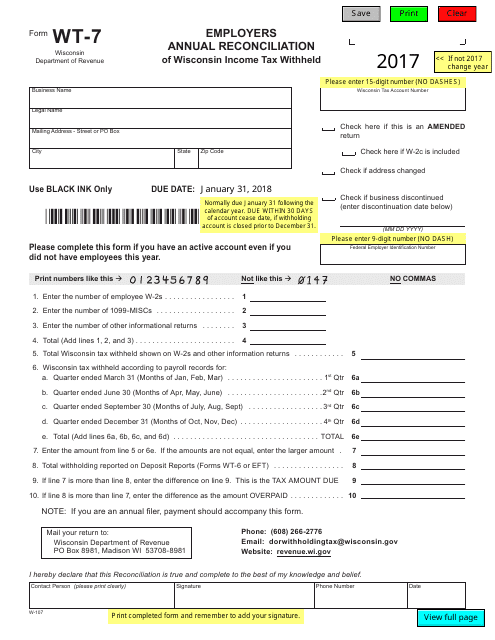

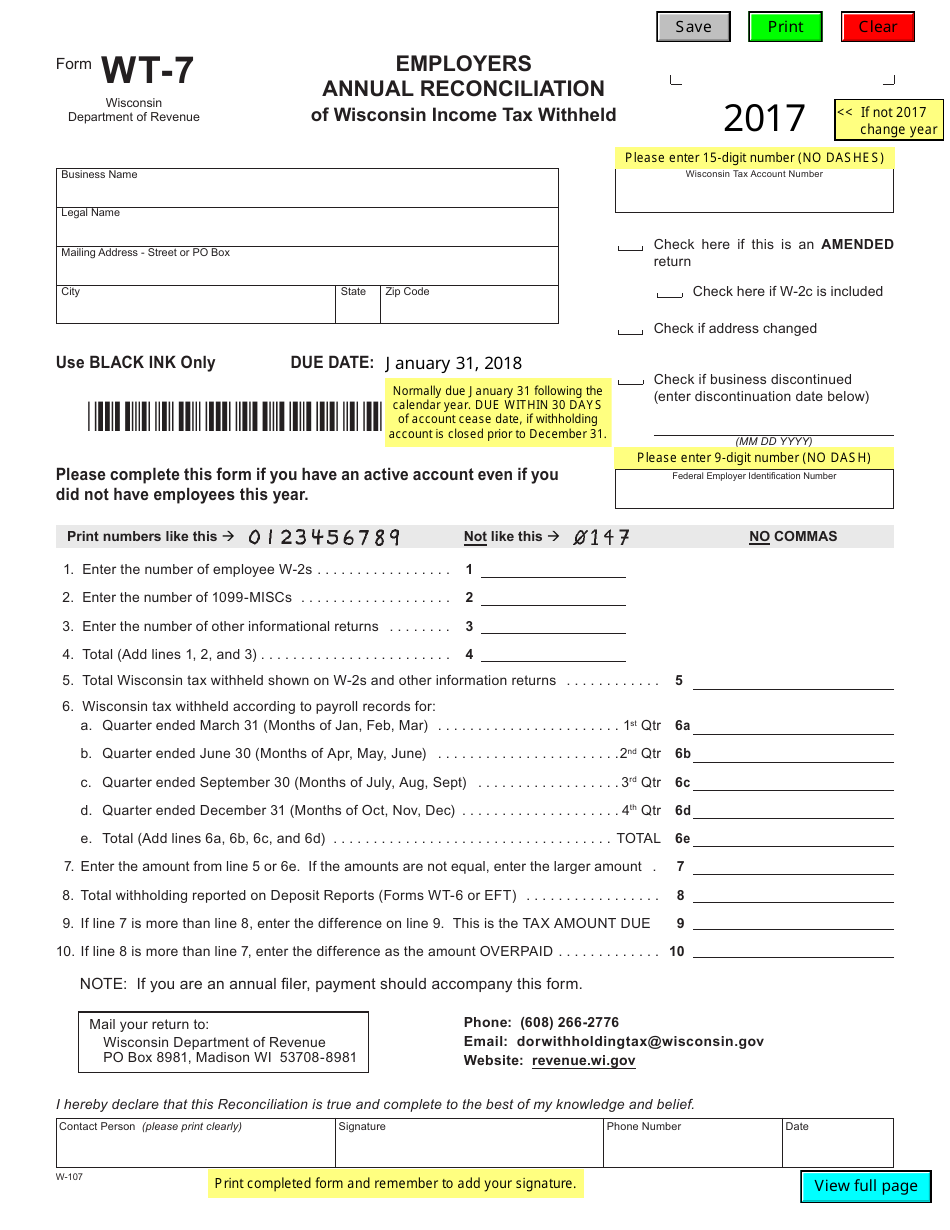

Form WT-7 Employers Annual Reconciliation of Wisconsin Income Tax Withheld - Wisconsin

What Is Form WT-7?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WT-7?

A: Form WT-7 is the Employers Annual Reconciliation of Wisconsin Income Tax Withheld.

Q: Who needs to file Form WT-7?

A: Employers in Wisconsin who have withheld Wisconsin income tax from their employees' wages need to file Form WT-7.

Q: What is the purpose of Form WT-7?

A: Form WT-7 is used to report the total amount of Wisconsin income tax withheld from employees' wages during the tax year.

Q: When is Form WT-7 due?

A: Form WT-7 is due on January 31st of the year following the tax year.

Q: Are there any penalties for not filing Form WT-7?

A: Yes, there may be penalties for not filing Form WT-7 or for filing late. It is important to file the form by the due date to avoid penalties.

Q: Is Form WT-7 the only form that employers need to file for Wisconsin income tax withholding?

A: No, employers also need to file Form WT-6, the Quarterly Withholding Tax Return, throughout the year.

Q: What information do I need to complete Form WT-7?

A: To complete Form WT-7, you will need the total Wisconsin income tax withheld from employees' wages, the number of employees, and other pertinent payroll information.

Q: What do I do with Form WT-7 after I file it?

A: After filing Form WT-7, you should keep a copy for your records and provide a copy to each employee.

Form Details:

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WT-7 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.