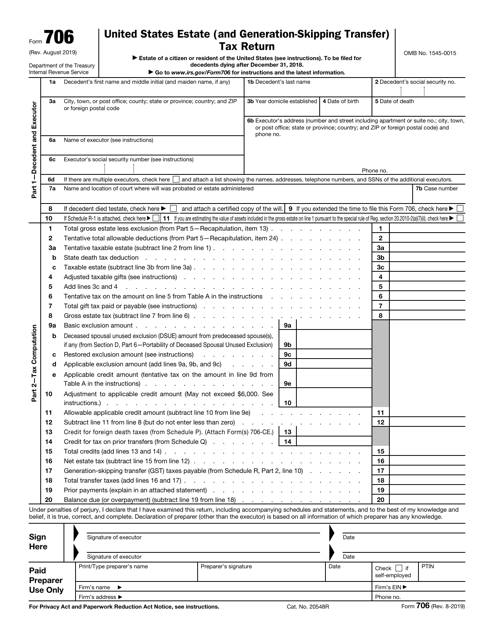

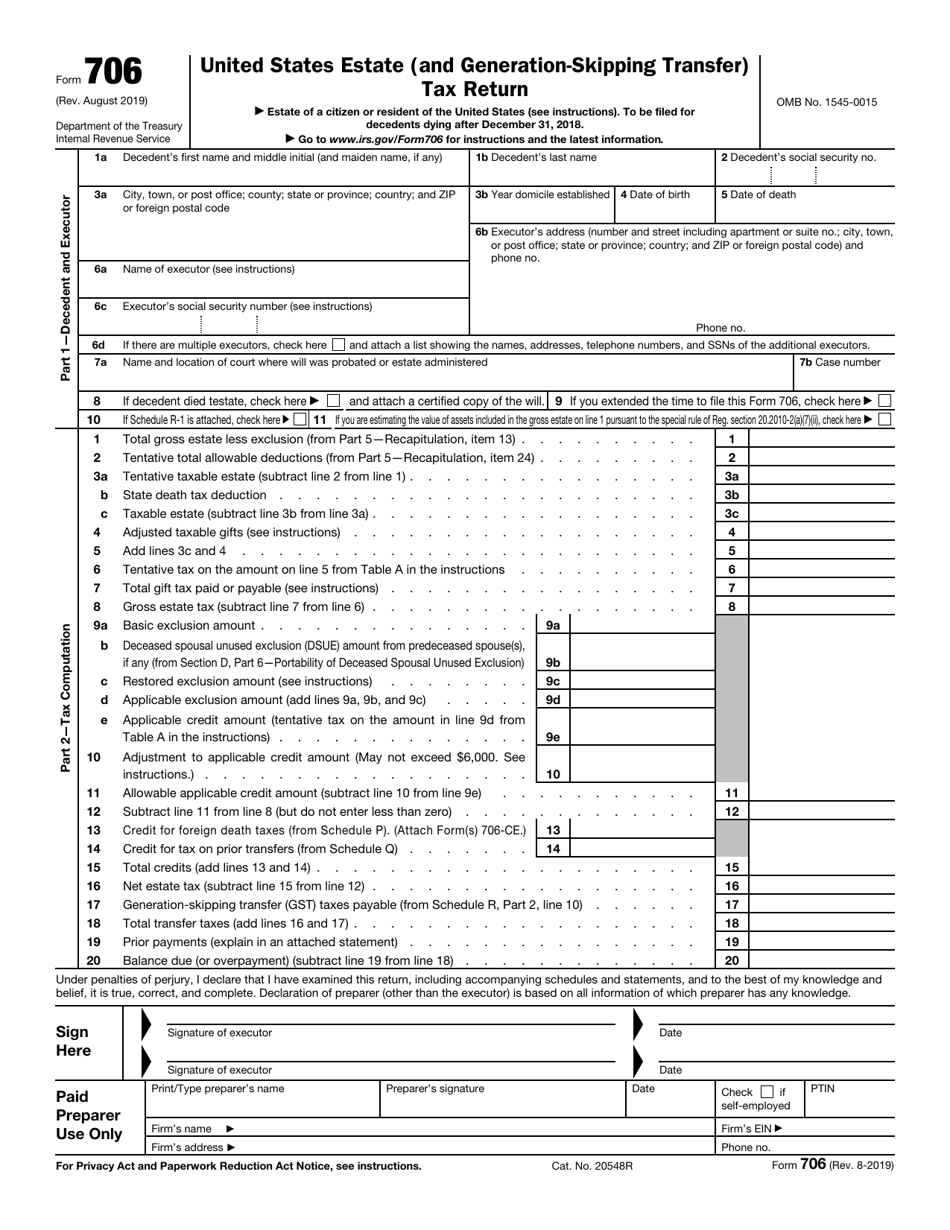

IRS Form 706 United States Estate (And Generation-Skipping Transfer) Tax Return

What Is IRS Form 706?

IRS Form 706, United States Estate (And Generation-Skipping Transfer) Tax Return , is a formal statement prepared and submitted by estate administrators to calculate the estate tax liability of the person that recently died.

Alternate Names:

- United States Estate Tax Return;

- 706 Tax Form.

Alternatively, this form can be filed when you compute the tax liability in the name of the decedent when the recipient of the assets is more than one generation younger. Fill out this instrument to inform fiscal authorities about the assets of the individual that passed away, the deductions that apply to the tax that must still be paid, and the beneficiaries of the estate.

This document was issued by the Internal Revenue Service (IRS) on August 1, 2019 - older editions of the form are now obsolete. An IRS Form 706 fillable version is available for download below.

IRS Form 706 Instructions

Follow these Form 706 instructions to determine the proper amount of estate tax to pay or learn how much tax is owed when the assets are transferred to a person more than one generation younger than the decedent:

-

Identify the decedent and yourself . Indicate the name and the location of the court where the estate was administered or the will was probated and specify the number of the case.

-

Compute the tax - you need to apply the rates listed in official Form 706 guidelines to the total amount of transfers that took place before the death of the person in question as well as after . Confirm your decision to opt for an alternate valuation of tax if you believe this is a better option.

-

Certify the accuracy of the details you put in writing on the first page of the instrument . Alternatively, the form can be signed by a tax professional you hired to help you out with the paperwork.

-

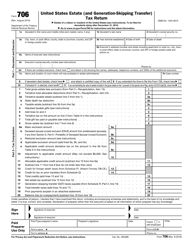

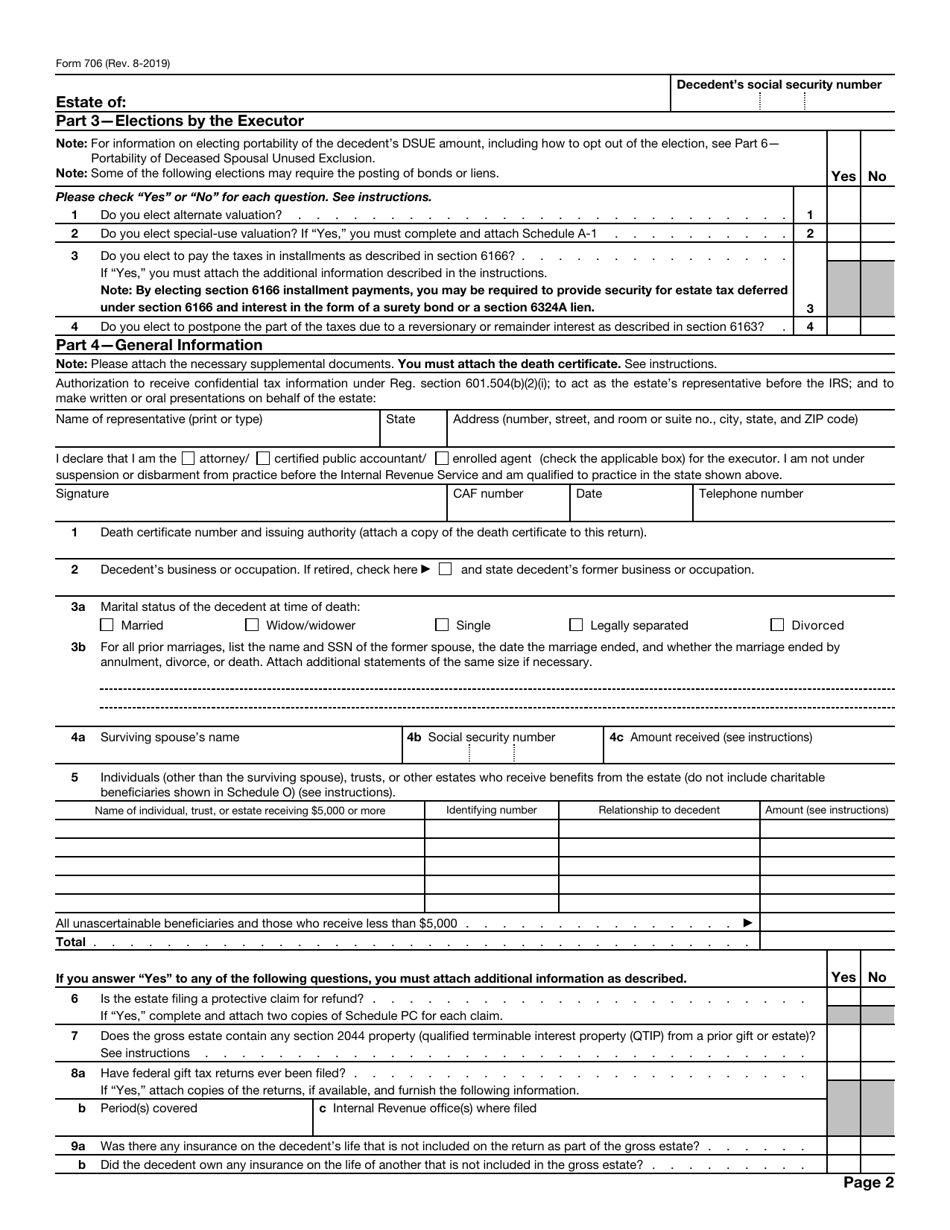

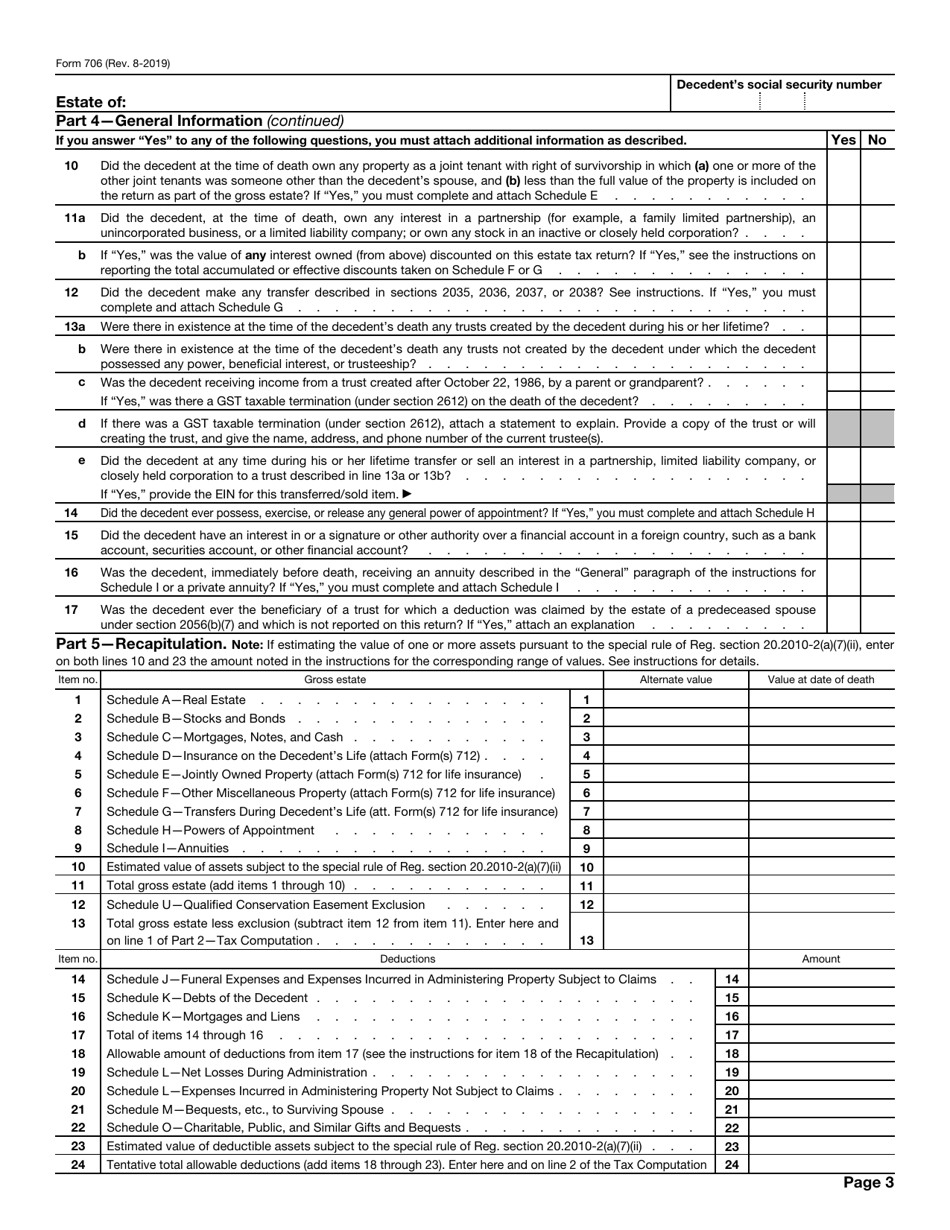

Provide more information about yourself and the person whose estate you represent . You need to record the personal details of the deceased individual, state whether they were married at the time of death or not, and identify the beneficiaries of the estate. Answer questions about the decedent's assets and activities - if you answer affirmatively, you will have to complete certain schedules as a part of the form.

