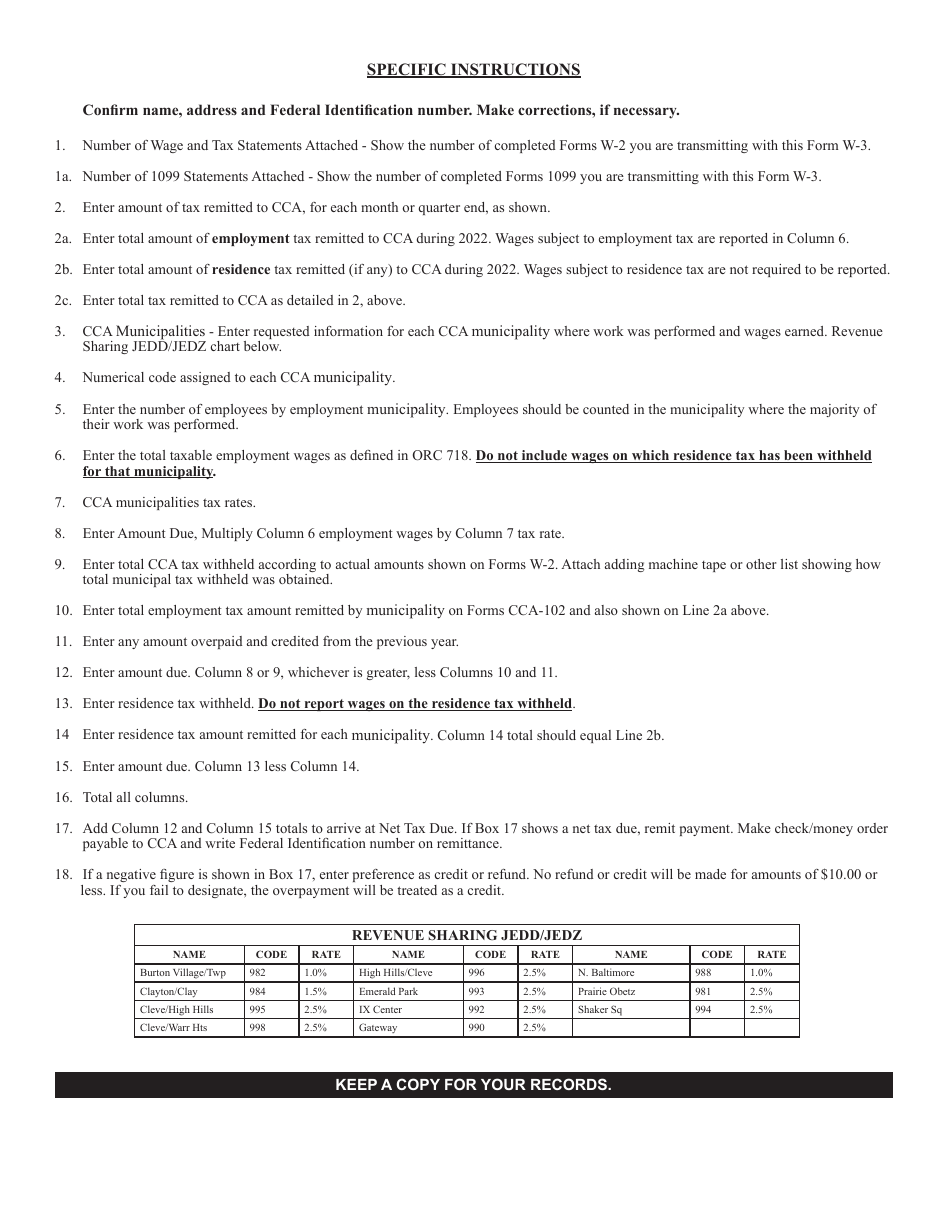

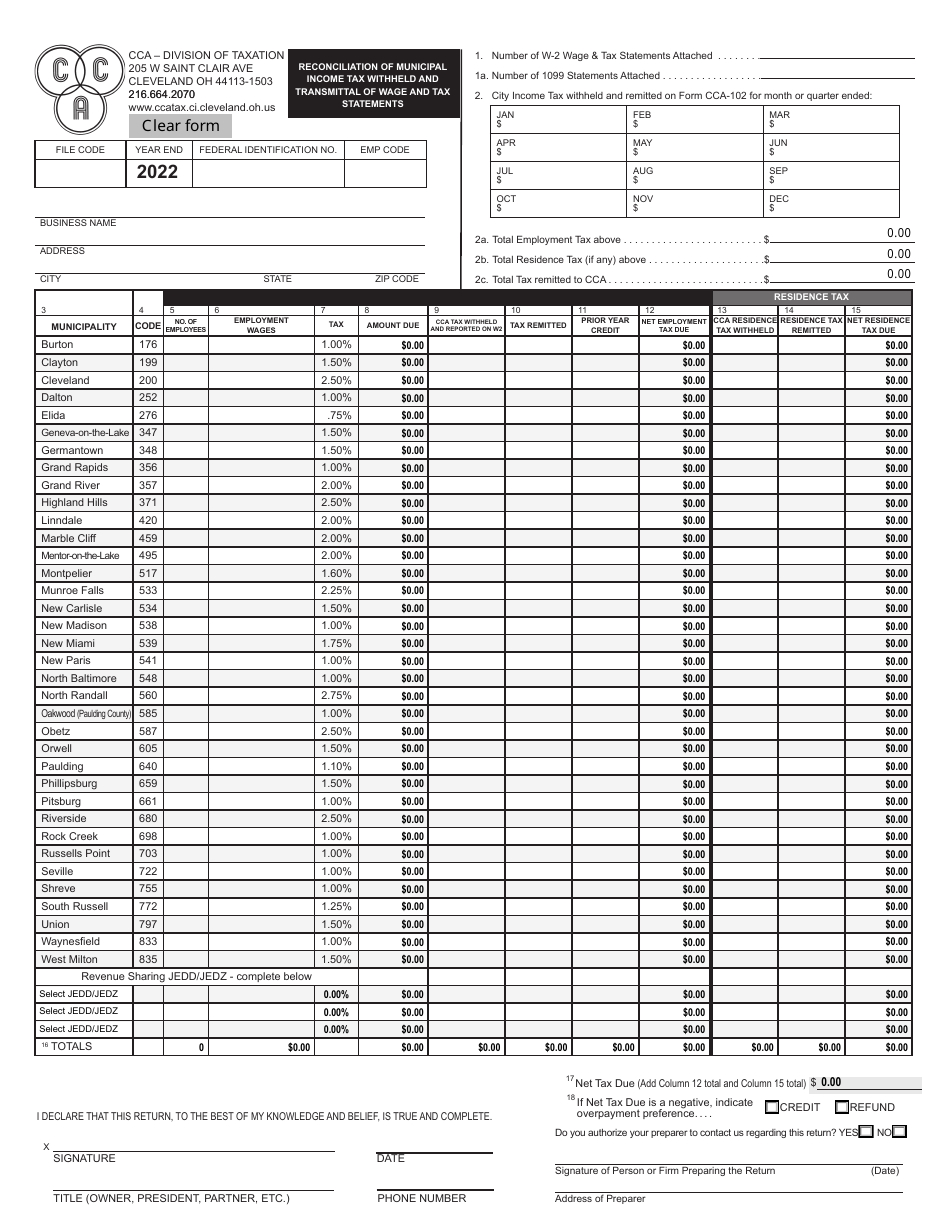

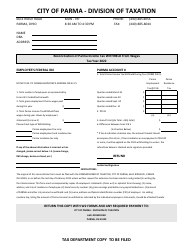

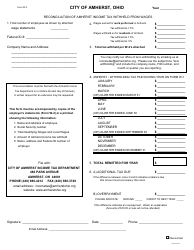

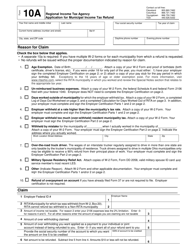

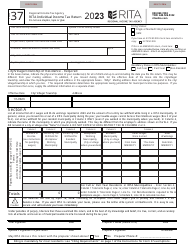

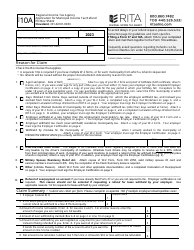

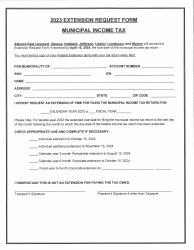

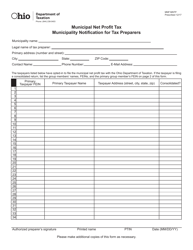

Reconciliation of Municipal Income Tax Withheld and Transmittal of Wage and Tax Statements - City of Cleveland, Ohio

Reconciliation of Municipal Income Tax Withheld and Transmittal of Wage and Tax Statements is a legal document that was released by the Division of Taxation - City of Cleveland, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Cleveland.

FAQ

Q: What is the purpose of the Reconciliation of Municipal Income Tax Withheld and Transmittal of Wage and Tax Statements?

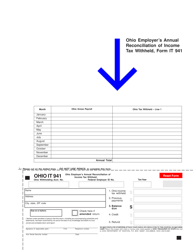

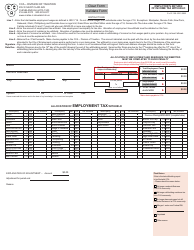

A: The purpose of the form is to report the amount of income tax withheld from employees' wages and to reconcile this amount with the total tax liability of the employer.

