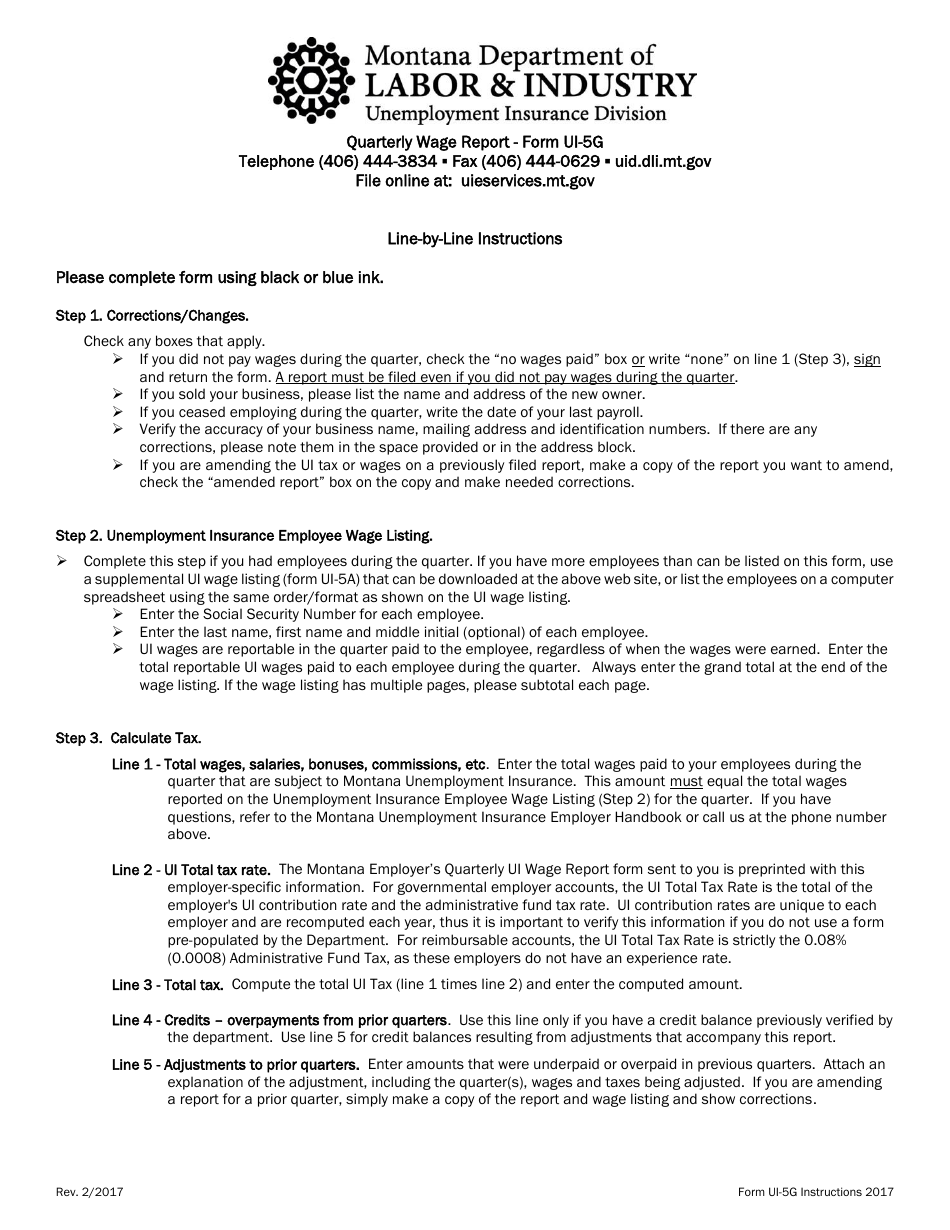

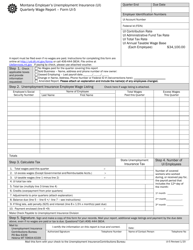

Instructions for Form UI-5G Montana Employer's Unemployment Insurance (Ui) Quarterly Wage Report - Montana

This document contains official instructions for Form UI-5G , Montana Employer's Unemployment Insurance (Ui) Quarterly Wage Report - a form released and collected by the Montana Department of Labor and Industry.

FAQ

Q: What is Form UI-5G?

A: Form UI-5G is the Montana Employer's Unemployment Insurance (UI) Quarterly Wage Report.

Q: What is the purpose of Form UI-5G?

A: The purpose of Form UI-5G is to report quarterly wages for unemployment insurance purposes in Montana.

Q: Who needs to file Form UI-5G?

A: Employers in Montana who have paid wages to one or more employees during the quarter need to file Form UI-5G.

