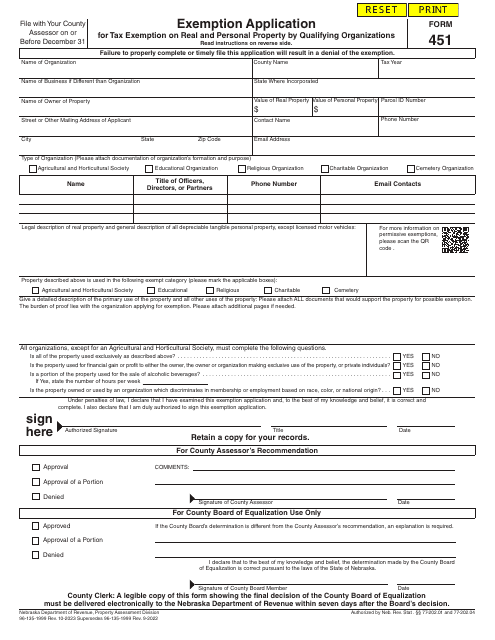

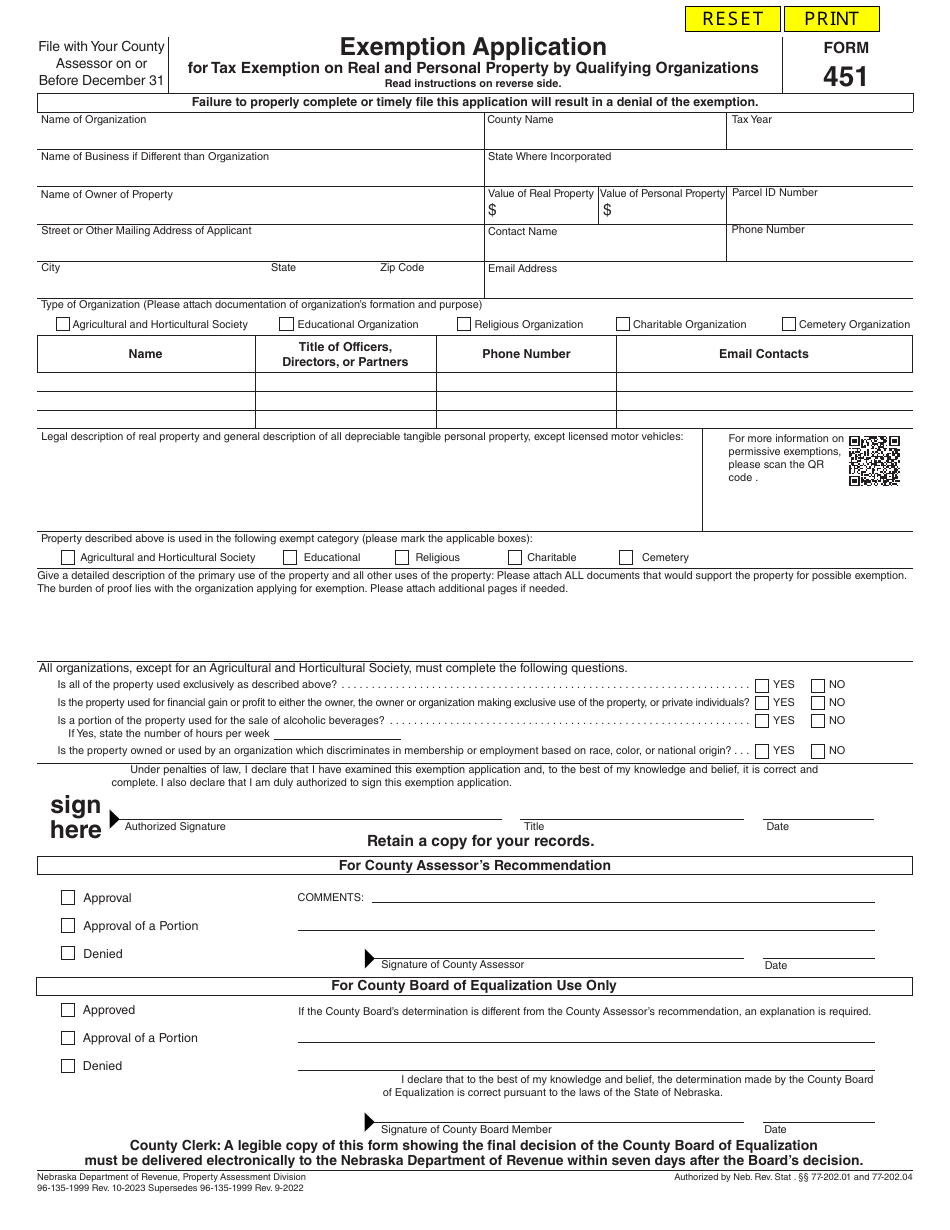

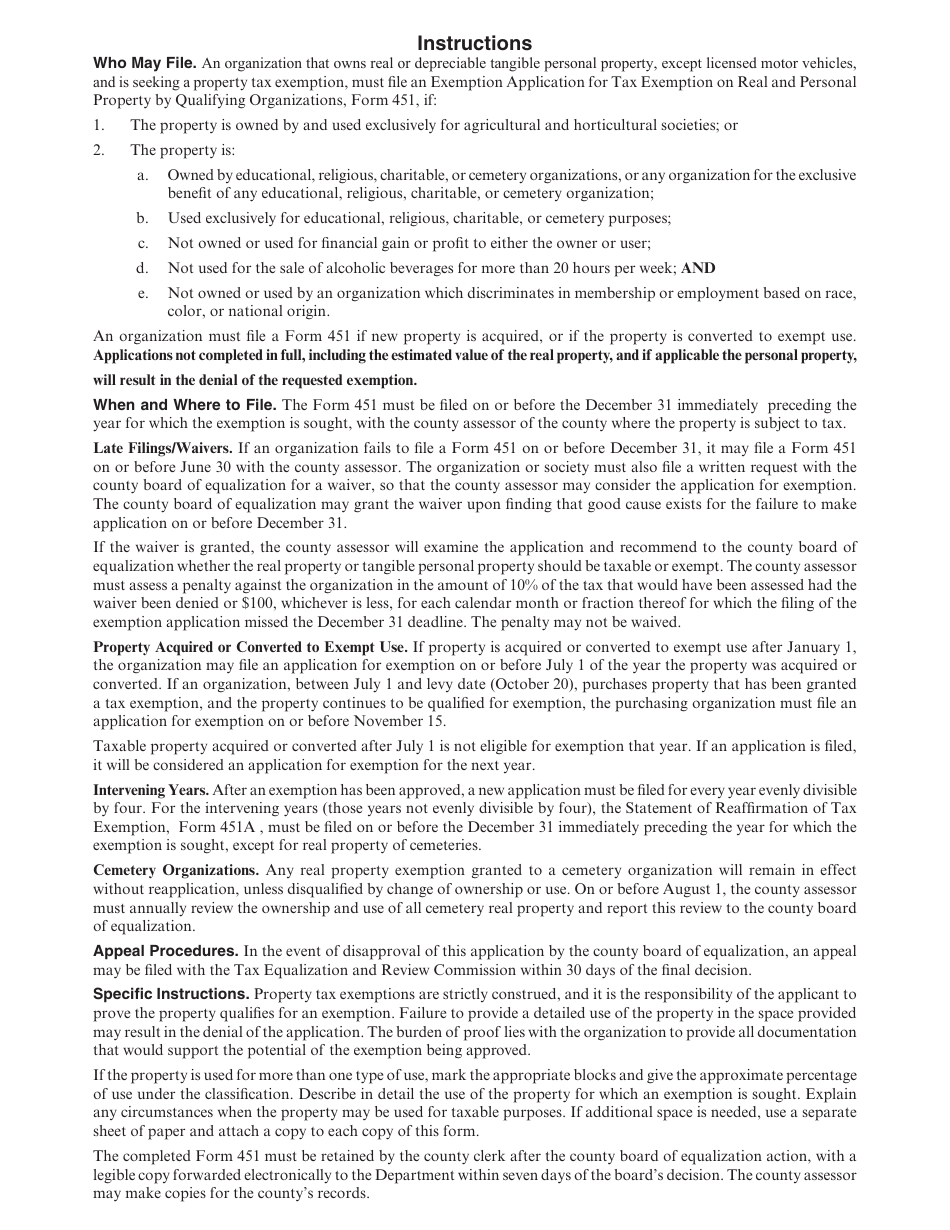

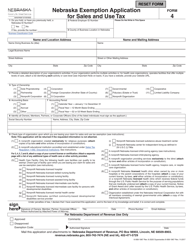

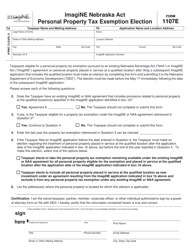

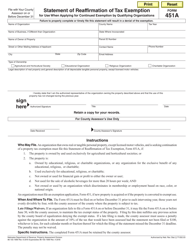

Form 451 Exemption Application for Tax Exemption on Real and Personal Property by Qualifying Organizations - Nebraska

Fill PDF Online

Fill out online for free

without registration or credit card

What Is Form 451?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 451 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.