This version of the form is not currently in use and is provided for reference only. Download this version of

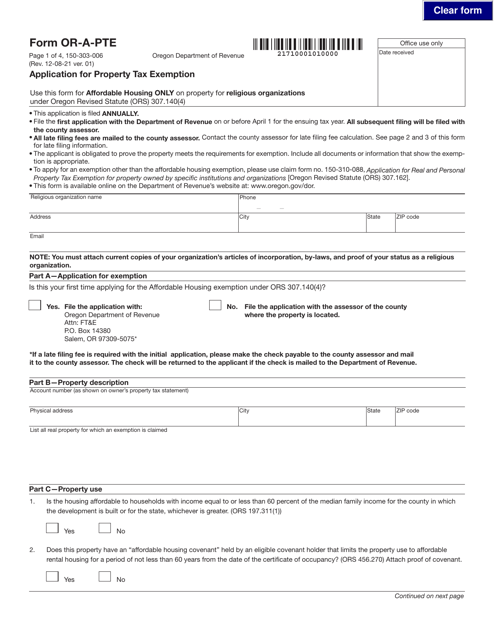

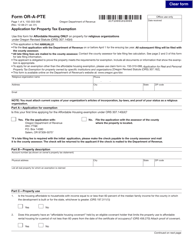

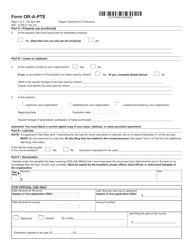

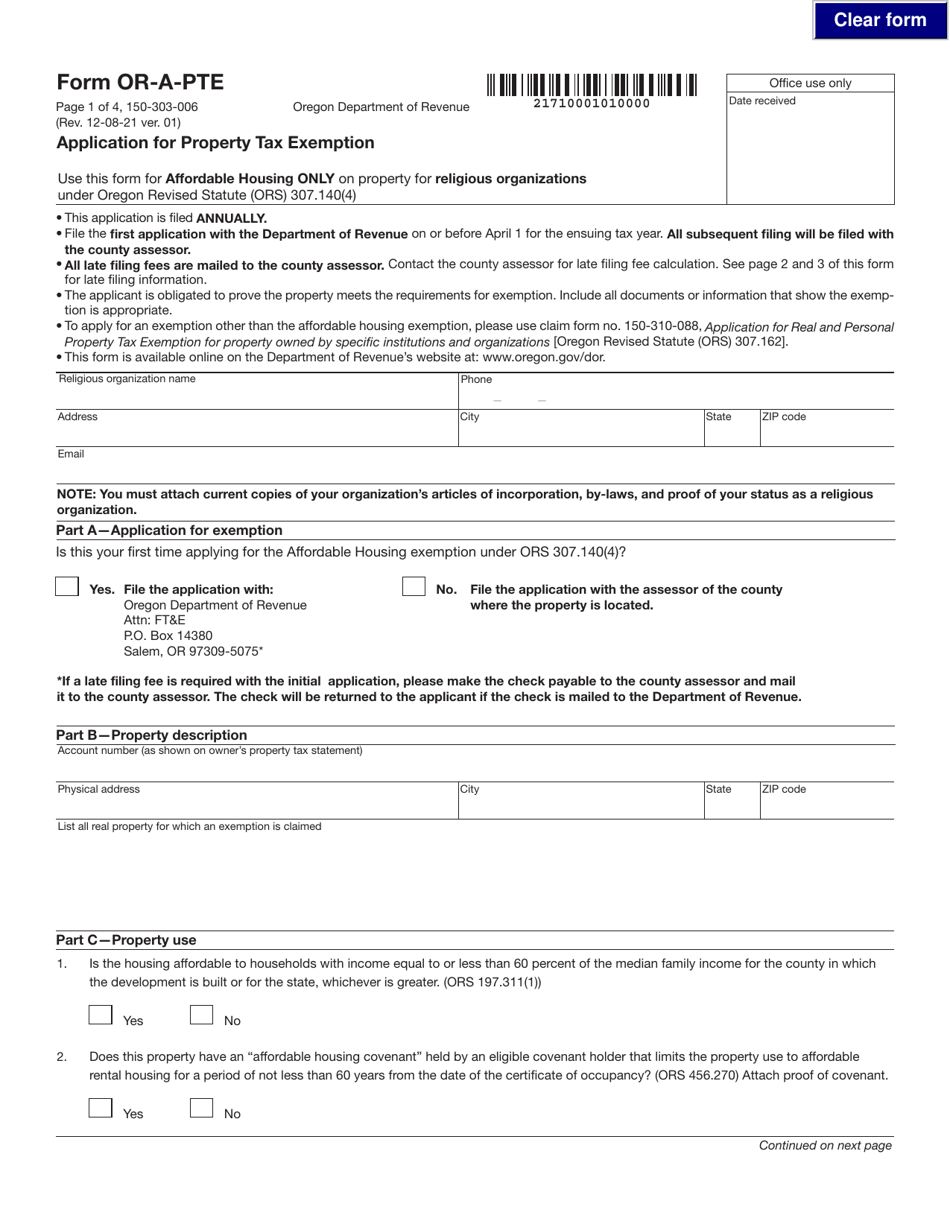

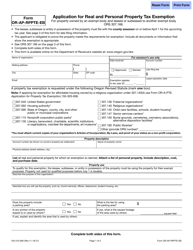

Form OR-A-PTE (150-303-006)

for the current year.

