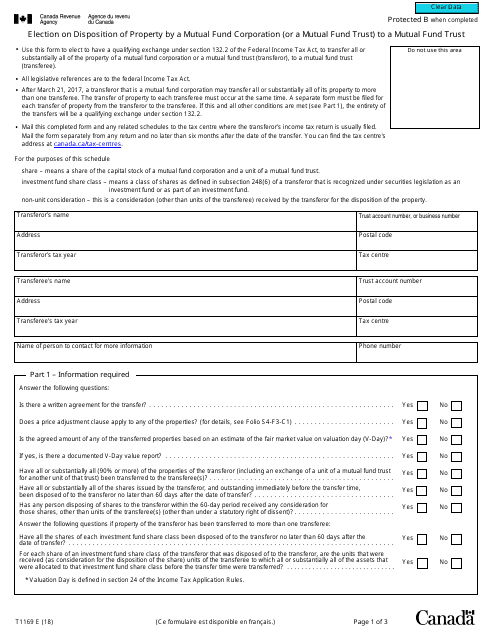

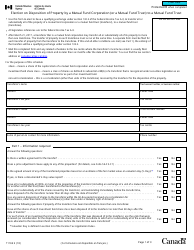

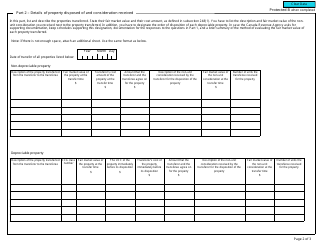

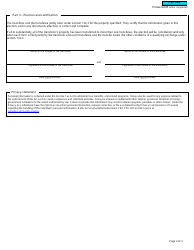

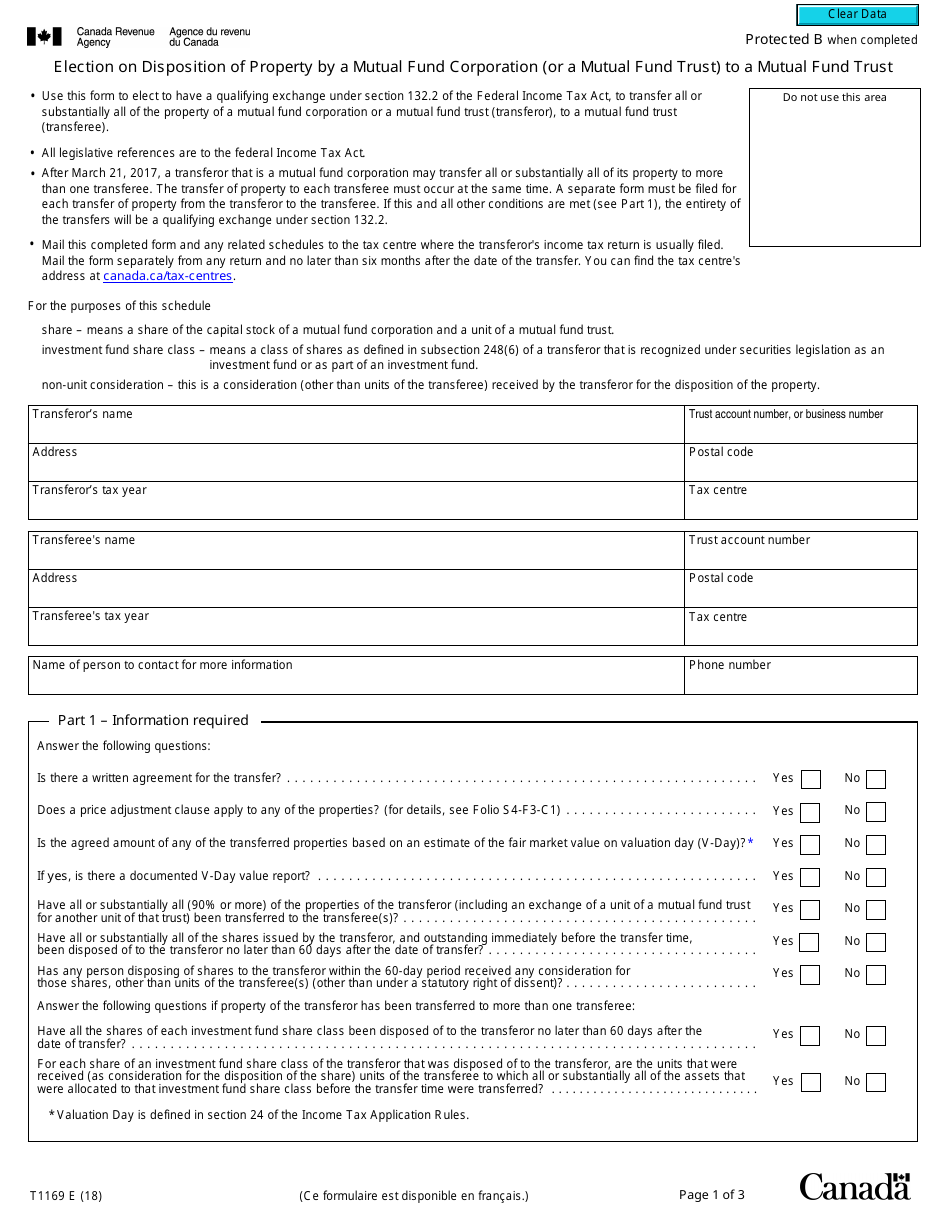

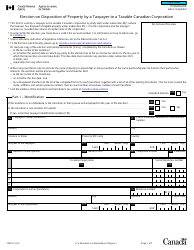

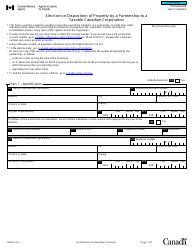

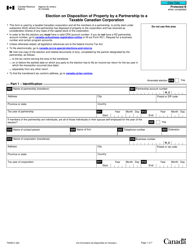

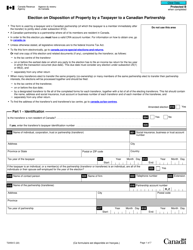

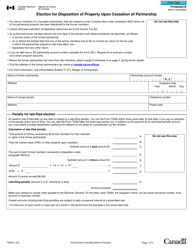

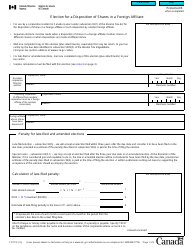

Form T1169 Election on Disposition of Property by a Mutual Fund Corporation (Or a Mutual Fund Trust) to a Mutual Fund Trust - Canada

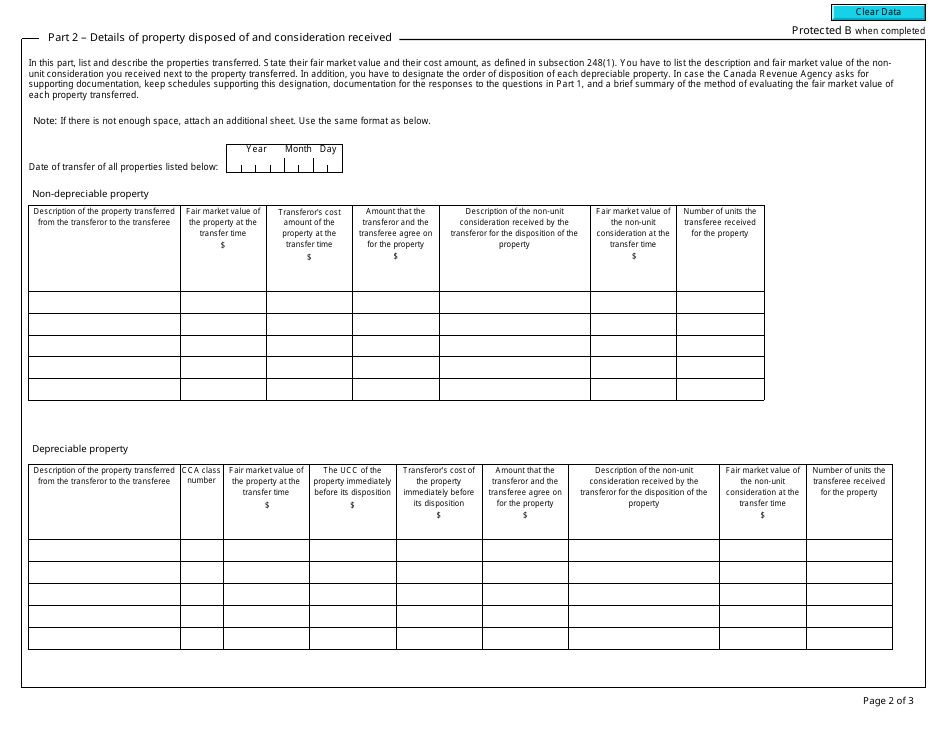

Form T1169 Election on Disposition of Property by a Mutual Fund Corporation (Or a Mutual Fund Trust) to a Mutual Fund Trust in Canada is used to elect or provide information about the disposition of property by a Mutual Fund Corporation or a Mutual Fund Trust to a Mutual Fund Trust. This form helps in reporting and calculating tax liabilities associated with such transactions. It is specific to the tax rules and requirements in Canada.

FAQ

Q: What is Form T1169?

A: Form T1169 is a tax form used in Canada for the election on disposition of property by a mutual fund corporation (or a mutual fund trust) to a mutual fund trust.

Q: Who is required to fill out Form T1169?

