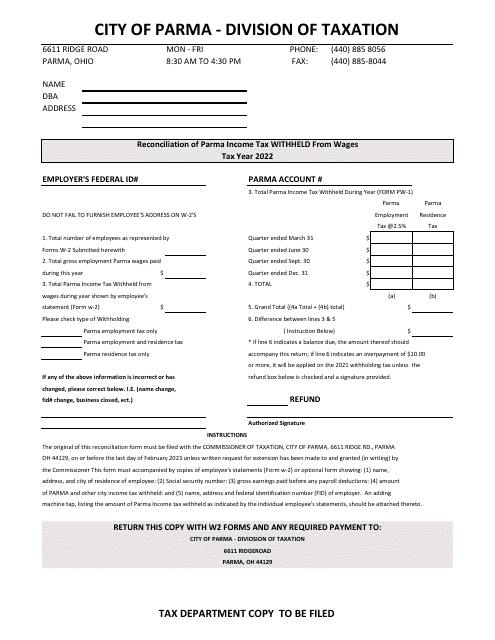

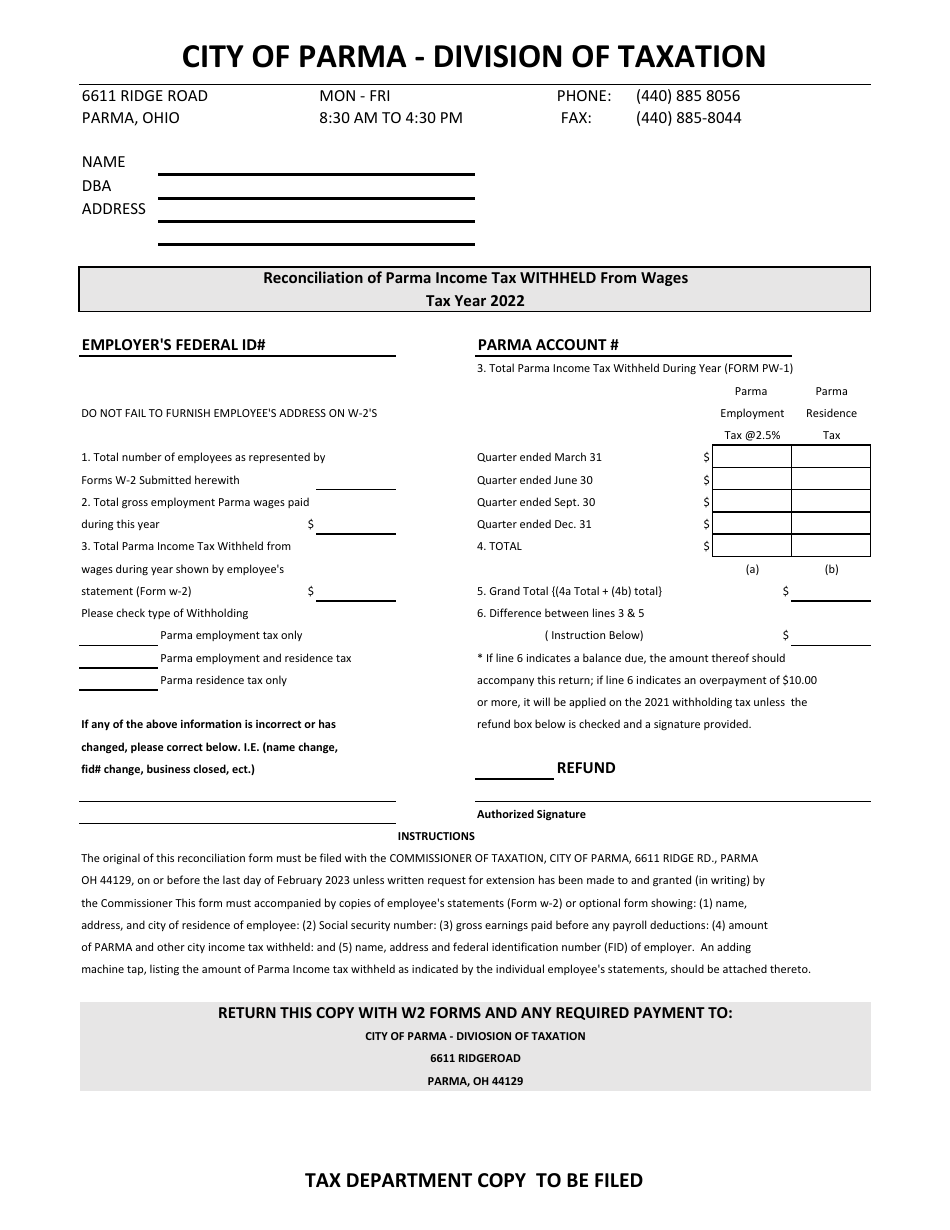

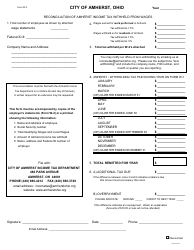

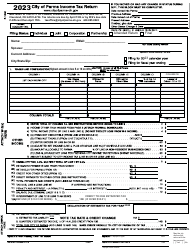

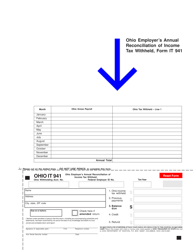

Reconciliation of Parma Income Tax Withheld From Wages - City of Parma, Ohio

Reconciliation of Parma Income Tax Withheld From Wages is a legal document that was released by the Division of Taxation - City of Parma, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Parma.

FAQ

Q: What is the Parma Income Tax?

A: The Parma Income Tax is a tax imposed by the City of Parma, Ohio on individuals' earned income.

Q: What is the purpose of withholding income tax from wages?

A: The purpose of withholding income tax from wages is to collect taxes from individuals' paychecks throughout the year.

Q: How is the amount of income tax withheld determined?

A: The amount of income tax withheld is determined based on the employee's earnings and the tax rate set by the City of Parma.

Q: Why do I need to reconcile my income tax withheld?

A: Reconciliation is necessary to ensure that the correct amount of income tax was withheld and to settle any discrepancies.

Q: How do I reconcile my income tax withheld?

A: To reconcile your income tax withheld, you need to review your W-2 form and compare the amount withheld to the tax liability calculated on your Parma tax return.

Q: What happens if the amount withheld is less than the tax liability?

A: If the amount withheld is less than the tax liability, you may owe additional taxes to the City of Parma.

Q: What happens if the amount withheld is more than the tax liability?

A: If the amount withheld is more than the tax liability, you may be eligible for a refund of the excess amount.

Q: Are there any penalties for not reconciling income tax withheld?

A: There may be penalties imposed by the City of Parma for failure to reconcile income tax withheld.

Form Details:

- The latest edition currently provided by the Division of Taxation - City of Parma, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Division of Taxation - City of Parma, Ohio.