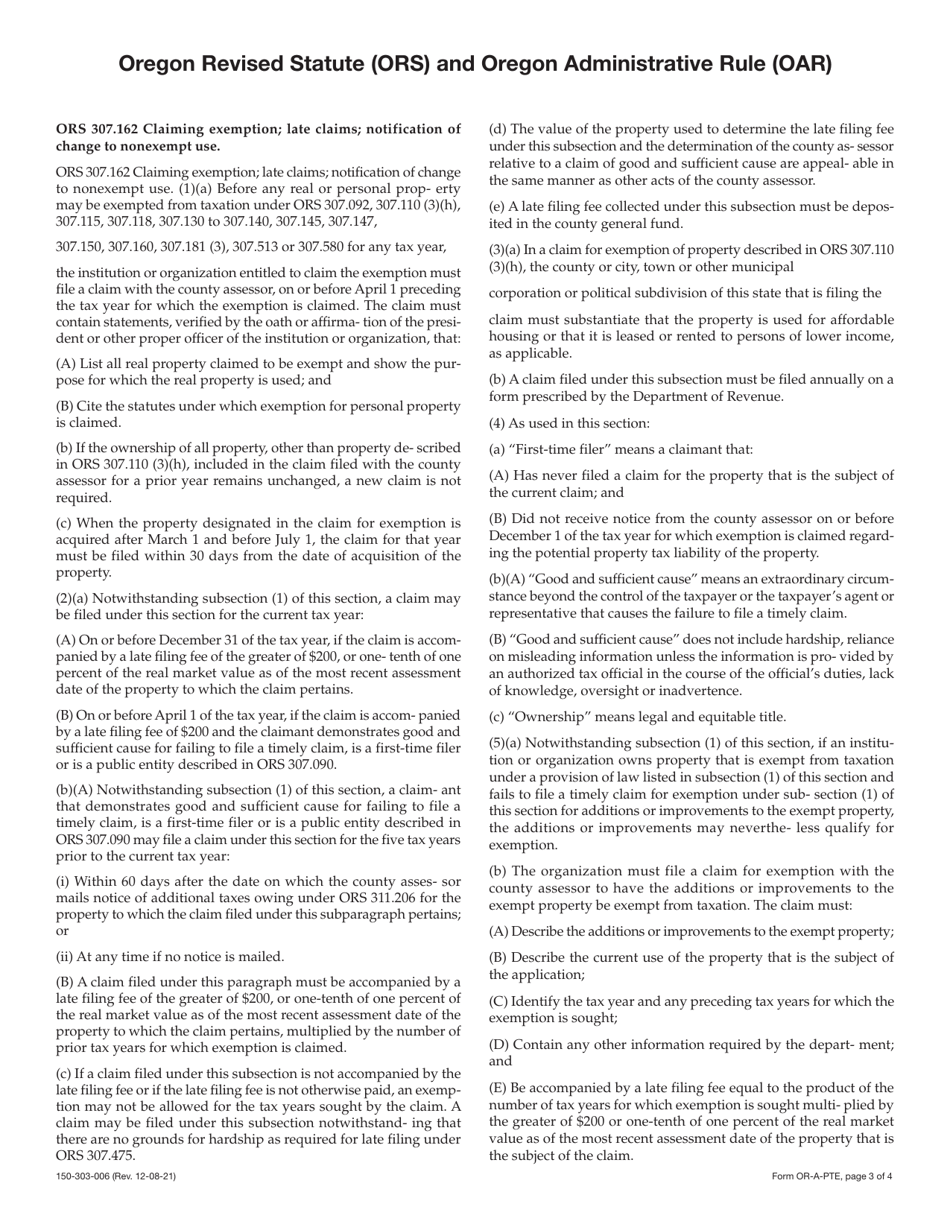

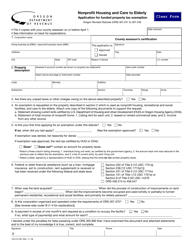

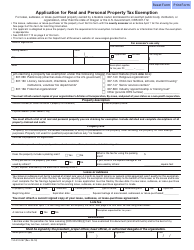

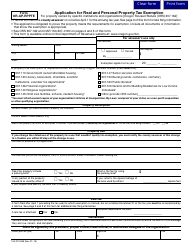

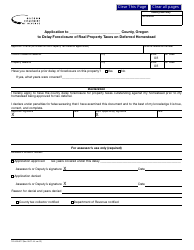

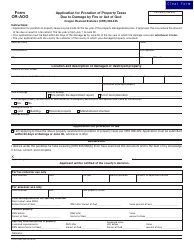

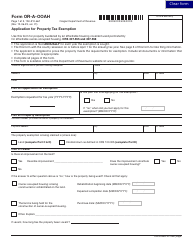

Form OR-A-PTE (150-303-006) Application for Property Tax Exemption - Oregon

What Is Form OR-A-PTE (150-303-006)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-A-PTE?

A: Form OR-A-PTE is the Application for Property Tax Exemption in Oregon.

Q: What is the purpose of Form OR-A-PTE?

A: The purpose of Form OR-A-PTE is to apply for a property tax exemption in Oregon.

Q: Who is eligible to fill out Form OR-A-PTE?

A: Property owners who meet certain criteria may be eligible to fill out Form OR-A-PTE.

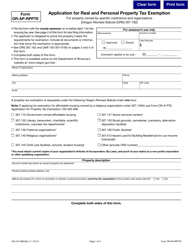

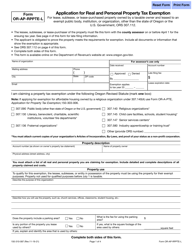

Q: What type of properties can be exempted from property tax?

A: Certain types of properties, such as religious, charitable, or educational institutions, may qualify for property tax exemption.

Q: When is the deadline to submit Form OR-A-PTE?

A: The deadline to submit Form OR-A-PTE is April 1st of the assessment year.

Q: What documents should I include with Form OR-A-PTE?

A: You may need to include supporting documents such as proof of ownership, articles of incorporation, or IRS determination letter with Form OR-A-PTE.

Q: How long does it take to process Form OR-A-PTE?

A: The processing time for Form OR-A-PTE may vary, so it's recommended to submit it as early as possible.

Q: What happens if my application for property tax exemption is approved?

A: If your application is approved, your property will be exempt from property tax for the qualifying period.

Form Details:

- Released on December 8, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-A-PTE (150-303-006) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.