-

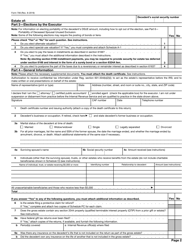

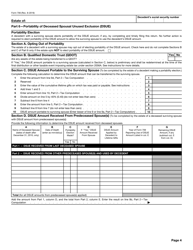

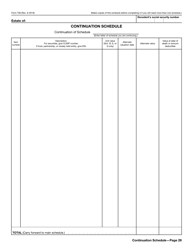

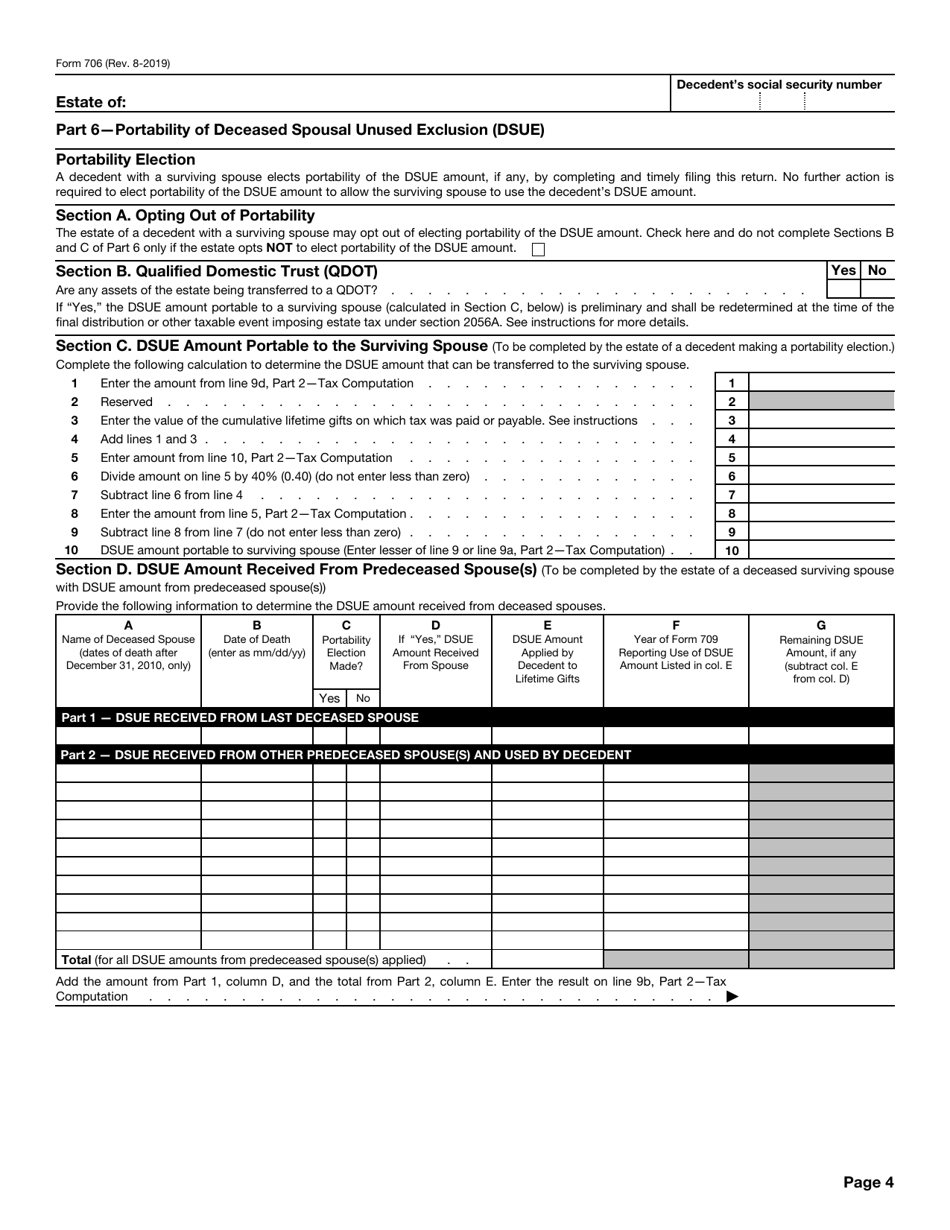

Enter the alternate value of the decedent's possessions and record their value at the time of their death . List the amounts of deductions that will be applied to the tax. You can use this section of the document as a Form 706 checklist - refer to it when you complete the schedules to make sure you do not miss anything. Verify the decision to choose portability of the deceased spousal unused exemption - the amount in question will be applied to the future transfers of the surviving spouse.

