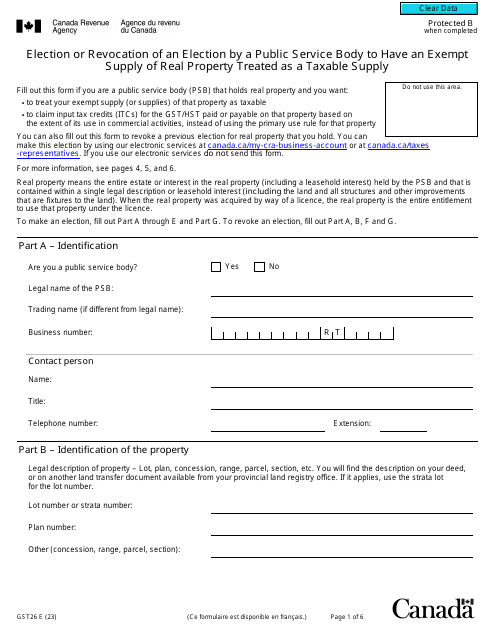

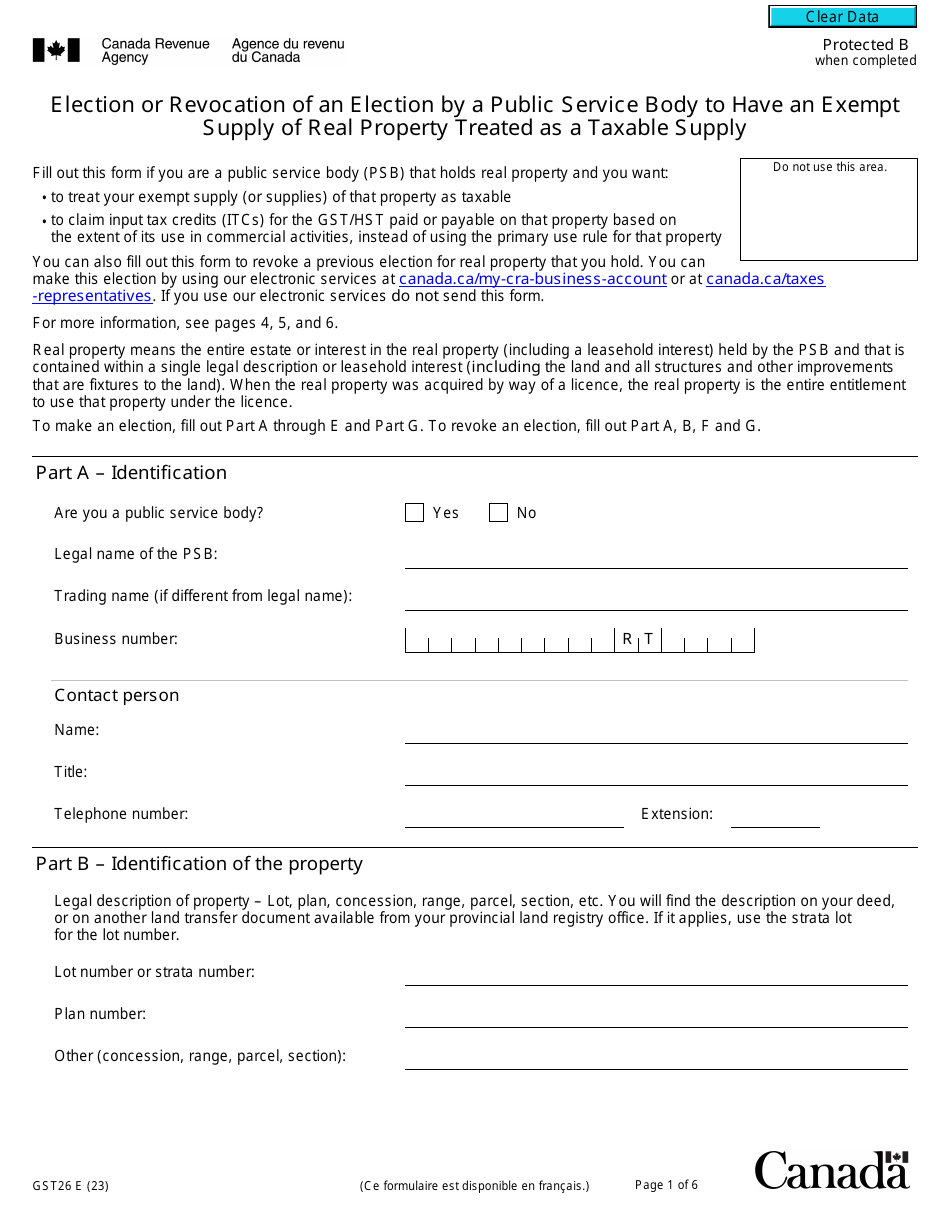

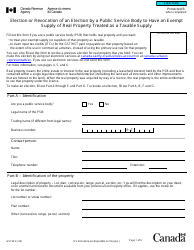

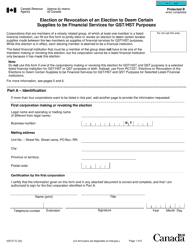

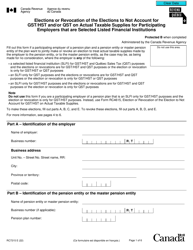

Form GST26 Election or Revocation of an Election by a Public Service Body to Have an Exempt Supply of Real Property Treated as a Taxable Supply - Canada

