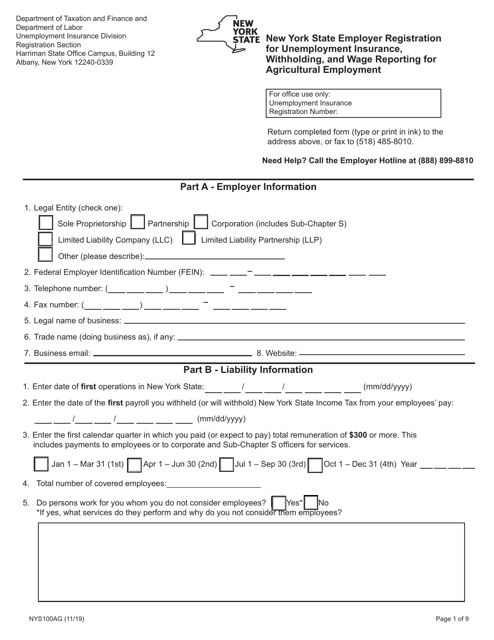

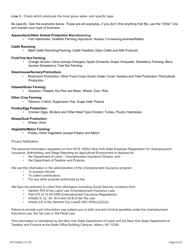

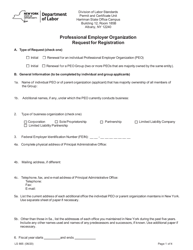

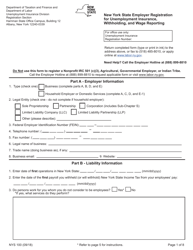

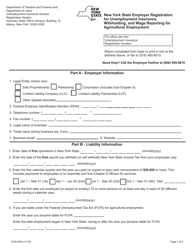

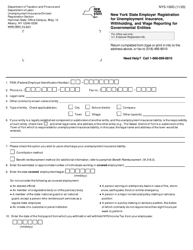

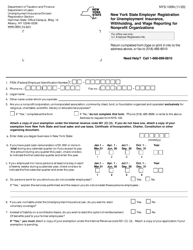

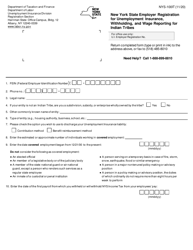

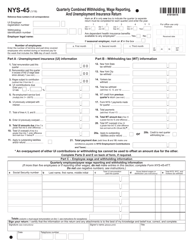

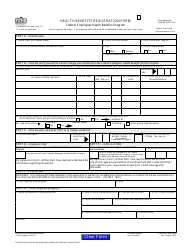

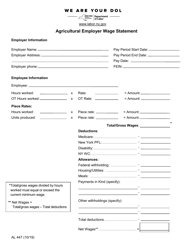

Form NYS100AG New York State Employer Registration for Unemployment Insurance, Withholding, and Wage Reporting for Agricultural Employment - New York