A: Mutual fund corporations or mutual fund trusts in Canada are required to fill out Form T1169.

Q: What is the purpose of Form T1169?

A: The purpose of Form T1169 is to report and elect the disposition of property by a mutual fund corporation or mutual fund trust to a mutual fund trust.

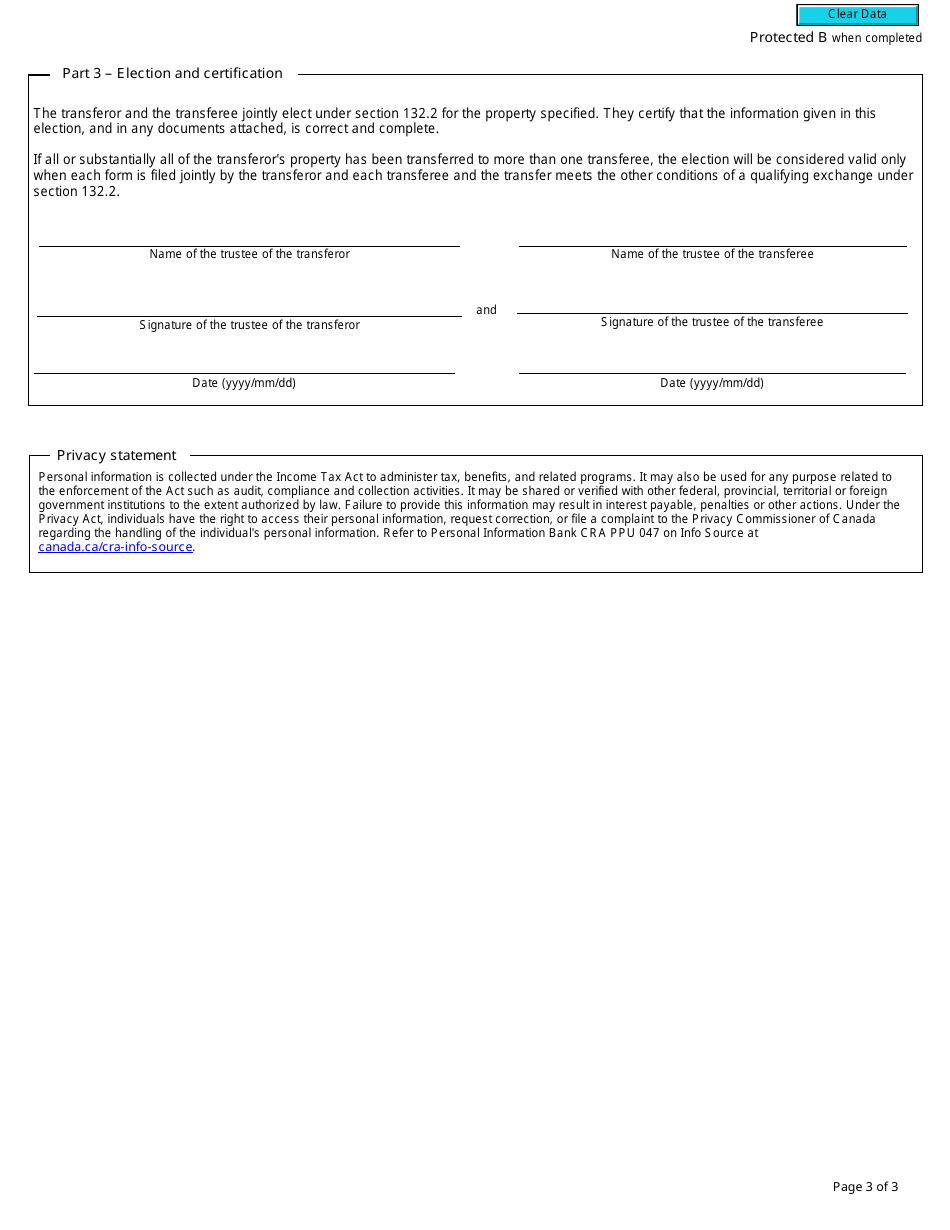

Q: When is Form T1169 due?

A: Form T1169 is due within 90 days after the end of the taxation year in which the disposition occurred.

Q: Are there any penalties for not filing Form T1169?

A: Yes, there may be penalties for not filing Form T1169, including the potential loss of certain tax benefits.

Q: Can I file Form T1169 electronically?

A: Yes, Form T1169 can be filed electronically using the CRA's My Business Account or Represent a Client services.

Q: Do I need to include supporting documents with Form T1169?

A: It is not required to include supporting documents with Form T1169, but the CRA may request them for verification purposes.

Q: Who should I contact for more information about Form T1169?

A: For more information about Form T1169, you can contact the Canada Revenue Agency (CRA) directly.