-

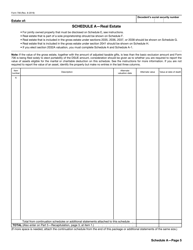

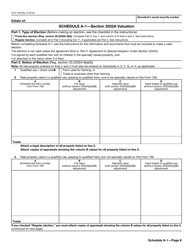

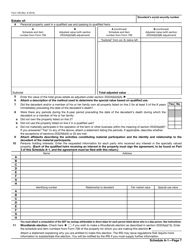

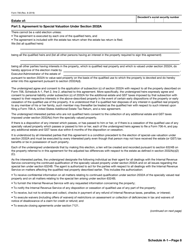

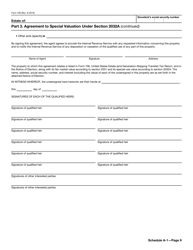

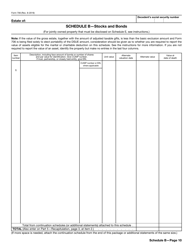

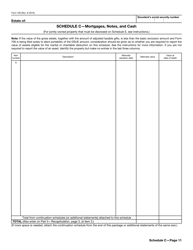

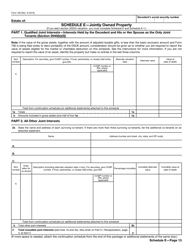

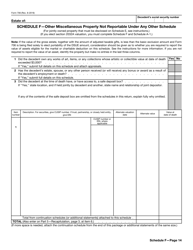

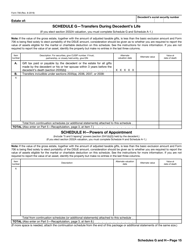

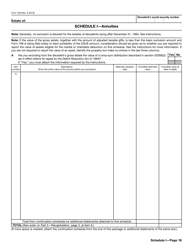

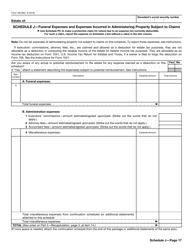

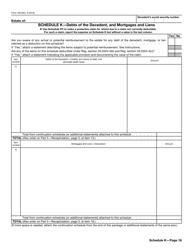

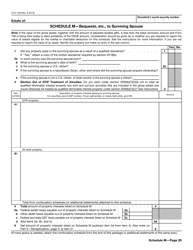

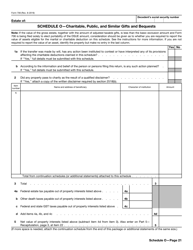