Q: How often do I need to file Form UI-5G?

A: Form UI-5G needs to be filed quarterly, by the last day of the month following the end of the quarter.

Q: What information do I need to provide on Form UI-5G?

A: You will need to provide information such as your business name, address, total wages paid, total hours worked, and any taxable wages.

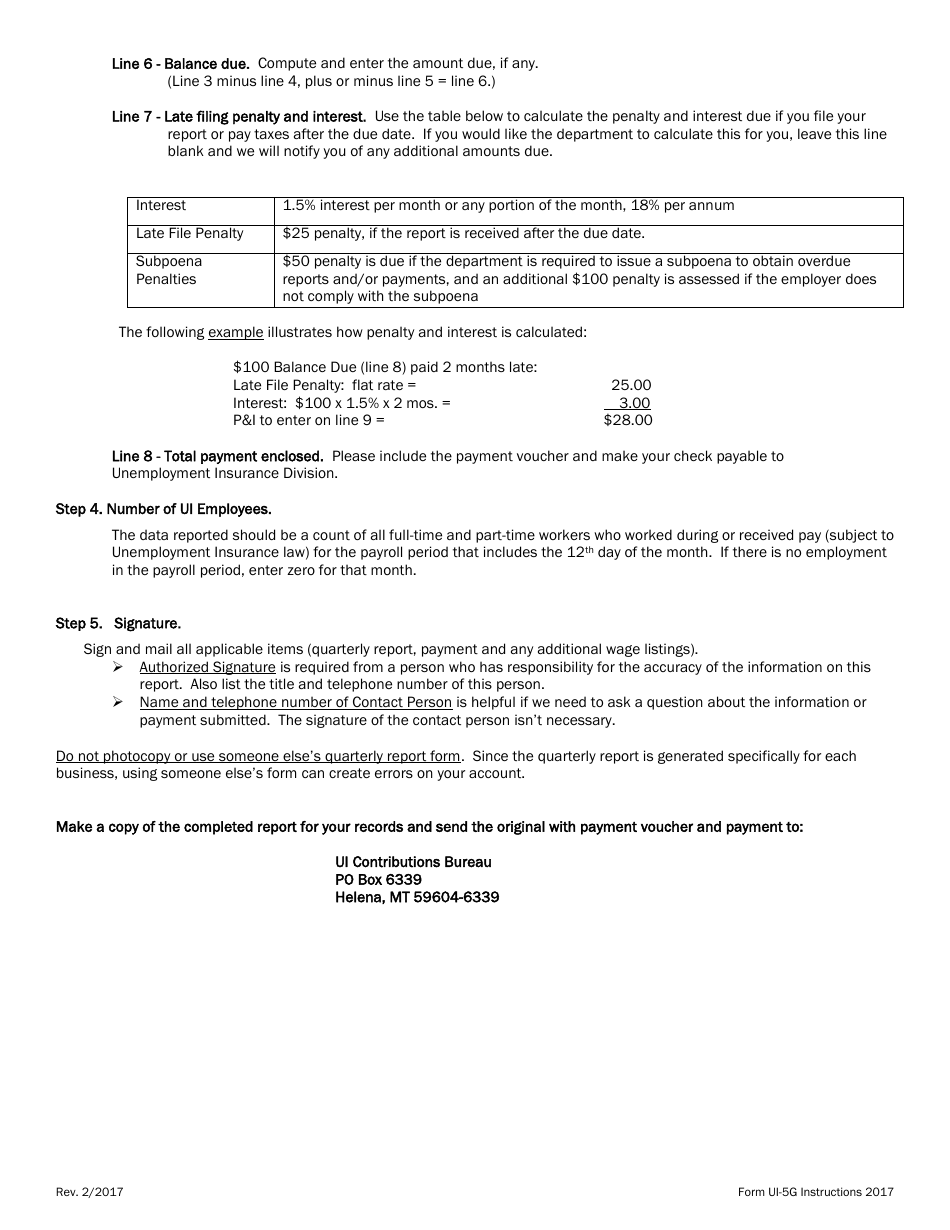

Q: Are there any penalties for not filing Form UI-5G?

A: Yes, there may be penalties for not filing Form UI-5G on time or for providing inaccurate or incomplete information.

Q: Can I request an extension to file Form UI-5G?

A: Yes, you can request an extension by contacting the Montana Department of Labor and Industry's Unemployment Insurance Division.

Q: What should I do if I made a mistake on Form UI-5G?

A: If you made a mistake on Form UI-5G, you should contact the Montana Department of Labor and Industry's Unemployment Insurance Division to correct the error.

Q: Is there a fee to file Form UI-5G?

A: No, there is no fee to file Form UI-5G.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Montana Department of Labor and Industry.