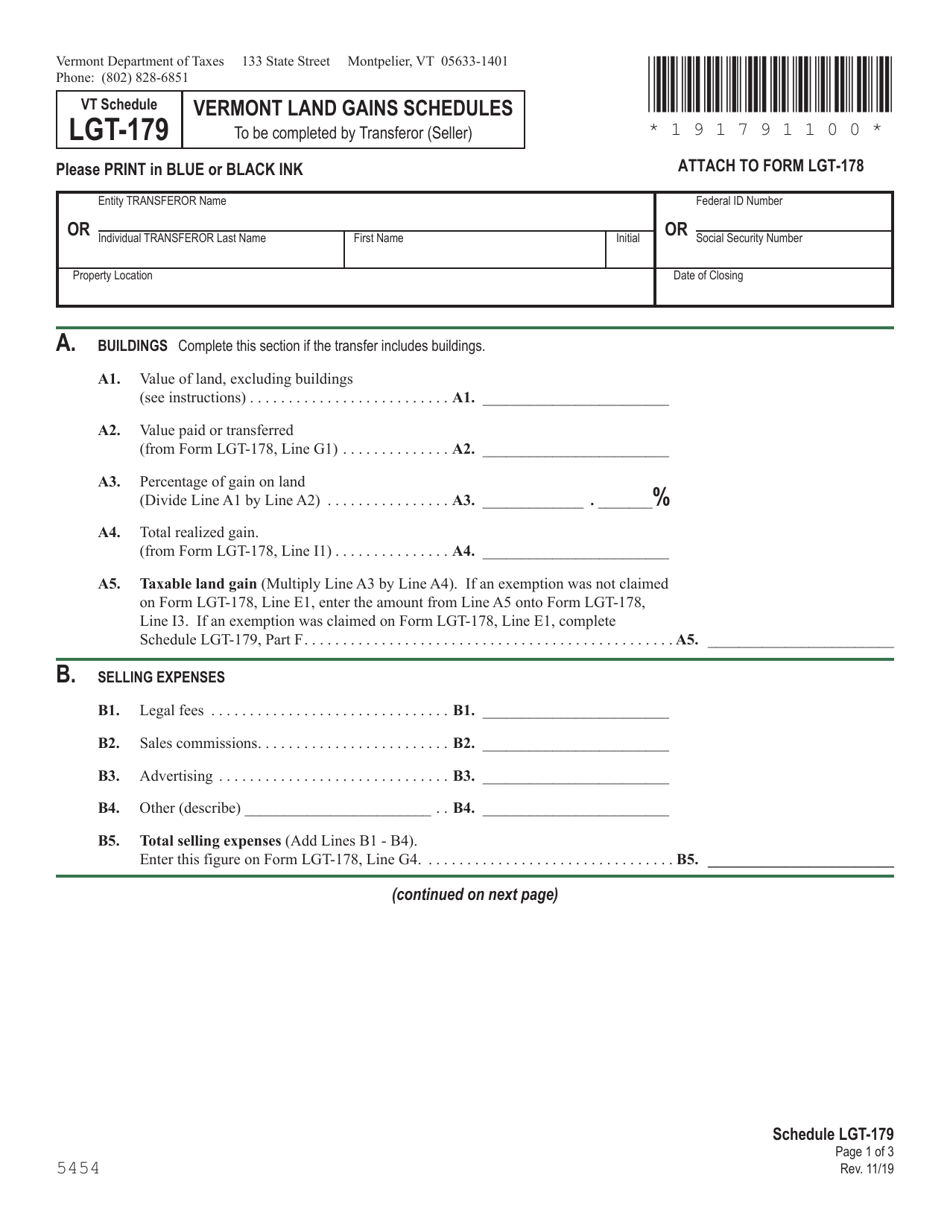

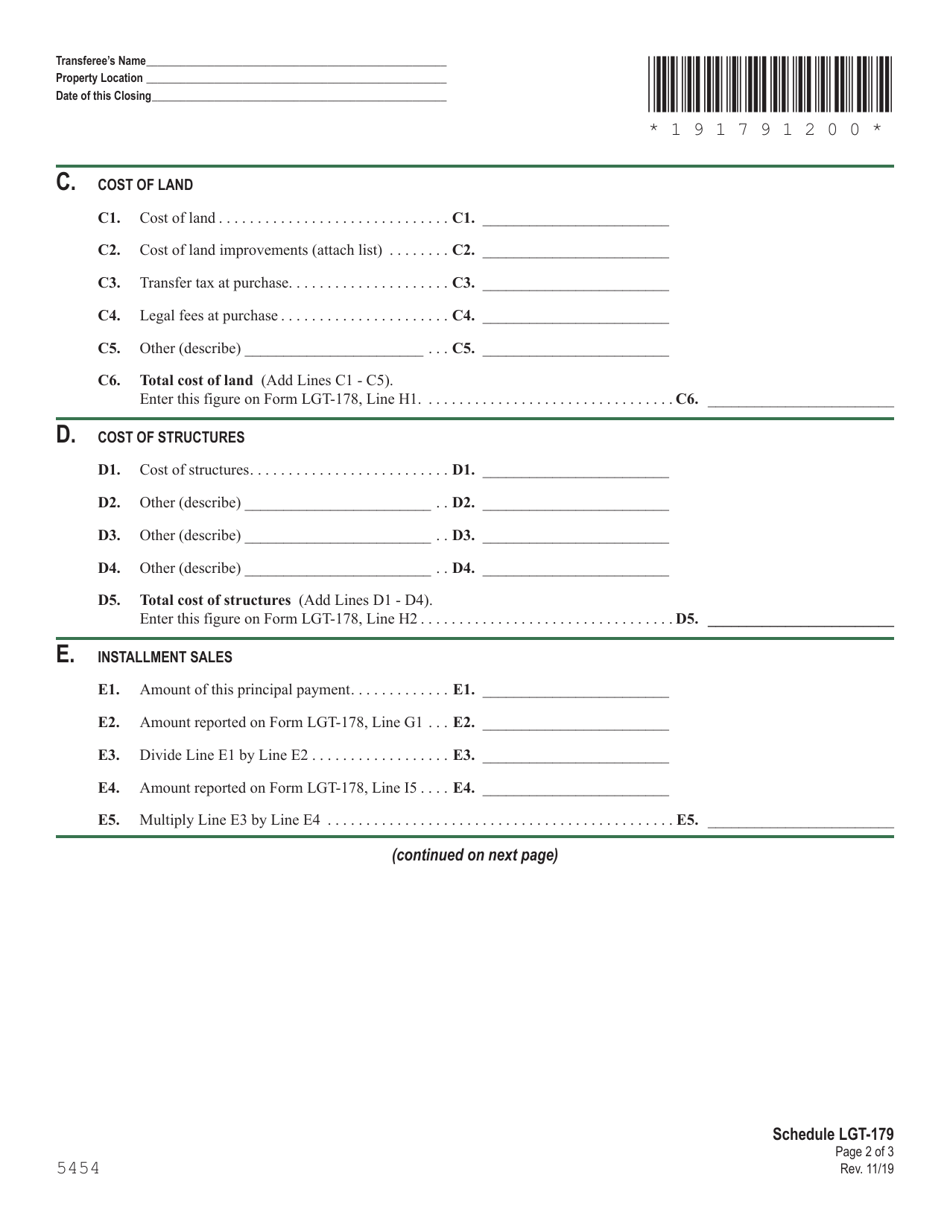

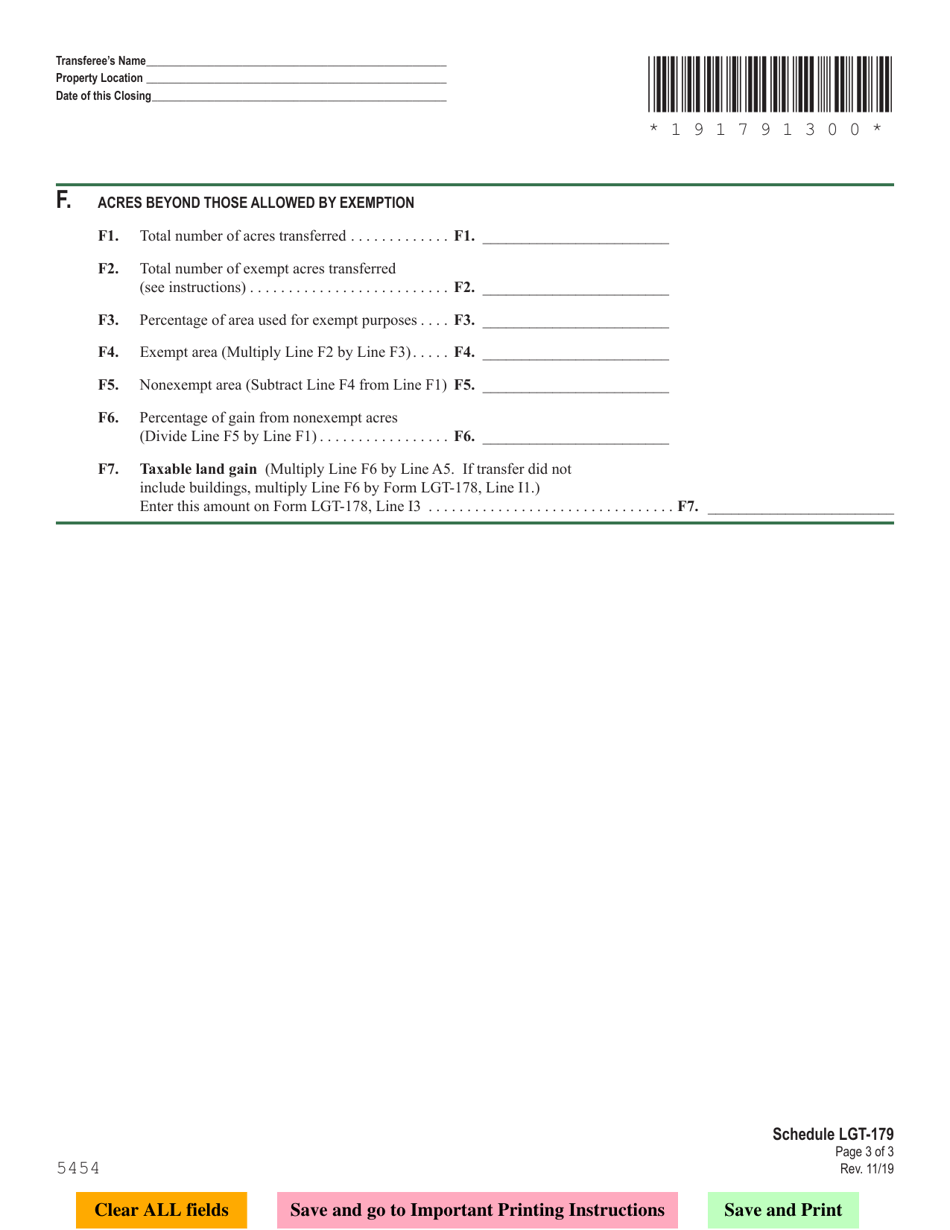

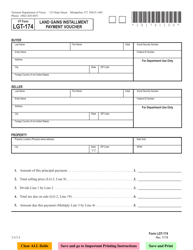

Schedule LGT-179 Vermont Land Gains Schedules - Vermont

What Is Schedule LGT-179?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is LGT-179?

A: LGT-179 refers to the Vermont Land Gains Tax Schedule.

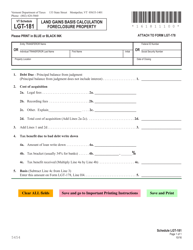

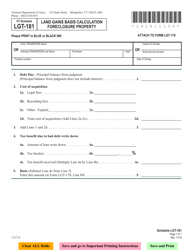

Q: What is the purpose of the Vermont Land Gains Tax Schedule?

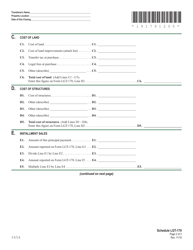

A: The Vermont Land Gains Tax Schedule is used to report and calculate tax on gains from the sale of Vermont real property.

Q: Who needs to file the LGT-179?

A: Individuals or entities who have realized a gain from the sale of Vermont real property are required to file the LGT-179.

Q: What is the due date for filing LGT-179?

A: The LGT-179 must be filed on or before April 15th of the year following the year in which the gain was realized.

Q: Are there any exemptions or deductions available?

A: Yes, there are certain exemptions and deductions available, such as the principal residence exemption and the allowable cost of improvements deduction. These can help reduce the taxable gain.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule LGT-179 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.