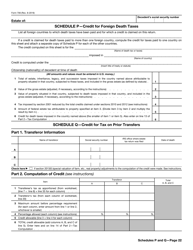

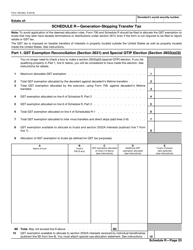

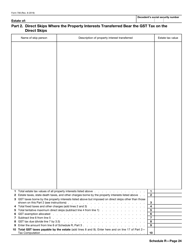

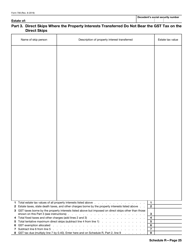

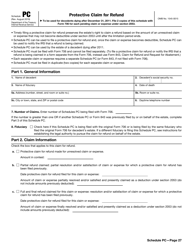

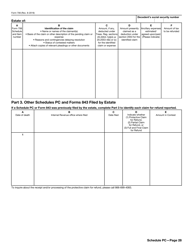

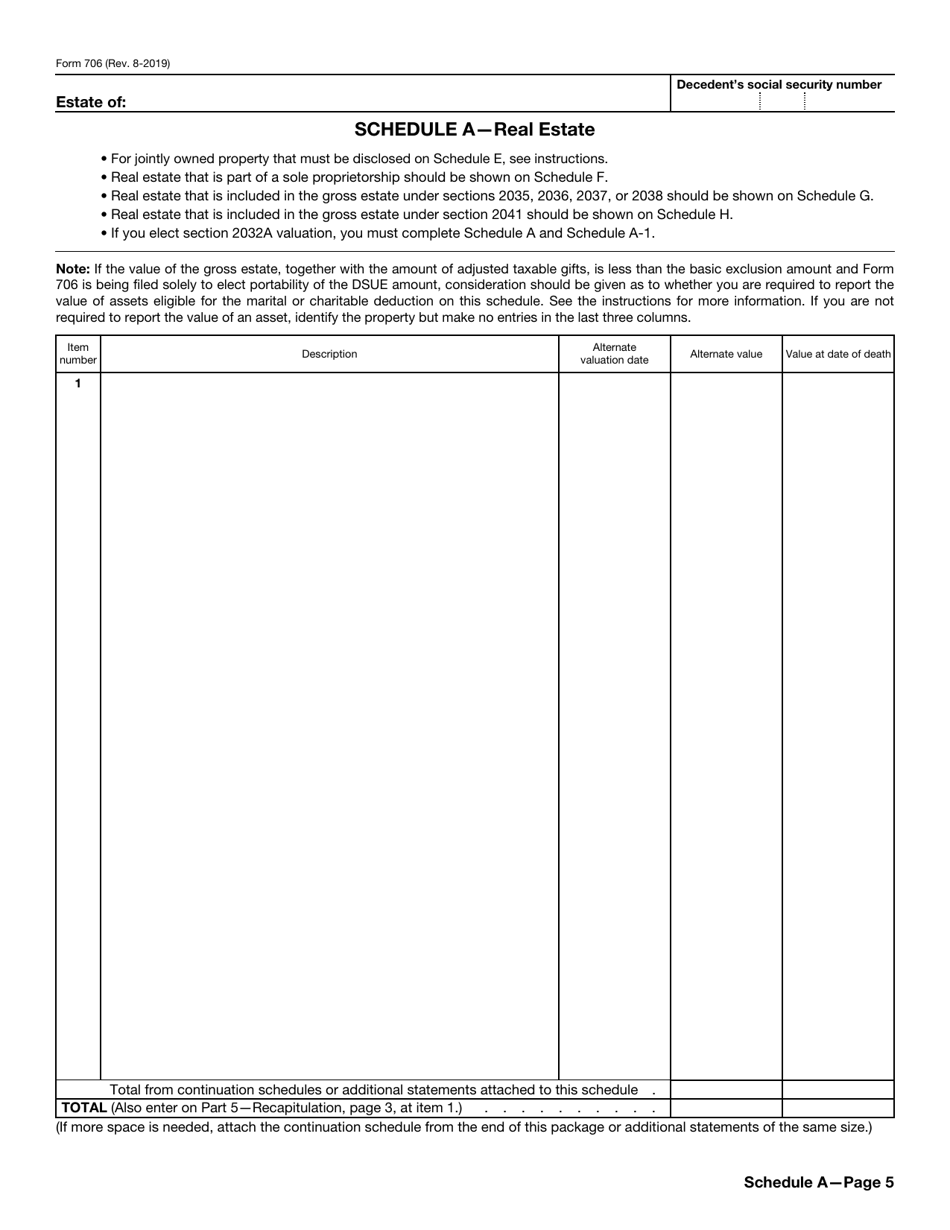

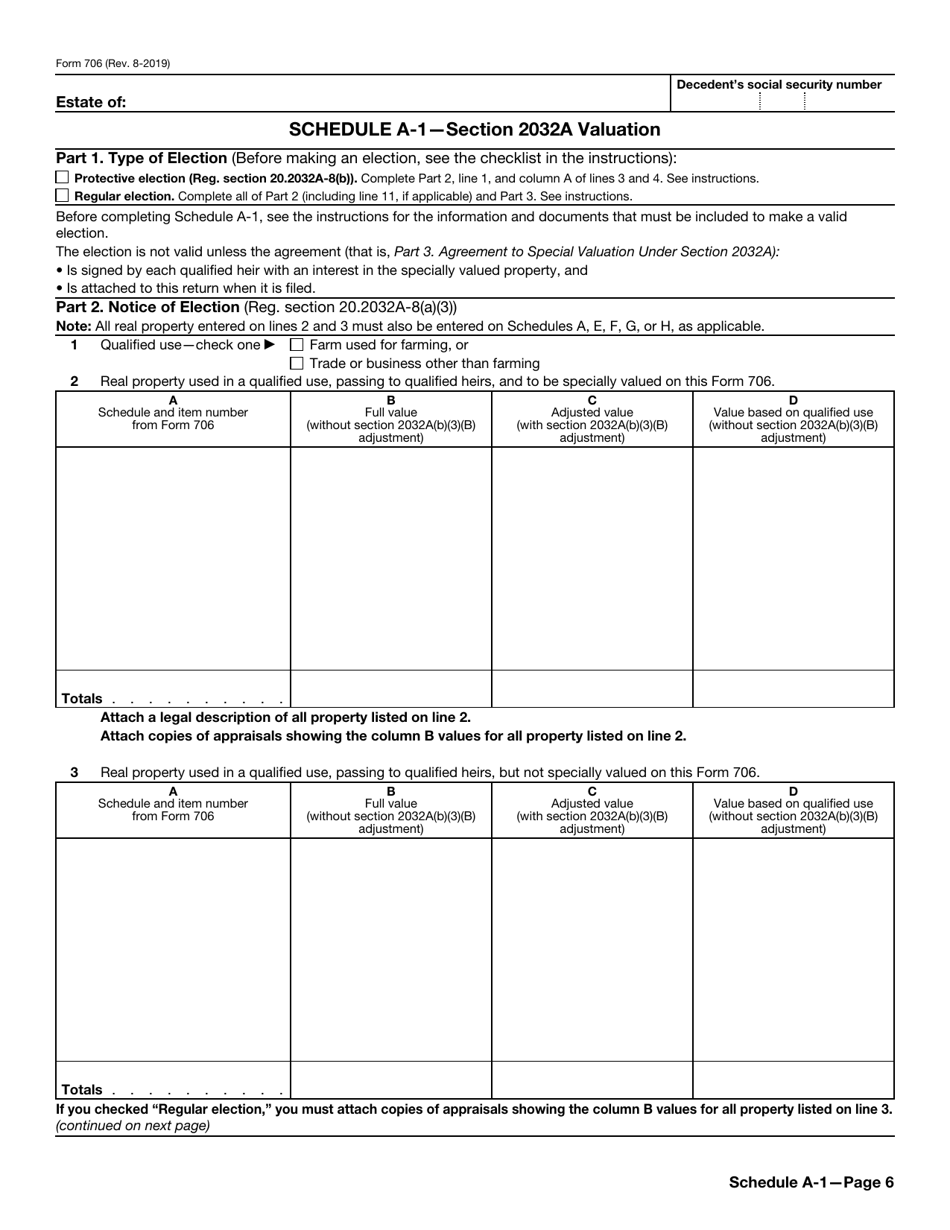

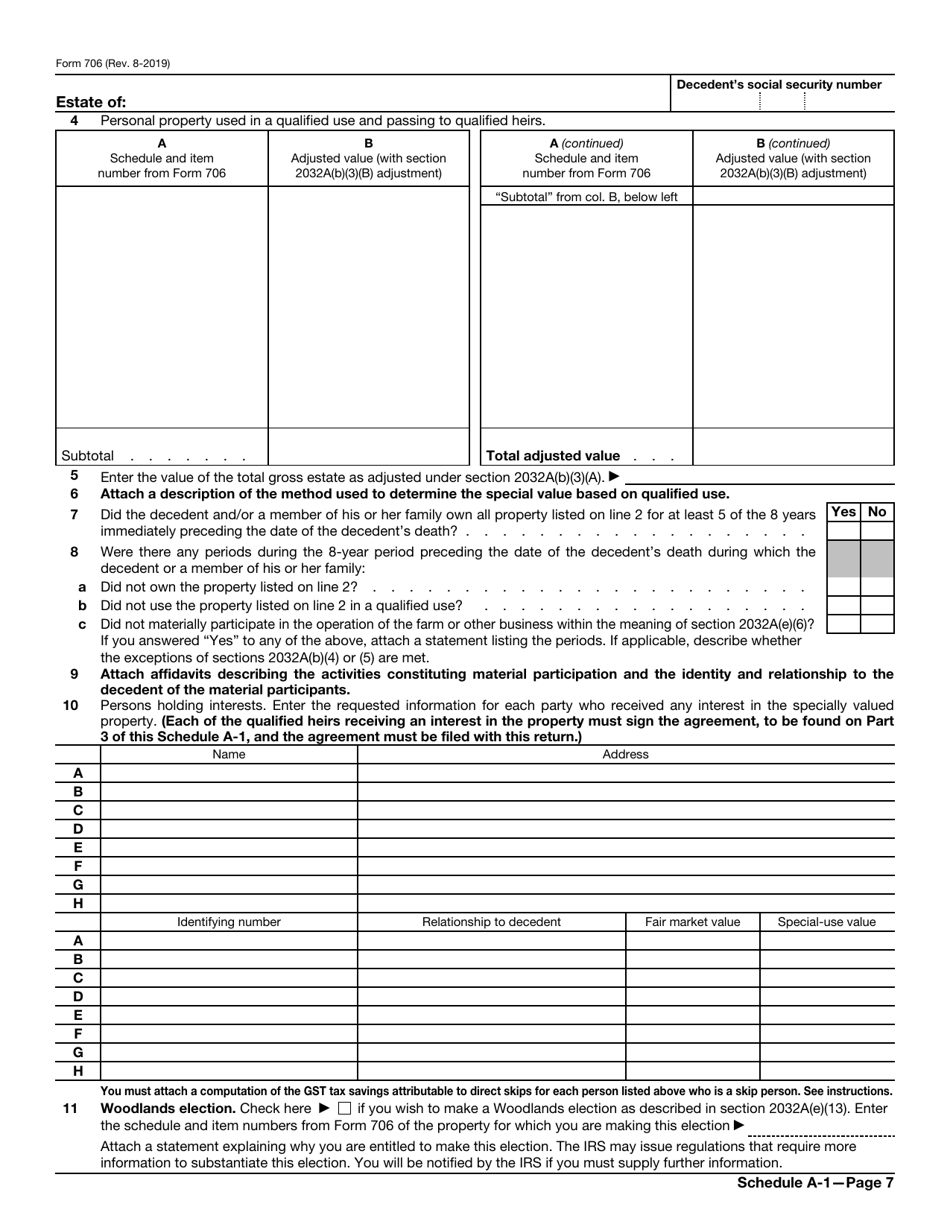

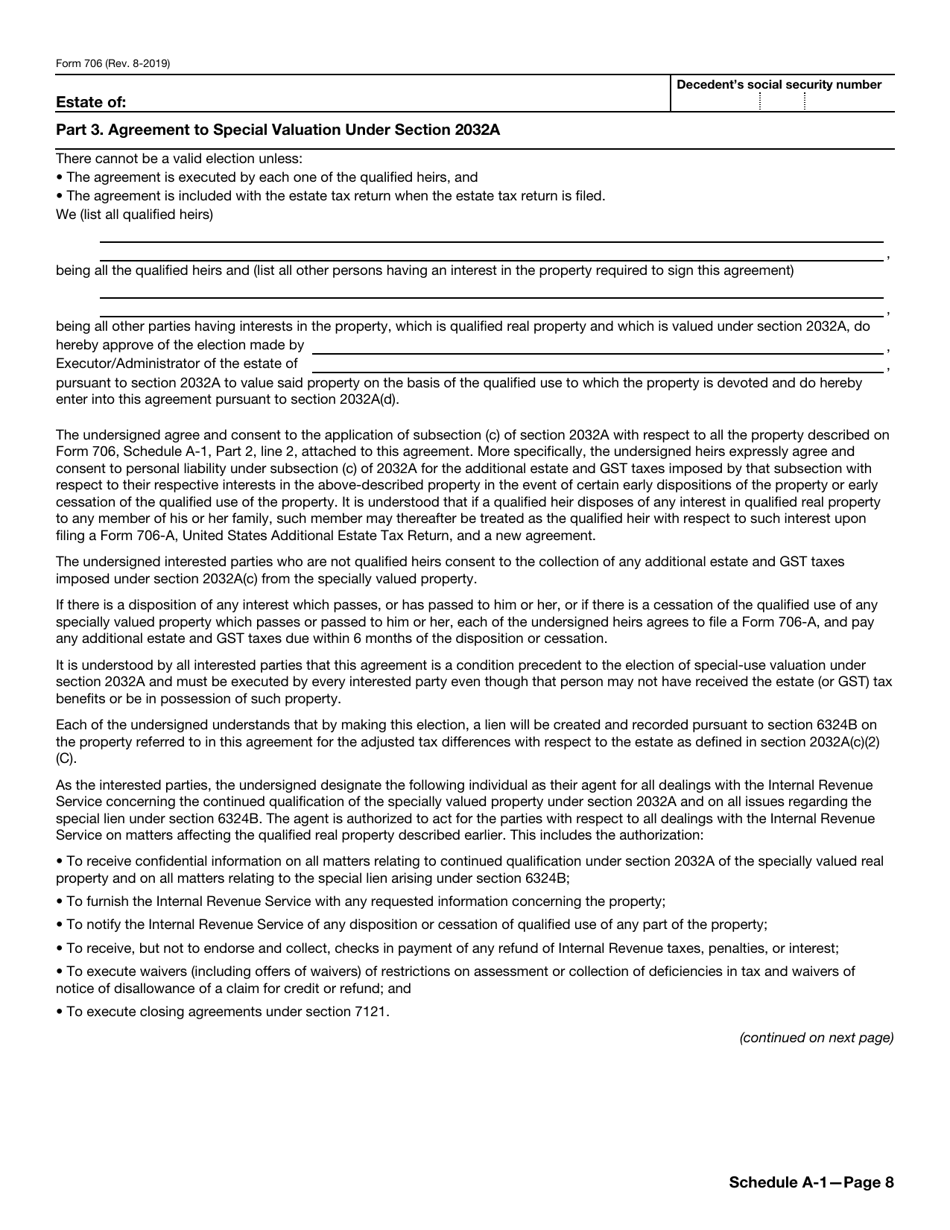

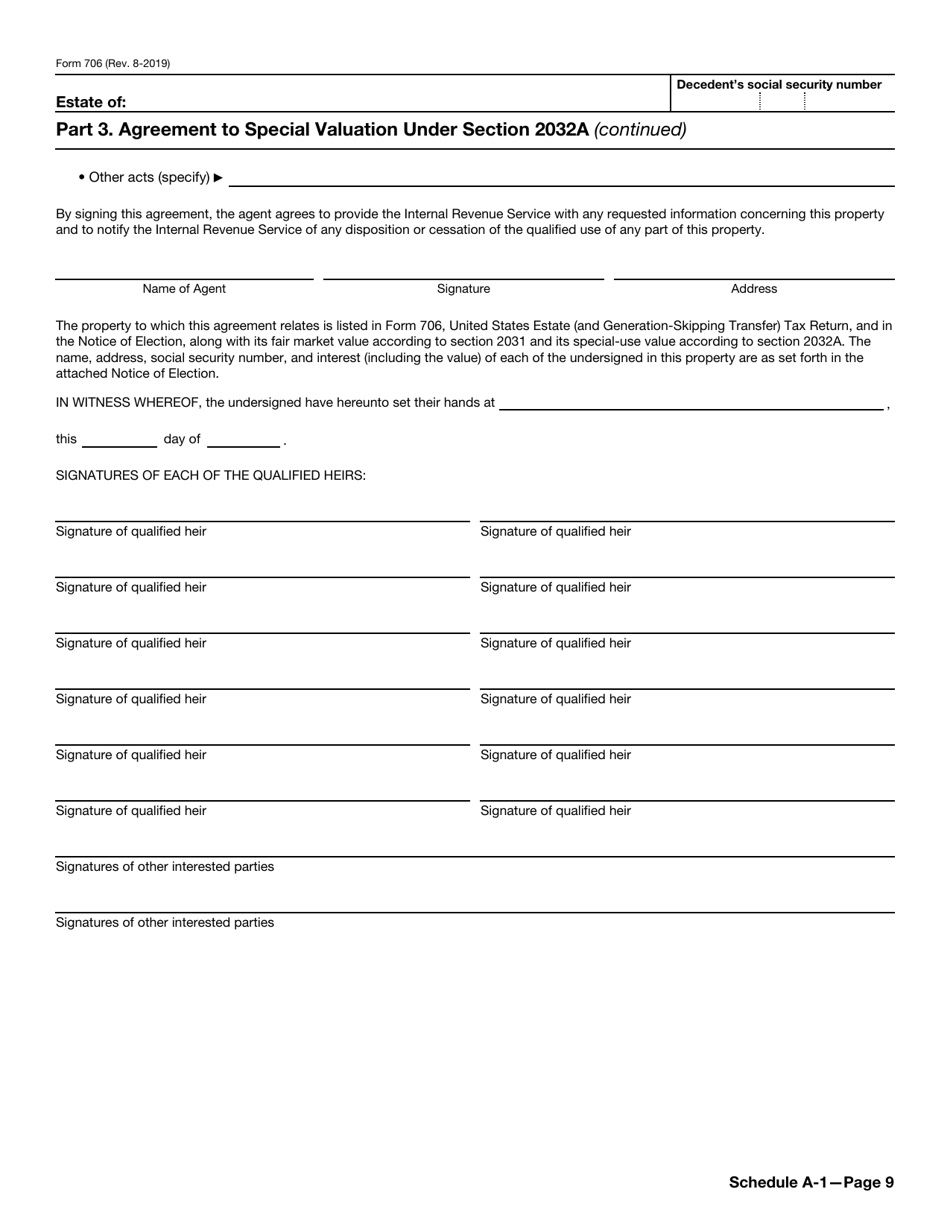

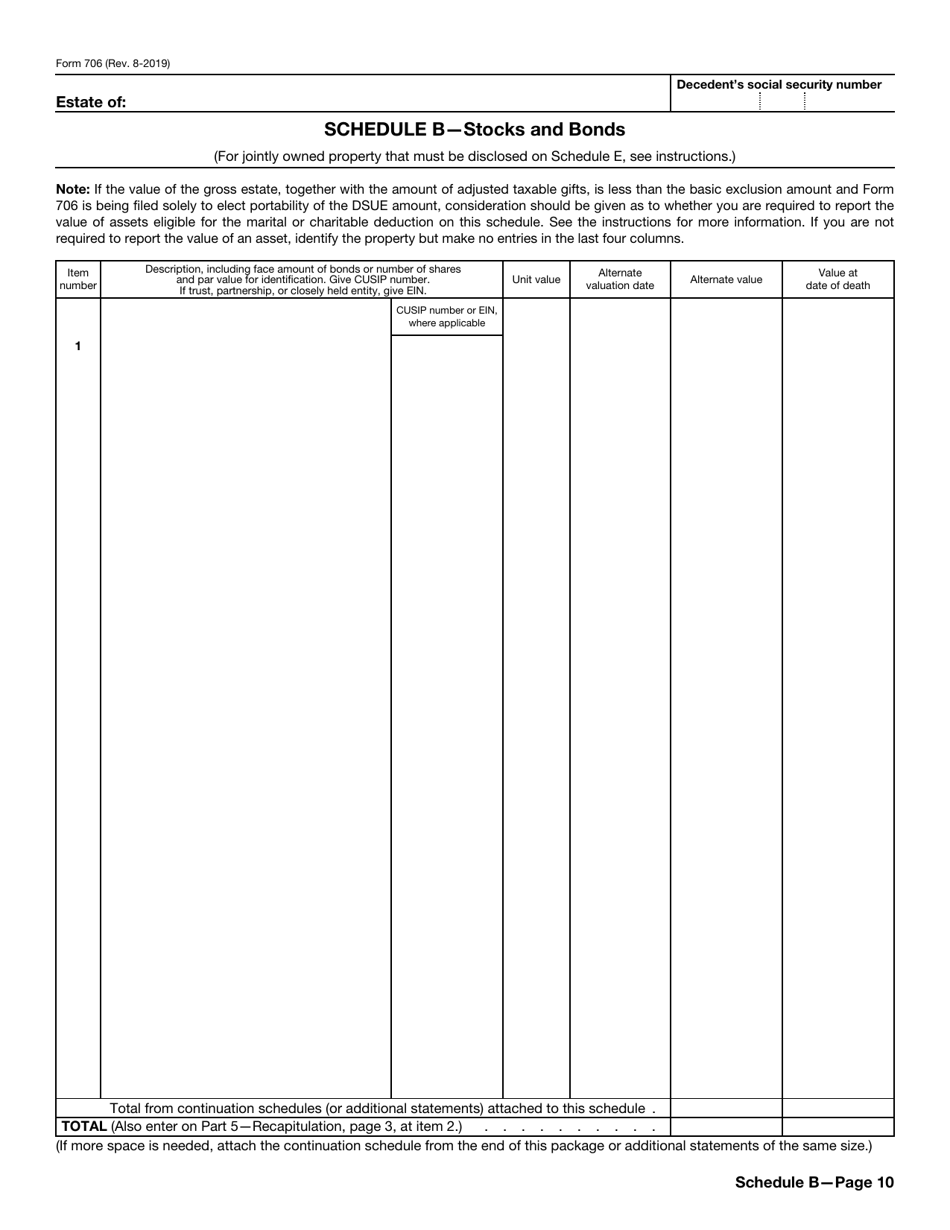

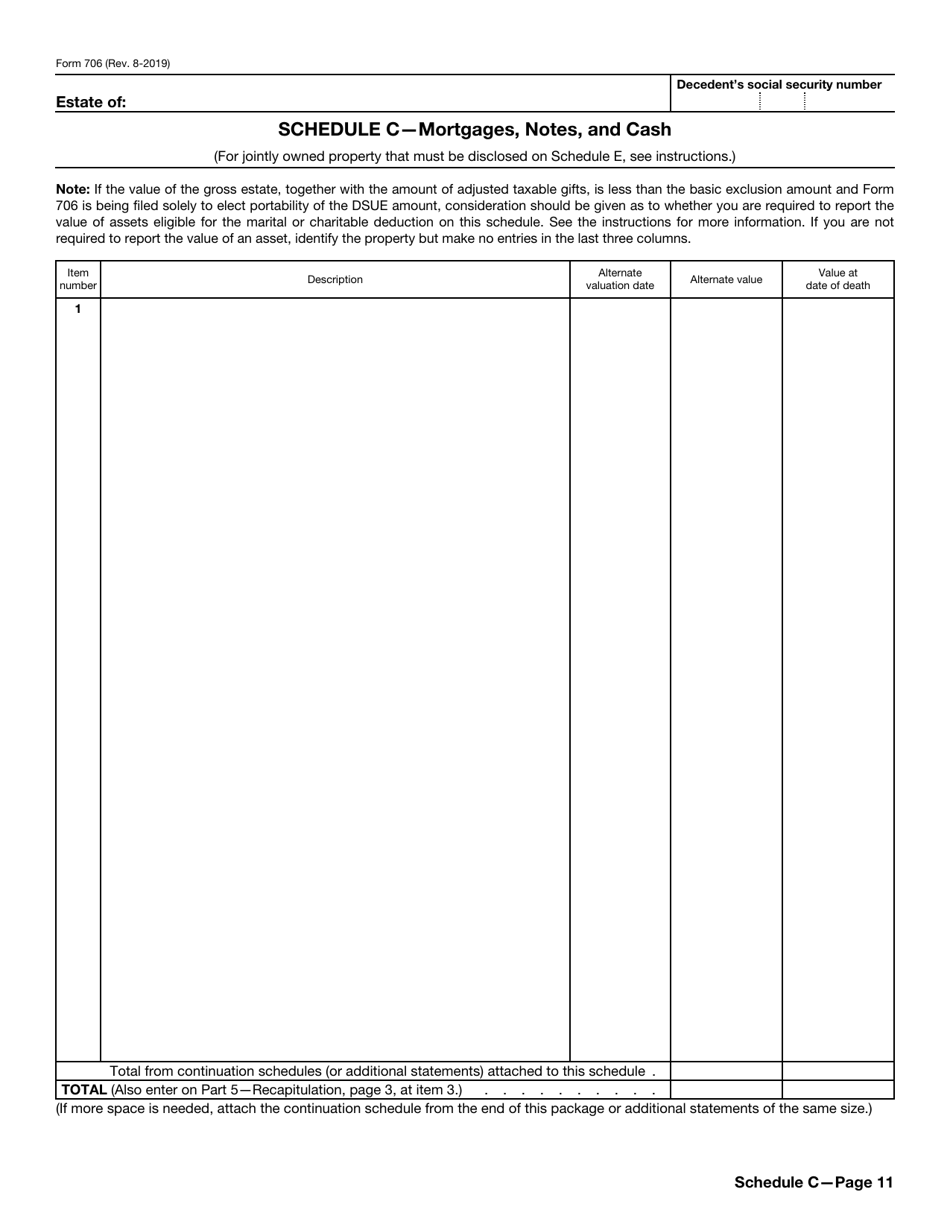

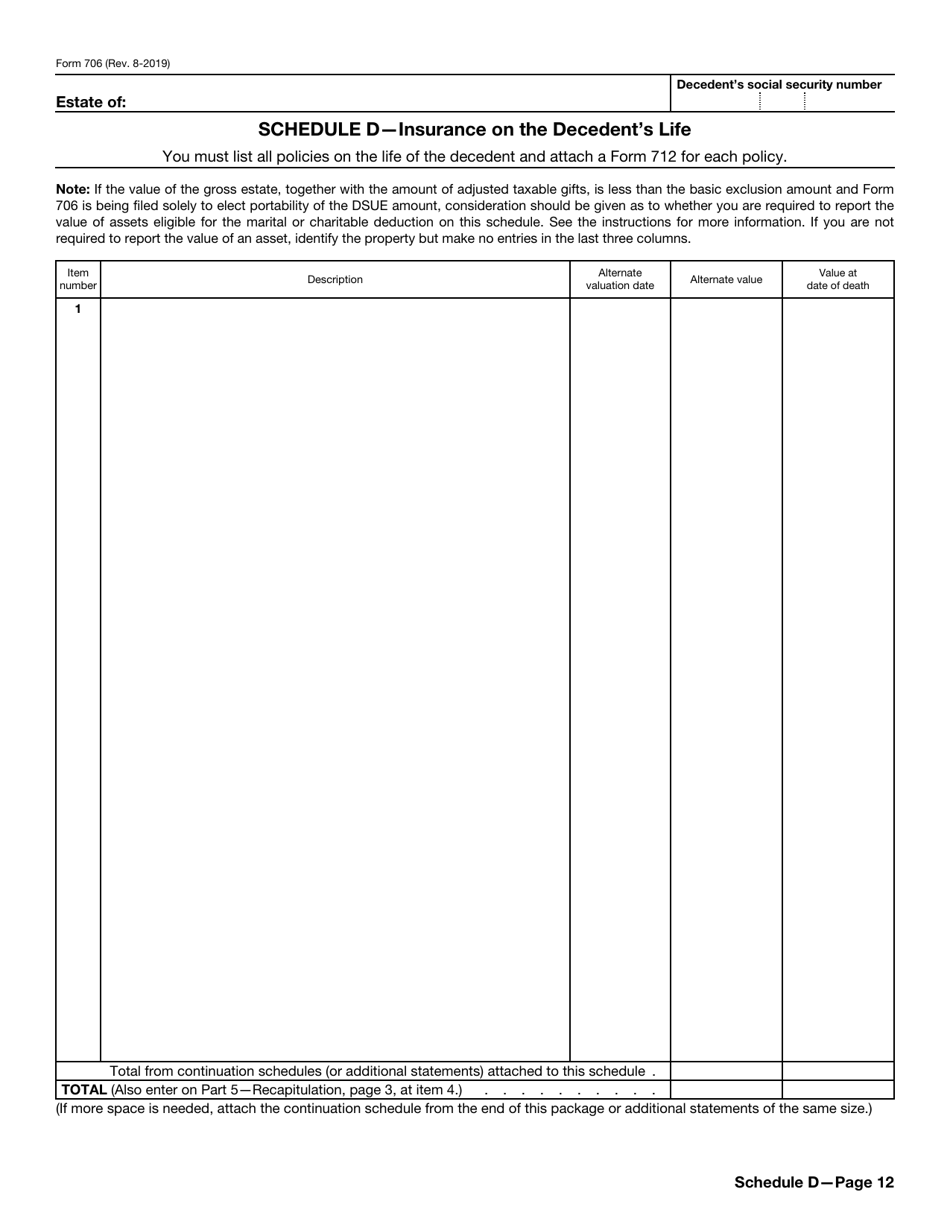

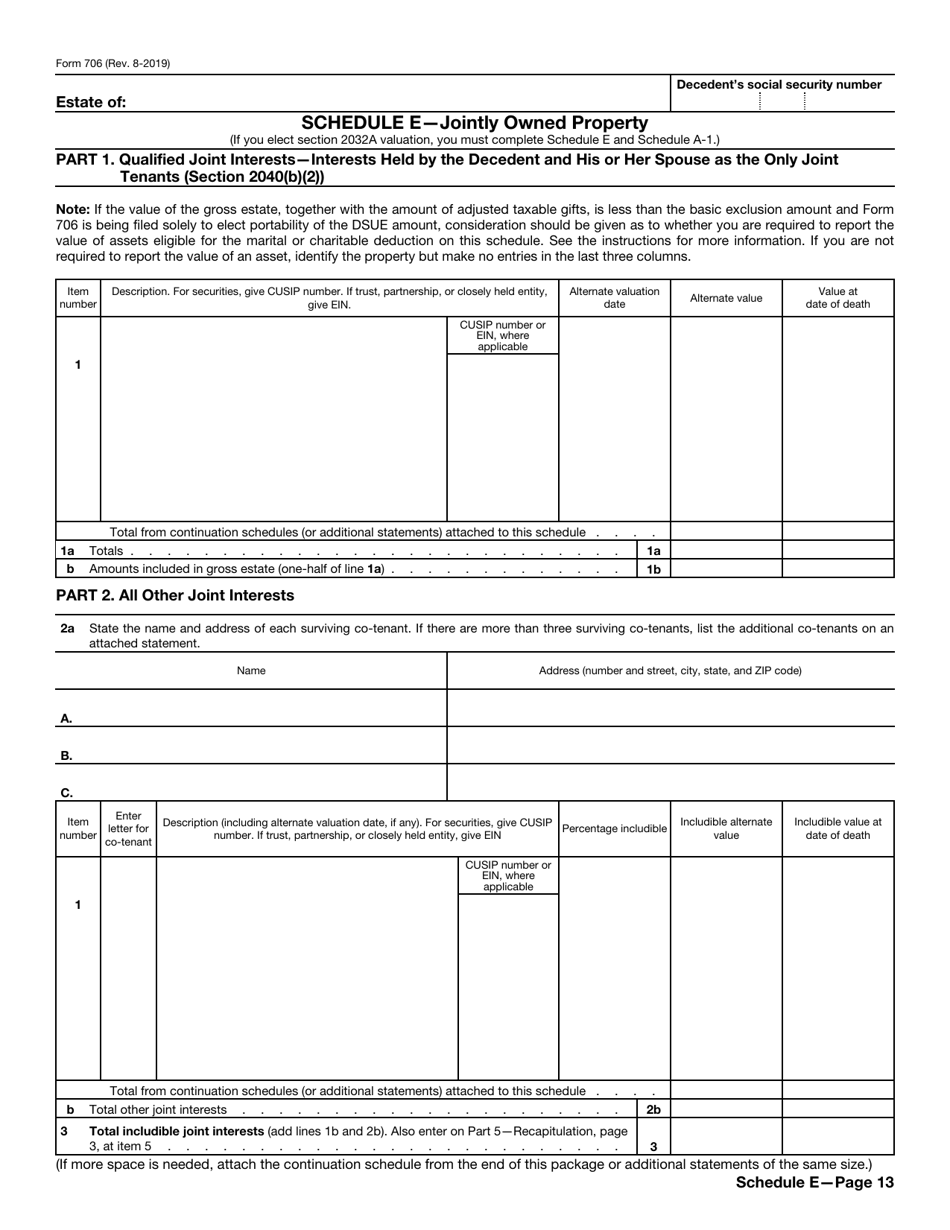

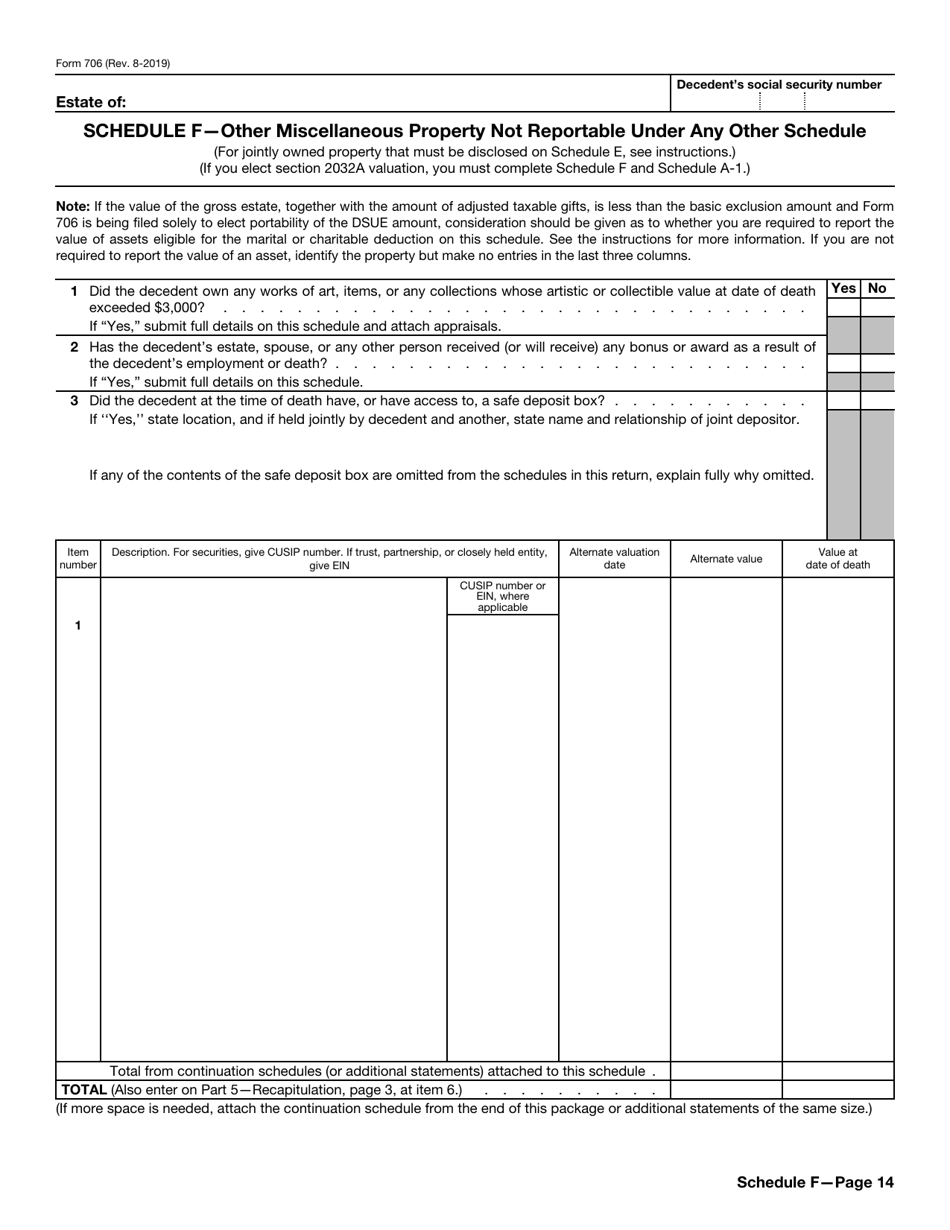

