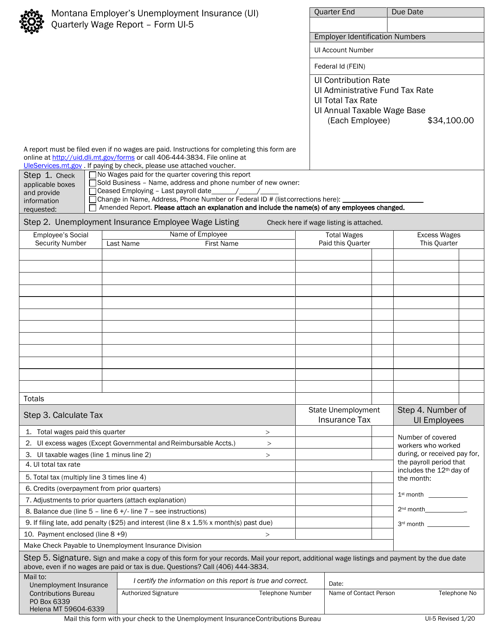

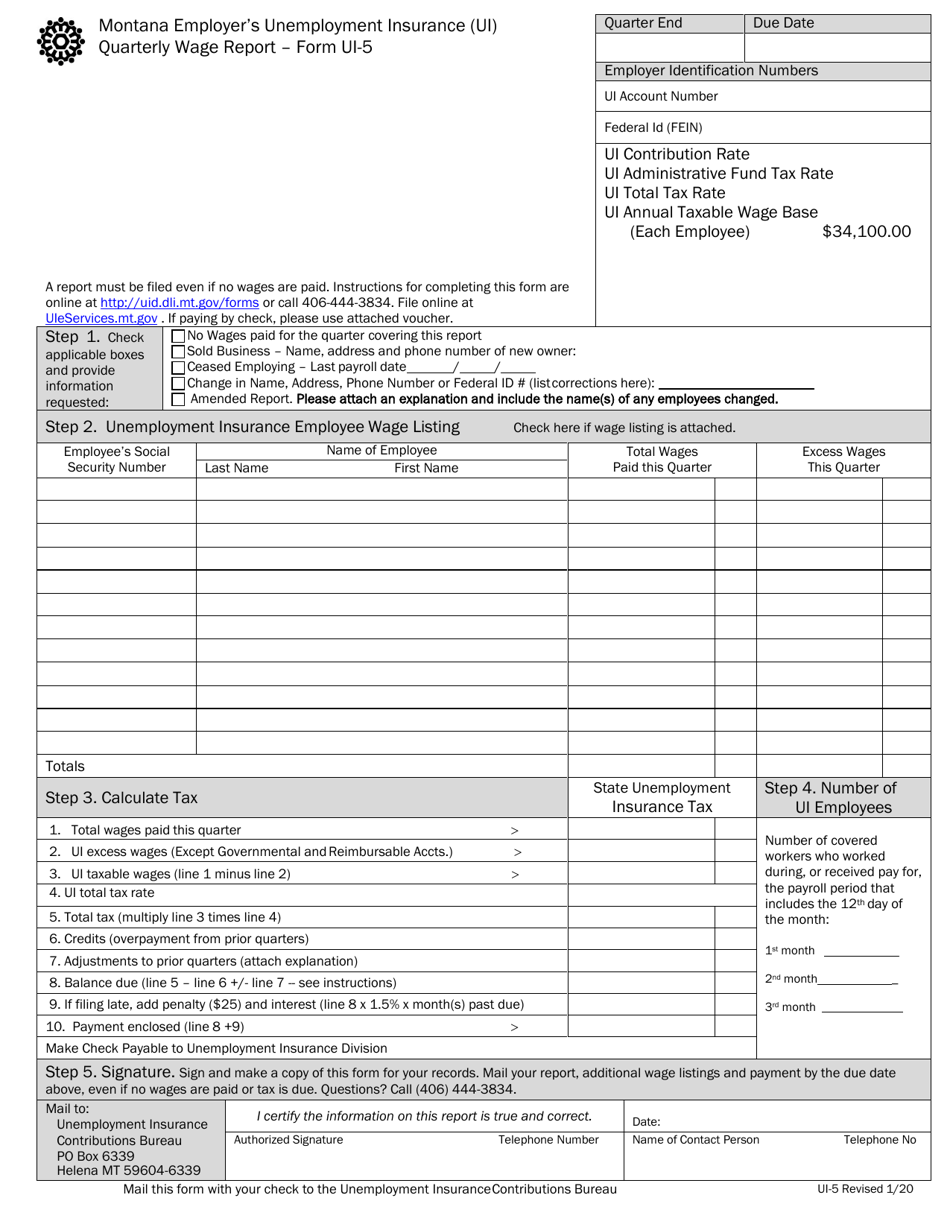

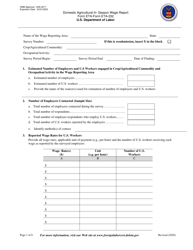

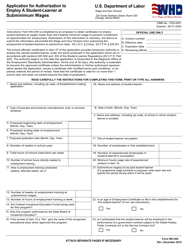

Form UI-5 Quarterly Wage Report - Montana

What Is Form UI-5?

This is a legal form that was released by the Montana Department of Labor and Industry - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form UI-5 Quarterly Wage Report?

A: The Form UI-5 Quarterly Wage Report is a report used in Montana to report wages paid to employees on a quarterly basis.

Q: Who needs to file the Form UI-5?

A: Employers in Montana are required to file the Form UI-5 if they have employees and pay wages subject to Unemployment Insurance (UI) taxes.

Q: When is the Form UI-5 due?

A: The Form UI-5 is due quarterly and must be filed by the last day of the month following the end of the quarter.

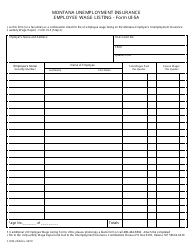

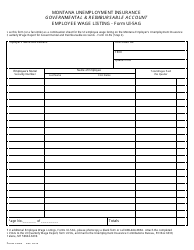

Q: What information is required on the Form UI-5?

A: The Form UI-5 requires information about the employer, employee wages, and tax liability. This includes employee names, Social Security numbers, and wage details.

Q: Are there any penalties for not filing the Form UI-5?

A: Yes, there are penalties for late or non-filing of the Form UI-5. It is important to file the report on time to avoid any penalties or interest charges.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Montana Department of Labor and Industry;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form UI-5 by clicking the link below or browse more documents and templates provided by the Montana Department of Labor and Industry.