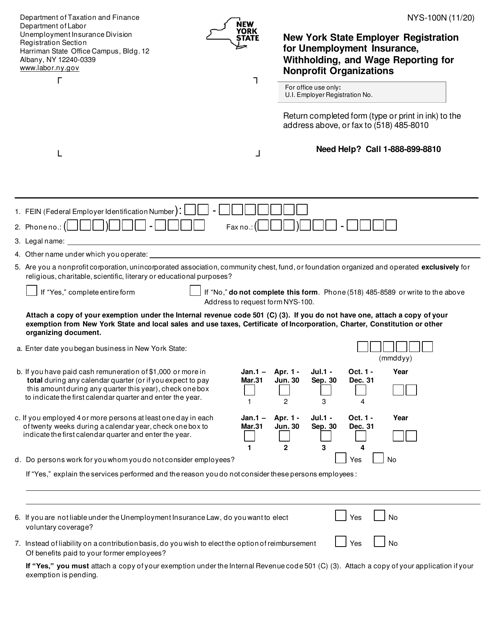

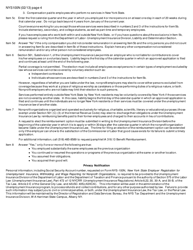

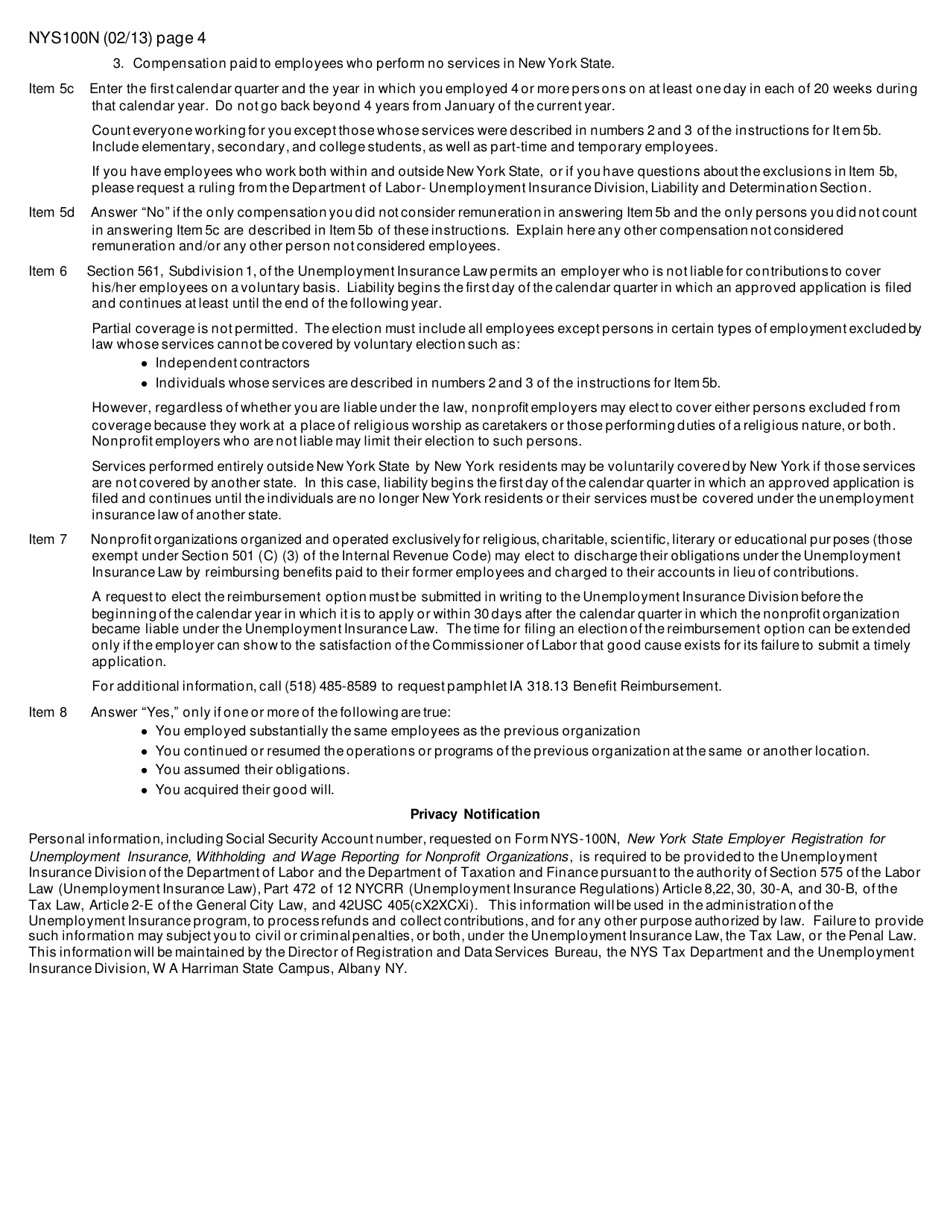

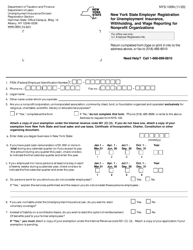

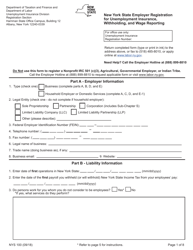

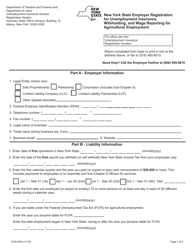

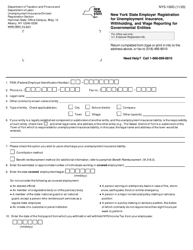

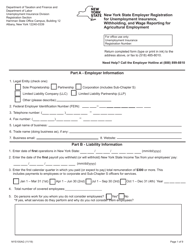

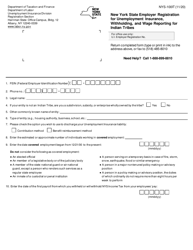

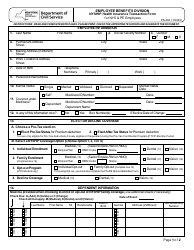

Form NYS-100N New York State Employer Registration for Unemployment Insurance, Withholding, and Wage Reporting for Nonprofit Organizations - New York

What Is Form NYS-100N?

This is a legal form that was released by the New York State Department of Labor - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NYS-100N?

A: Form NYS-100N is a registration form for nonprofit organizations in New York State to register for Unemployment Insurance, Withholding, and Wage Reporting.

Q: Who needs to file Form NYS-100N?

A: Nonprofit organizations in New York State that have employees need to file Form NYS-100N to register for Unemployment Insurance, Withholding, and Wage Reporting.

Q: What is the purpose of Form NYS-100N?

A: The purpose of Form NYS-100N is to register nonprofit organizations in New York State for Unemployment Insurance, Withholding, and Wage Reporting.

Q: Is Form NYS-100N only for nonprofit organizations?

A: Yes, Form NYS-100N is specifically for nonprofit organizations in New York State.

