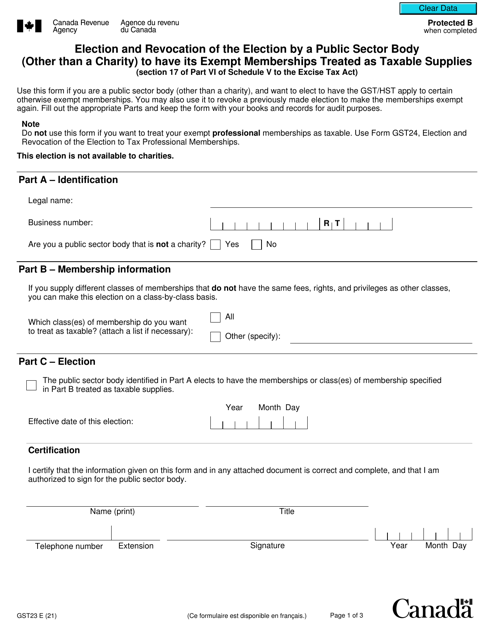

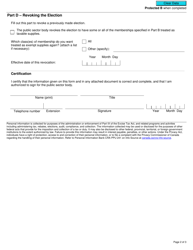

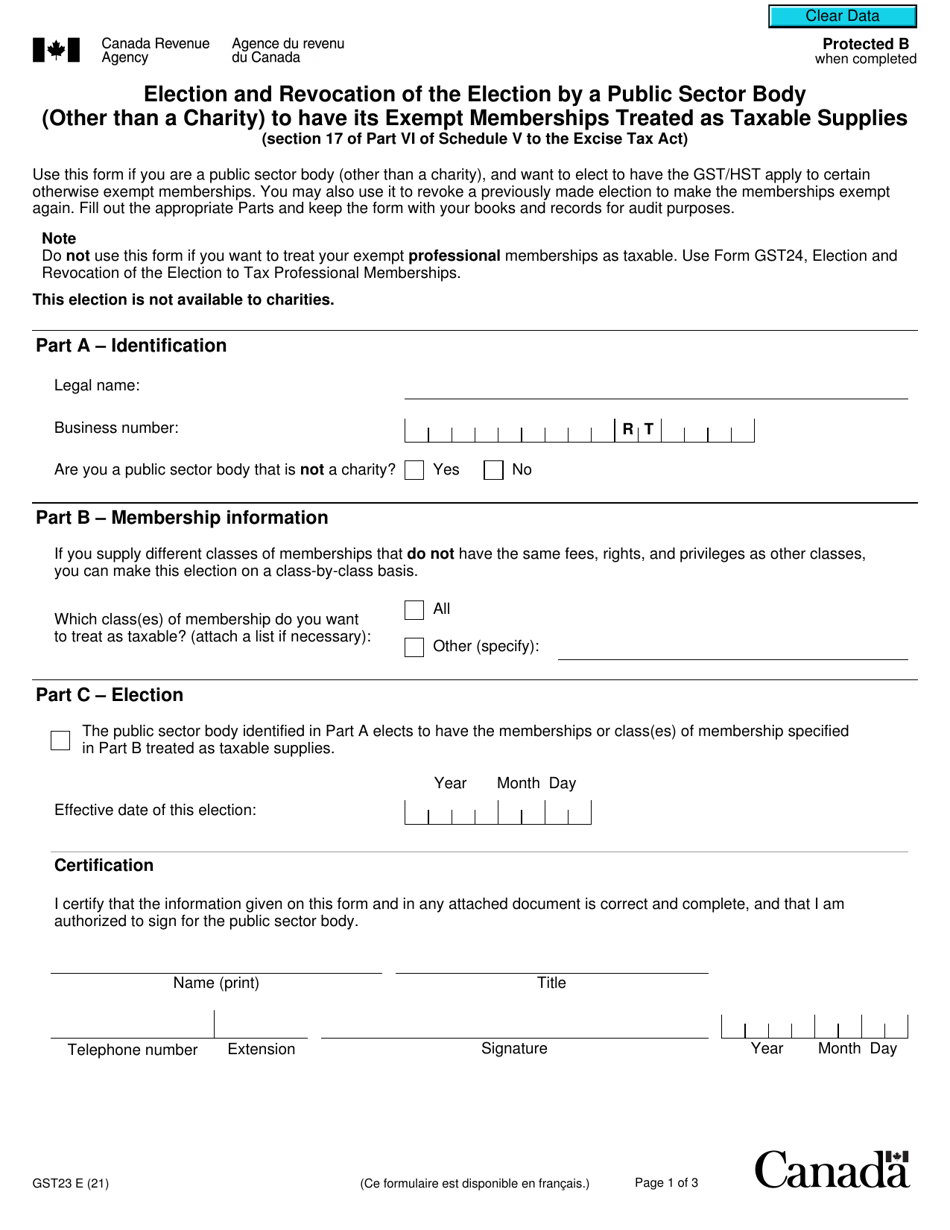

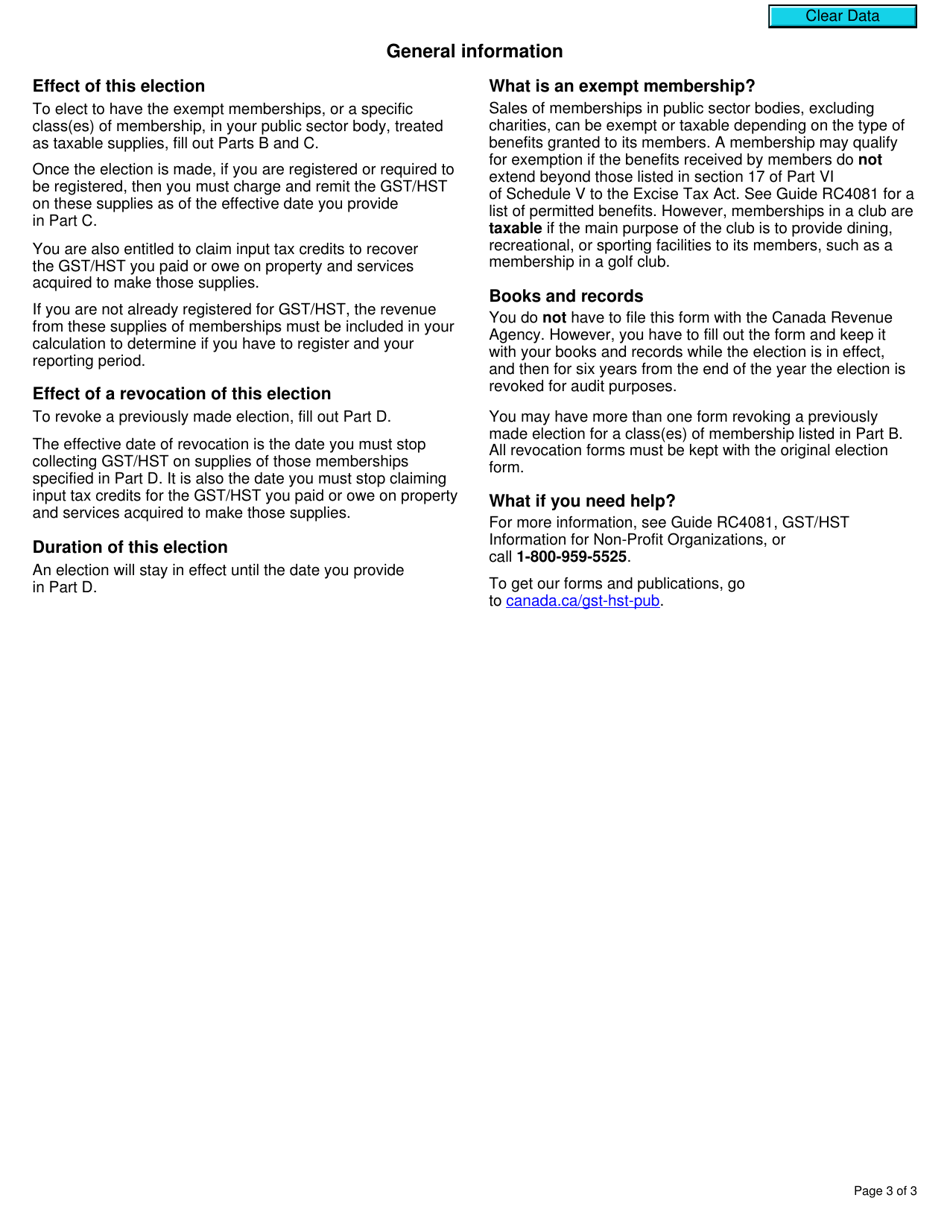

Form GST23 Election and Revocation of the Election by a Public Sector Body (Other Than a Charity) to Have Its Exempt Memberships Treated as Taxable Supplies - Canada

Form GST23 in Canada is used by public sector bodies, except for charities, to elect to have their exempt memberships treated as taxable supplies for Goods and Services Tax (GST) purposes. It is used to indicate the intention to charge and collect GST on the membership fees.

The Form GST23 is filed by a public sector body in Canada (other than a charity) to elect or revoke the election to have its exempt memberships treated as taxable supplies.

Form GST23 Election and Revocation of the Election by a Public Sector Body (Other Than a Charity) to Have Its Exempt Memberships Treated as Taxable Supplies - Canada - Frequently Asked Questions (FAQ)

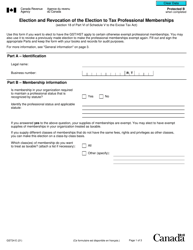

Q: What is Form GST23?

A: Form GST23 is used by a public sector body (other than a charity) in Canada to make an election or revocation of the election for treating its exempt memberships as taxable supplies.

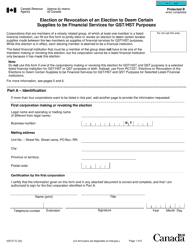

Q: Who can use Form GST23?

A: The form can be used by public sector bodies in Canada, except charities, to elect or revoke the election to have their exempt memberships treated as taxable supplies.

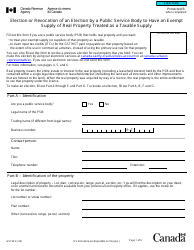

Q: What does the election mean?

A: The election allows a public sector body to treat its exempt memberships as taxable supplies for the purpose of Goods and Services Tax (GST).

Q: What is considered a public sector body?

A: In Canada, a public sector body refers to a government or public authority at any level, including municipalities, universities, schools, and hospitals.

Q: What are exempt memberships?

A: Exempt memberships are memberships that are generally not subject to GST. By making the election, a public sector body can treat these memberships as taxable supplies.

Q: When should Form GST23 be submitted?

A: Form GST23 should be submitted within 90 days of the election or revocation of the election.

Q: Is there a deadline for submitting the form?

A: Yes, the form should be submitted within 90 days of the election or revocation of the election.

Q: Can charities use Form GST23?

A: No, Form GST23 is not applicable to charities. Charities have a separate process for making elections related to taxable supplies.

Q: What is the purpose of treating exempt memberships as taxable supplies?

A: Treating exempt memberships as taxable supplies allows the public sector body to claim Input Tax Credits (ITCs) and recover any GST paid on related expenses.