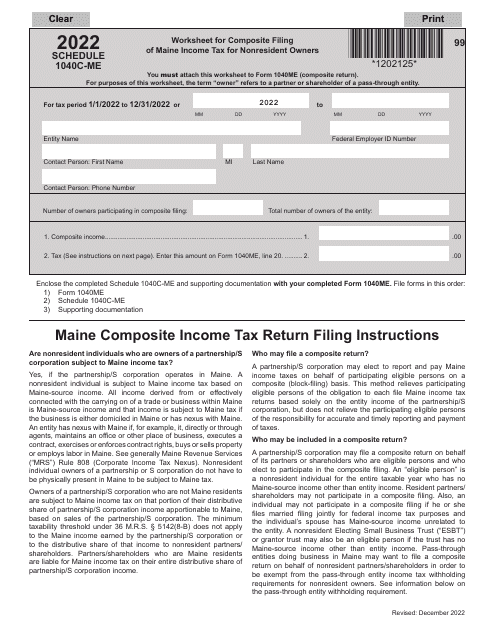

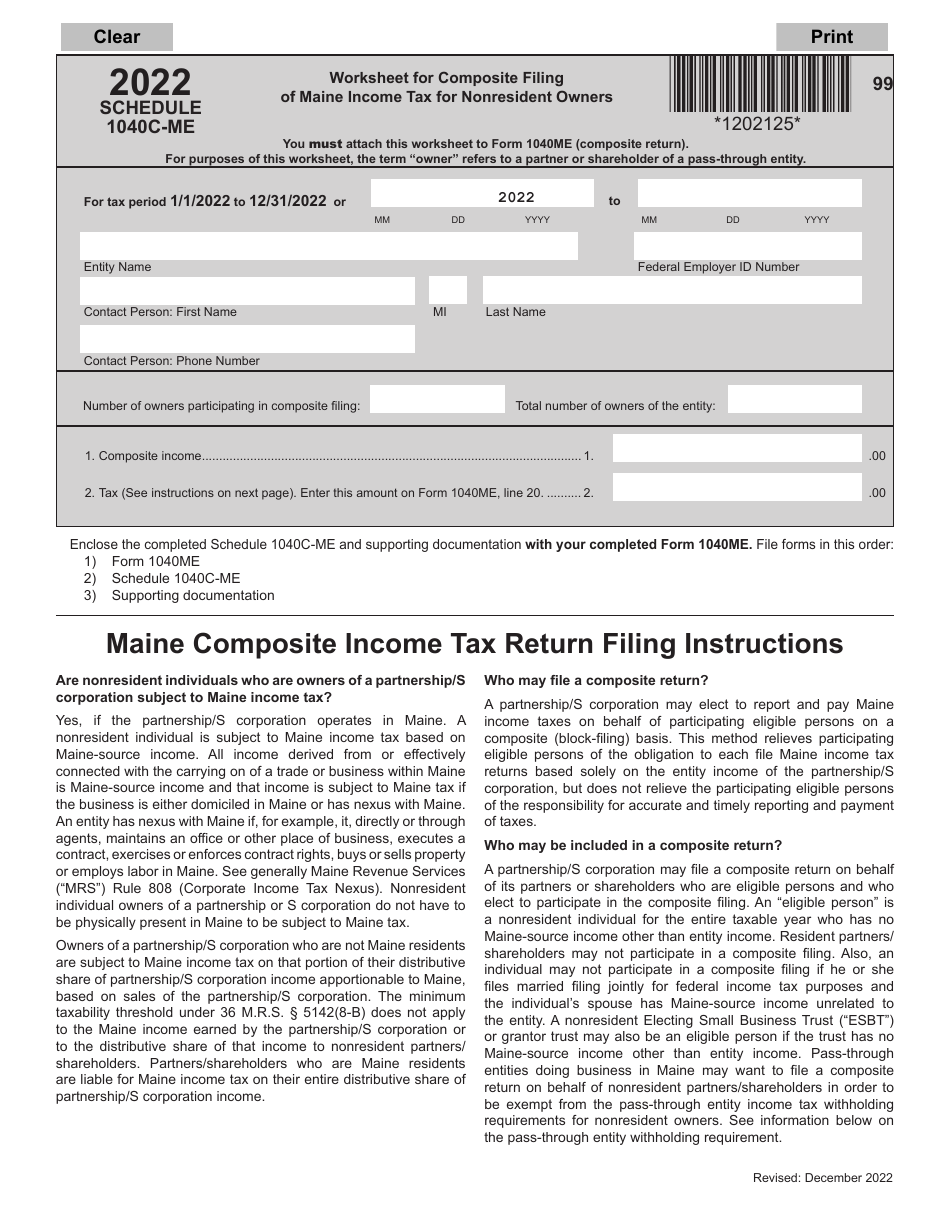

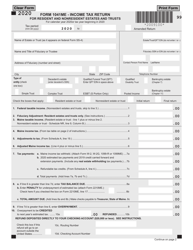

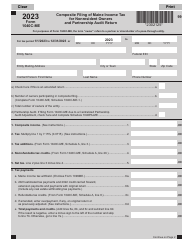

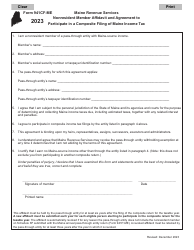

Schedule 1040C-ME Worksheet for Composite Filing of Maine Income Tax for Nonresident Owners - Maine

What Is Schedule 1040C-ME?

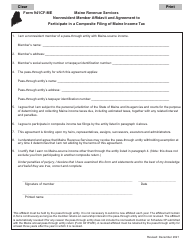

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule 1040C-ME?

A: Schedule 1040C-ME is a worksheet for composite filing of Maine income tax for nonresident owners.

Q: Who needs to file Schedule 1040C-ME?

A: Nonresident owners who have Maine income tax withheld from certain entities may need to file Schedule 1040C-ME.

Q: What is composite filing?

A: Composite filing allows nonresident owners to file a single tax return and pay their share of the income tax on behalf of the entity.

Q: What information is required for Schedule 1040C-ME?

A: Schedule 1040C-ME requires information about the nonresident owner, including their income, deductions, credits, and tax withheld.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule 1040C-ME by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.