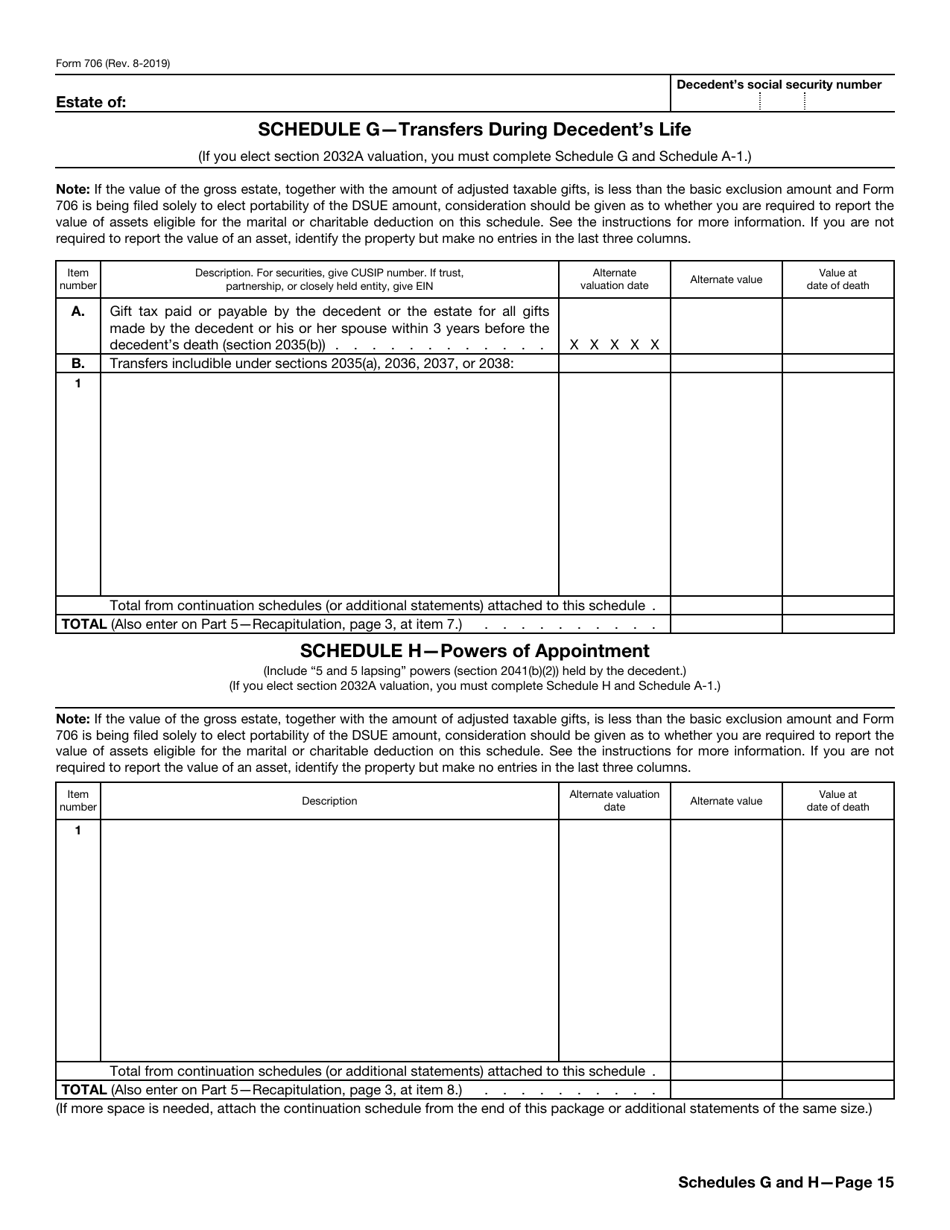

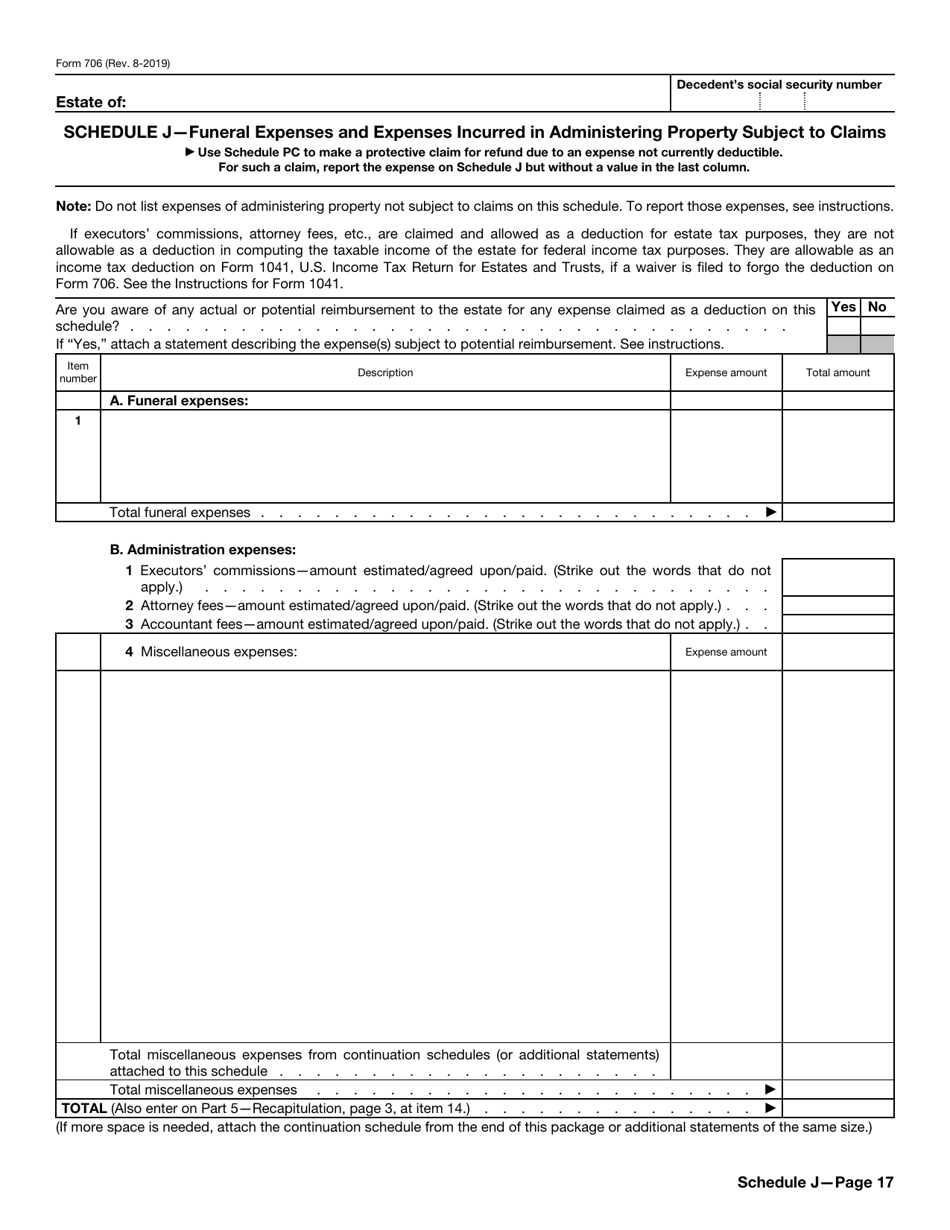

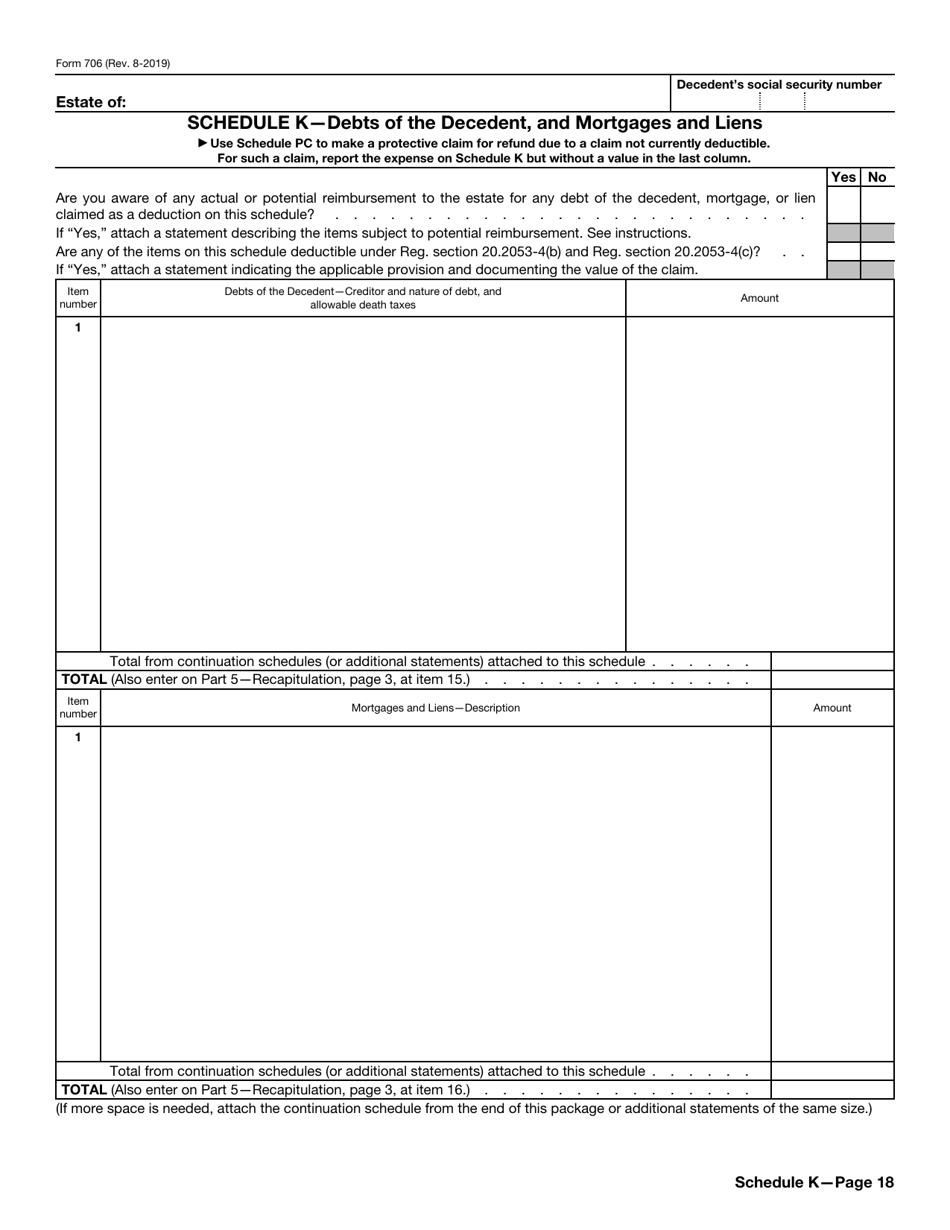

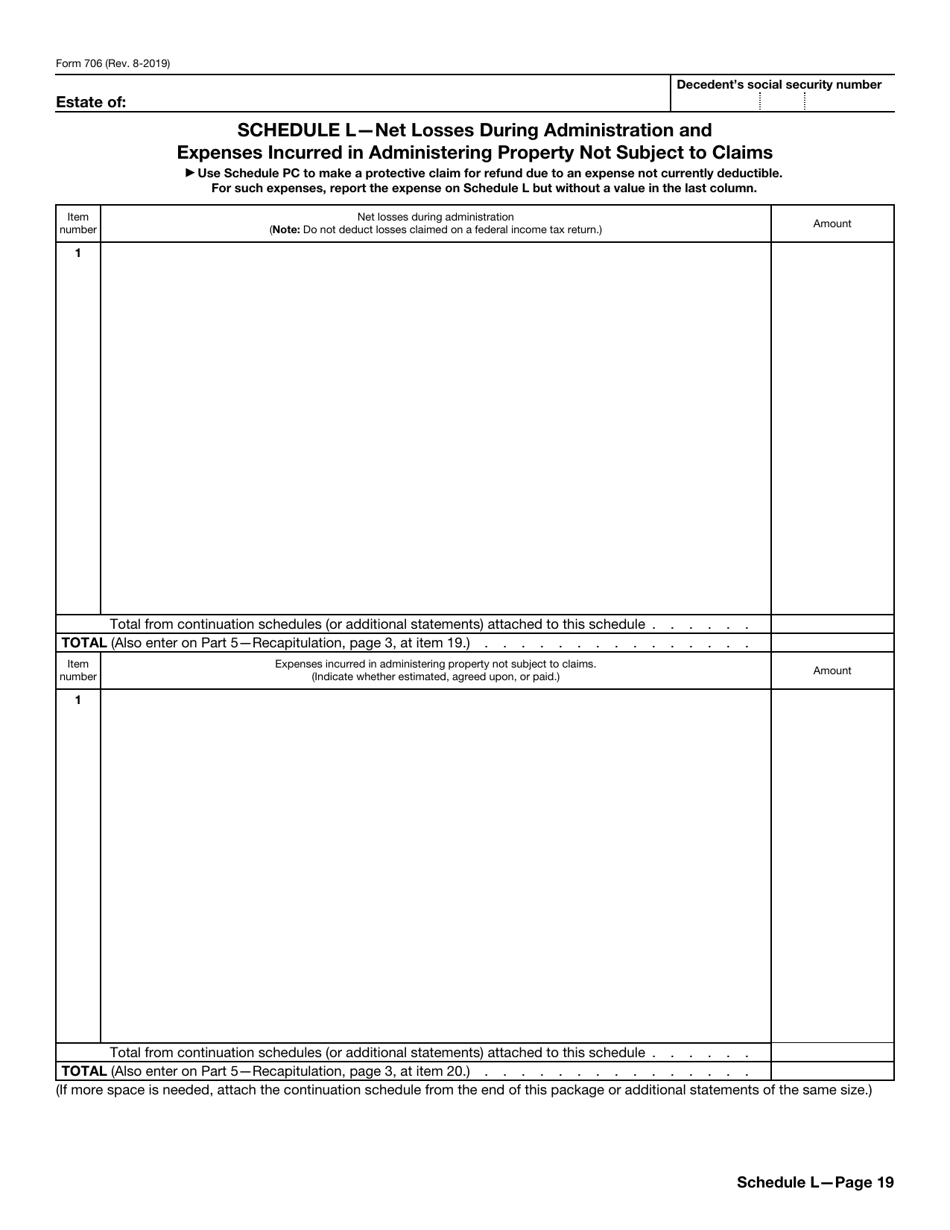

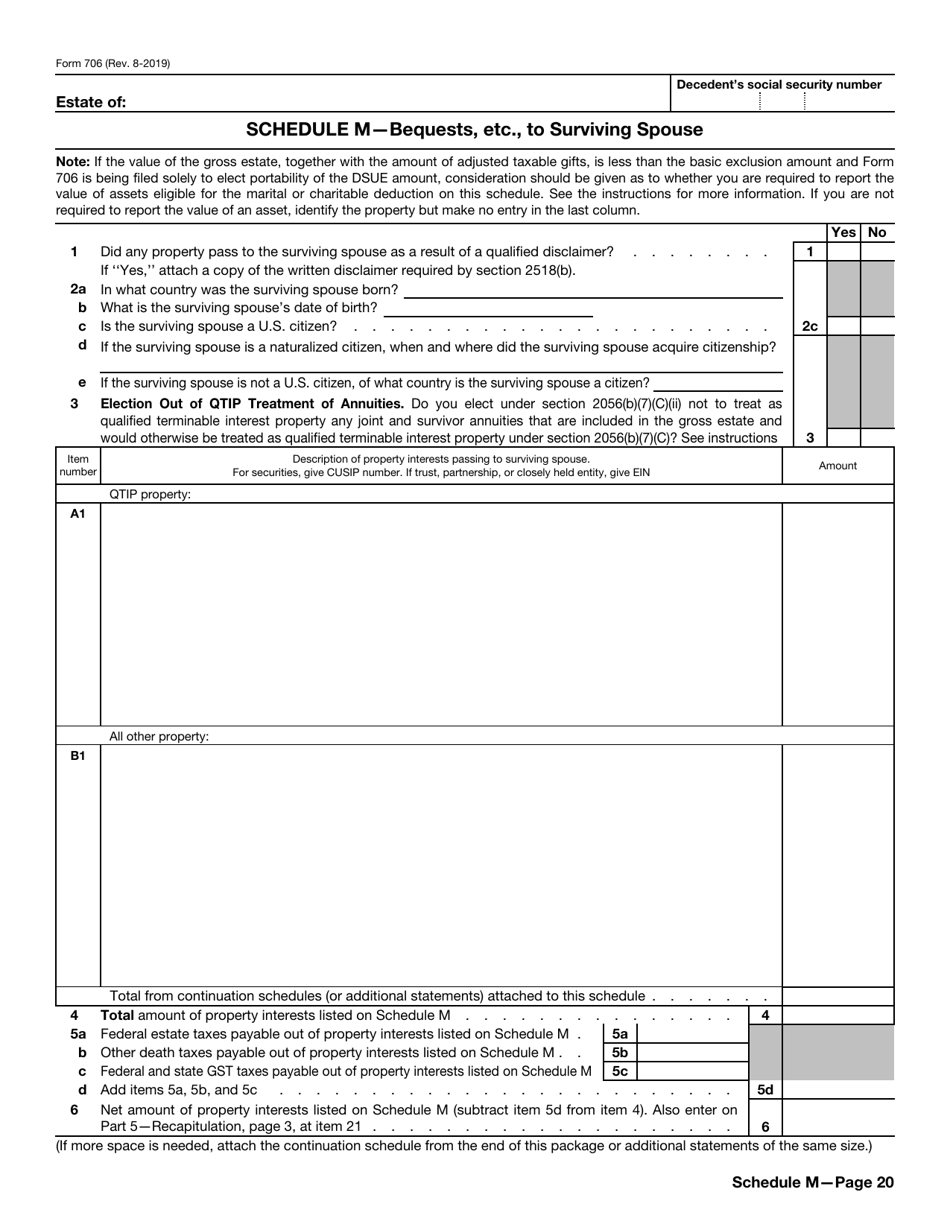

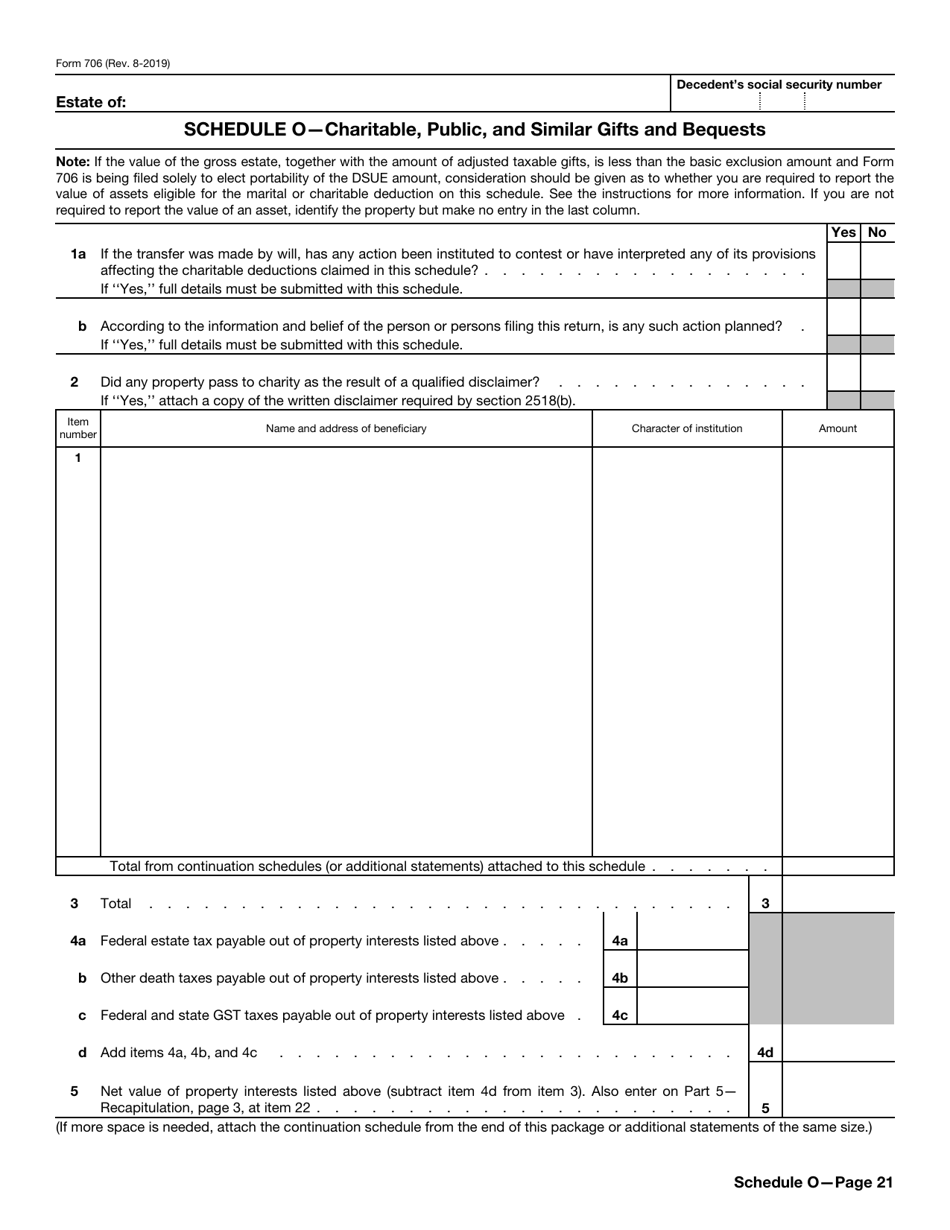

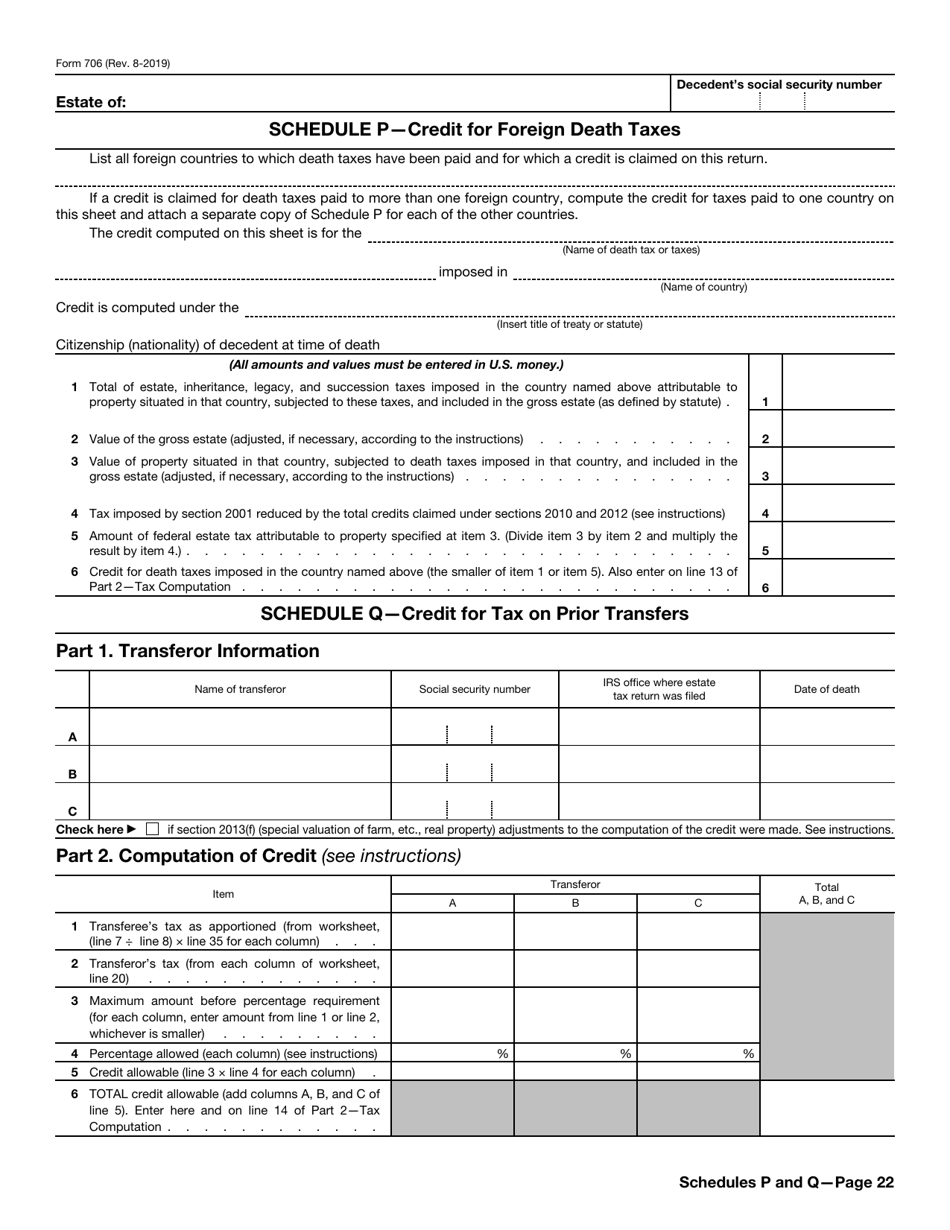

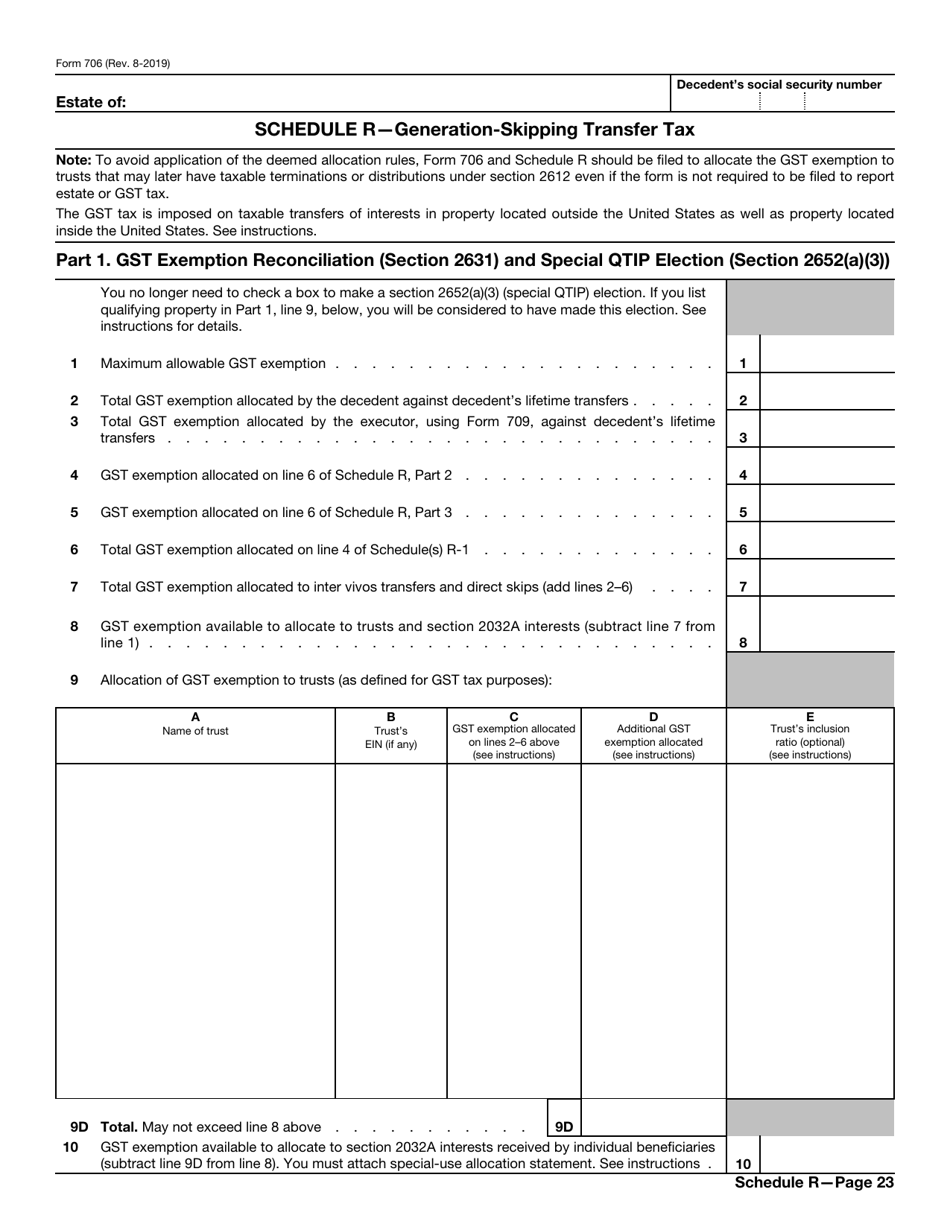

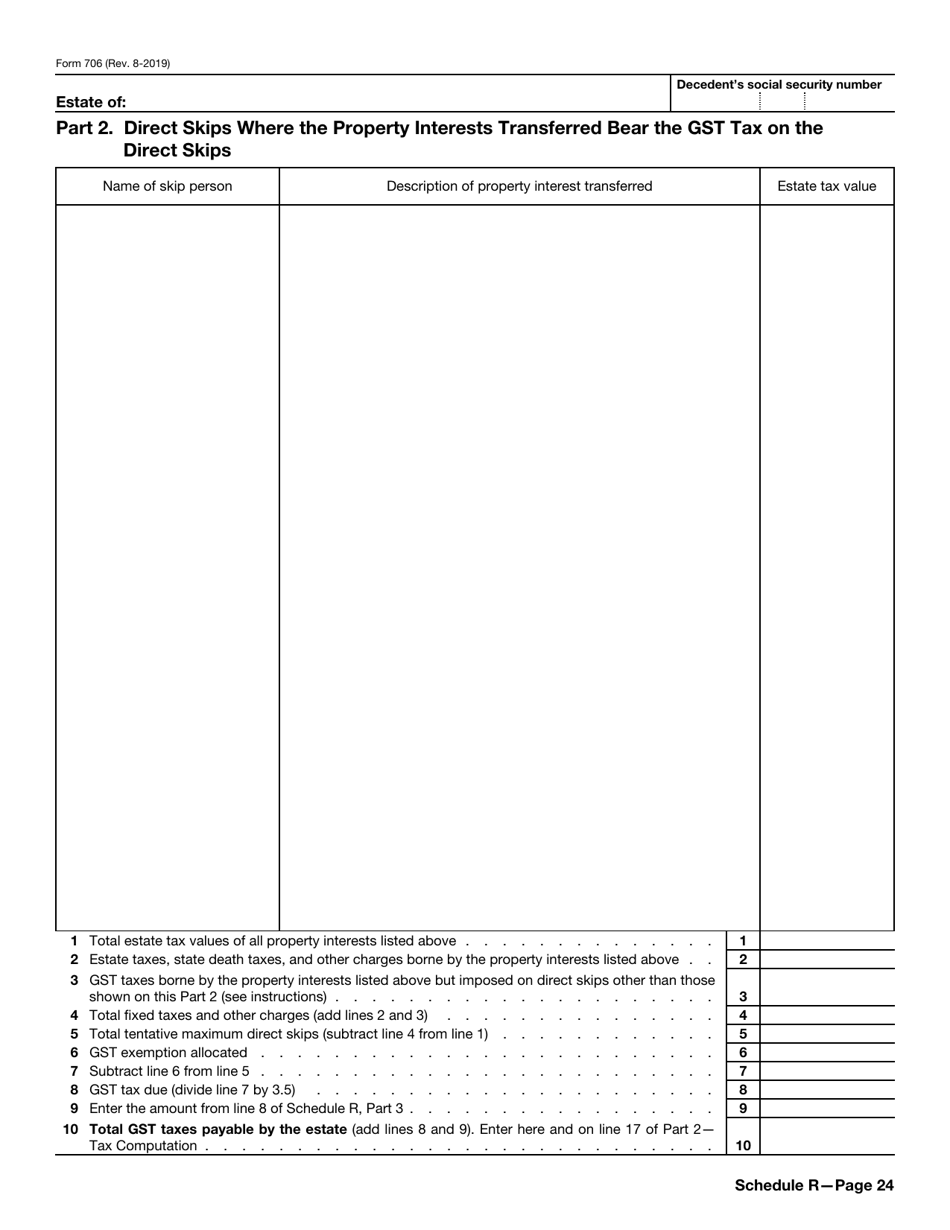

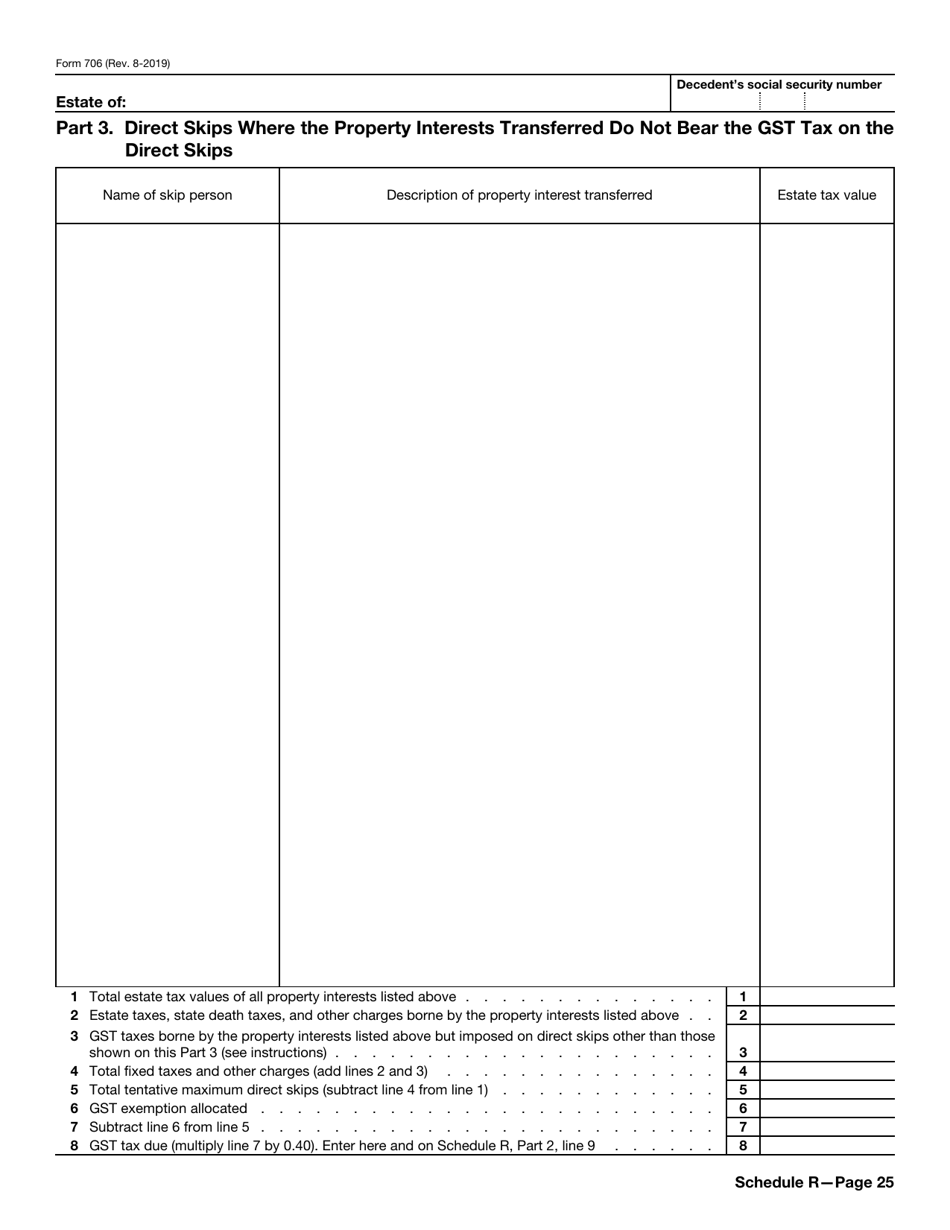

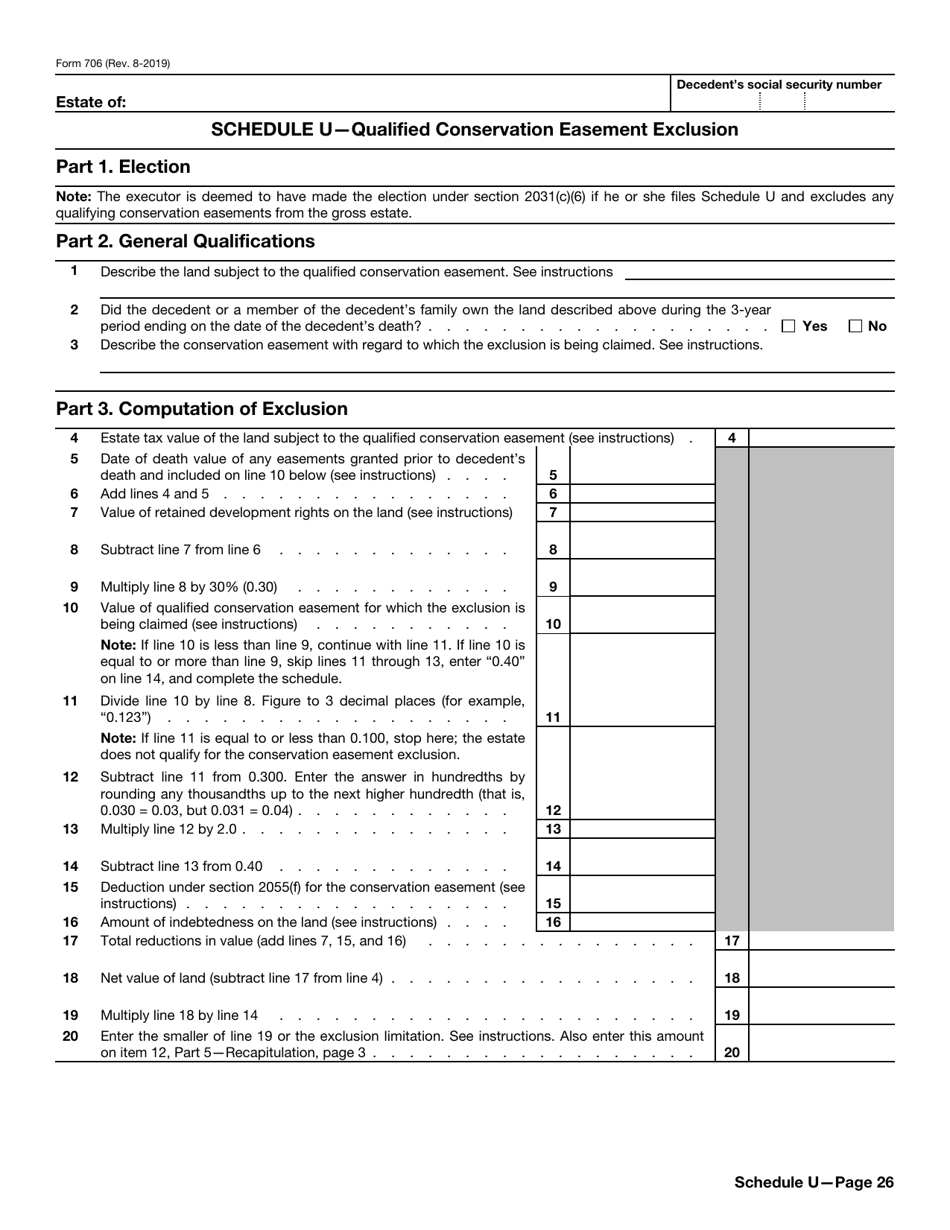

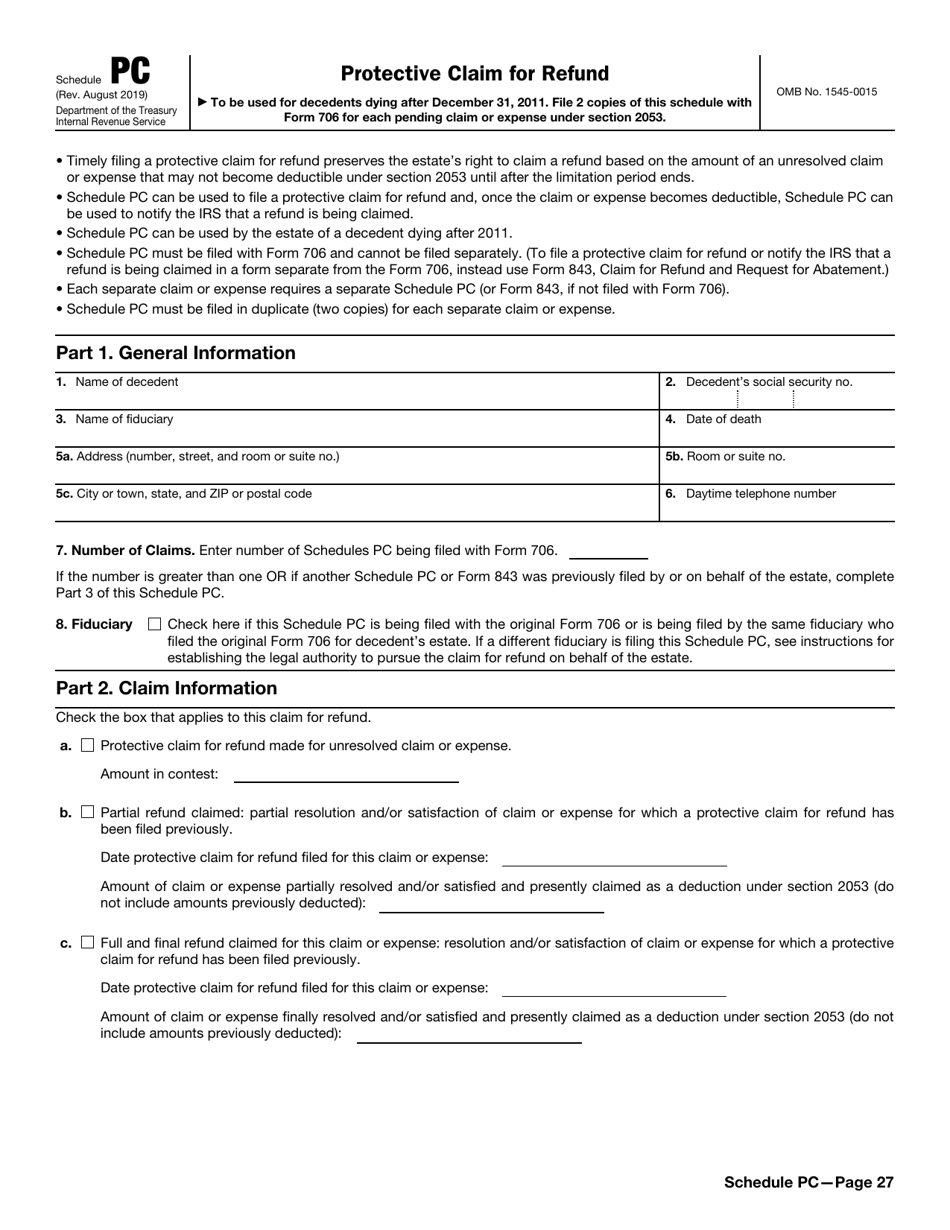

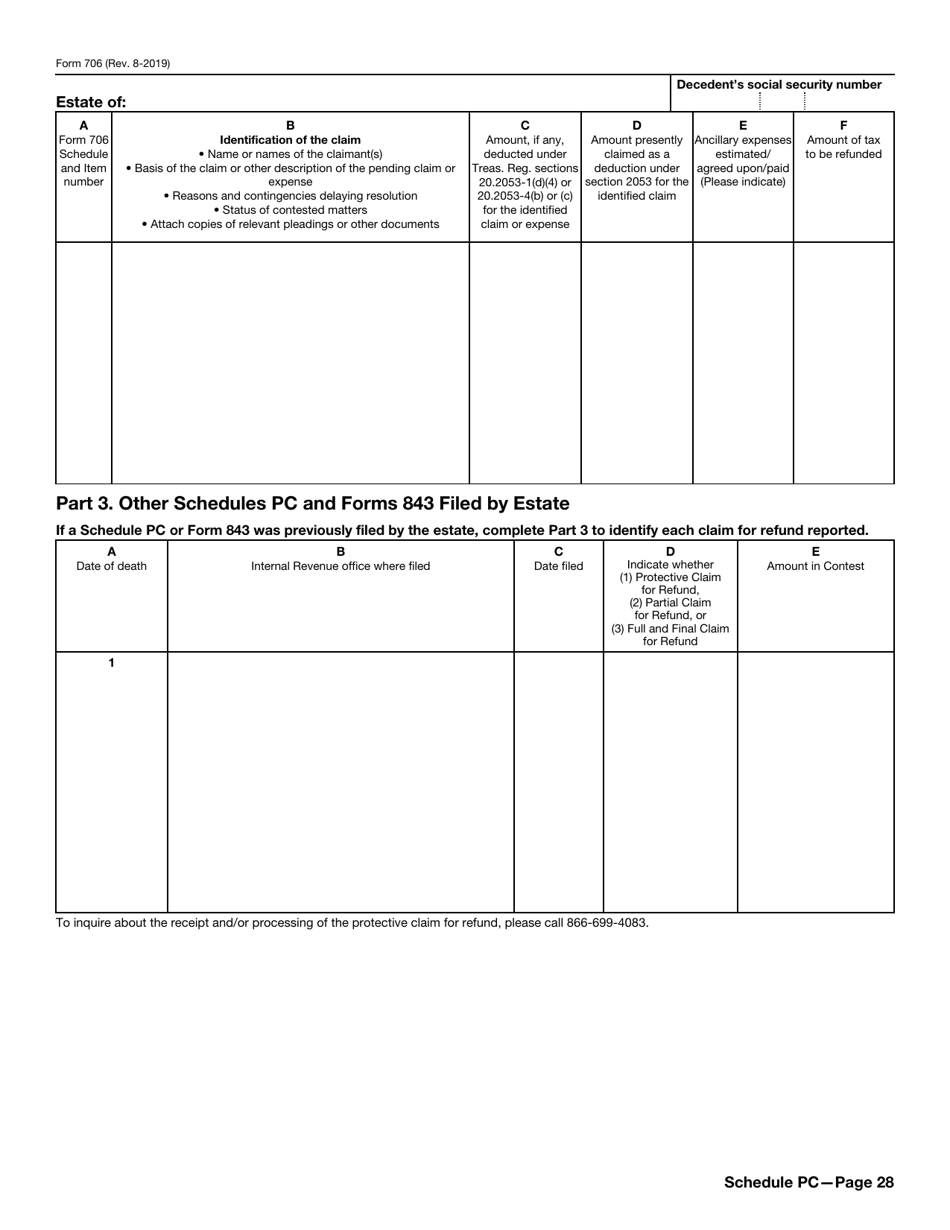

