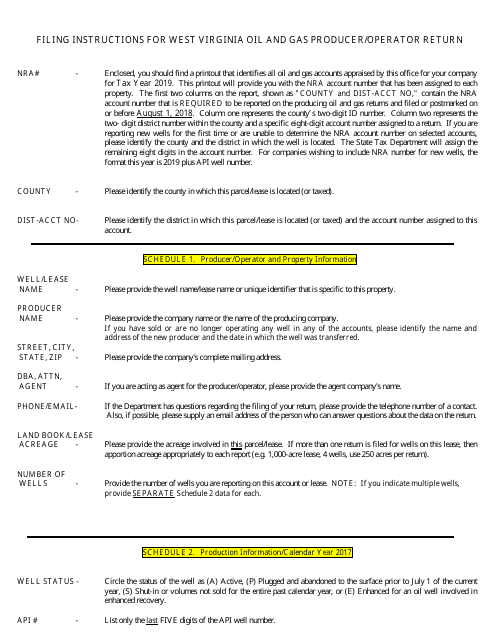

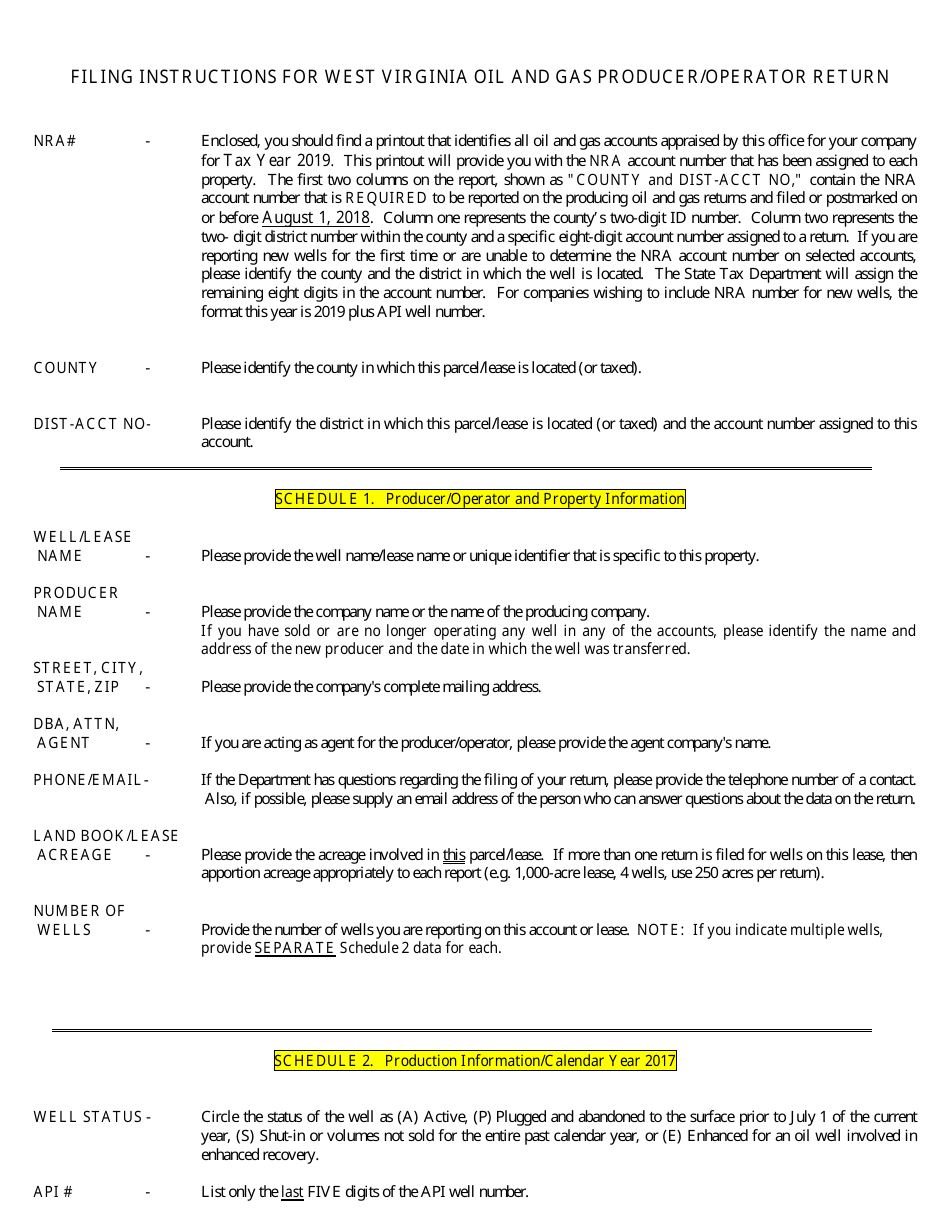

Instructions for Form STC-1235 West Virginia Oil and Gas Producer / Operator Return - West Virginia

This document contains official instructions for Form STC-1235 , West Virginia Oil and Gas Producer/Operator Return - a form released and collected by the West Virginia State Tax Department. An up-to-date fillable Form STC-1235 is available for download through this link.

FAQ

Q: What is Form STC-1235?

A: Form STC-1235 is the West Virginia Oil and Gas Producer/Operator Return.

Q: Who needs to file Form STC-1235?

A: Oil and gas producers and operators in West Virginia need to file Form STC-1235.

