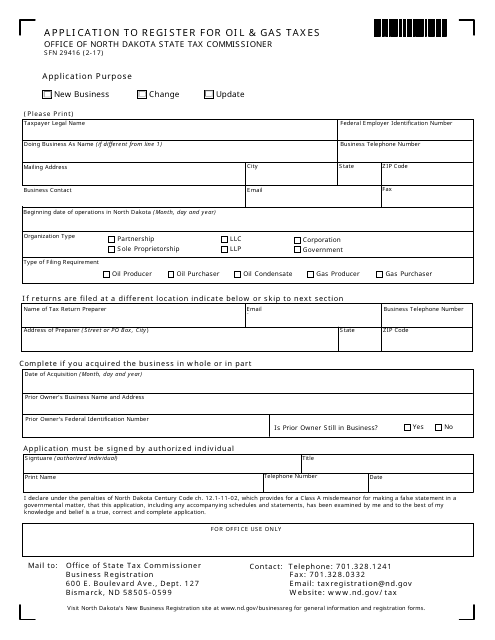

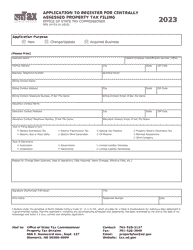

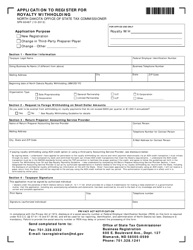

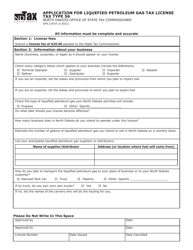

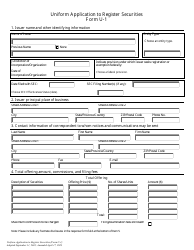

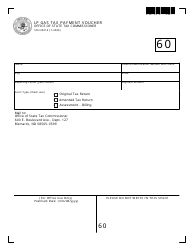

Form SFN29416 Application to Register for Oil & Gas Taxes - North Dakota

What Is Form SFN29416?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form SFN29416?

A: The Form SFN29416 is an application to register for oil & gas taxes in North Dakota.

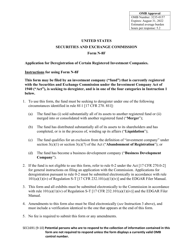

Q: Who needs to fill out the Form SFN29416?

A: Any individual or business engaged in the oil & gas industry in North Dakota needs to fill out this form.

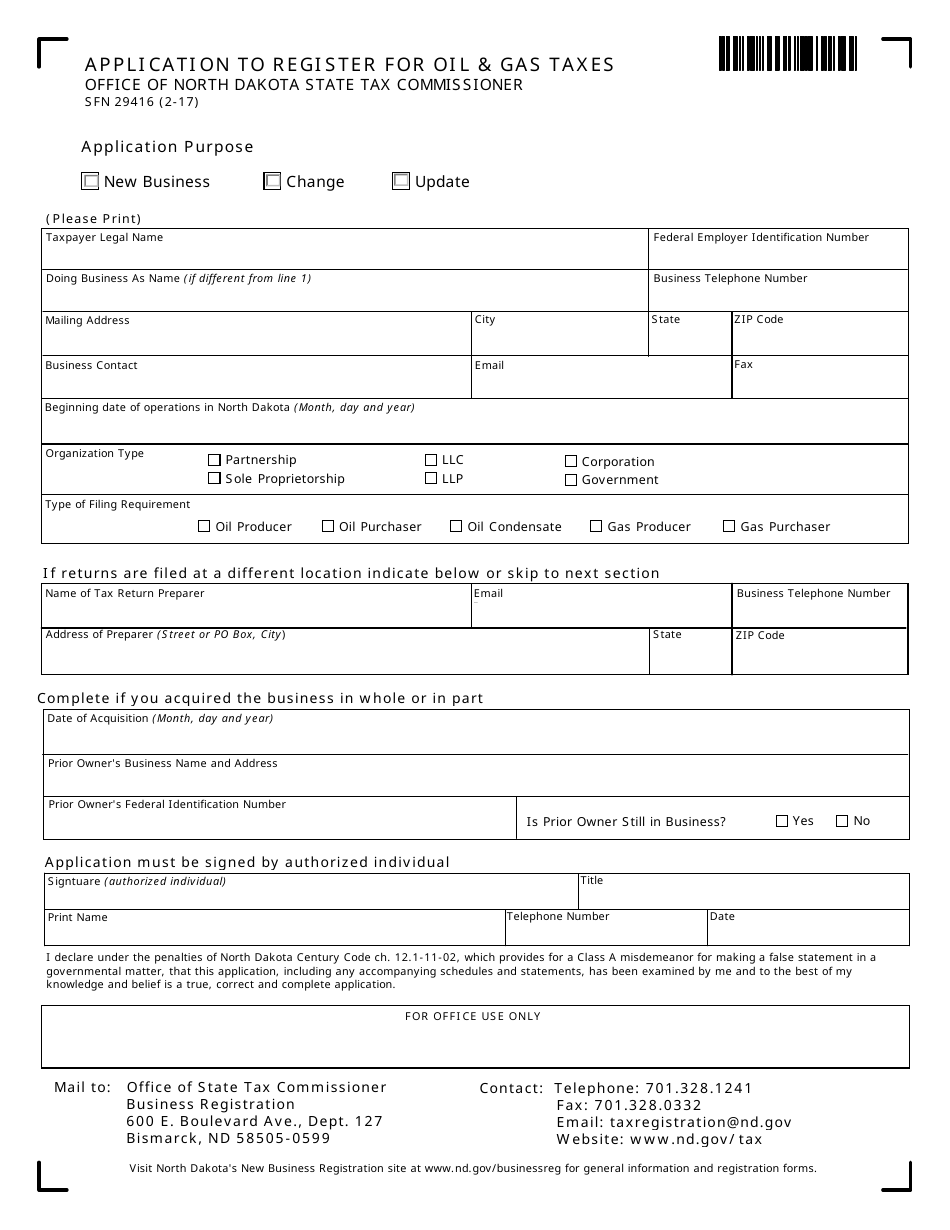

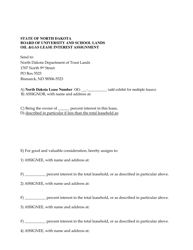

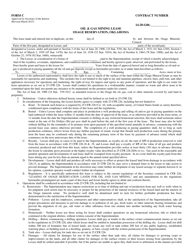

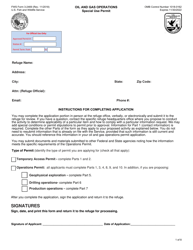

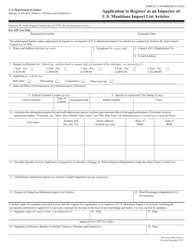

Q: What information is required on the Form SFN29416?

A: The form requires information such as the applicant's name, address, contact information, details of oil & gas operations, and ownership interests.

Q: Are there any fees associated with filing the Form SFN29416?

A: There are no fees associated with filing this form.

Q: Are there any deadlines for filing the Form SFN29416?

A: The form should be filed within 30 days of commencing oil & gas operations in North Dakota.

Q: What are the consequences of not filing the Form SFN29416?

A: Failure to file this form may result in penalties and interest charges.

Form Details:

- Released on February 1, 2017;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN29416 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.