Fill out schedules to properly describe the assets that comprise the estate, the expenses, and the deductions that apply . You will have to elaborate on the real estate of the decedent, their bonds and stocks, cash and mortgages, property they owned jointly with someone else, authorizations they signed to let other people control the disposition of the assets, annuities, funeral costs, liens and debts, bequests to give certain property to the surviving spouse, charitable transfers and tax credits.

Who Must File Form 706?

The administrator of the estate is obliged to file IRS Form 706 in two rather rare circumstances:

-

The gross estate of the deceased person exceeds $12,920,000.

-

The person responsible for managing the estate prefers to apply the deceased spousal unused exemption amount to prospective transfers in the name of the surviving spouse of the decedent no matter how big or small the estate is.

Where to File Form 706?

There are four different addresses for the Tax Form 706:

-

Send the form to the Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999 if there are no unusual circumstances related to your filing.

-

In case you prefer private delivery, submit the documentation to the Internal Revenue Submission Processing Center, 333 W. Pershing Road, Kansas City, MO 64108 .

-

File the paperwork with the Internal Revenue Service Center, Attn: E&G, Stop 824G, 7940 Kentucky Drive, Florence, KY 41042-2915 if you have completed an amended instrument.

-

When filing an amended form via private delivery, send the document to the I nternal Revenue Service Center, Attn: E&G, Stop 824G, 7940 Kentucky Drive, Florence, KY 41042-2915 .

Note that you have only nine months after the death of the decedent to submit the papers. If you cannot comply with the requirement established for the Form 706 due date, fill out IRS Form 4768, Application for Extension of Time To File a Return and/or Pay U.S. Estate (and Generation-Skipping Transfer) Taxes, and get six more months to deal with the tax return.