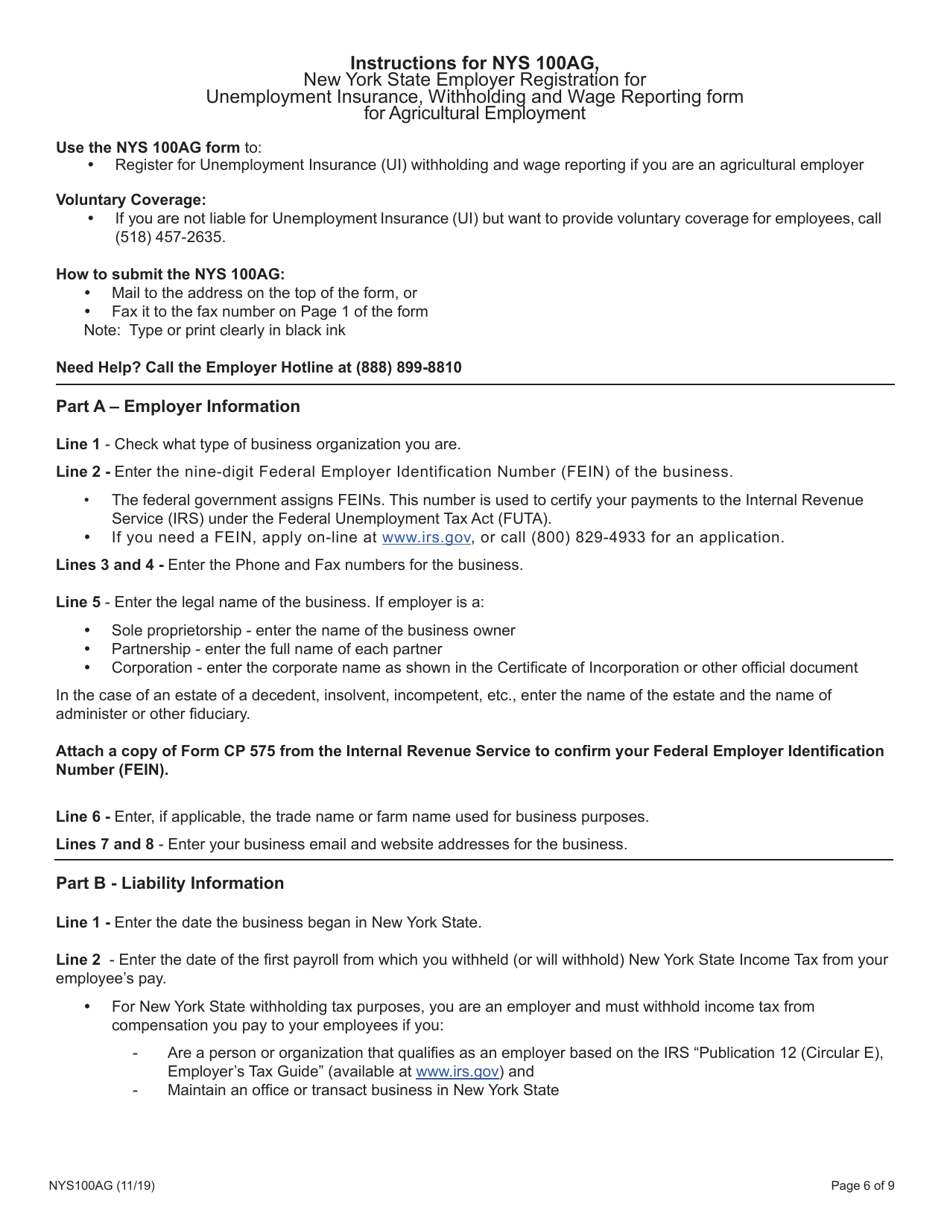

What Is Form NYS100AG?

This is a legal form that was released by the New York State Department of Labor - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NYS100AG?

A: Form NYS100AG is the New York State Employer Registration for Unemployment Insurance, Withholding, and Wage Reporting for Agricultural Employment.