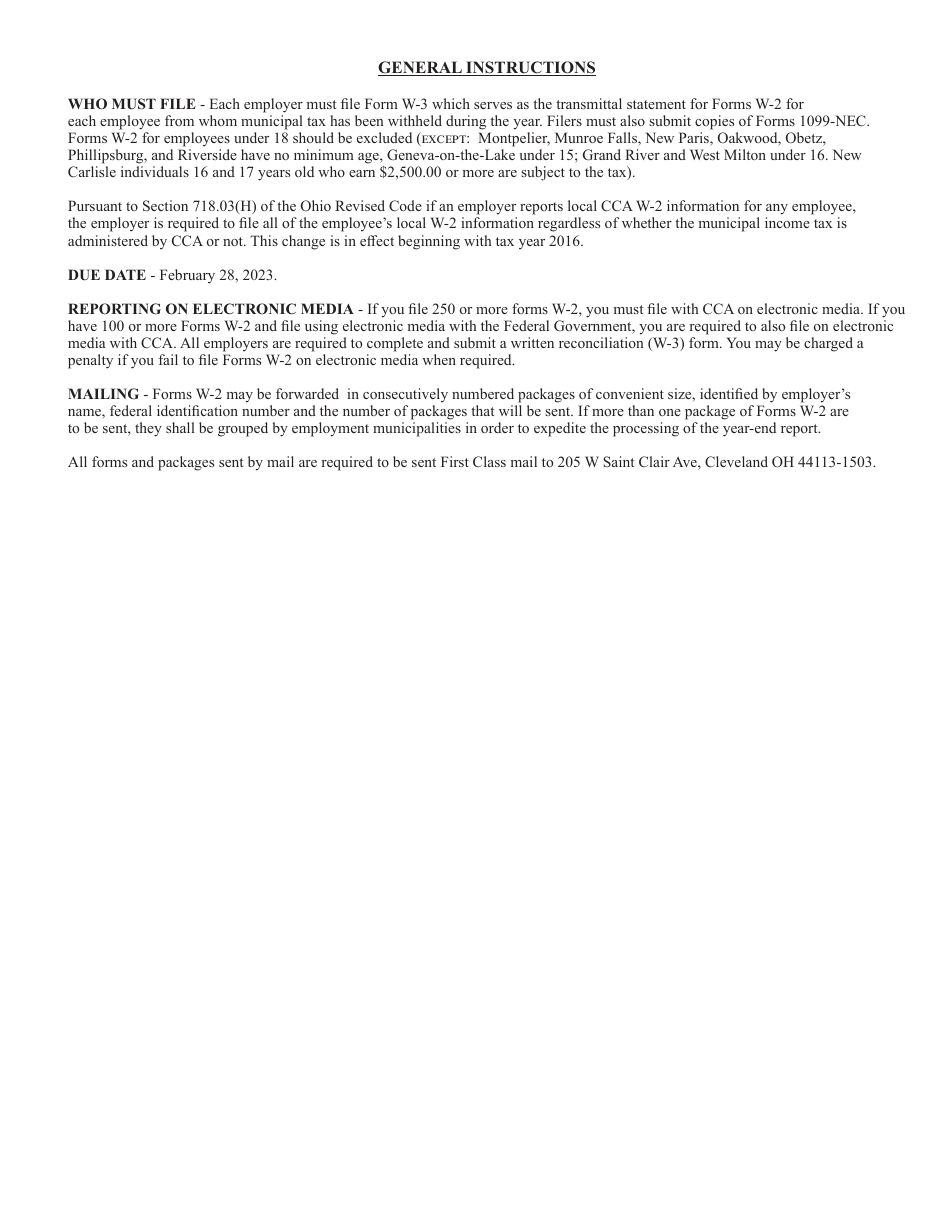

Q: Who needs to file the Reconciliation of Municipal Income Tax Withheld and Transmittal of Wage and Tax Statements?

A: Employers in the City of Cleveland, Ohio who have withheld municipal income tax from their employees' wages need to file this form.

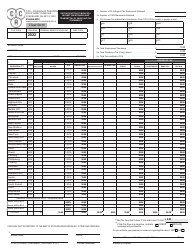

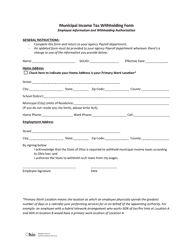

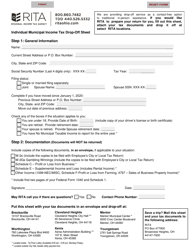

Q: What information is required to complete the form?

A: The form requires the employer to provide information such as the total number of employees, total taxable wages, total tax withheld, and any other required details.

Q: When is the deadline to file the form?

A: The form must be filed by January 30th of the following year.

Form Details:

- The latest edition currently provided by the Division of Taxation - City of Cleveland, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Division of Taxation - City of Cleveland, Ohio.