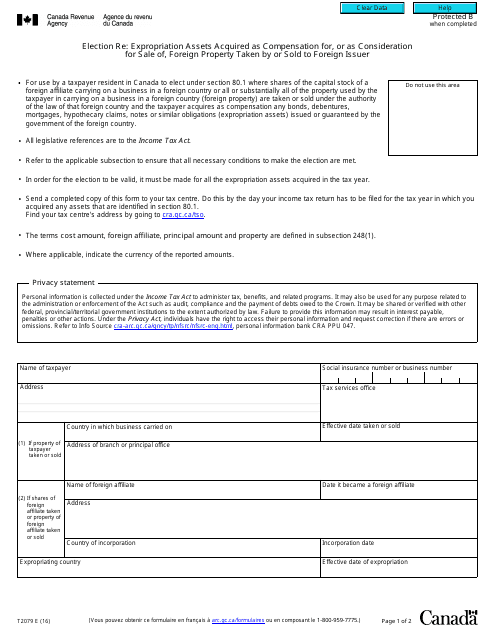

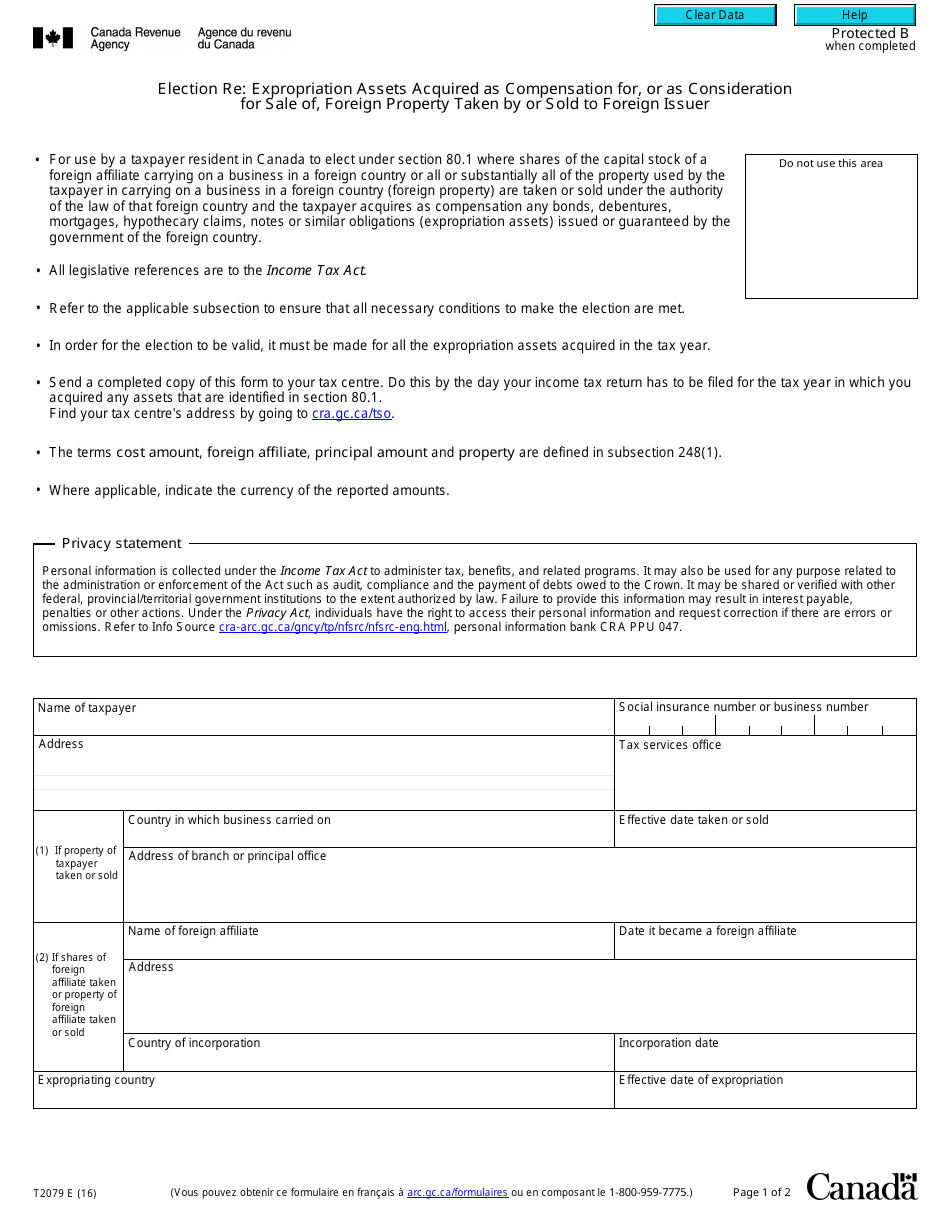

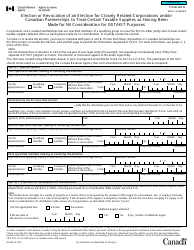

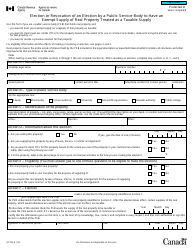

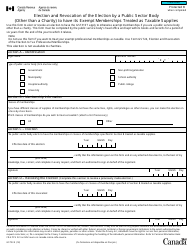

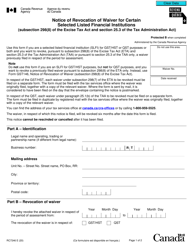

Form T2079 Election Re: Expropriation Assets Acquired as Compensation for or a Consideration for Sale of Foreign Property Taken by or Sold to Foreign Issuer - Canada

Form T2079 or the "Form T2079 "election Re: Expropriation Assets Acquired As Compensation For Or A Consideration For Sale Of Foreign Property Taken By Or Sold To Foreign Issuer" - Canada" is a form issued by the Canadian Revenue Agency .

