This version of the form is not currently in use and is provided for reference only. Download this version of

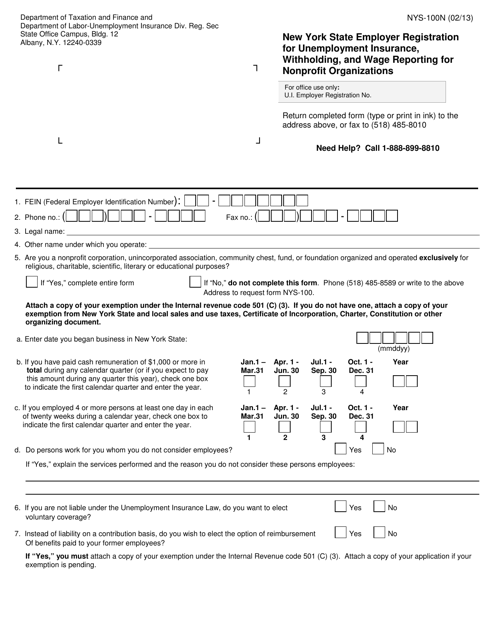

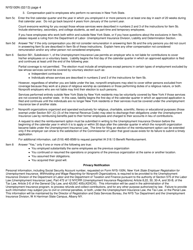

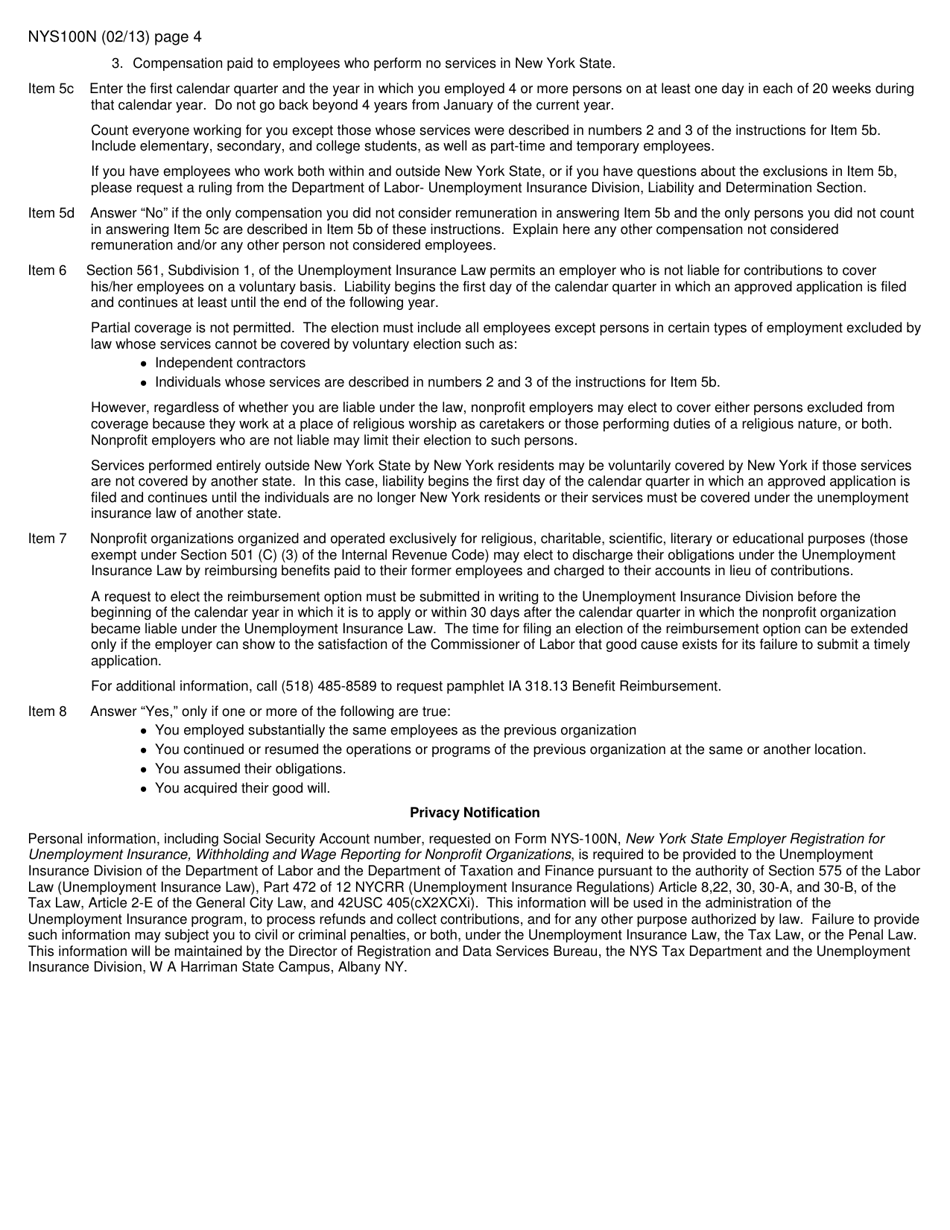

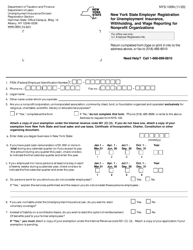

Form NYS-100N

for the current year.

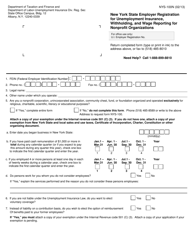

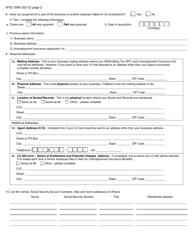

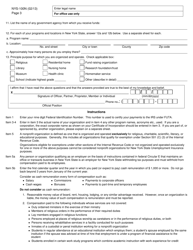

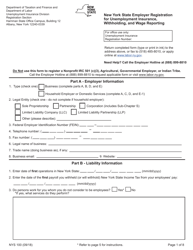

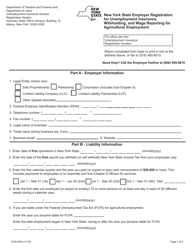

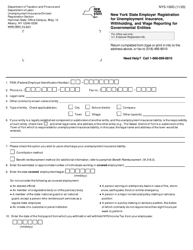

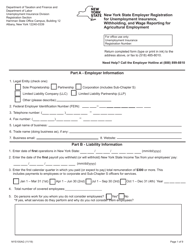

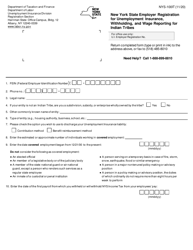

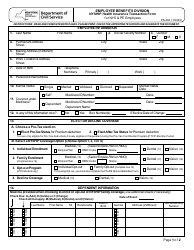

Form NYS-100N New York State Employer Registration for Unemployment Insurance, Withholding, and Wage Reporting for Nonprofit Organizations - New York

What Is Form NYS-100N?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NYS-100N?

A: Form NYS-100N is the New York State Employer Registration for Unemployment Insurance, Withholding, and Wage Reporting for Nonprofit Organizations.

Q: Who needs to fill out Form NYS-100N?

A: Nonprofit organizations in New York State that have employees need to fill out Form NYS-100N.

Q: What is the purpose of Form NYS-100N?

A: The purpose of Form NYS-100N is to register nonprofit organizations as employers for unemployment insurance, withholding taxes, and wage reporting purposes.

