This version of the form is not currently in use and is provided for reference only. Download this version of

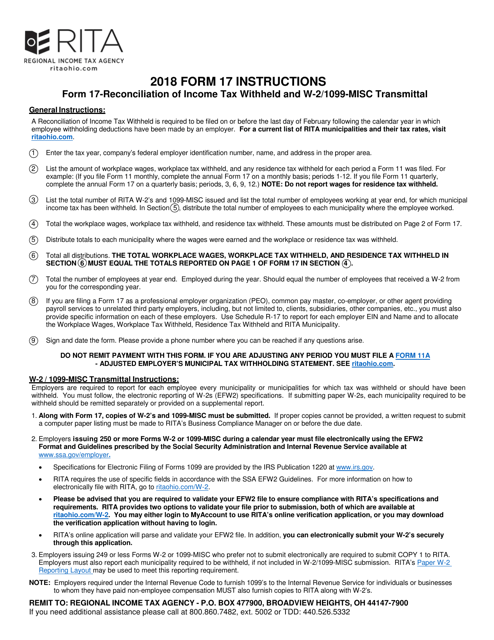

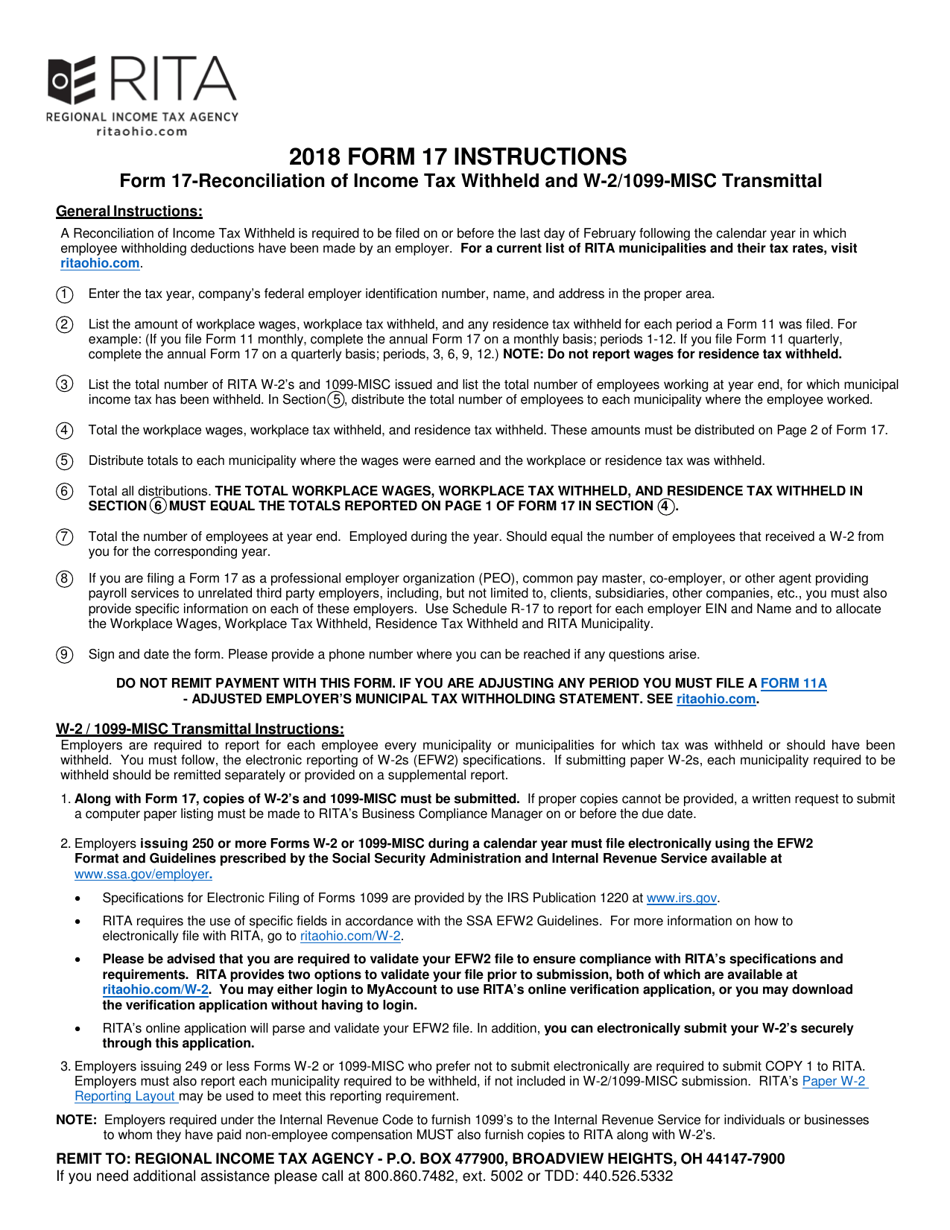

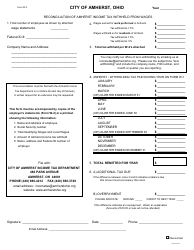

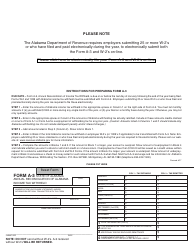

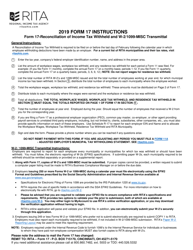

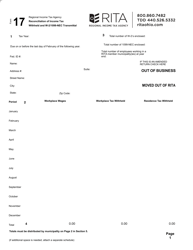

Instructions for Form 17

for the current year.

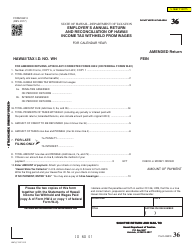

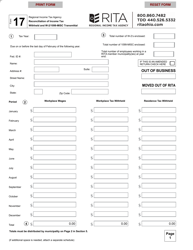

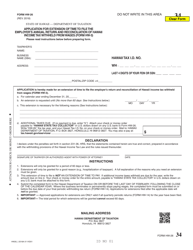

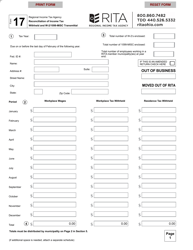

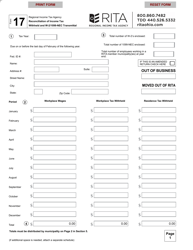

Instructions for Form 17 Reconciliation of Income Tax Withheld and W-2 / 1099-misc Transmittal - Ohio

This document contains official instructions for Form 17 , Reconciliation of Income Tax Withheld and W-2/1099-misc Transmittal - a form released and collected by the Ohio Regional Income Tax Agency (RITA).

FAQ

Q: What is Form 17?

A: Form 17 is the Reconciliation of Income Tax Withheld and W-2/1099-misc Transmittal form for Ohio.

Q: What is the purpose of Form 17?

A: Form 17 is used to report and reconcile the income tax withheld from employees' wages with the amounts reported on W-2 and 1099-MISC forms.

Q: Who needs to file Form 17?

A: Employers in Ohio who withheld income tax from their employees' wages and issued W-2 or 1099-MISC forms must file Form 17.

Q: When is Form 17 due?

A: Form 17 is due on or before February 28th of the year following the tax year being reported.

Q: Are there any penalties for not filing Form 17?

A: Yes, failure to file Form 17 or filing it late may result in penalties and interest.

Q: Can Form 17 be filed electronically?

A: Yes, the Ohio Department of Taxation allows employers to file Form 17 electronically.

Q: What other forms should be included with Form 17?

A: Form 17 should be accompanied by copies of all W-2 and 1099-MISC forms issued to employees or contractors.

Q: Is Form 17 only applicable to Ohio residents?

A: Yes, Form 17 is specific to Ohio income tax withholding and is not applicable to residents of other states.

Q: What should I do if there are errors on Form 17?

A: If there are errors on Form 17, you should correct them and file an amended form as soon as possible.

Instruction Details:

- This 1-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Ohio Regional Income Tax Agency (RITA).