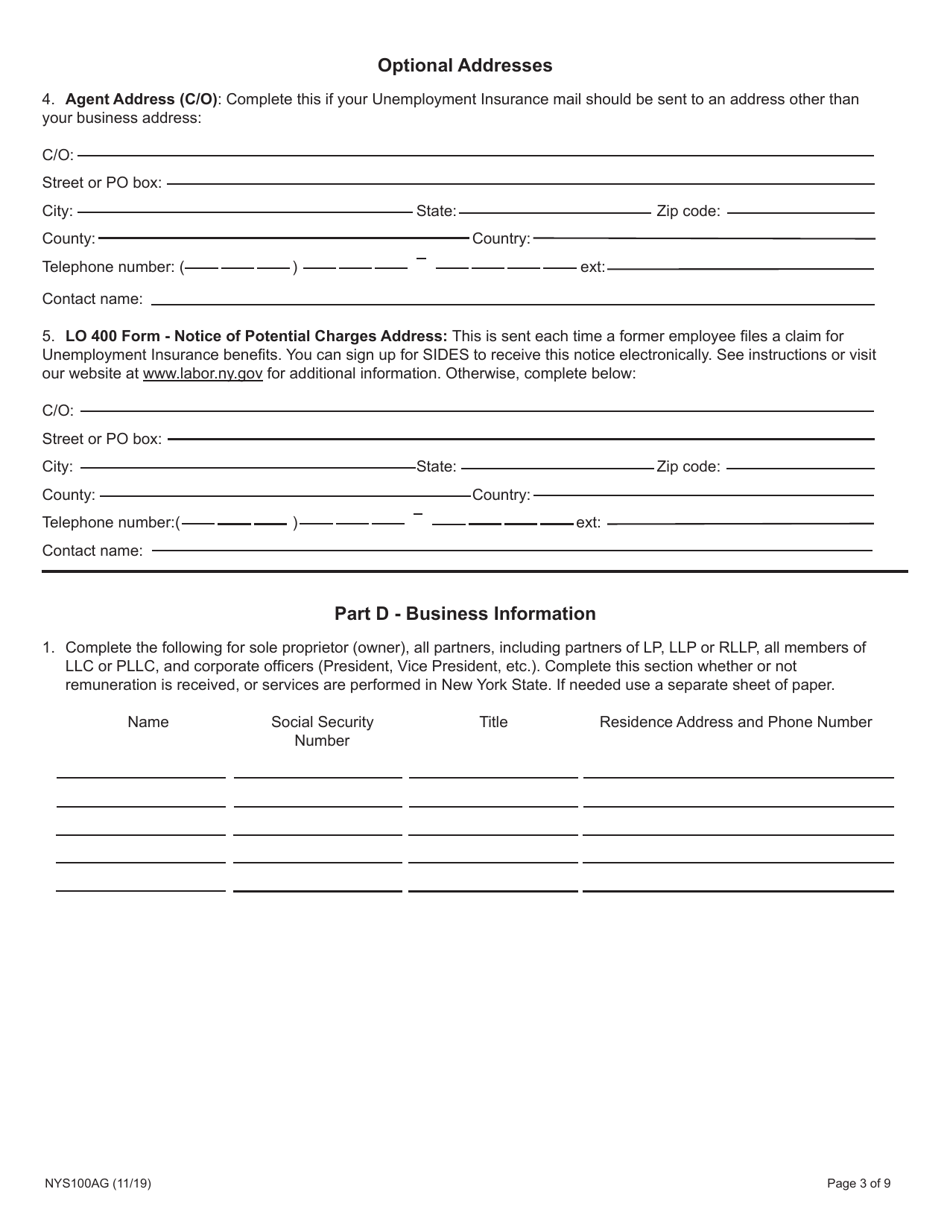

Q: Who needs to file Form NYS100AG?

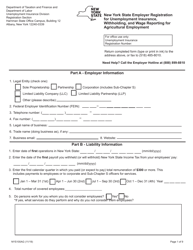

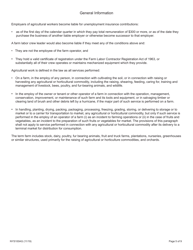

A: Farm employers in New York State who hire agricultural workers need to file Form NYS100AG.

Q: What is the purpose of Form NYS100AG?

A: The purpose of Form NYS100AG is to register farm employers in New York State for unemployment insurance, withholding, and wage reporting related to agricultural employment.

