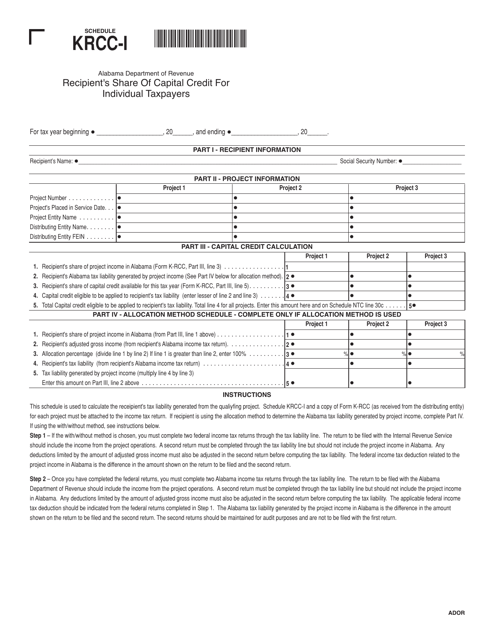

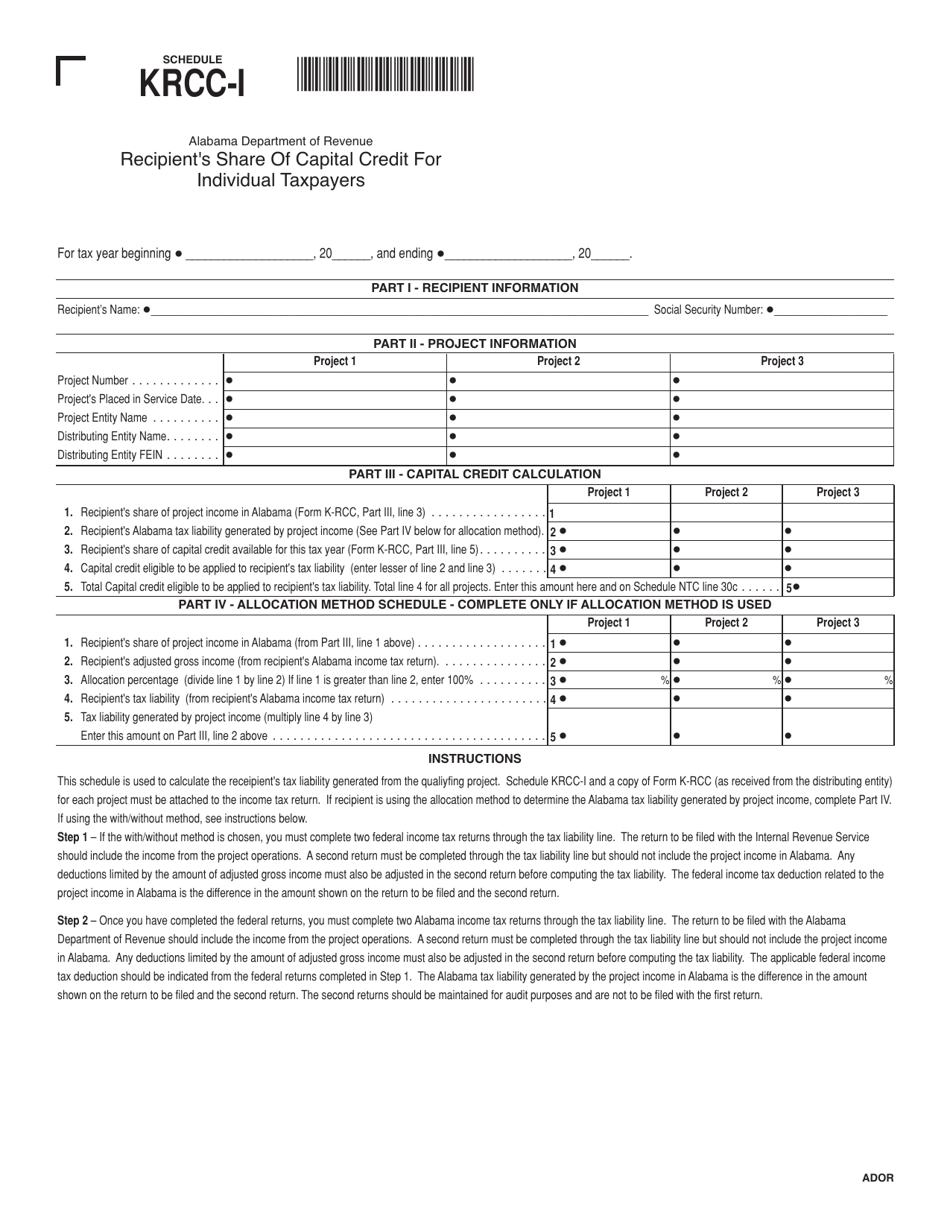

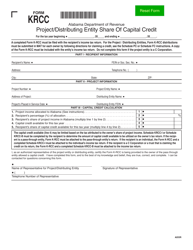

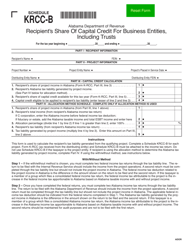

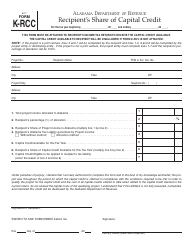

Schedule KRCC-I Recipient's Share of Capital Credit for Individual Taxpayers - Alabama

What Is Schedule KRCC-I?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is KRCC-I?

A: KRCC-I stands for Recipient's Share of Capital Credit for Individual Taxpayers.

Q: Who is eligible for KRCC-I?

A: Individual taxpayers in Alabama are eligible for KRCC-I.

Q: What does KRCC-I represent?

A: KRCC-I represents the recipient's share of capital credit.

Q: What is the purpose of KRCC-I?

A: The purpose of KRCC-I is to distribute capital credits to individual taxpayers in Alabama.

Form Details:

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule KRCC-I by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.