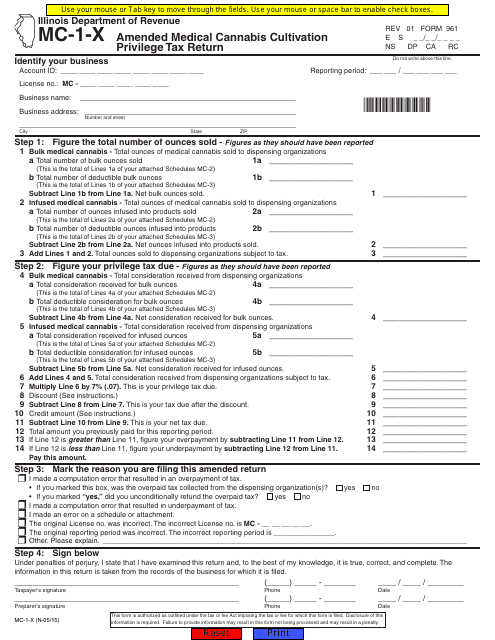

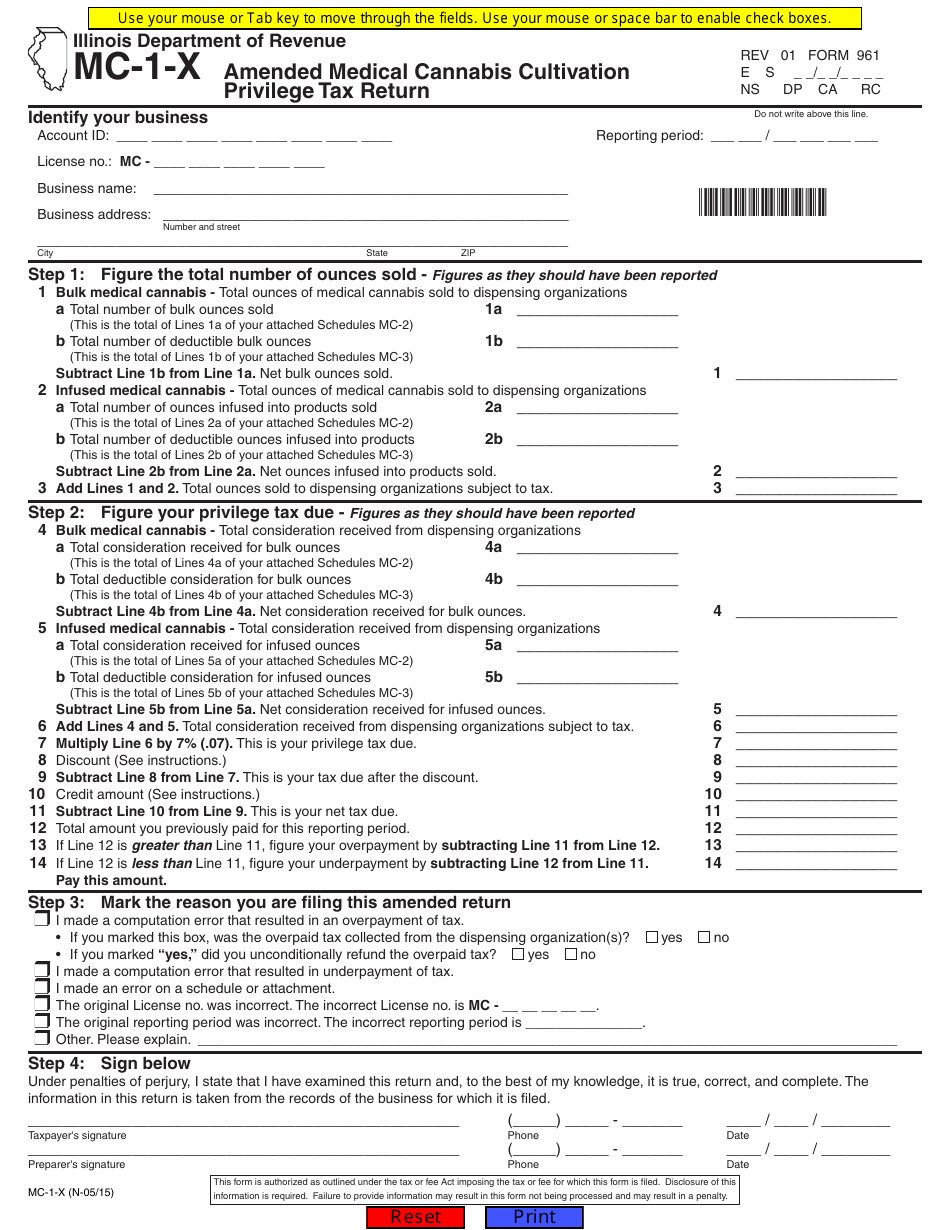

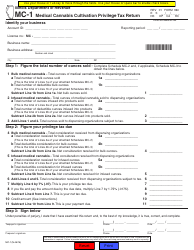

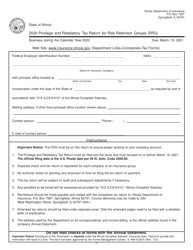

Form MC-1-X Amended Medical Cannabis Cultivation Privilege Tax Return - Illinois

What Is Form MC-1-X?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the Form MC-1-X?

A: The Form MC-1-X is the Amended Medical Cannabis Cultivation Privilege Tax Return specifically for Illinois.

Q: Who should file the Form MC-1-X?

A: Medical cannabis cultivation businesses in Illinois should file the Form MC-1-X.

Q: What is the purpose of the Form MC-1-X?

A: The purpose of the Form MC-1-X is to report any changes or corrections to previously filed Medical Cannabis Cultivation Privilege Tax Returns in Illinois.

Q: When should the Form MC-1-X be filed?

A: The Form MC-1-X should be filed as soon as possible after the discovery of an error or change that needs to be reported.

Q: Are there any penalties for not filing the Form MC-1-X?

A: Yes, there may be penalties imposed for failing to file the Form MC-1-X or for filing it late.

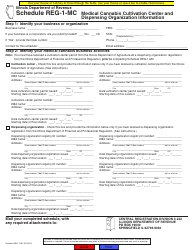

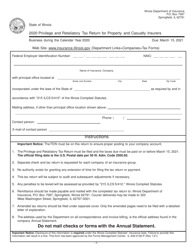

Q: What information is required on the Form MC-1-X?

A: The Form MC-1-X requires information such as the business name, address, tax period, and details of the changes or corrections being reported.

Q: Is the Form MC-1-X specific to medical cannabis cultivation businesses only?

A: Yes, the Form MC-1-X is specifically designed for medical cannabis cultivation businesses in Illinois.

Q: Can I use the Form MC-1-X for other tax purposes?

A: No, the Form MC-1-X is solely for reporting changes or corrections to Medical Cannabis Cultivation Privilege Tax Returns in Illinois.

Form Details:

- Released on May 1, 2015;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MC-1-X by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.