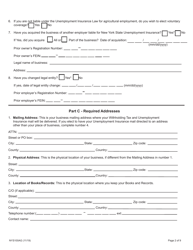

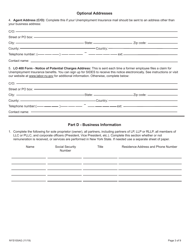

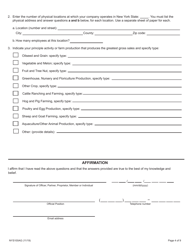

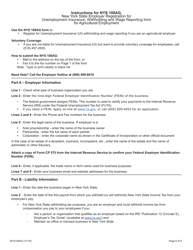

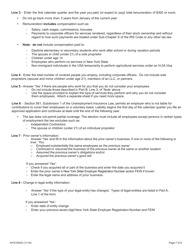

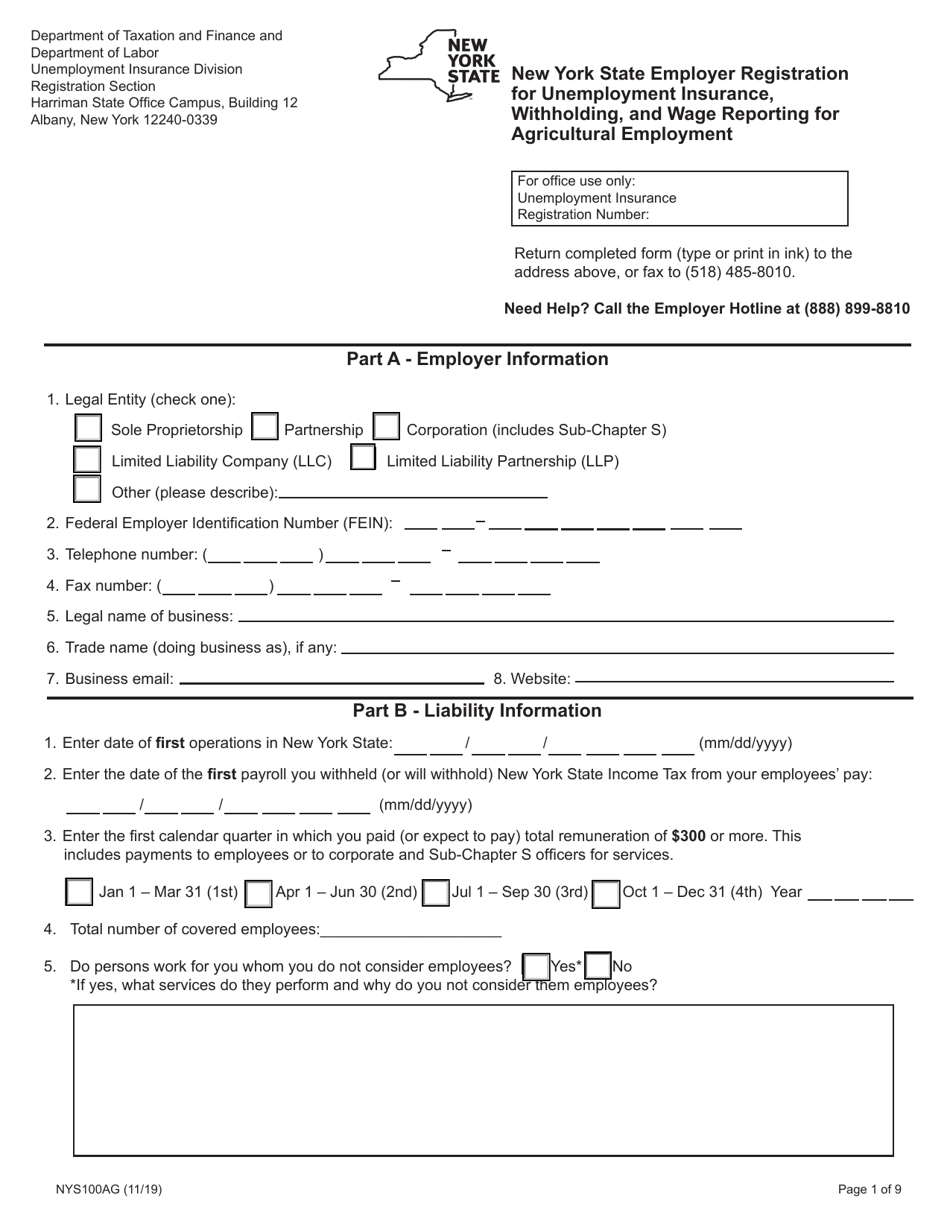

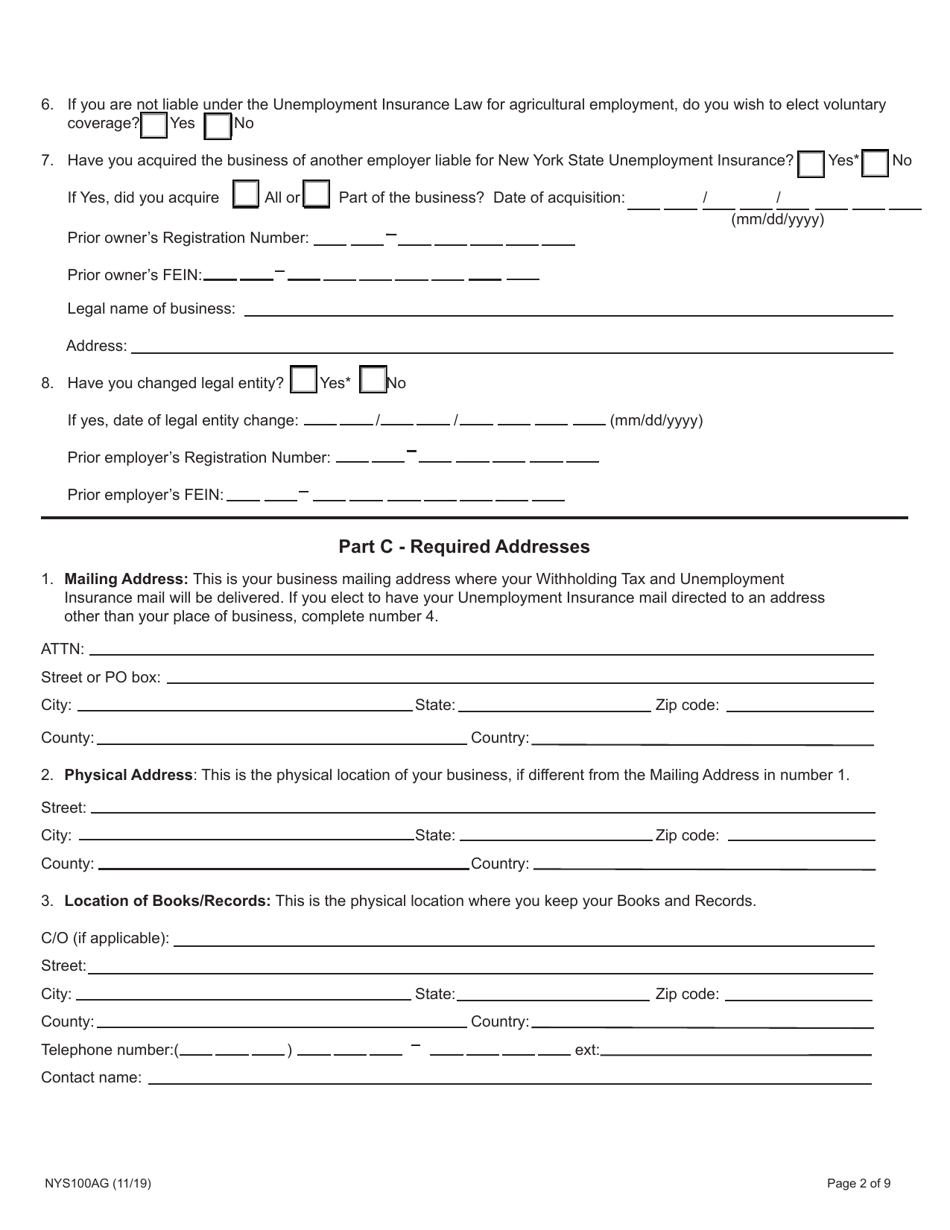

