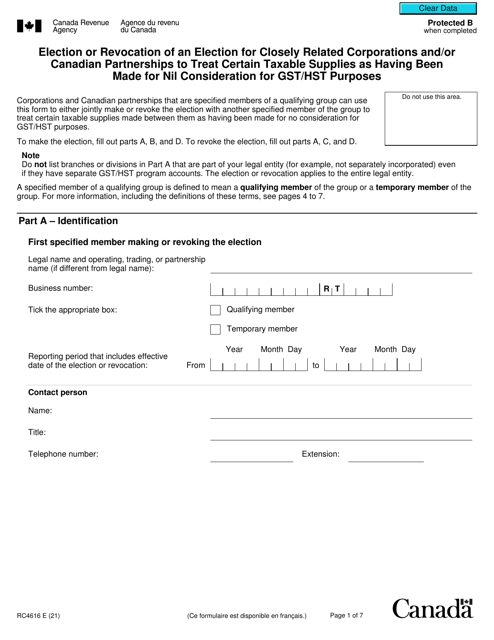

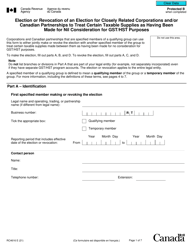

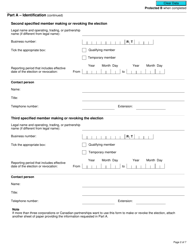

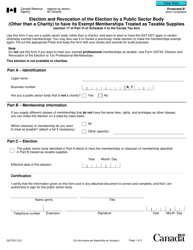

Form RC4616 Election or Revocation of an Election for Closely Related Corporations and / or Canadian Partnerships to Treat Certain Taxable Supplies as Having Been Made for Nil Consideration for Gst / Hst Purposes - Canada