Download a PDF version of the Form T2079 down below or find it on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2079?

A: Form T2079 is a tax form used in Canada.

Q: What is the purpose of Form T2079?

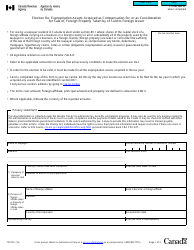

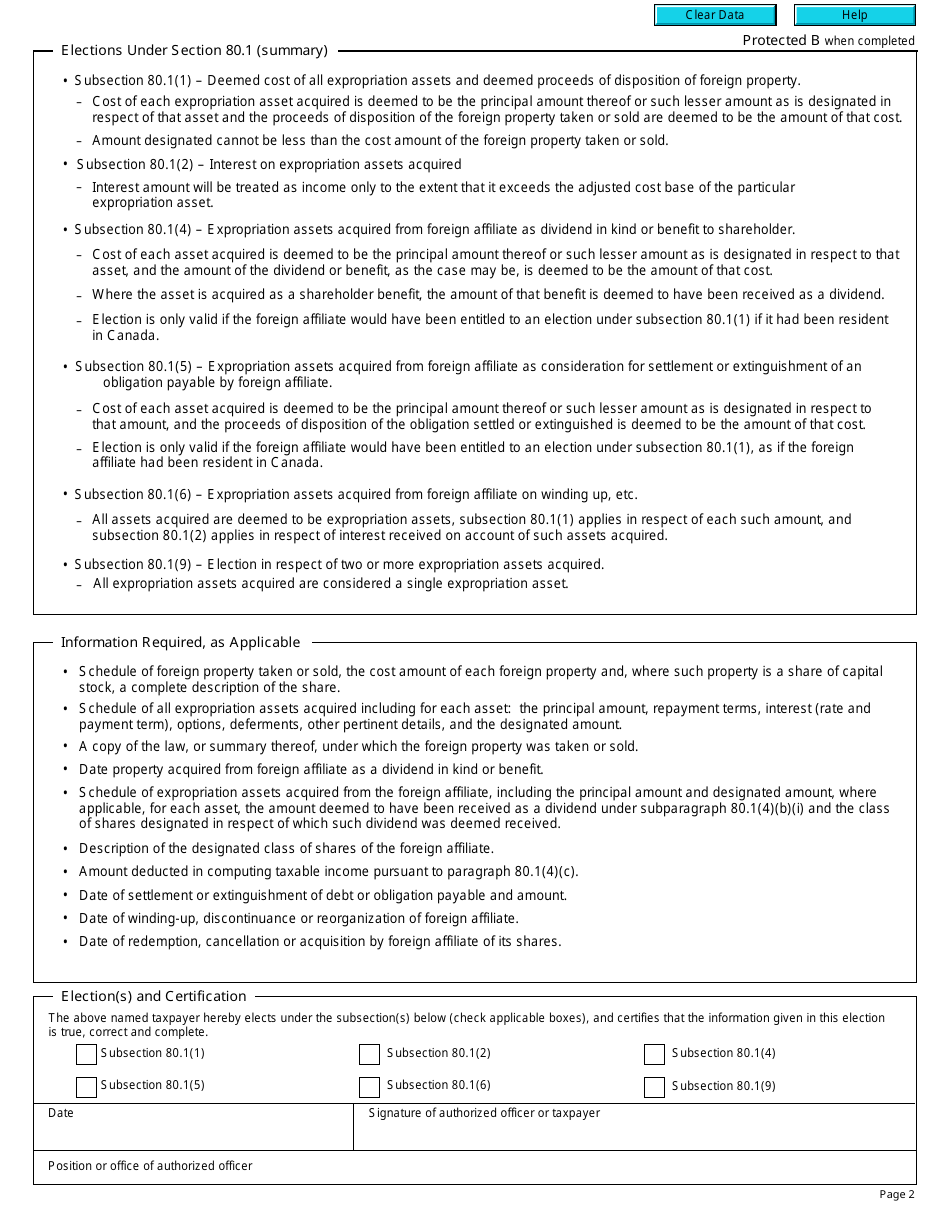

A: The purpose of Form T2079 is to declare an election regarding expropriation assets acquired as compensation for or as consideration for sale of foreign property taken by or sold to a foreign issuer.

Q: Who needs to fill out Form T2079?

A: Individuals or corporations who have expropriation assets acquired as compensation for or as consideration for sale of foreign property taken by or sold to a foreign issuer need to fill out Form T2079.

Q: What information is required when filling out Form T2079?

A: When filling out Form T2079, you need to provide information such as your identification details, details of the expropriation assets, details of the foreign property taken or sold, and details of the foreign issuer.

Q: Is Form T2079 mandatory?

A: Form T2079 is only mandatory if you have expropriation assets acquired as compensation for or as consideration for sale of foreign property taken by or sold to a foreign issuer.

Q: Are there any deadlines for filing Form T2079?

A: The deadline for filing Form T2079 depends on your specific tax situation. It is recommended to consult the CRA or a tax professional for accurate deadlines and instructions.

Q: What are the consequences of not filing Form T2079?

A: Failing to file Form T2079 when required may result in penalties, interest, or other consequences from the CRA. It is important to comply with all tax obligations.

Q: Is there any fee associated with filing Form T2079?

A: There is no specific fee associated with filing Form T2079. However, there may be fees associated with using authorized tax software or seeking assistance from a tax professional.