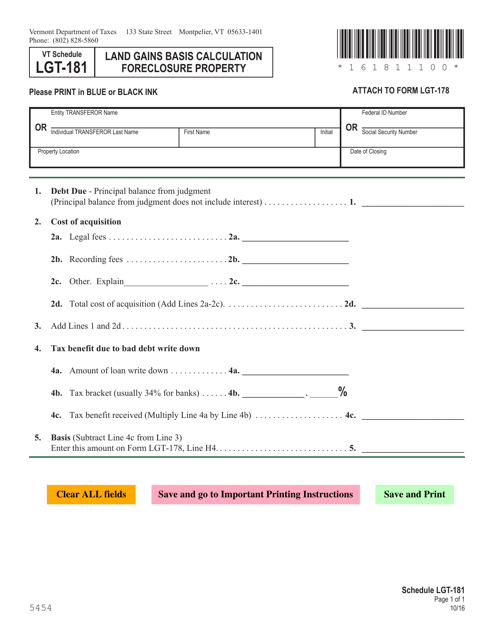

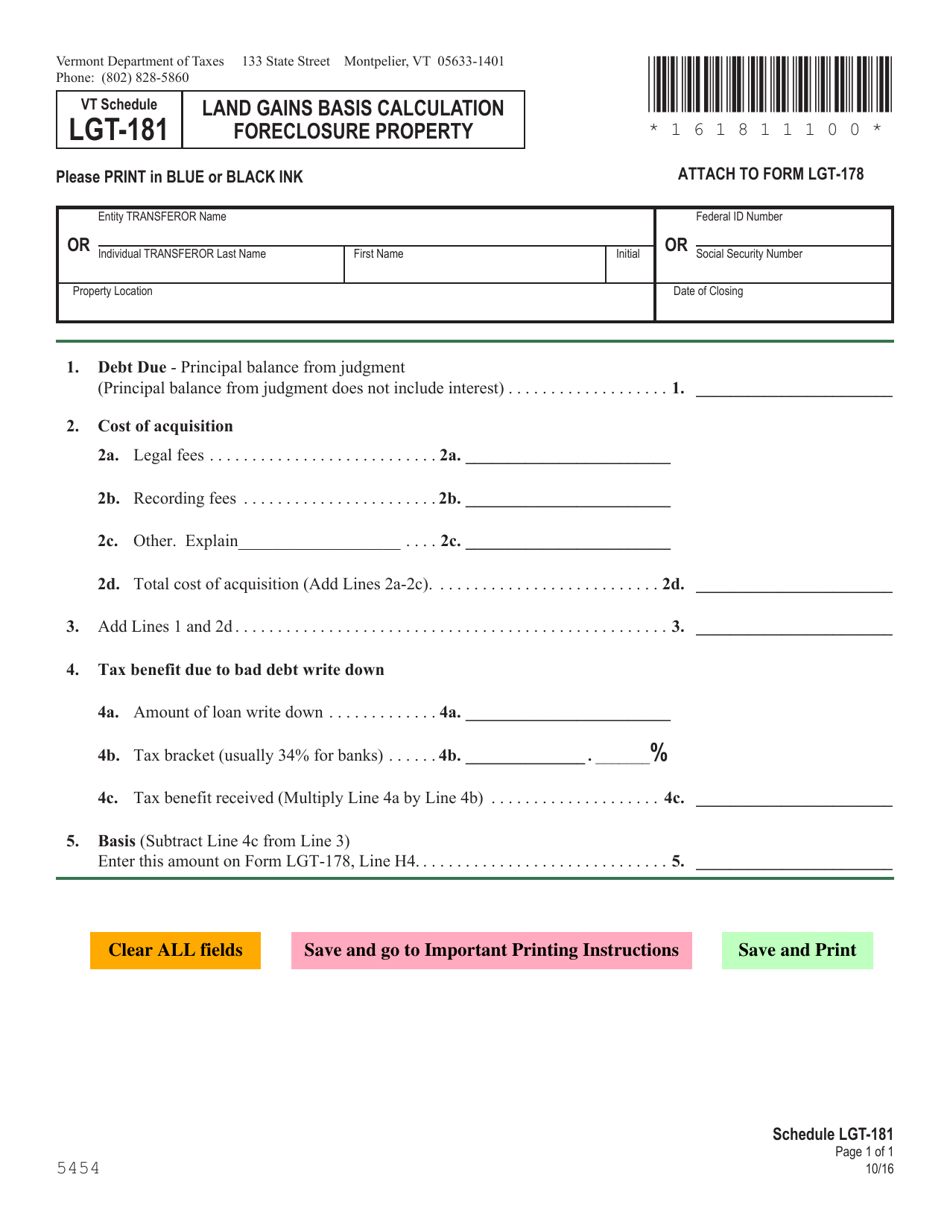

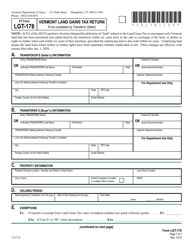

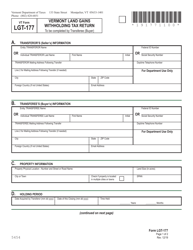

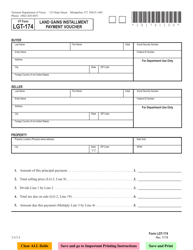

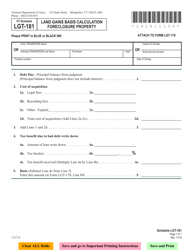

VT Form LGT-181 Land Gains Basis Calculation Foreclosure Property - Vermont

What Is VT Form LGT-181?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. Check the official instructions before completing and submitting the form.

FAQ

Q: What is VT Form LGT-181?

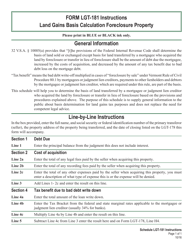

A: VT Form LGT-181 is a form used to calculate land gains basis for foreclosure property in Vermont.

Q: What is land gains basis?

A: Land gains basis refers to the original cost or value of the land.

Q: What is foreclosure property?

A: Foreclosure property refers to a property that has been taken back by a lender or government entity due to non-payment of a mortgage or loan.

Q: Why is land gains basis important for foreclosure property?

A: Calculating the land gains basis for foreclosure property is important for determining the potential tax liability or gain on the property.

Q: How to use VT Form LGT-181?

A: You can use VT Form LGT-181 to calculate the land gains basis for foreclosure property by following the instructions provided on the form.

Q: Is VT Form LGT-181 specific to Vermont?

A: Yes, VT Form LGT-181 is specific to Vermont and is used for land gains basis calculation for foreclosure property in the state.

Form Details:

- Released on October 1, 2016;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form LGT-181 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.