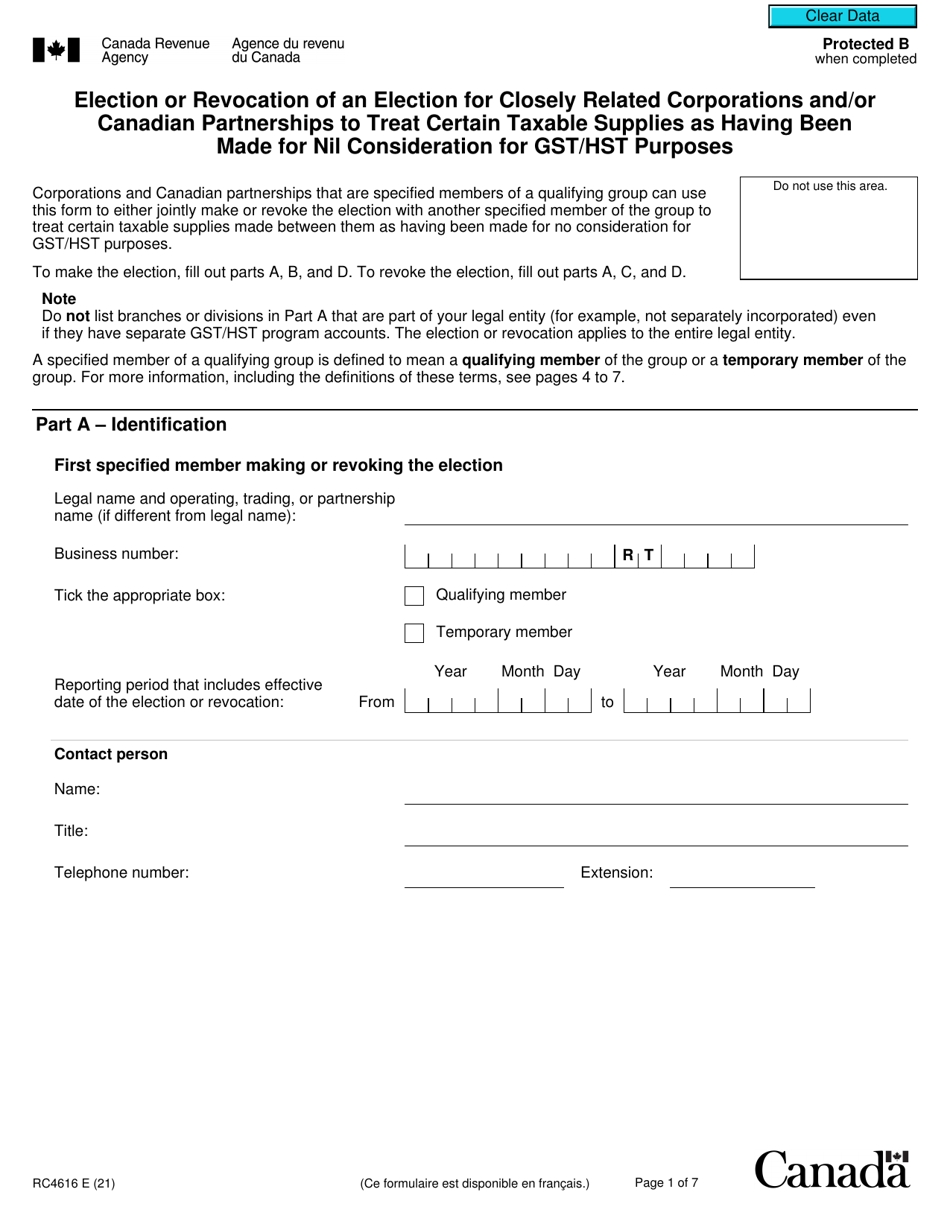

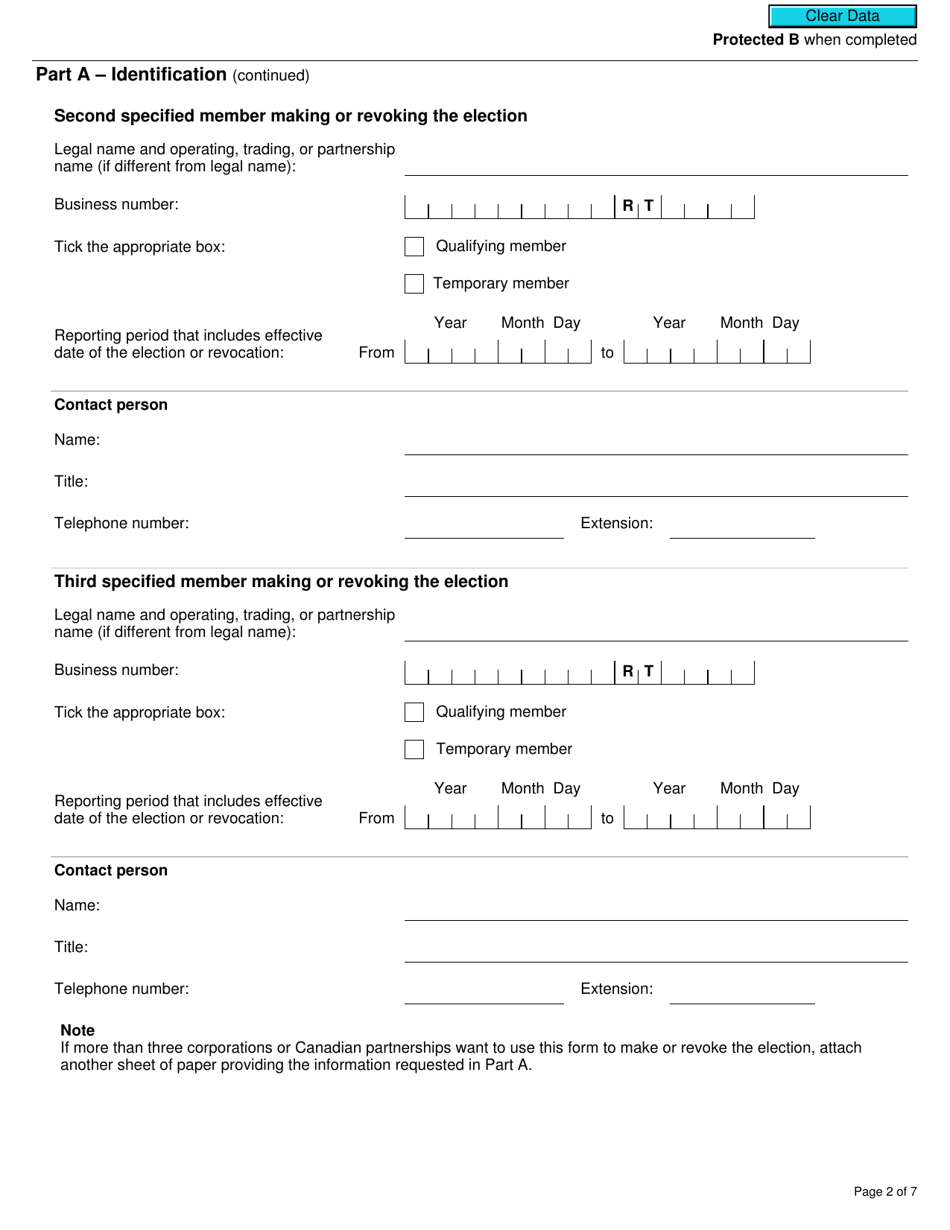

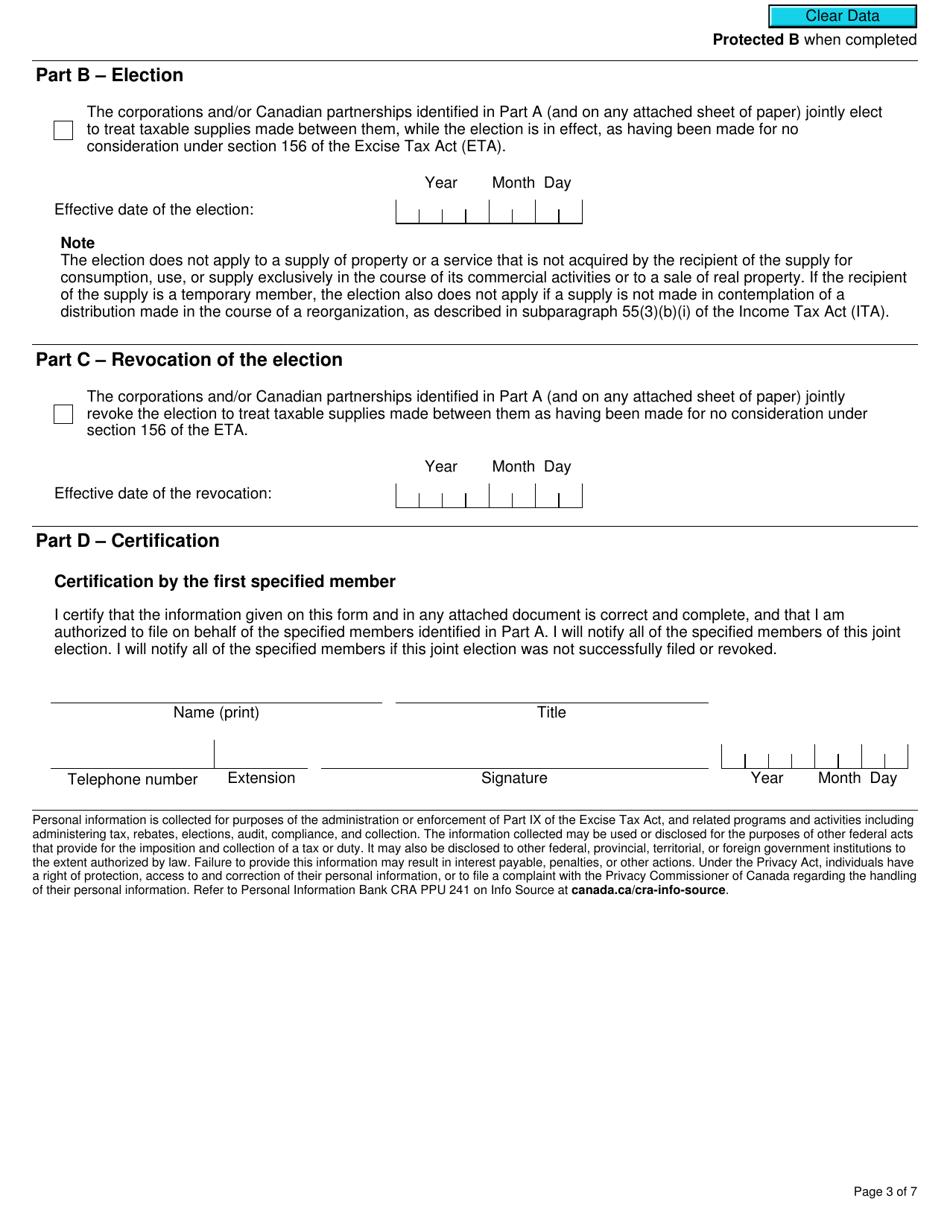

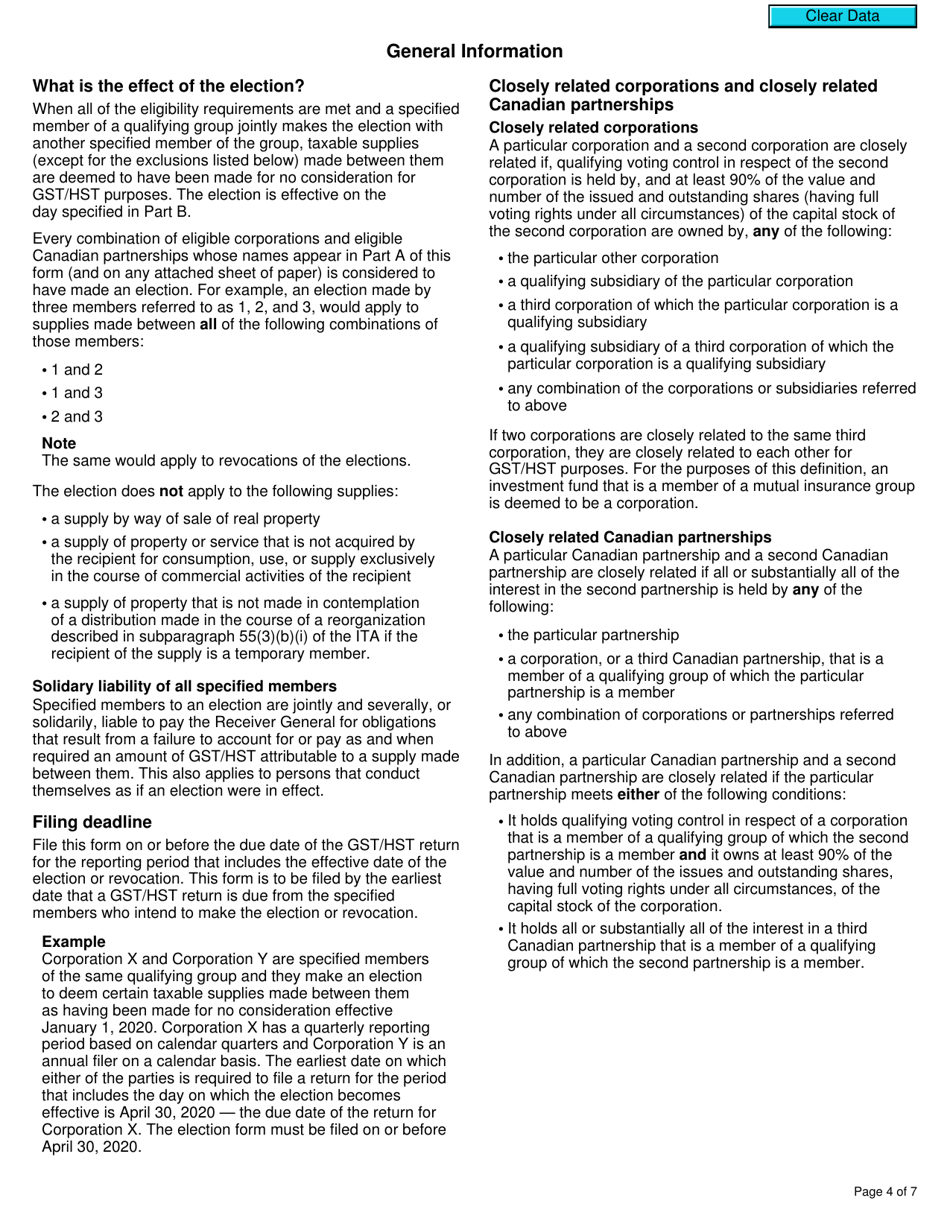

Form RC4616 is used by closely related corporations and/or Canadian partnerships to make an election or revoke an election to treat certain taxable supplies as having been made for nil consideration for GST/HST purposes in Canada. This election allows them to not charge GST/HST on specific transactions.

The form RC4616 is filed by closely related corporations and/or Canadian partnerships in Canada to make an election or revoke an election to treat certain taxable supplies as having been made for nil consideration for GST/HST purposes.

