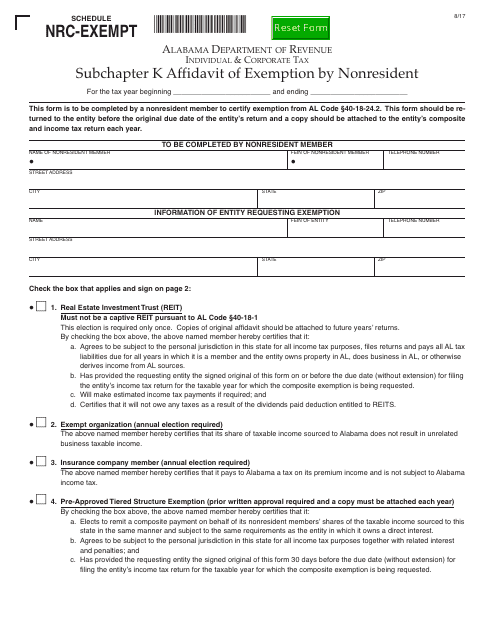

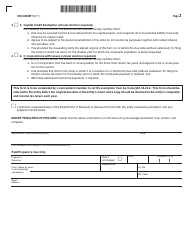

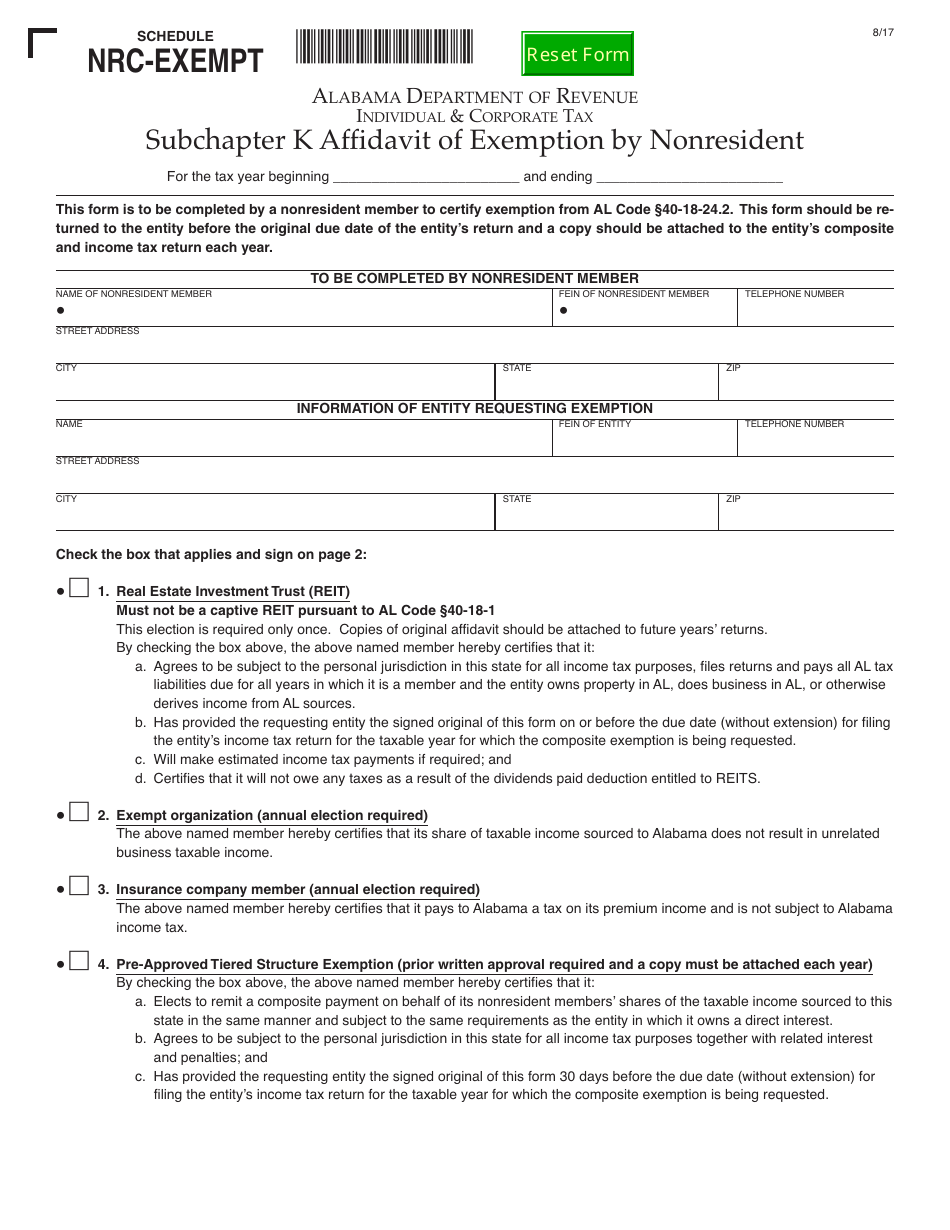

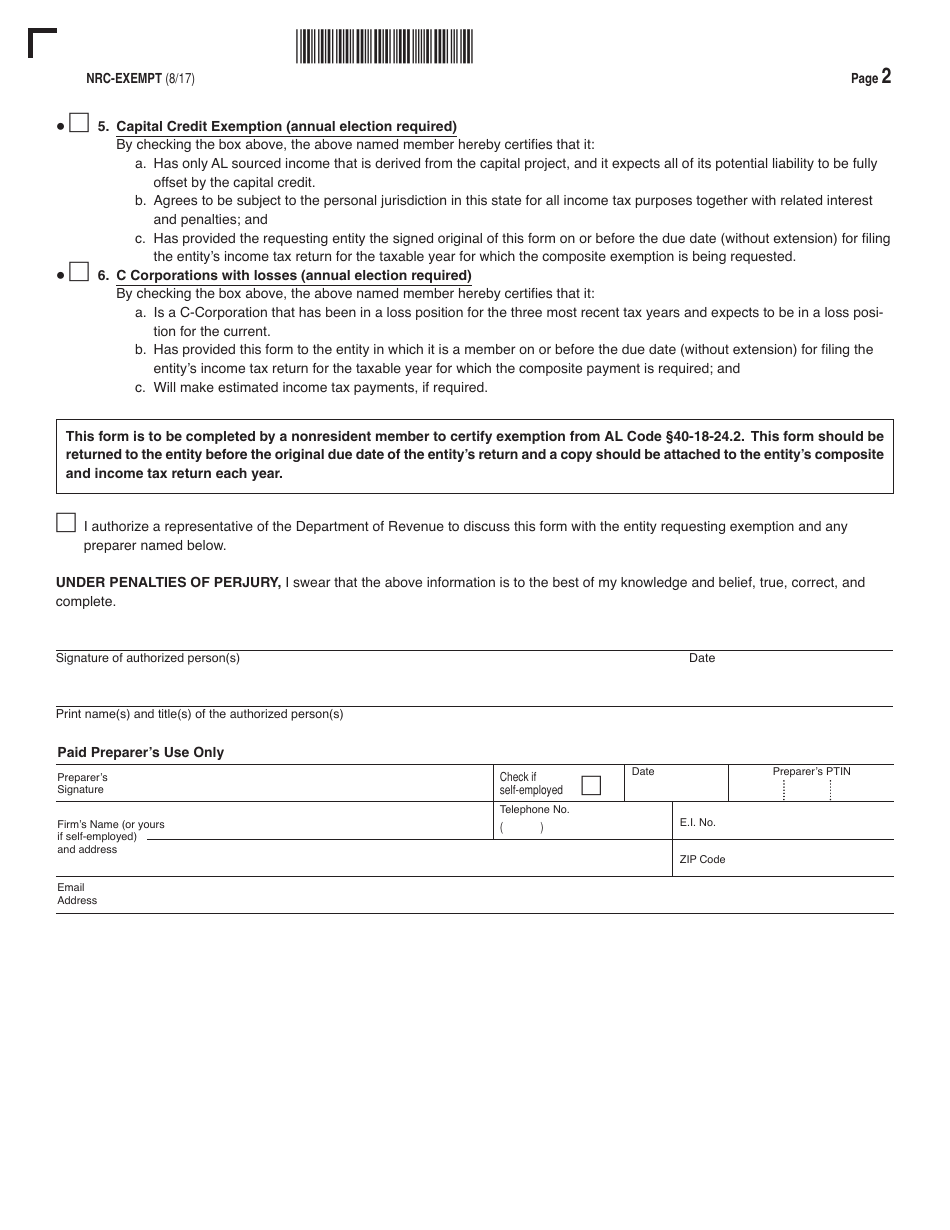

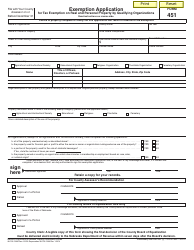

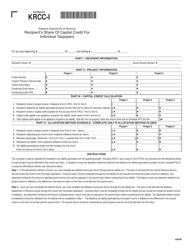

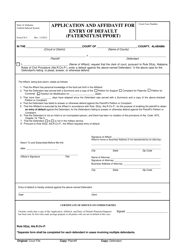

Schedule NRC-EXEMPT Subchapter K Affidavit of Exemption by Nonresident - Alabama

What Is Schedule NRC-EXEMPT?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule NRC-EXEMPT?

A: Schedule NRC-EXEMPT is a form used in Alabama for the Affidavit of Exemption by Nonresident.

Q: Who can use Schedule NRC-EXEMPT?

A: Nonresidents of Alabama who are seeking exemption from certain taxes may use Schedule NRC-EXEMPT.

Q: What is the purpose of Schedule NRC-EXEMPT?

A: The purpose of Schedule NRC-EXEMPT is to provide documentation of a nonresident's exemption from certain taxes in Alabama.

Q: Do I need to file Schedule NRC-EXEMPT if I am a resident of Alabama?

A: No, Schedule NRC-EXEMPT is specifically for nonresidents seeking exemption from taxes in Alabama.

Q: Are there any fees associated with filing Schedule NRC-EXEMPT?

A: There are no fees associated with filing Schedule NRC-EXEMPT.

Q: What documents do I need to support my exemption claim with Schedule NRC-EXEMPT?

A: You may need to provide supporting documents such as proof of residency in another state or documentation of exempt income.

Q: Can I claim multiple exemptions on Schedule NRC-EXEMPT?

A: Yes, you may claim multiple exemptions on Schedule NRC-EXEMPT if you meet the eligibility requirements for each exemption.

Q: What taxes are covered by the exemptions on Schedule NRC-EXEMPT?

A: The exemptions on Schedule NRC-EXEMPT may cover Alabama income tax, business privilege tax, or other taxes as specified.

Q: Is Schedule NRC-EXEMPT only for individuals or can businesses also use it?

A: Both individuals and businesses can use Schedule NRC-EXEMPT if they meet the eligibility requirements for the exemptions.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule NRC-EXEMPT by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.