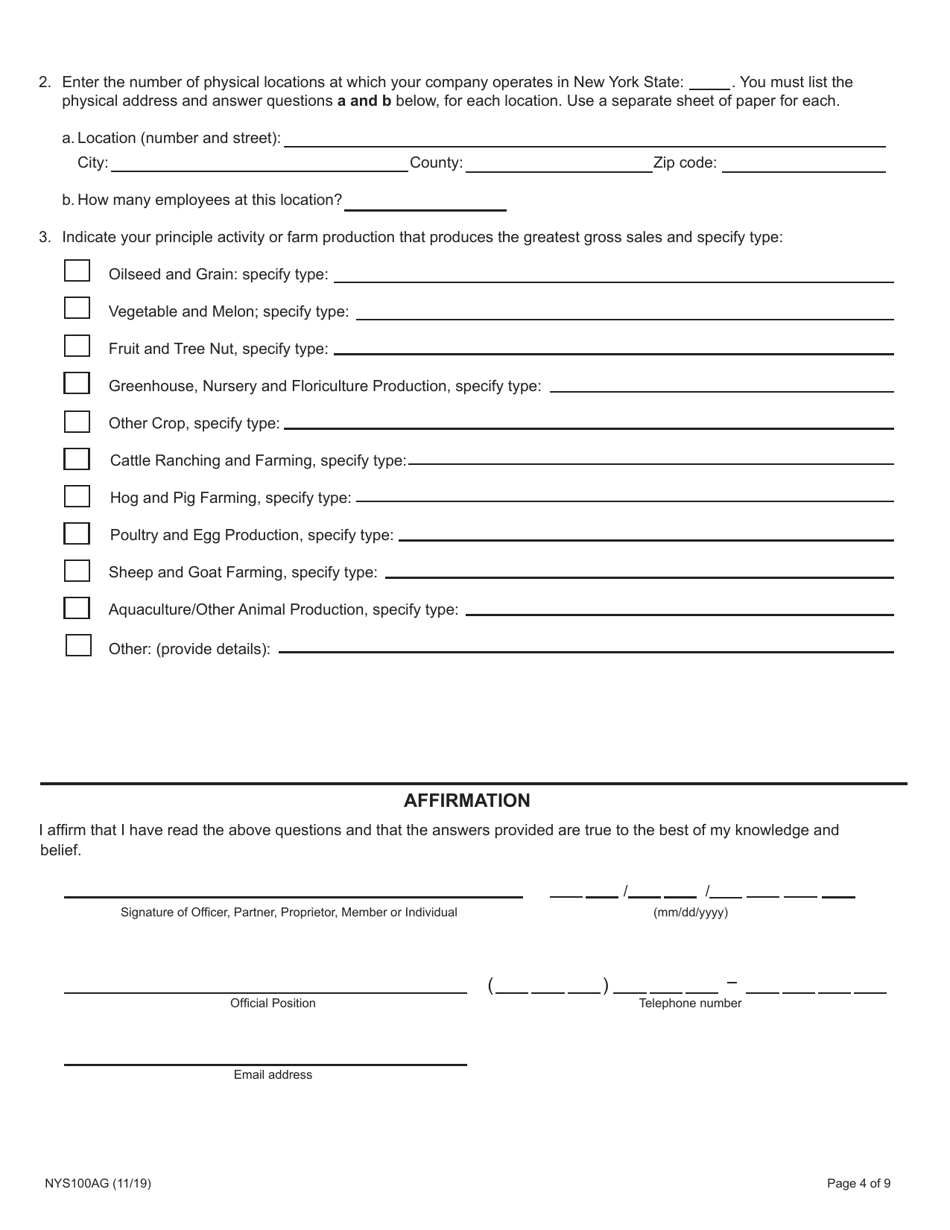

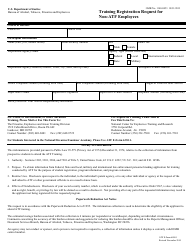

Q: What information is required on Form NYS100AG?

