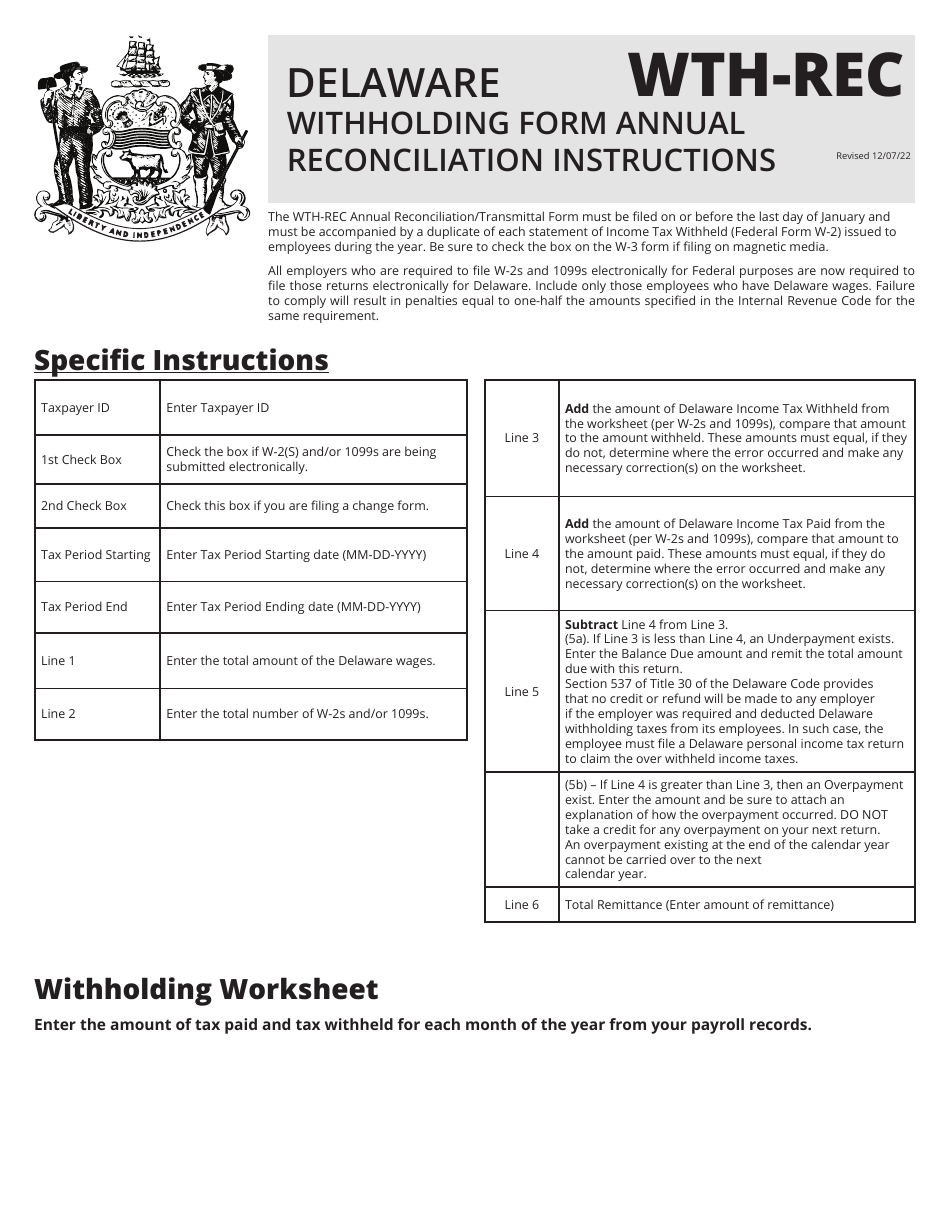

Instructions for Form WTH-REC Annual Reconciliation of Delaware Income Tax Withheld - Delaware

This document contains official instructions for Form WTH-REC , Annual Reconciliation of Delaware Income Tax Withheld - a form released and collected by the Delaware Department of Finance - Division of Revenue. An up-to-date fillable Form WTH-REC is available for download through this link.

FAQ

Q: What is Form WTH-REC?

A: Form WTH-REC is a form used for the annual reconciliation of Delaware income tax withheld.

Q: Who needs to file Form WTH-REC?

A: Employers who have withheld Delaware income tax from their employees' wages must file Form WTH-REC.

Q: When is Form WTH-REC due?

A: Form WTH-REC is due on February 28th of the following year.

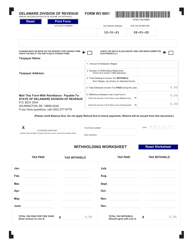

Q: How do I complete Form WTH-REC?

A: You can complete Form WTH-REC by entering the total wages paid and the total amount of Delaware income tax withheld for each employee.

Q: Are there any penalties for not filing Form WTH-REC?

A: Yes, there are penalties for not filing Form WTH-REC or filing it late. It is important to file on time to avoid these penalties.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Delaware Department of Finance - Division of Revenue.