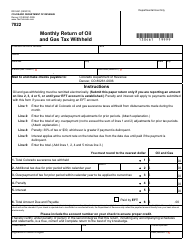

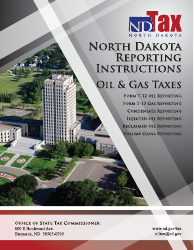

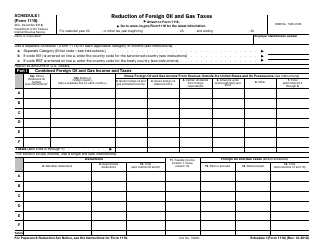

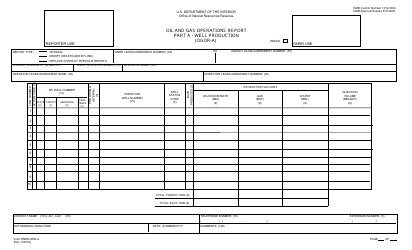

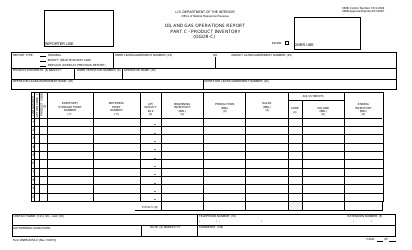

Instructions for Oil and Gas Taxes Reporting - Fort Berthold Reservation - North Dakota

This document was released by North Dakota Office of State Tax Commissioner and contains the most recent official instructions for Oil and Gas Taxes Reporting - Fort Berthold Reservation .

