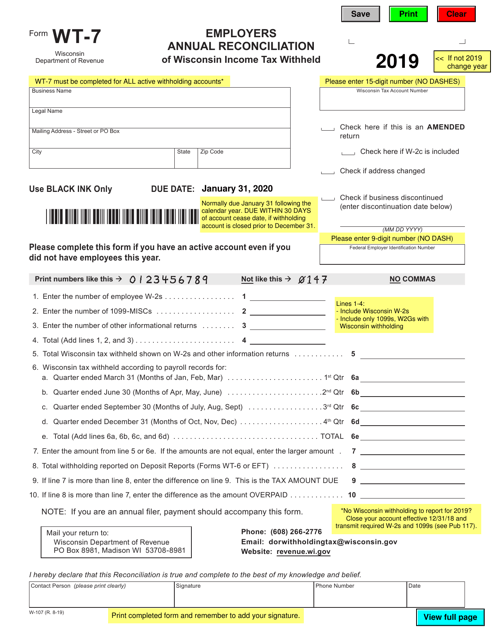

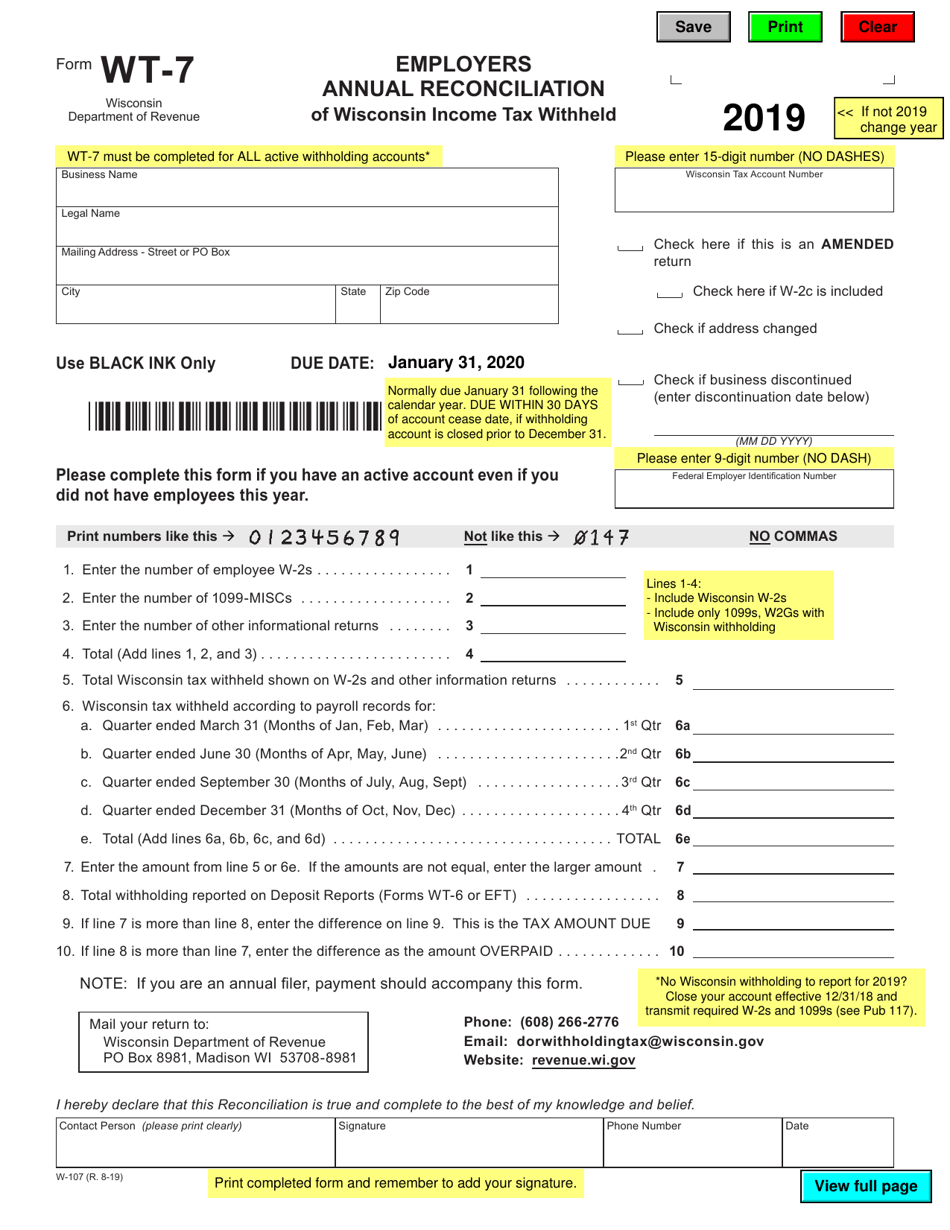

This version of the form is not currently in use and is provided for reference only. Download this version of

Form WT-7 (W-107)

for the current year.

Form WT-7 (W-107) Employers Annual Reconciliation of Wisconsin Income Tax Withheld - Wisconsin

What Is Form WT-7 (W-107)?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WT-7?

A: Form WT-7 is the Employers Annual Reconciliation of Wisconsin Income Tax Withheld.

Q: Who needs to file Form WT-7?

A: Employers in Wisconsin who have withheld Wisconsin income tax from their employees' paychecks need to file Form WT-7.

Q: What is the purpose of filing Form WT-7?

A: The purpose of filing Form WT-7 is to reconcile the amount of Wisconsin income tax withheld from employees' paychecks with the total amount of tax due for the year.

Q: When is Form WT-7 due?

A: Form WT-7 is due annually by January 31st of the following year.

Q: Are there any penalties for not filing Form WT-7?

A: Yes, there are penalties for not filing Form WT-7 or filing it late. It is important to file the form on time to avoid penalties and interest charges.

Q: Do I need to attach any additional documents with Form WT-7?

A: No, you do not need to attach any additional documents with Form WT-7.

Q: What if I have overpaid or underpaid Wisconsin income tax?

A: If you have overpaid Wisconsin income tax, you can claim a refund, and if you have underpaid, you may need to make additional payments.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WT-7 (W-107) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.