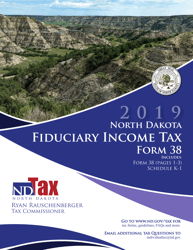

Instructions for Oil and Gas Taxes - North Dakota

This document was released by North Dakota Office of State Tax Commissioner and contains the most recent official instructions for Oil and Gas Taxes .

FAQ

Q: What are oil and gas taxes?

A: Oil and gas taxes are taxes imposed on the extraction and production of oil and gas resources.

Q: How are oil and gas taxes structured in North Dakota?

A: In North Dakota, oil and gas taxes are primarily structured as production taxes and extraction taxes.

Q: What is a production tax?

A: A production tax is a tax imposed on the gross value of oil and gas produced from a well in North Dakota.

Q: What is an extraction tax?

A: An extraction tax is a tax imposed on the net value of oil and gas extracted from the ground in North Dakota.

Q: What is the current production tax rate in North Dakota?

A: The current production tax rate in North Dakota is 10%.

Q: What is the current extraction tax rate in North Dakota?

A: The current extraction tax rate in North Dakota is 6.5%.

Q: Do oil and gas companies in North Dakota pay property taxes?

A: Yes, oil and gas companies in North Dakota are also subject to property taxes on their production and extraction equipment and facilities.

Q: Are there any additional taxes or fees related to oil and gas in North Dakota?

A: Yes, in addition to production and extraction taxes, there may be additional taxes or fees such as oil conditioning, oil inspection, and oil and gas disposal fees.

Q: Who collects and administers the oil and gas taxes in North Dakota?

A: The North Dakota State Tax Department is responsible for the collection and administration of oil and gas taxes in the state.

Q: How are oil and gas tax revenues used in North Dakota?

A: Oil and gas tax revenues in North Dakota are used to fund various state programs and services, including infrastructure projects, education, and environmental conservation.

Instruction Details:

- This 19-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the North Dakota Office of State Tax Commissioner.