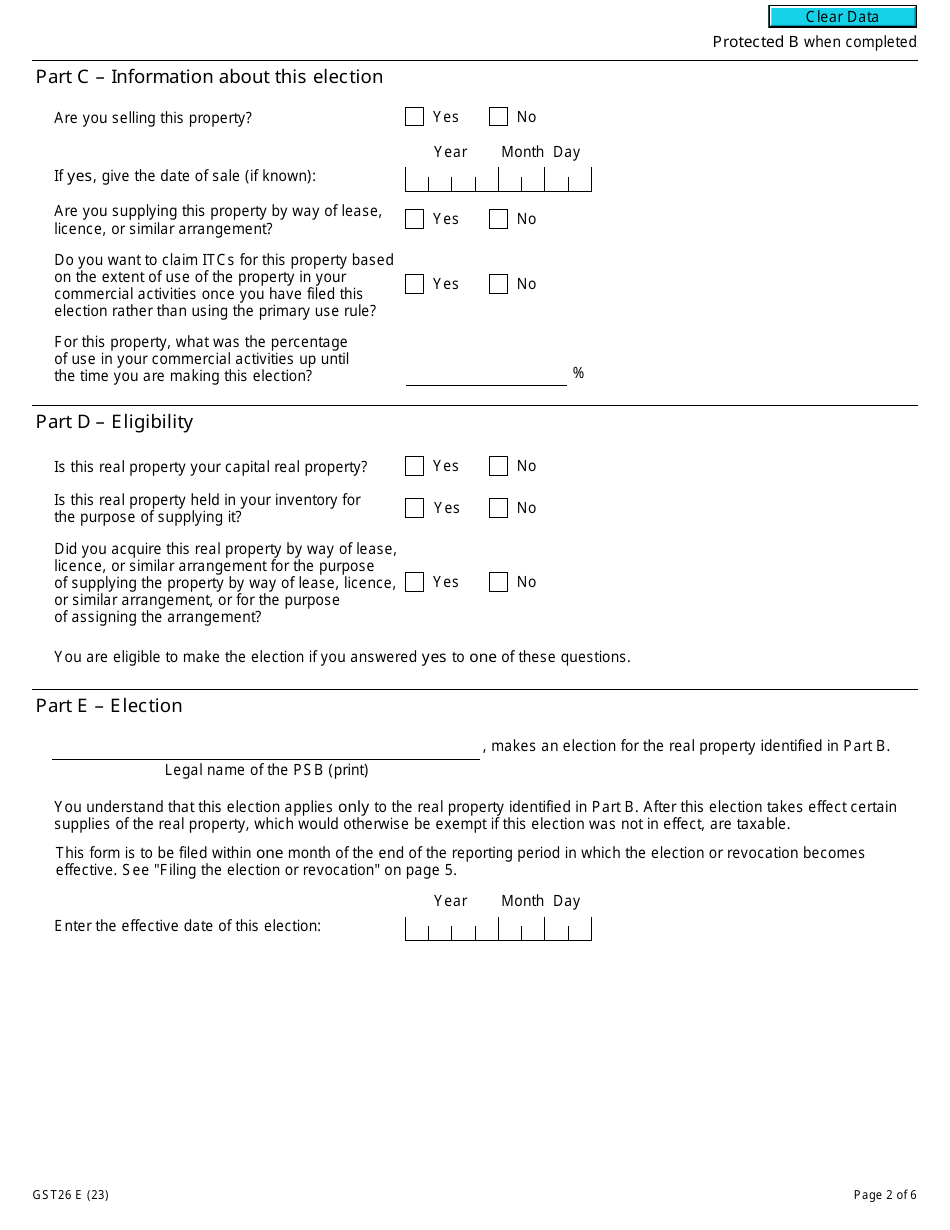

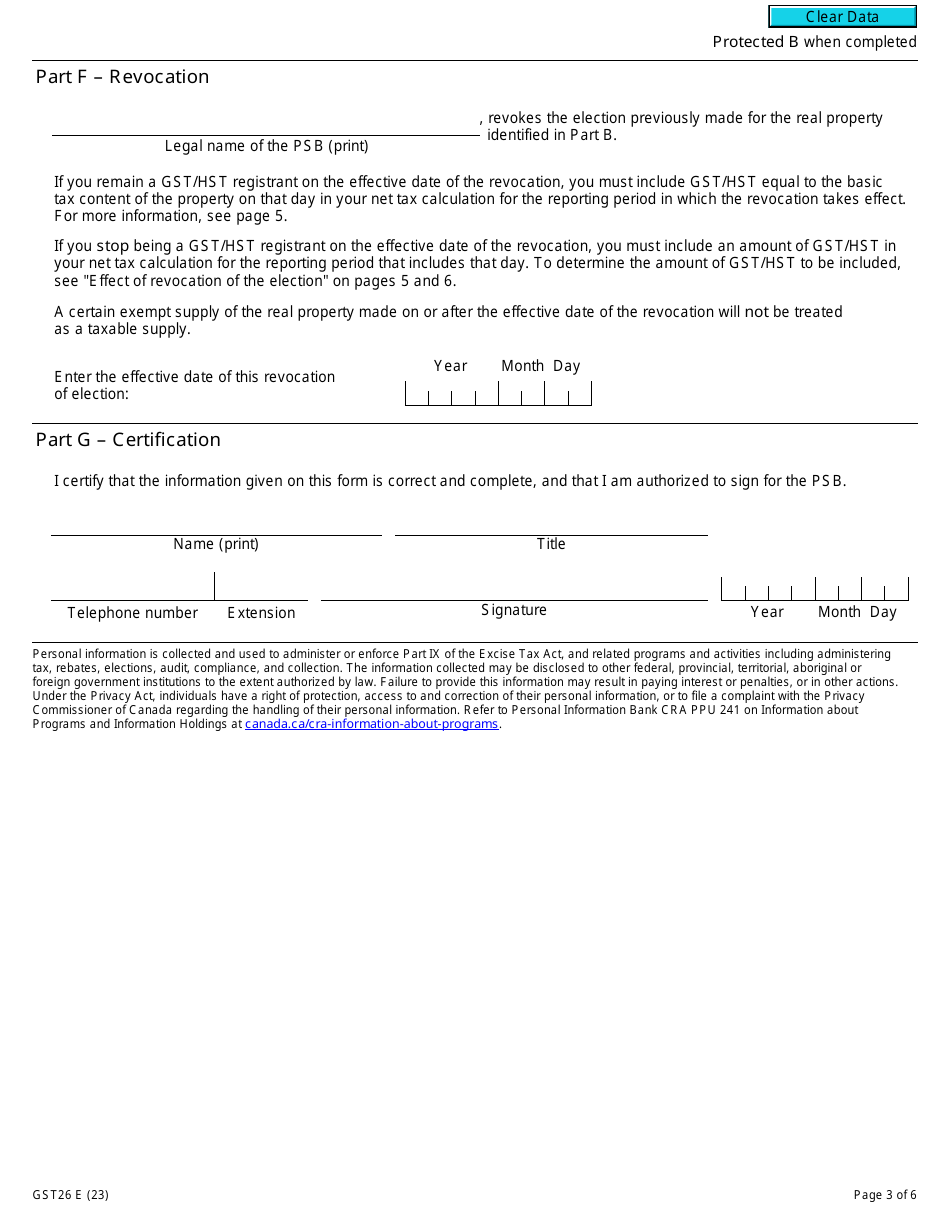

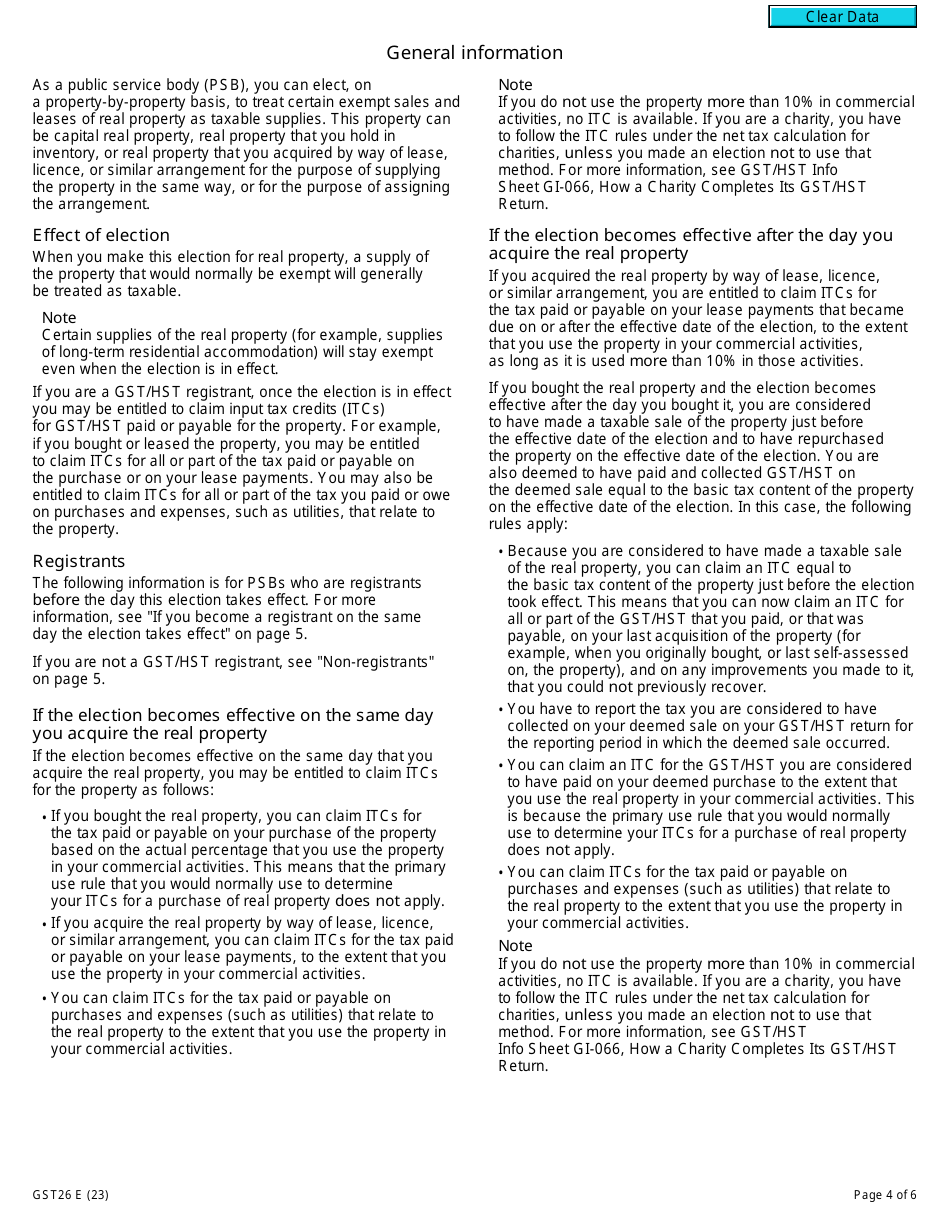

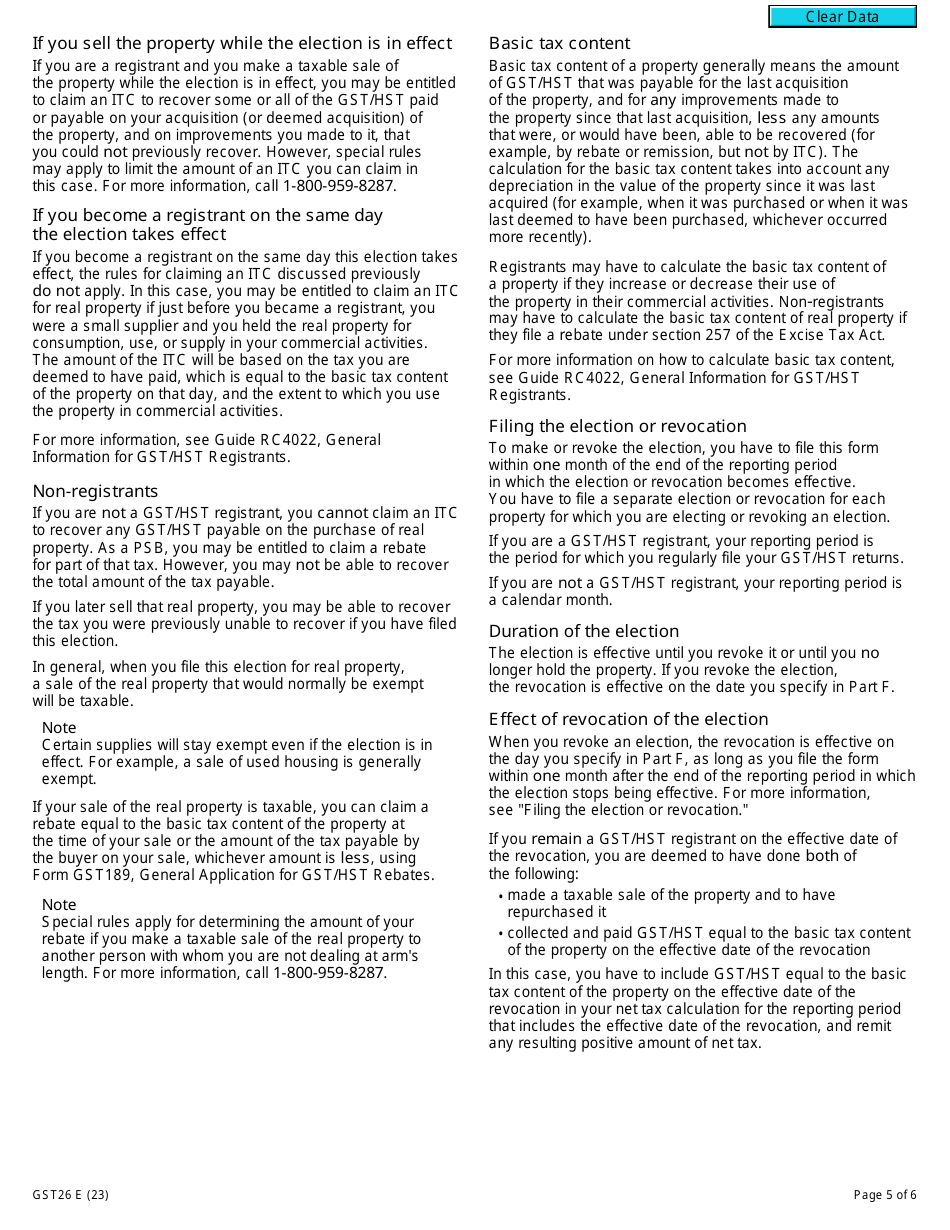

Form GST26 is used in Canada by public service bodies to either make an election or revoke an election to have an exempt supply of real property treated as a taxable supply for Goods and Services Tax/Harmonized Sales Tax (GST/HST) purposes.

The public service body files the Form GST26 Election or Revocation of an Election to have an exempt supply of real property treated as a taxable supply in Canada.

