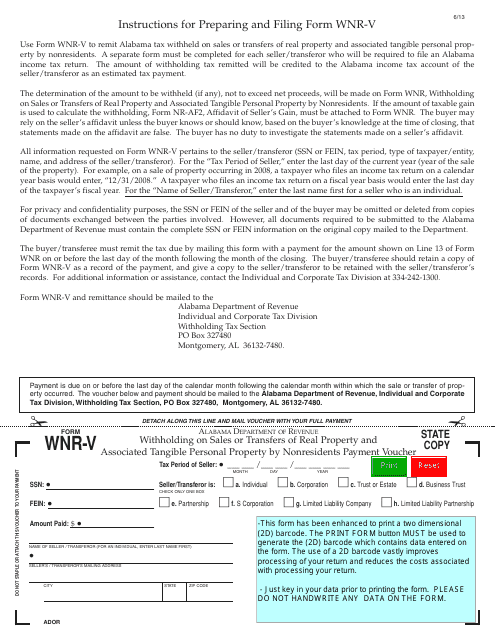

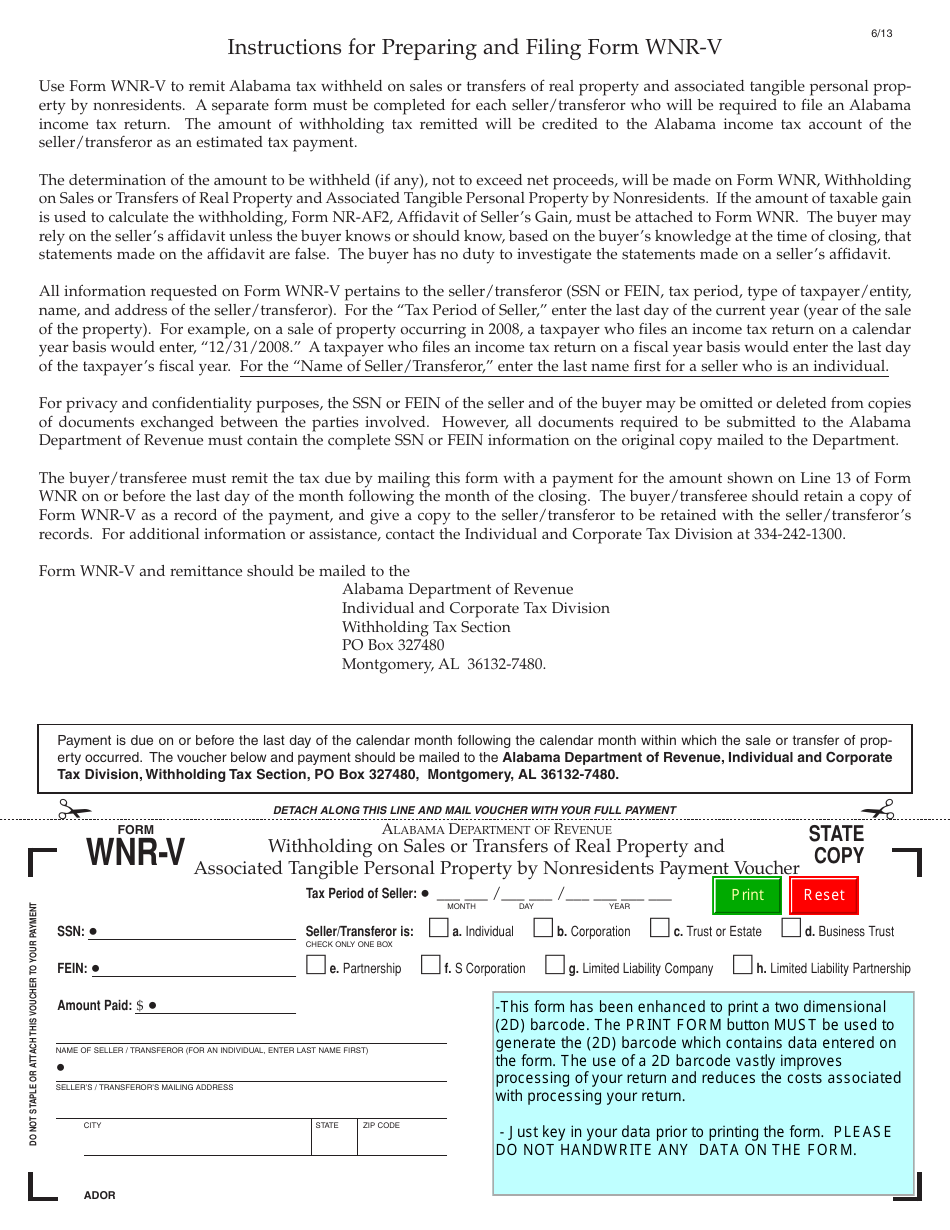

Form WNR-V Withholding on Sales or Transfers of Real Property and Associated Tangible Personal Property by Nonresidents Payment Voucher - Alabama

What Is Form WNR-V?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WNR-V?

A: Form WNR-V is a payment voucher used for withholding on sales or transfers of real property and associated tangible personal property by nonresidents in Alabama.

Q: Who needs to use Form WNR-V?

A: Nonresidents who are selling or transferring real property and associated tangible personal property in Alabama need to use Form WNR-V.

Q: What is the purpose of Form WNR-V?

A: The purpose of Form WNR-V is to report and submit payment for the withholding tax required on the sale or transfer of real property and associated tangible personal property by nonresidents in Alabama.

Q: When is Form WNR-V due?

A: Form WNR-V is due on or before the date of the sale or transfer of the real property and associated tangible personal property.

Q: Are there any penalties for late submission of Form WNR-V?

A: Yes, there are penalties for late submission of Form WNR-V. It is important to file and submit the form on time to avoid penalties.

Q: How do I submit Form WNR-V?

A: Form WNR-V should be submitted along with the payment to the Alabama Department of Revenue.

Q: Is Form WNR-V required for residents of Alabama?

A: No, Form WNR-V is only required for nonresidents of Alabama who are selling or transferring real property and associated tangible personal property in the state.

Form Details:

- Released on June 1, 2013;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WNR-V by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.