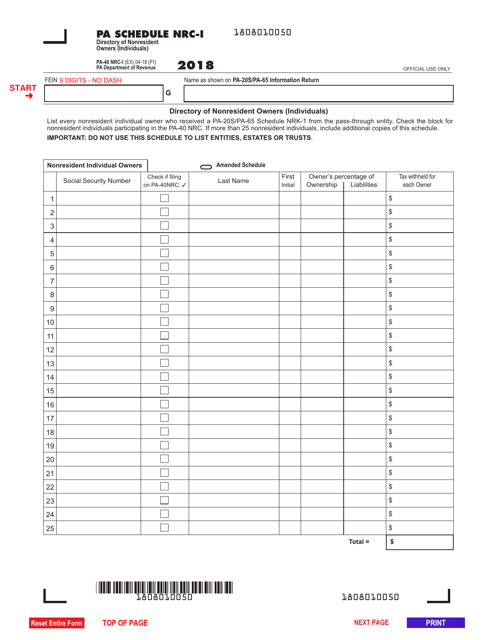

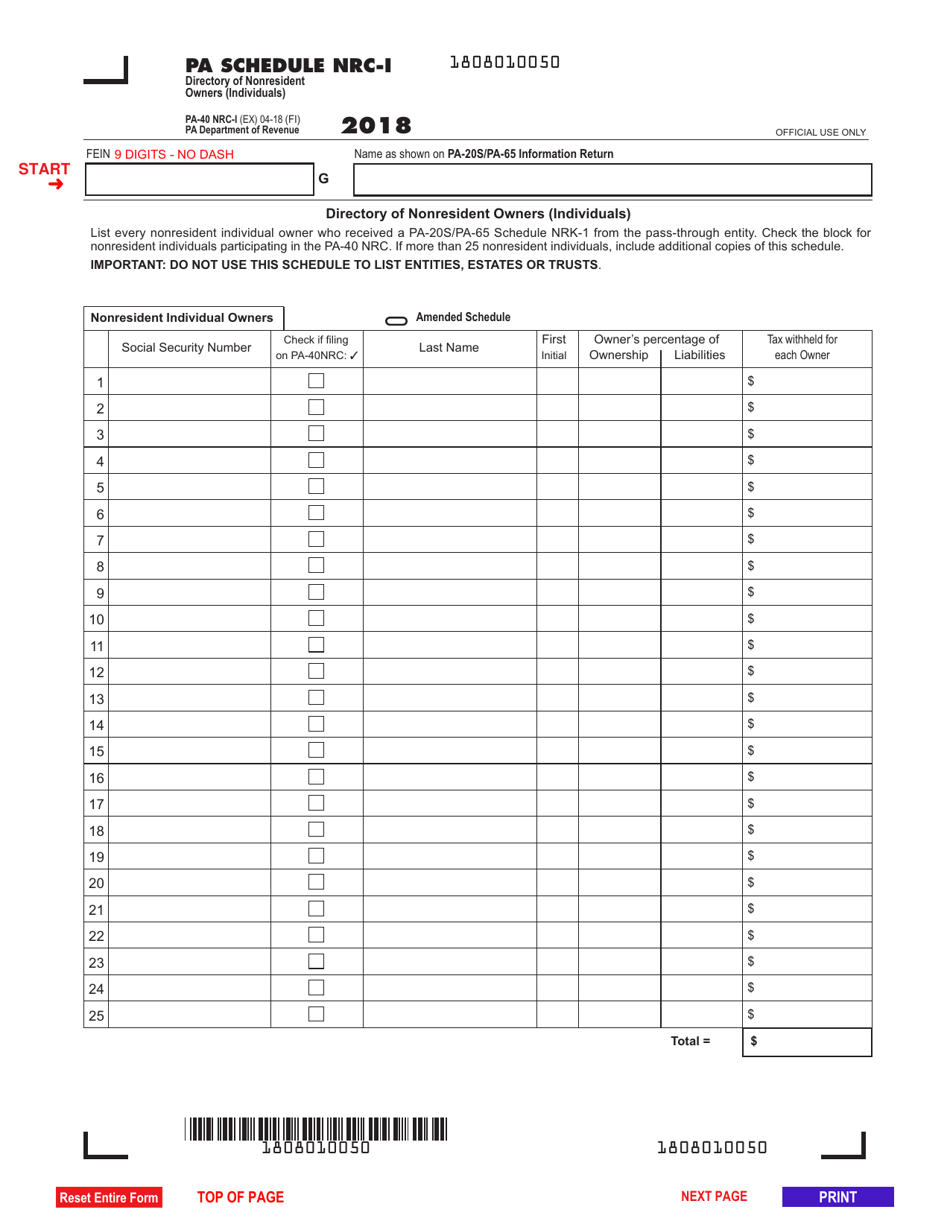

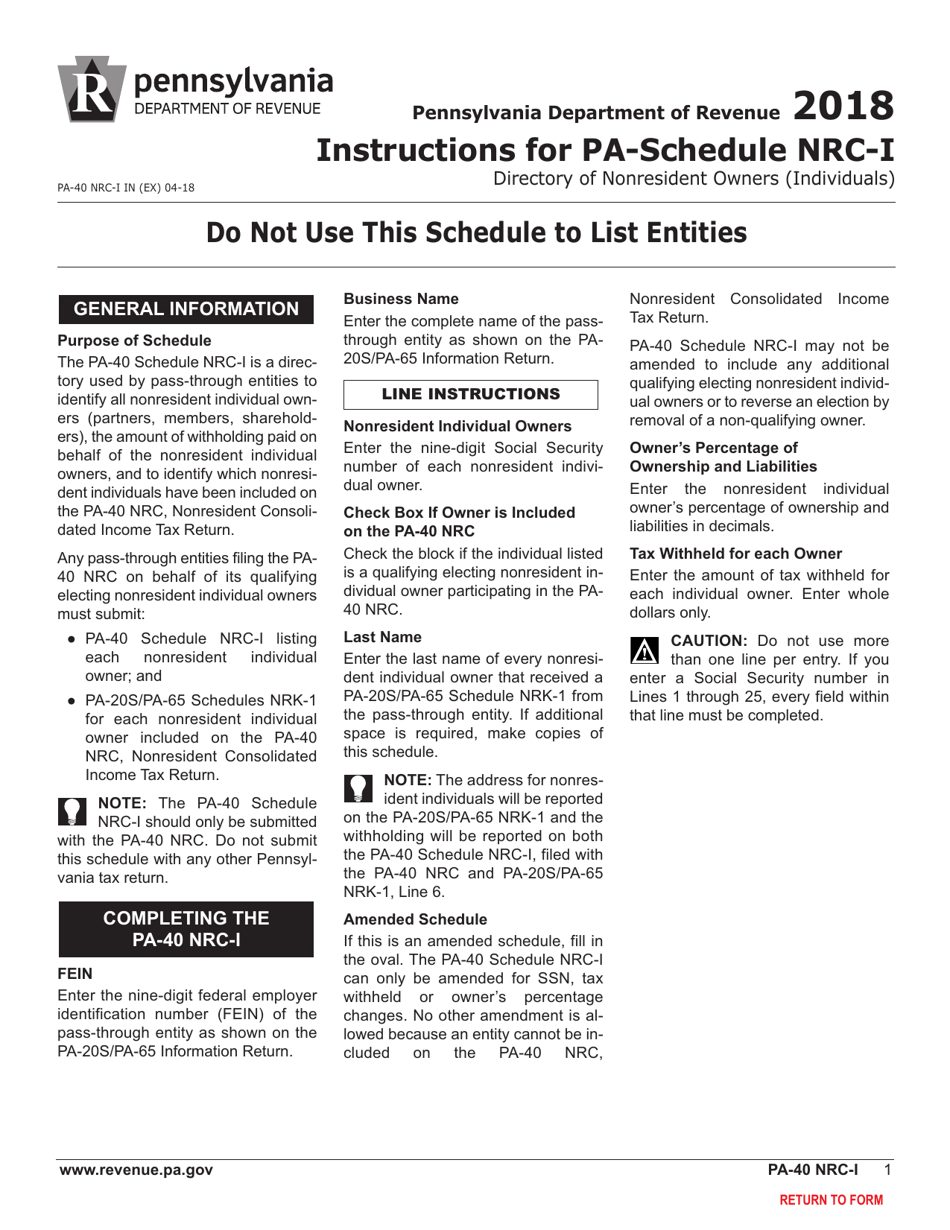

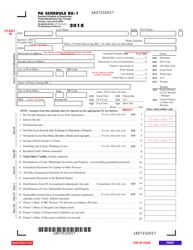

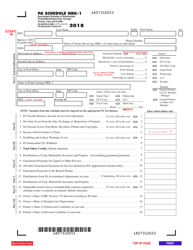

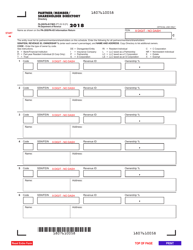

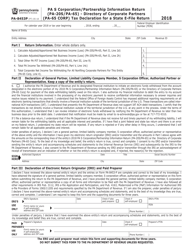

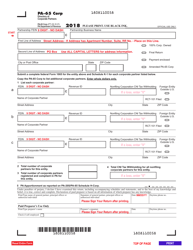

Form PA-40 Schedule NRC-I Directory of Nonresident Owners (Individuals) - Pennsylvania

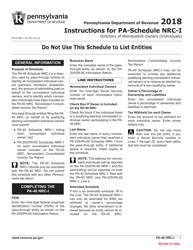

What Is Form PA-40 Schedule NRC-I?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is PA-40 Schedule NRC-I?

A: PA-40 Schedule NRC-I is a form used by nonresident individuals who own Pennsylvania real estate and are required to file a Pennsylvania personal income tax return.

Q: Who needs to file PA-40 Schedule NRC-I?

A: Nonresident individuals who own Pennsylvania real estate and need to file a Pennsylvania personal income tax return.

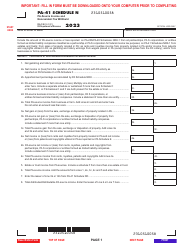

Q: What information is required on PA-40 Schedule NRC-I?

A: PA-40 Schedule NRC-I requires the nonresident owner's personal information, details of the Pennsylvania real estate owned, and income derived from the real estate.

Q: When is the deadline for filing PA-40 Schedule NRC-I?

A: The deadline for filing PA-40 Schedule NRC-I is the same as the deadline for filing the Pennsylvania personal income tax return, which is typically April 15th.

Q: What happens if I don't file PA-40 Schedule NRC-I?

A: Failure to file PA-40 Schedule NRC-I when required may result in penalties and interest.

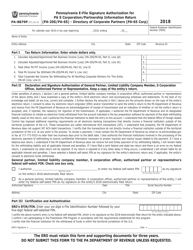

Q: Can I e-file PA-40 Schedule NRC-I?

A: No, PA-40 Schedule NRC-I cannot be e-filed. It must be filed by mail.

Q: Is there a fee to file PA-40 Schedule NRC-I?

A: There is no fee to file PA-40 Schedule NRC-I.

Q: Do I need to submit any supporting documentation with PA-40 Schedule NRC-I?

A: You do not need to submit supporting documentation with PA-40 Schedule NRC-I. However, you should retain the documentation for your records.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule NRC-I by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.