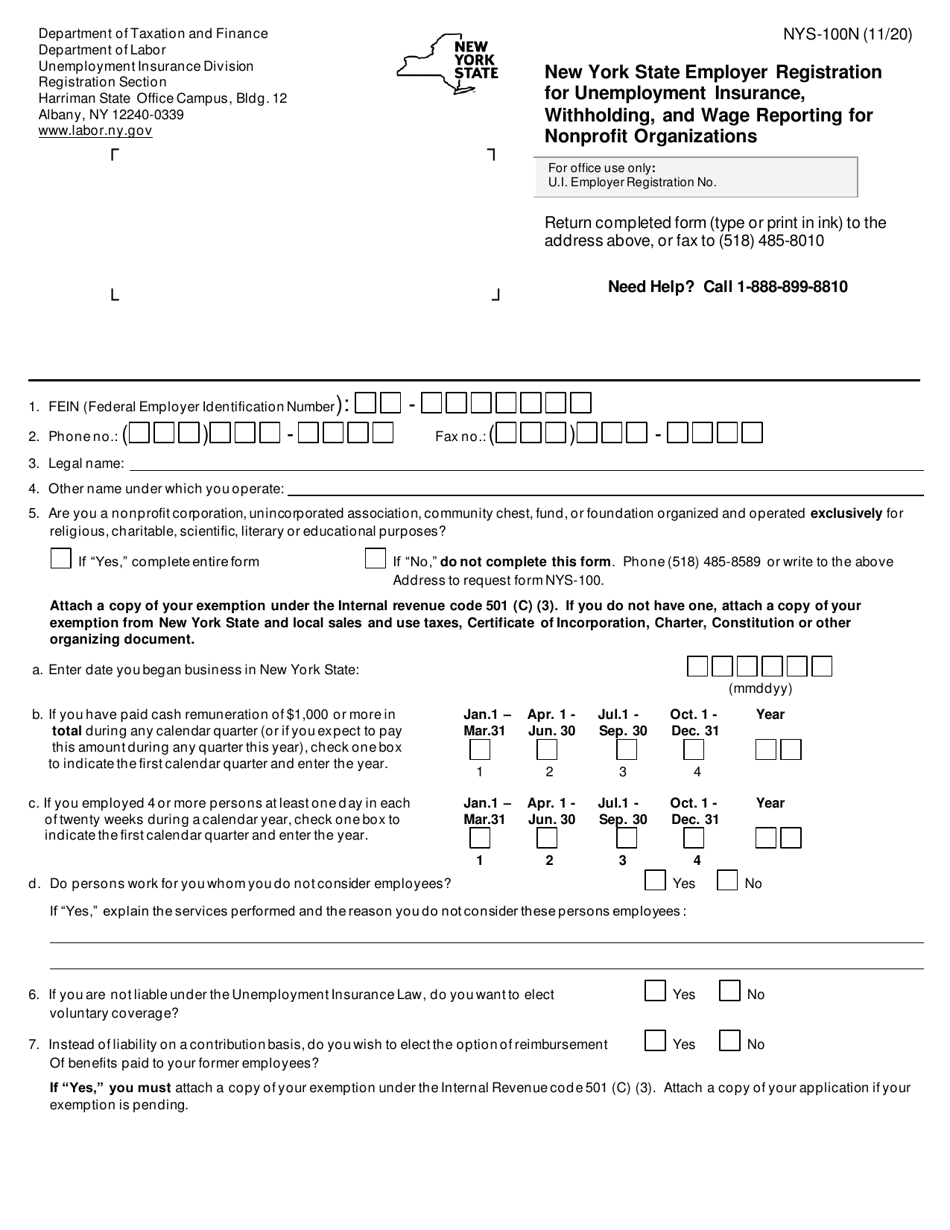

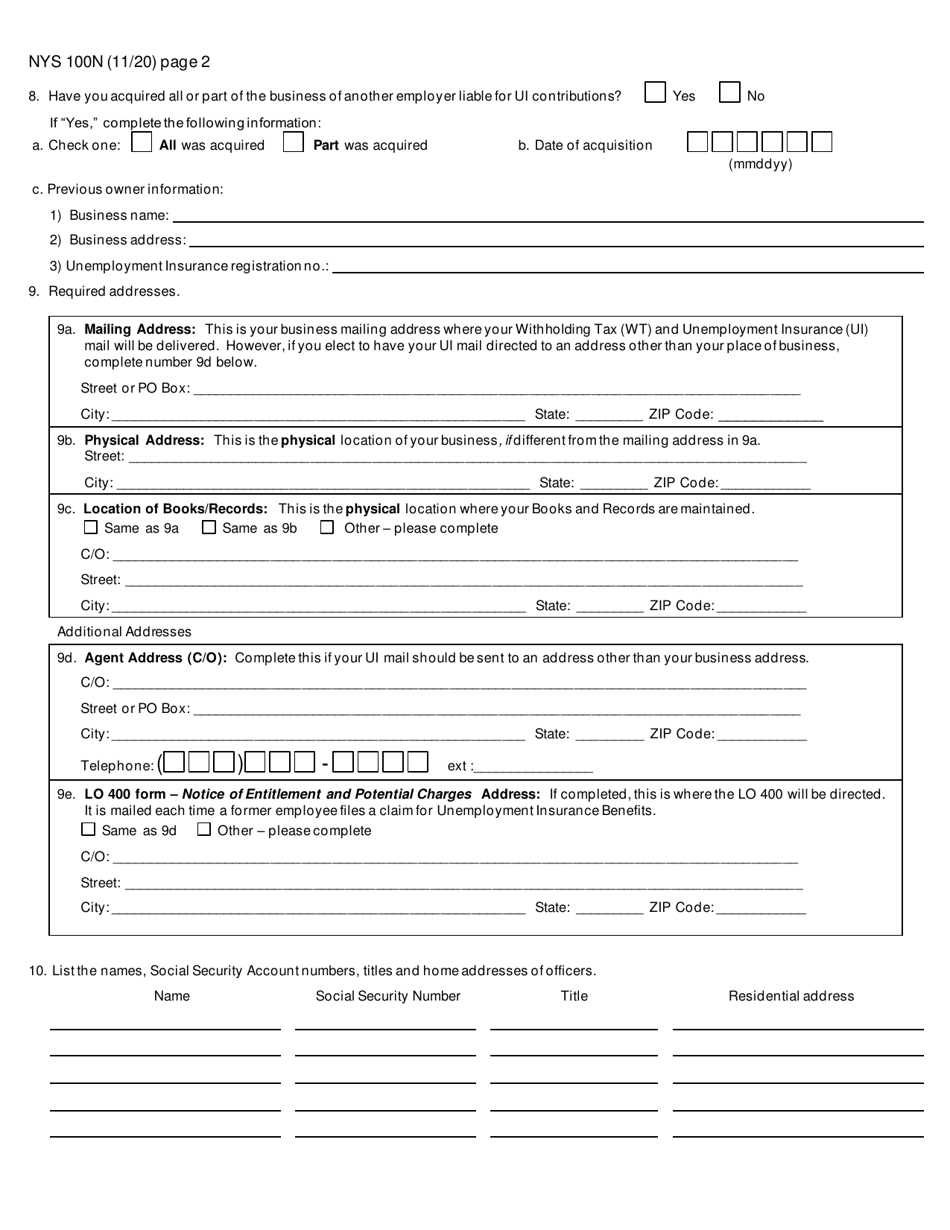

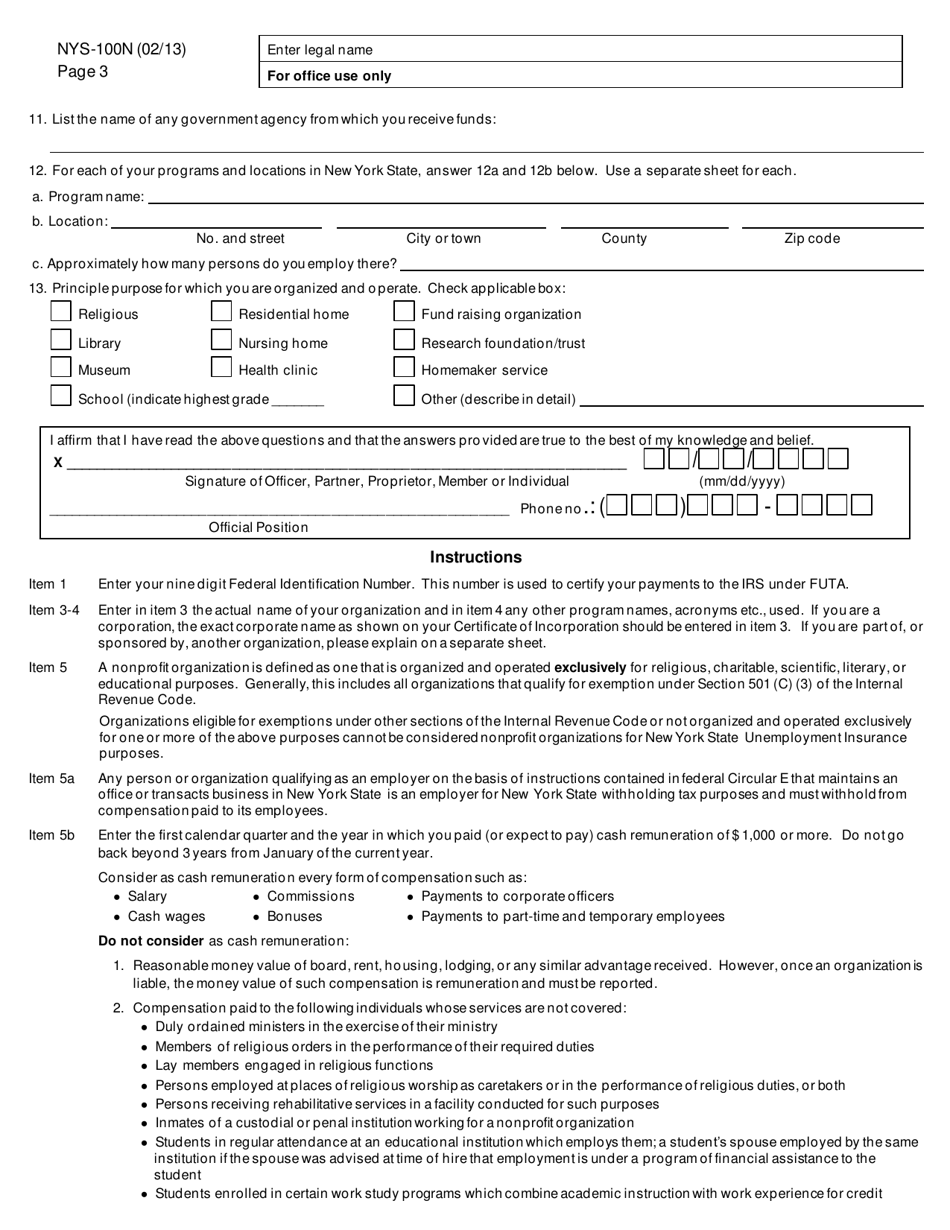

Q: What information is required on Form NYS-100N?

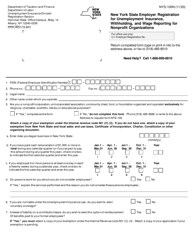

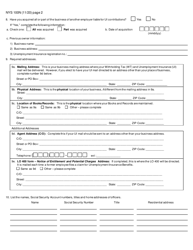

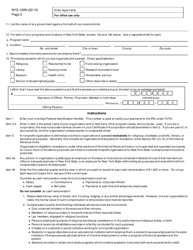

A: Form NYS-100N requires information such as the organization's name, address, federal employer identification number (FEIN), payroll period, and contact information.

Q: When do I need to file Form NYS-100N?

A: Form NYS-100N should be filed before the first date you pay wages to employees in New York State.

Q: Are there any fees associated with filing Form NYS-100N?

A: No, there are no fees associated with filing Form NYS-100N.

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the New York State Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYS-100N by clicking the link below or browse more documents and templates provided by the New York State Department of Labor.