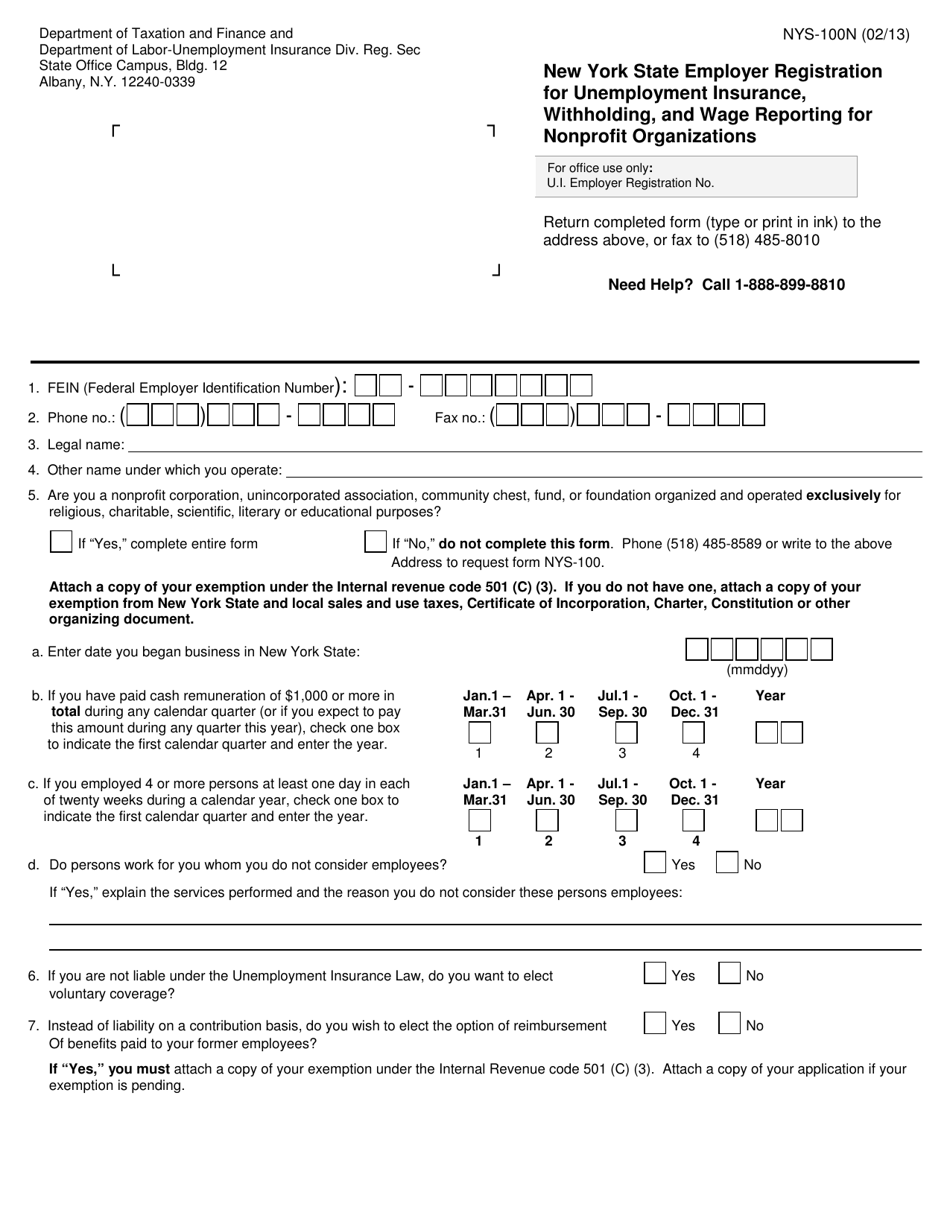

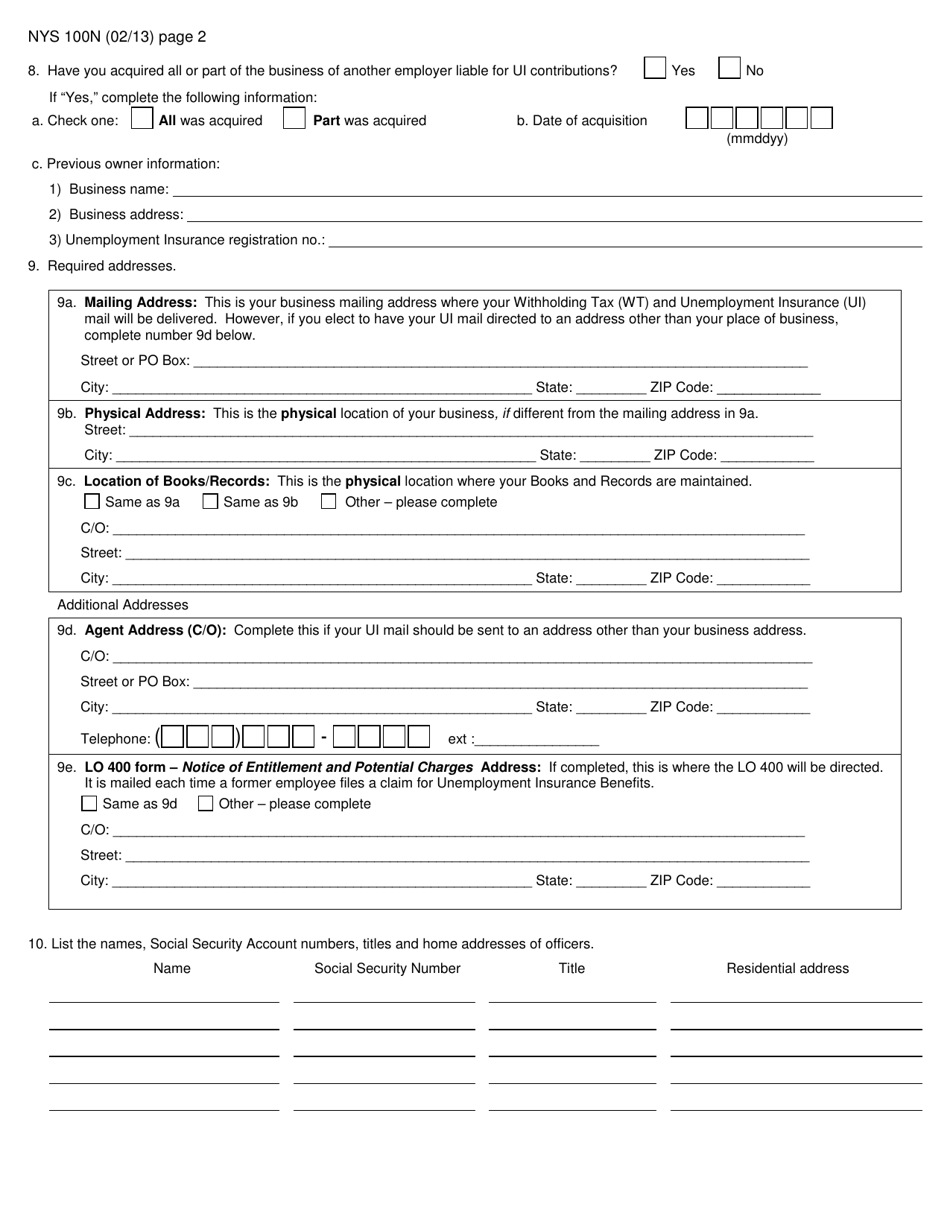

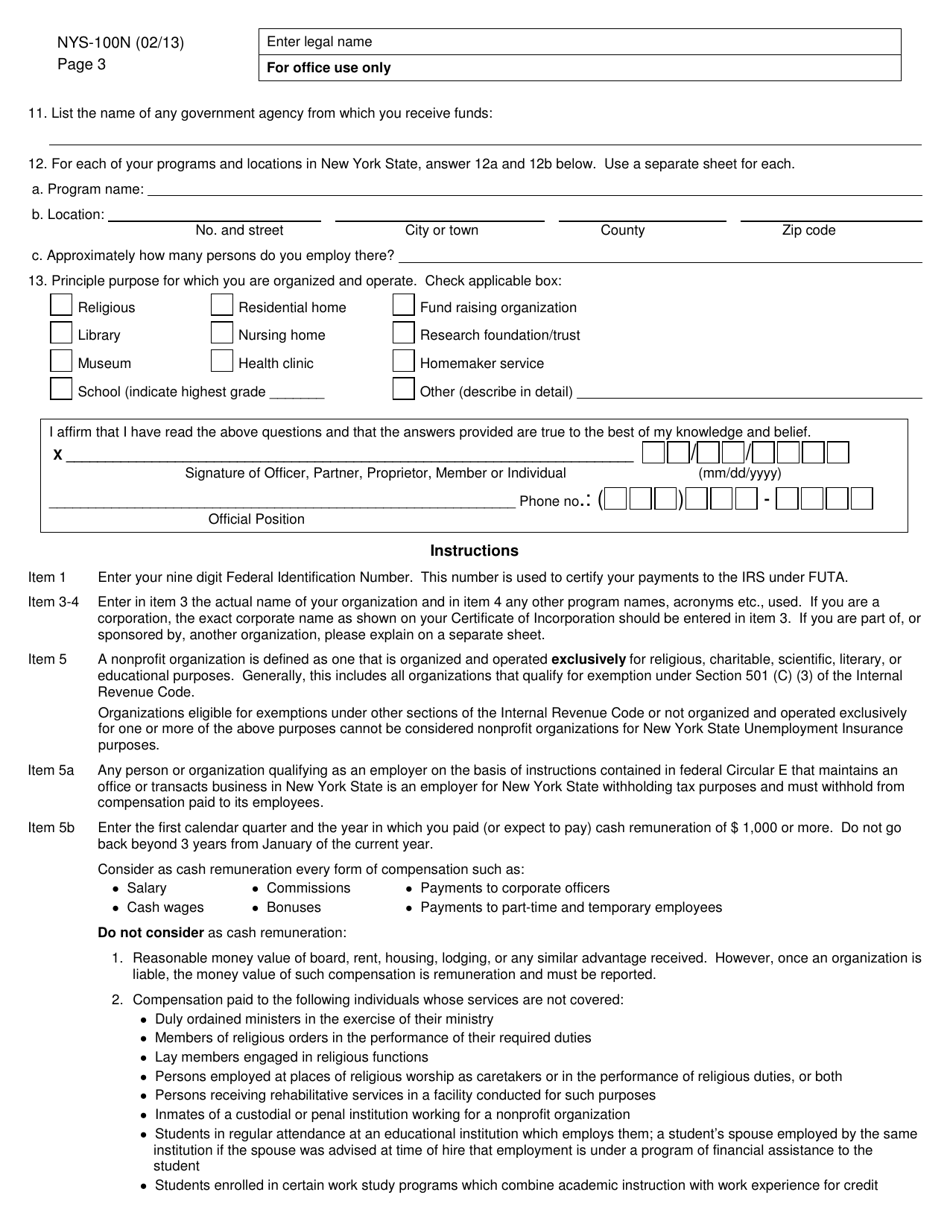

Q: What information is required on Form NYS-100N?

A: Form NYS-100N requires information such as the organization's name, address, federal employer identification number (FEIN), and contact information.

Q: Is there a deadline for filing Form NYS-100N?

A: Yes, nonprofit organizations in New York State should file Form NYS-100N within 20 days of hiring their first employee.

Q: Are there any fees associated with filing Form NYS-100N?

A: No, there are no fees associated with filing Form NYS-100N.

Q: What should I do after filing Form NYS-100N?

A: After filing Form NYS-100N, nonprofit organizations should receive a Certificate of Registration from the New York State Department of Labor.

Q: Do nonprofit organizations need to file Form NYS-100N annually?

A: No, nonprofit organizations do not need to file Form NYS-100N annually. However, they should notify the New York State Department of Labor of any changes to their information.

Q: What happens if a nonprofit organization does not file Form NYS-100N?

A: Nonprofit organizations that fail to file Form NYS-100N may be subject to penalties and fines by the New York State Department of Labor.

Form Details:

- Released on February 1, 2013;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYS-100N by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.