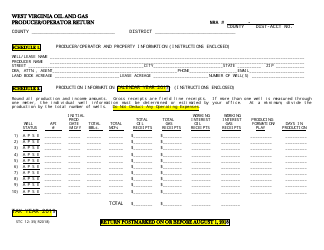

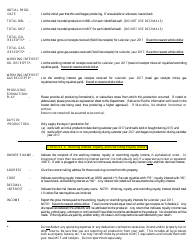

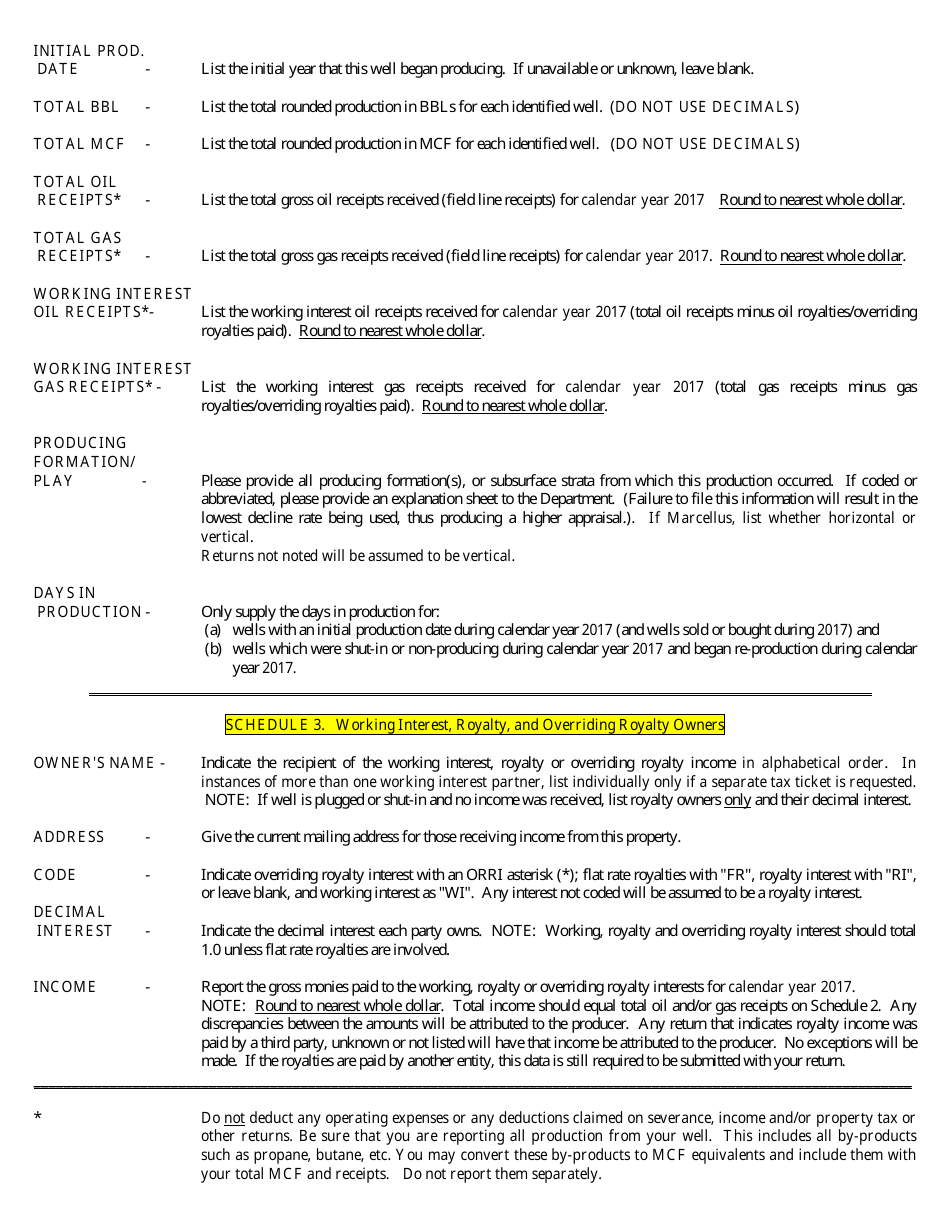

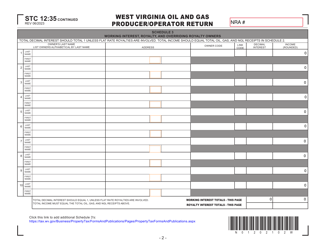

Q: What information is required on Form STC-1235?

A: Form STC-1235 requires information about oil and gas production and operations in West Virginia, including lease name, well information, and production data.

Q: When is the deadline to file Form STC-1235?

A: The deadline to file Form STC-1235 is typically on or before April 1st of the year following the reporting period.

Q: Are there any penalties for not filing Form STC-1235?

A: Yes, there are penalties for not filing Form STC-1235 or for filing late, including interest charges and penalties based on the amount of tax owed.

Q: What other forms or documentation may be required along with Form STC-1235?

A: Depending on your specific situation, additional forms and documentation may be required, such as schedules, worksheets, and supporting documents.

Q: Is there a way to request an extension for filing Form STC-1235?

A: Yes, it is possible to request an extension by contacting the West Virginia Department of Tax and Revenue.

Q: Is there a separate form for refunds or credits related to oil and gas production in West Virginia?

A: Yes, there is a separate form for refunds or credits related to oil and gas production in West Virginia, called Form STC399.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the West Virginia State Tax Department.