Form RC4616 Election or Revocation of an Election for Closely Related Corporations and/or Canadian Partnerships to Treat Certain Taxable Supplies as Having Been Made for Nil Consideration for Gst/Hst Purposes - Canada - Frequently Asked Questions (FAQ)

Q: What is form RC4616?

A: Form RC4616 is used in Canada for the election or revocation of an election for closely related corporations and/or Canadian partnerships to treat certain taxable supplies as having been made for nil consideration for GST/HST purposes.

Q: Who can use form RC4616?

A: Closely related corporations and/or Canadian partnerships can use form RC4616.

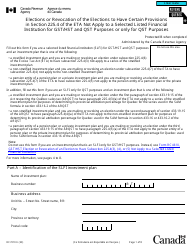

Q: What is the purpose of form RC4616?

A: The purpose of form RC4616 is to treat certain taxable supplies as having been made for nil consideration for GST/HST purposes.

Q: What is GST/HST?

A: GST stands for Goods and Services Tax, and HST stands for Harmonized Sales Tax. These are consumption taxes used in Canada.

Q: What does it mean to treat a taxable supply as having been made for nil consideration?

A: Treating a taxable supply as having been made for nil consideration means that the supply is treated as if it were made without any payment.

Q: Why would a closely related corporation or Canadian partnership want to treat a taxable supply as having been made for nil consideration?

A: There may be situations where closely related corporations or Canadian partnerships want to treat a taxable supply as having been made for nil consideration in order to simplify the calculation of GST/HST amounts.

Q: Is form RC4616 required to be filed for all taxable supplies?

A: No, form RC4616 is only used for certain taxable supplies that are being treated as having been made for nil consideration.

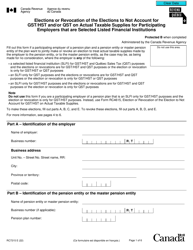

Q: Is the information on form RC4616 confidential?

A: Yes, the information provided on form RC4616 is confidential and is protected under the confidentiality provisions of the Income Tax Act.

Q: Is there a deadline for filing form RC4616?

A: The deadline for filing form RC4616 depends on various factors, such as the specific election being made. It is important to consult the CRA or a tax professional for the specific deadline.