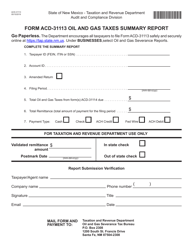

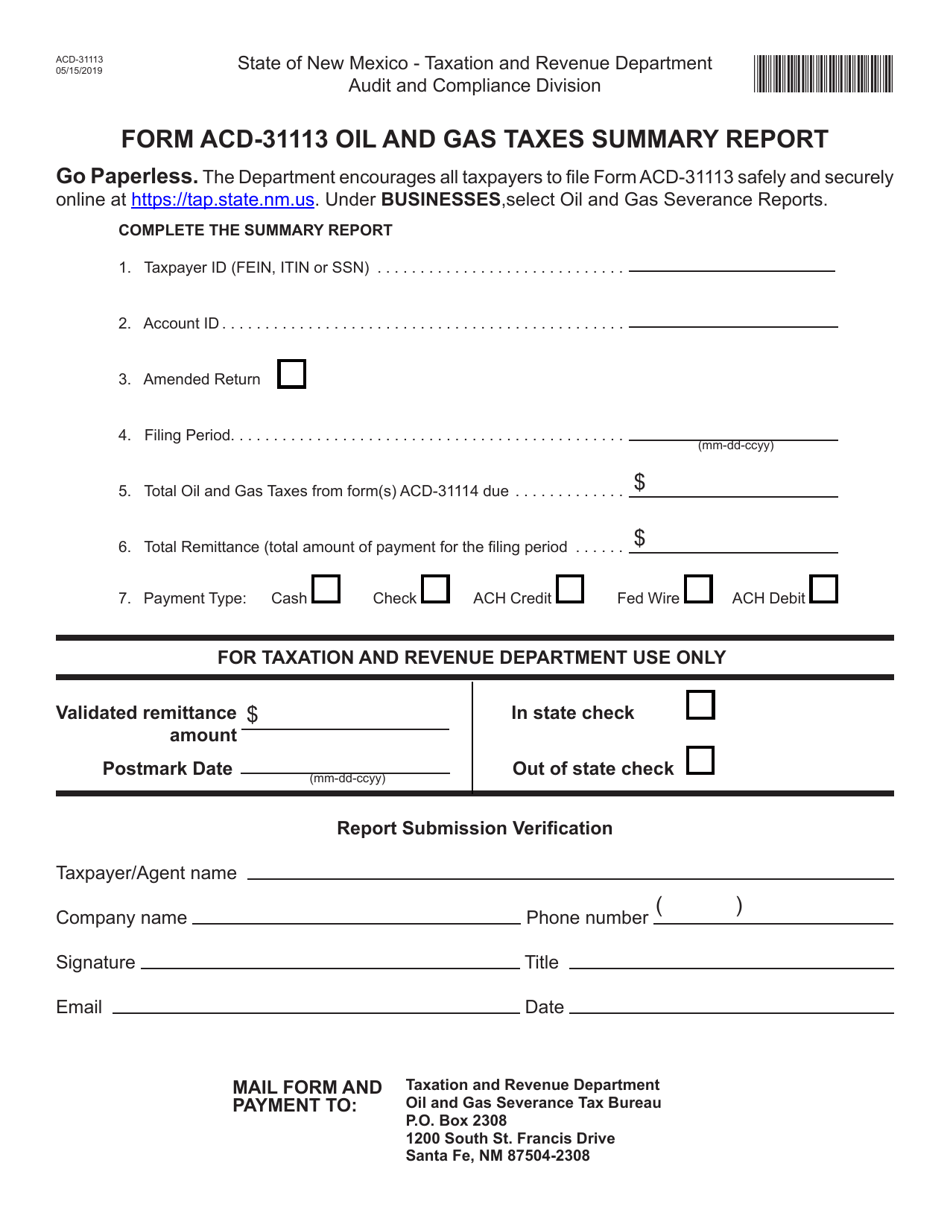

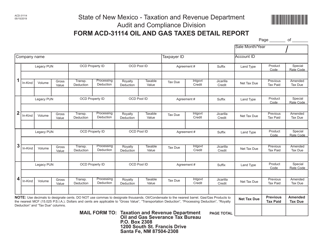

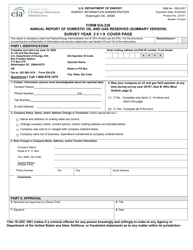

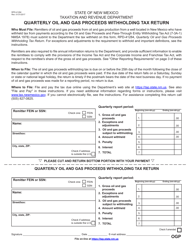

Form ACD-31113 Oil and Gas Taxes Summary Report - New Mexico

What Is Form ACD-31113?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ACD-31113?

A: Form ACD-31113 is the Oil and Gas Taxes Summary Report for New Mexico.

Q: Who needs to file Form ACD-31113?

A: Oil and gas companies operating in New Mexico need to file Form ACD-31113.

Q: What is the purpose of Form ACD-31113?

A: The purpose of Form ACD-31113 is to summarize oil and gas tax information for the state of New Mexico.