FAQ

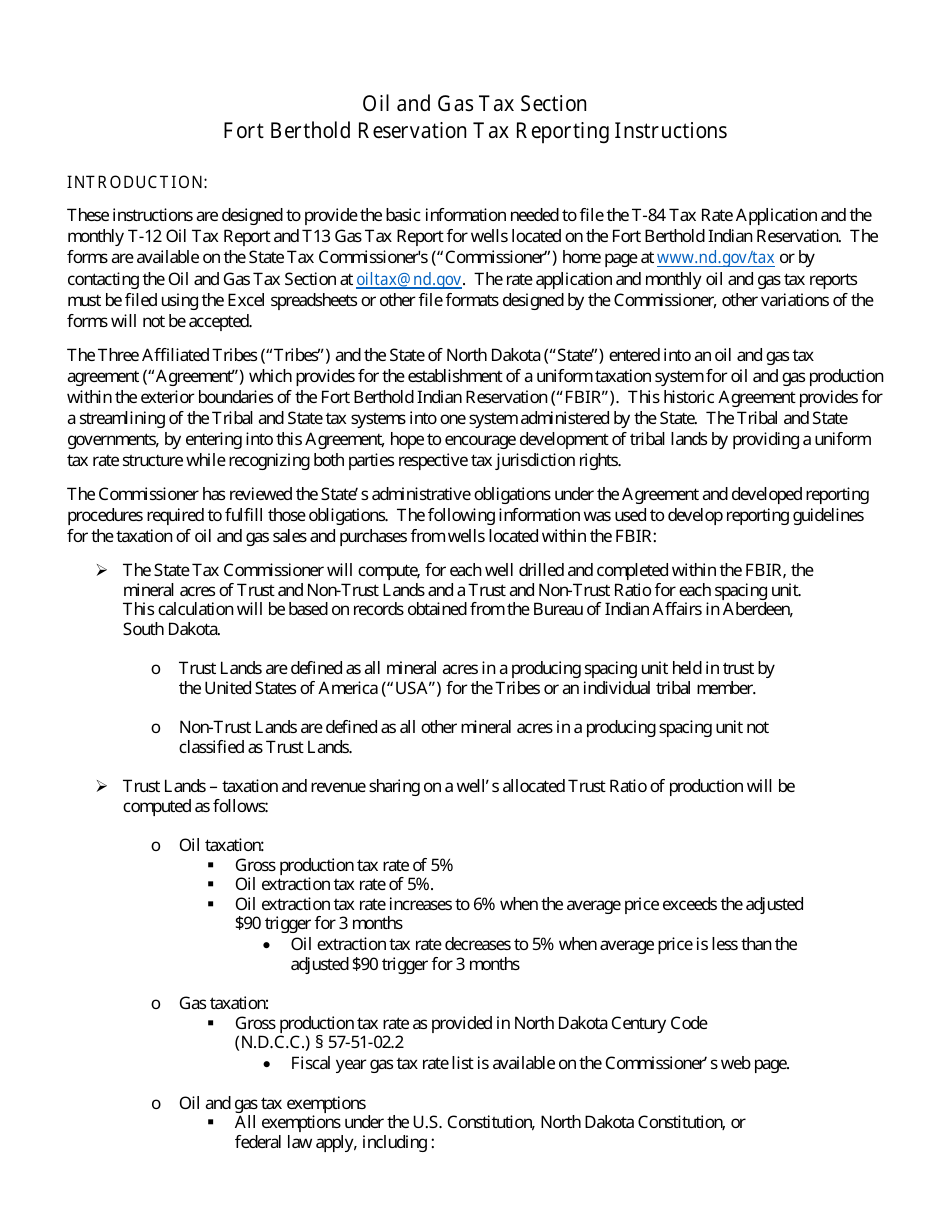

Q: What are the oil and gas taxes on Fort Berthold Reservation in North Dakota?

A: Oil and gas taxes on Fort Berthold Reservation in North Dakota are applicable.

Q: What is the purpose of oil and gas taxes reporting?

A: The purpose of oil and gas taxes reporting is to ensure proper taxation of oil and gas activities on the Fort Berthold Reservation.

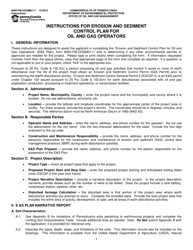

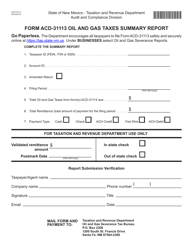

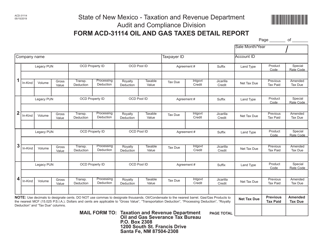

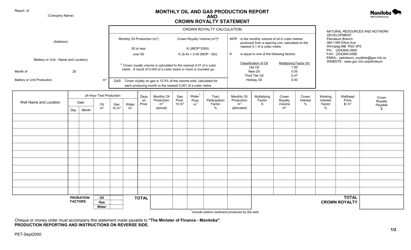

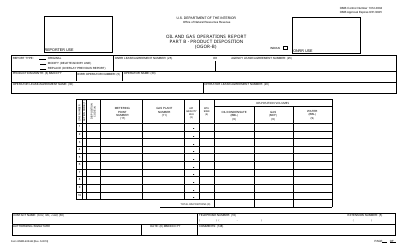

Q: How do I report oil and gas taxes?

A: To report oil and gas taxes, you need to follow the instructions provided by the Fort Berthold Reservation.

Q: Are oil and gas taxes mandatory?

A: Yes, oil and gas taxes are mandatory on Fort Berthold Reservation in North Dakota.

Q: What happens if I don't report oil and gas taxes?

A: Failure to report oil and gas taxes can result in penalties and legal consequences.

Q: Can I get help with oil and gas taxes reporting?

A: Yes, you can seek assistance from the Fort Berthold Reservation authorities for oil and gas taxes reporting.

Q: Are there any specific deadlines for oil and gas taxes reporting?

A: Yes, there are specific deadlines for oil and gas taxes reporting. You should refer to the instructions provided by the Fort Berthold Reservation for the exact deadlines.

Q: What are the consequences of late oil and gas taxes reporting?

A: Late reporting of oil and gas taxes may result in penalties or interest charges.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the North Dakota Office of State Tax Commissioner.