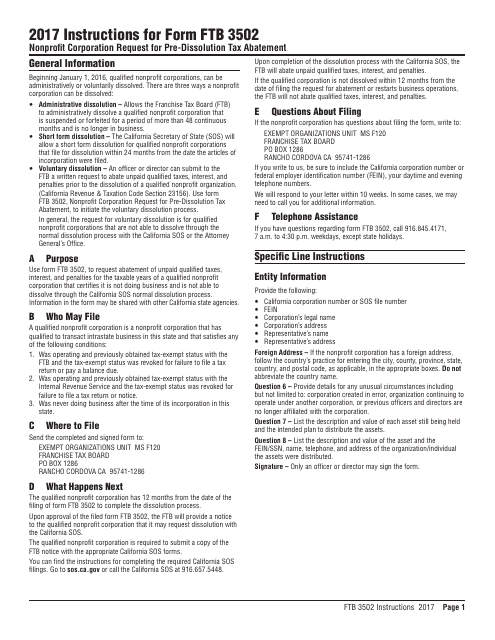

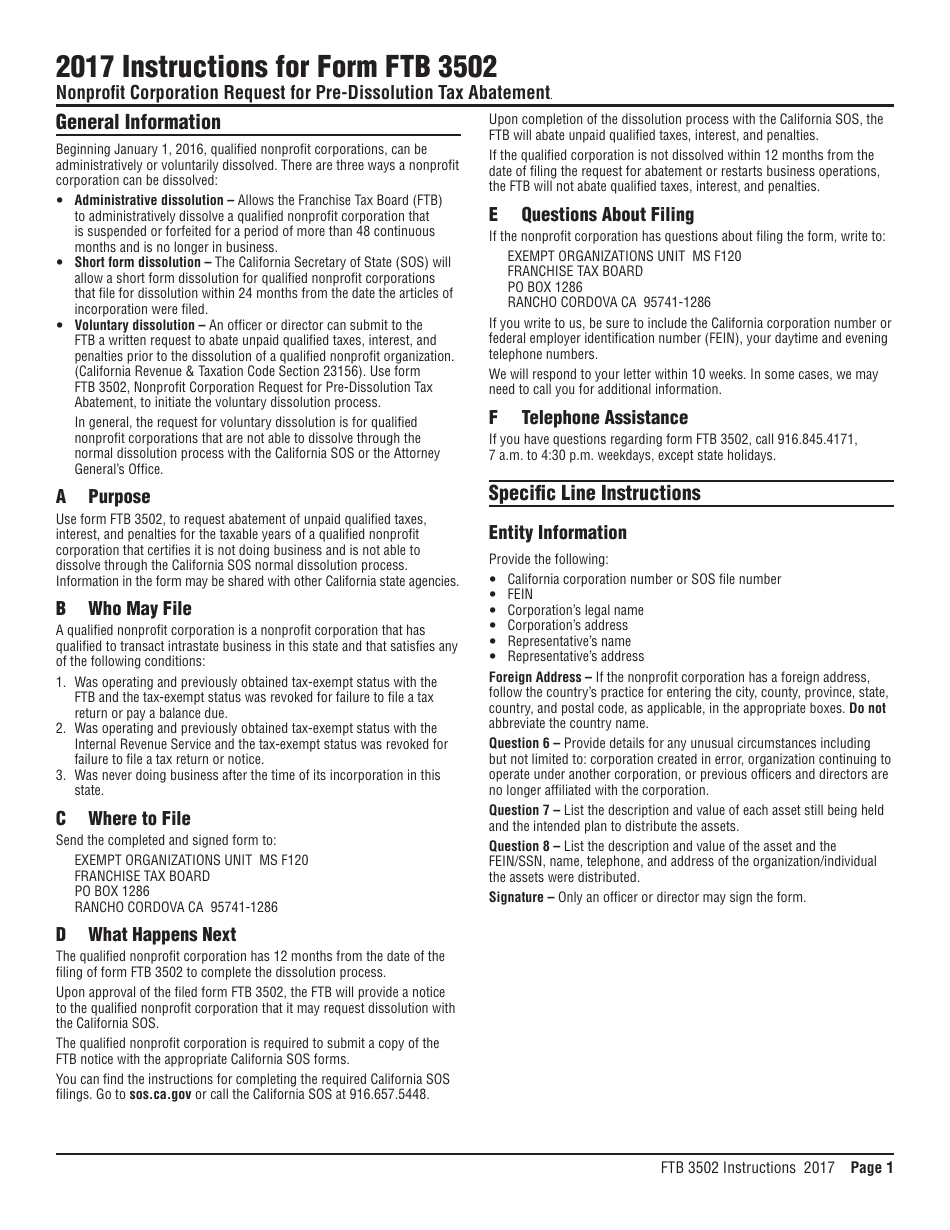

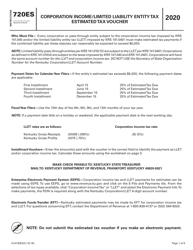

Instructions for Form FTB3502 Nonprofit Corporation Request for Pre-dissolution Tax Abatement - California

This document contains official instructions for Form FTB3502 , Nonprofit Corporation Request for Pre-dissolution Tax Abatement - a form released and collected by the California Franchise Tax Board.

FAQ

Q: What is Form FTB3502?

A: Form FTB3502 is a document used to request pre-dissolution tax abatement for a nonprofit corporation in California.

Q: What is a nonprofit corporation?

A: A nonprofit corporation is a type of organization that is formed for purposes other than generating profit.

Q: What is pre-dissolution tax abatement?

A: Pre-dissolution tax abatement is a process by which a nonprofit corporation can apply to have its tax liabilities forgiven before it officially dissolves.

Q: Who can use Form FTB3502?

A: Form FTB3502 is specifically for nonprofit corporations in California that are seeking pre-dissolution tax abatement.

Q: What information is required on Form FTB3502?

A: Form FTB3502 requires information about the nonprofit corporation's name, address, taxpayer identification number, dissolution date, and reasons for seeking tax abatement.

Q: Are there any fees associated with filing Form FTB3502?

A: No, there are no fees associated with filing Form FTB3502.

Q: How long does it take to process Form FTB3502?

A: The processing time for Form FTB3502 can vary, but it usually takes several weeks.

Q: What happens after submitting Form FTB3502?

A: After submitting Form FTB3502, the California Franchise Tax Board will review the request and notify the nonprofit corporation of their decision.

Instruction Details:

- This 1-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the California Franchise Tax Board.