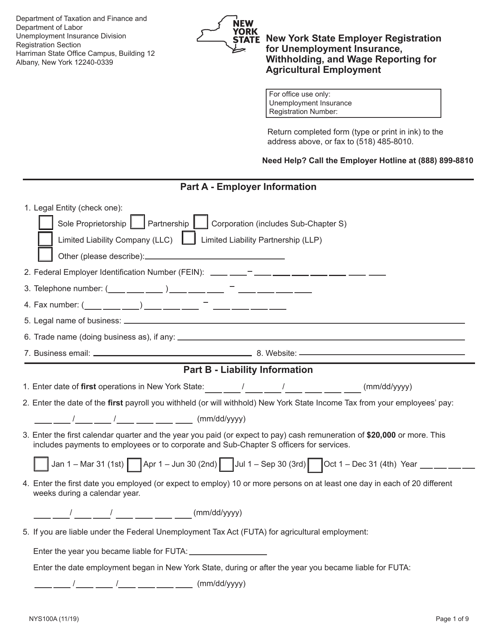

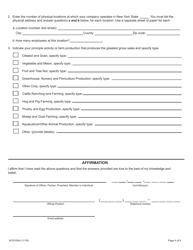

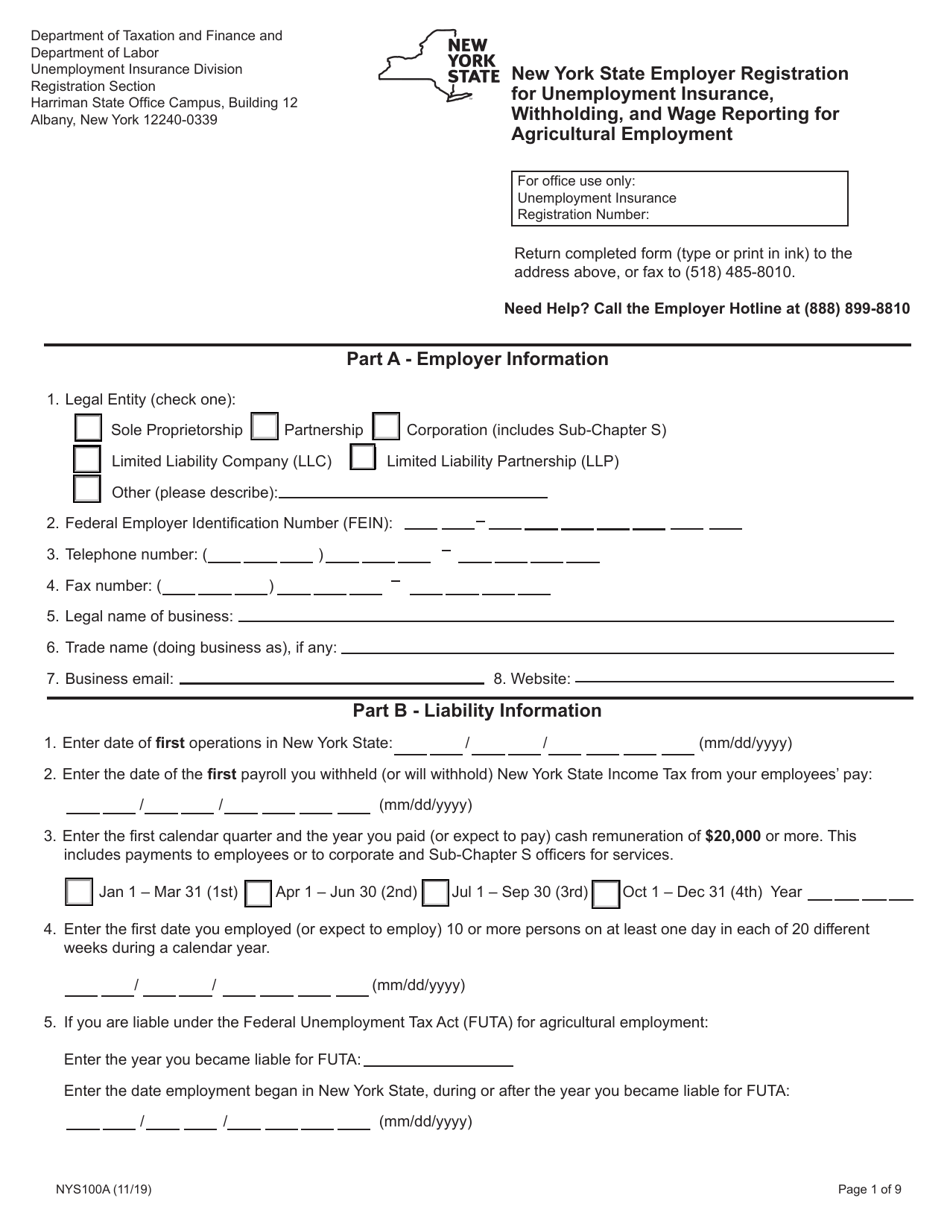

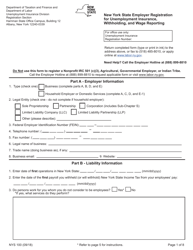

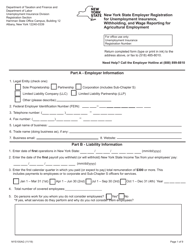

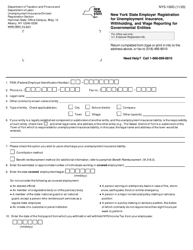

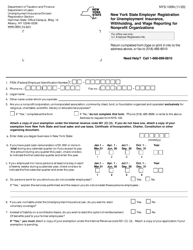

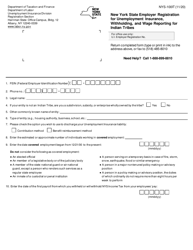

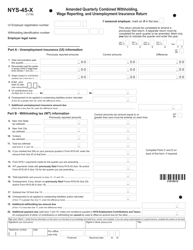

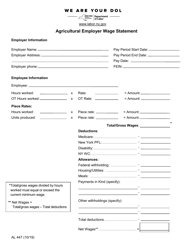

Form NYS100A New York State Employer Registration for Unemployment Insurance, Withholding, and Wage Reporting for Agricultural Employment - New York

What Is Form NYS100A?

This is a legal form that was released by the New York State Department of Labor - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NYS100A?

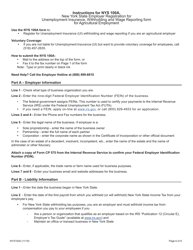

A: Form NYS100A is the New York State Employer Registration form for Unemployment Insurance, Withholding, and Wage Reporting for Agricultural Employment.

Q: Who needs to fill out Form NYS100A?

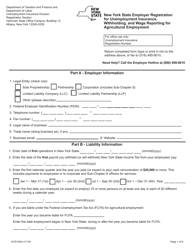

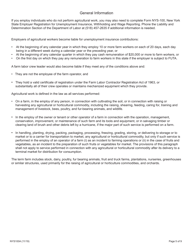

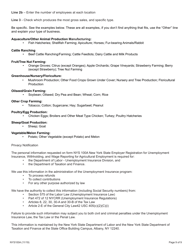

A: Employers who engage in agricultural employment in New York State need to fill out Form NYS100A.

Q: What is the purpose of Form NYS100A?

A: Form NYS100A is used to register agricultural employers for Unemployment Insurance, Withholding, and Wage Reporting purposes.

Q: What information is required on Form NYS100A?

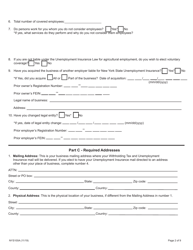

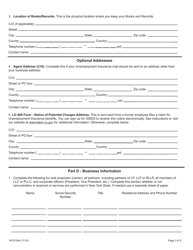

A: Form NYS100A requires information such as employer details, contact information, and agricultural employment details.

Q: Is there a fee to file Form NYS100A?

A: No, there is no fee to file Form NYS100A.

Q: When should Form NYS100A be filed?

A: Form NYS100A should be filed before engaging in agricultural employment in New York State.

Q: Are there any penalties for not filing Form NYS100A?

A: Yes, failure to file Form NYS100A may result in penalties imposed by the New York State Department of Taxation and Finance.

Q: Can additional information be attached to Form NYS100A?

A: Yes, additional information can be attached to Form NYS100A if necessary.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the New York State Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NYS100A by clicking the link below or browse more documents and templates provided by the New York State Department of Labor.