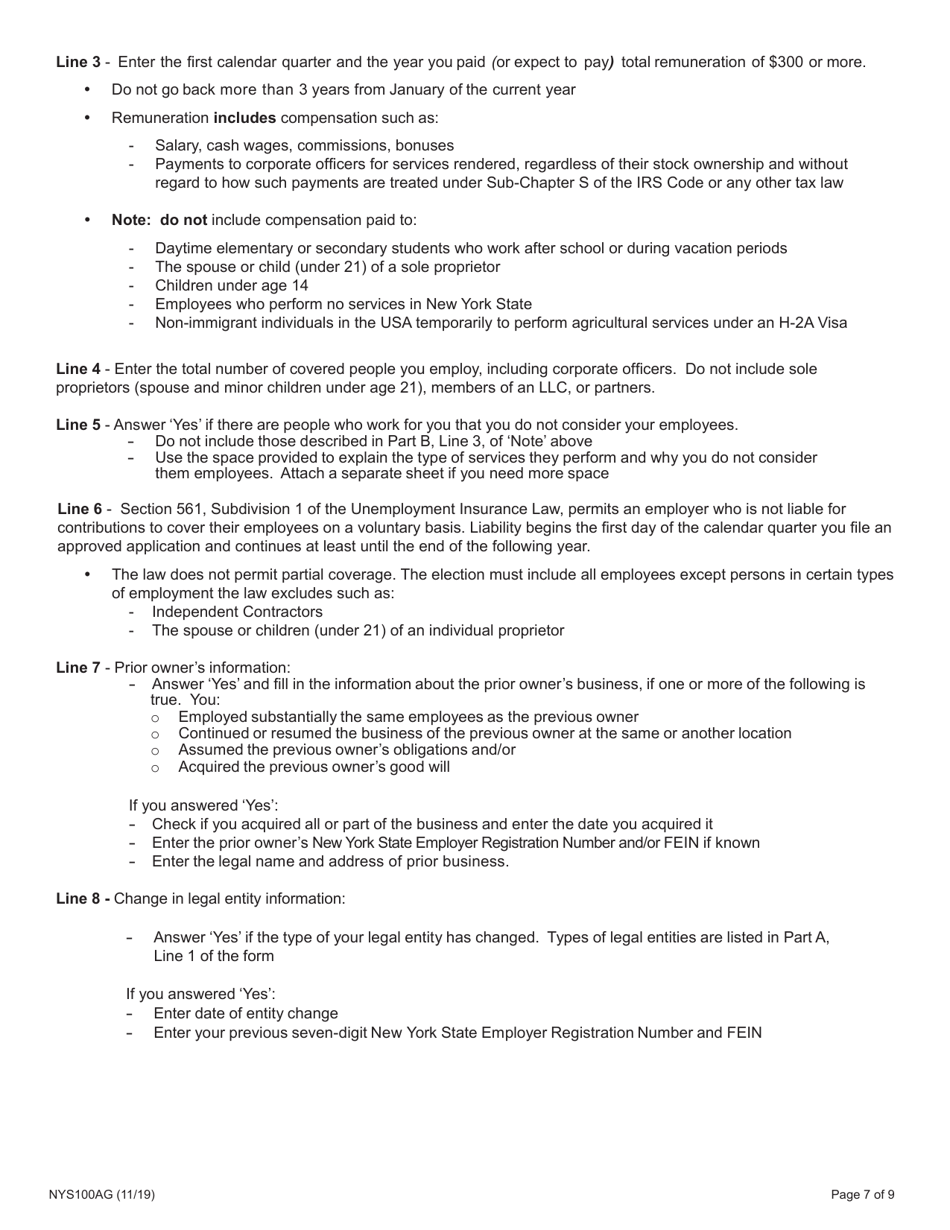

A: Form NYS100AG requires information such as the employer's name, address, federal employer identification number (FEIN), contact information, and details about the agricultural employment.

Q: Are there any filing fees for Form NYS100AG?

A: There are no filing fees for Form NYS100AG.

Q: When should I file Form NYS100AG?

A: Form NYS100AG should be filed within 20 days of hiring the first agricultural worker.

Q: What are the consequences of not filing Form NYS100AG?

A: Failure to file Form NYS100AG can result in penalties and legal consequences for farm employers.

Q: Is Form NYS100AG only applicable in New York State?

A: Yes, Form NYS100AG is specifically for agricultural employers in New York State.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the New York State Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NYS100AG by clicking the link below or browse more documents and templates provided by the New York State Department of Labor.