Form GST26 Election or Revocation of an Election by a Public Service Body to Have an Exempt Supply of Real Property Treated as a Taxable Supply - Canada - Frequently Asked Questions (FAQ)

Q: What is Form GST26?

A: Form GST26 is a form used by public service bodies in Canada to elect or revoke an election to have an exempt supply of real property treated as a taxable supply.

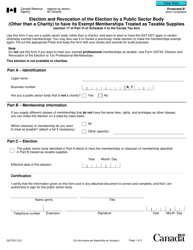

Q: What is a public service body?

A: A public service body is an organization designated by the Canadian government that provides certain public services.

Q: What is an exempt supply of real property?

A: An exempt supply of real property refers to the sale or lease of real property that is not subject to Goods and Services Tax (GST) or Harmonized Sales Tax (HST) in Canada.

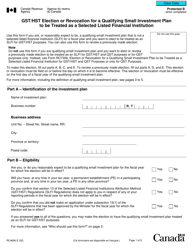

Q: What is a taxable supply of real property?

A: A taxable supply of real property refers to the sale or lease of real property that is subject to Goods and Services Tax (GST) or Harmonized Sales Tax (HST) in Canada.

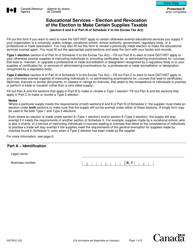

Q: Why would a public service body elect to have an exempt supply of real property treated as a taxable supply?

A: A public service body may choose to make this election in order to recover the input tax credits (ITCs) associated with the GST or HST paid on expenses related to the real property.

Q: How can a public service body use Form GST26?

A: A public service body can use Form GST26 to either elect or revoke an election to have an exempt supply of real property treated as a taxable supply.

Q: Do I need to provide any supporting documents with Form GST26?

A: It may be necessary to provide supporting documents along with Form GST26, depending on the specific circumstances.

Q: How can I get assistance with completing Form GST26?

A: You can contact the Canada Revenue Agency (CRA) for assistance with completing Form GST26.