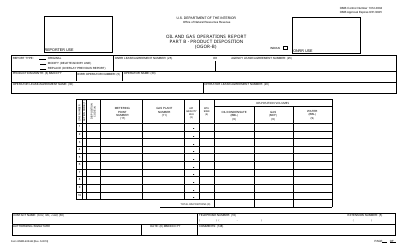

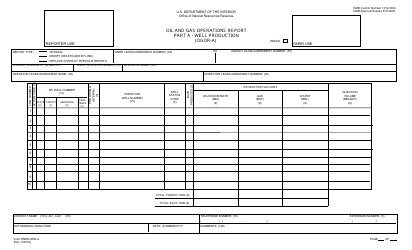

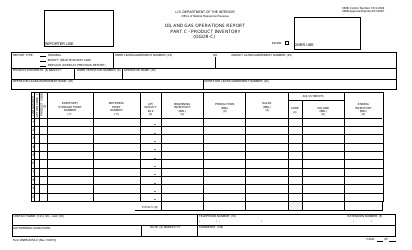

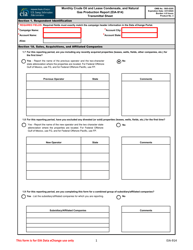

Q: What information is required on Form ACD-31113?

A: Form ACD-31113 requires companies to provide detailed information about oil and gas production, sales, and tax liability.

Q: When is Form ACD-31113 due?

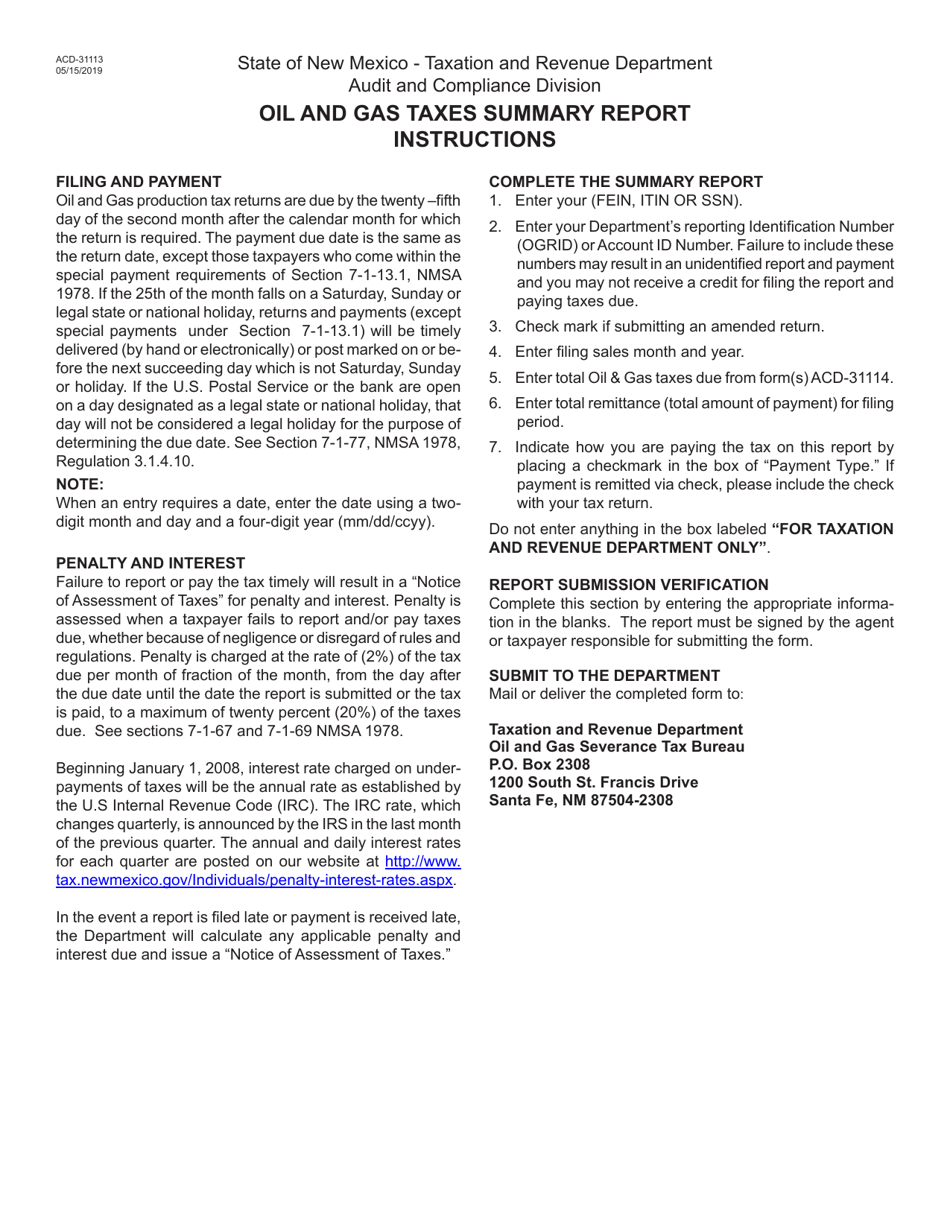

A: Form ACD-31113 is due on the 25th of each month following the end of the reporting period.

Q: Is there a penalty for late filing of Form ACD-31113?

A: Yes, there is a penalty for late filing of Form ACD-31113. The penalty is based on the amount of tax due.

Q: Are there any exemptions or deductions available for oil and gas taxes in New Mexico?

A: Yes, there are exemptions and deductions available for oil and gas taxes in New Mexico. These may include deductions for royalty payments and exemptions for certain types of production.

Form Details:

- Released on May 15, 2019;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ACD-31113 by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.