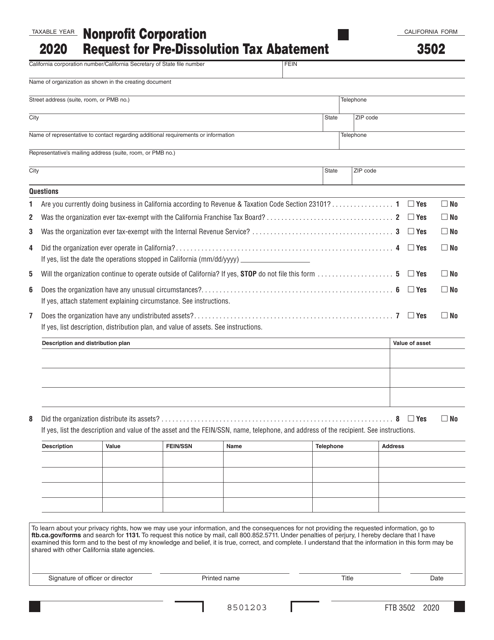

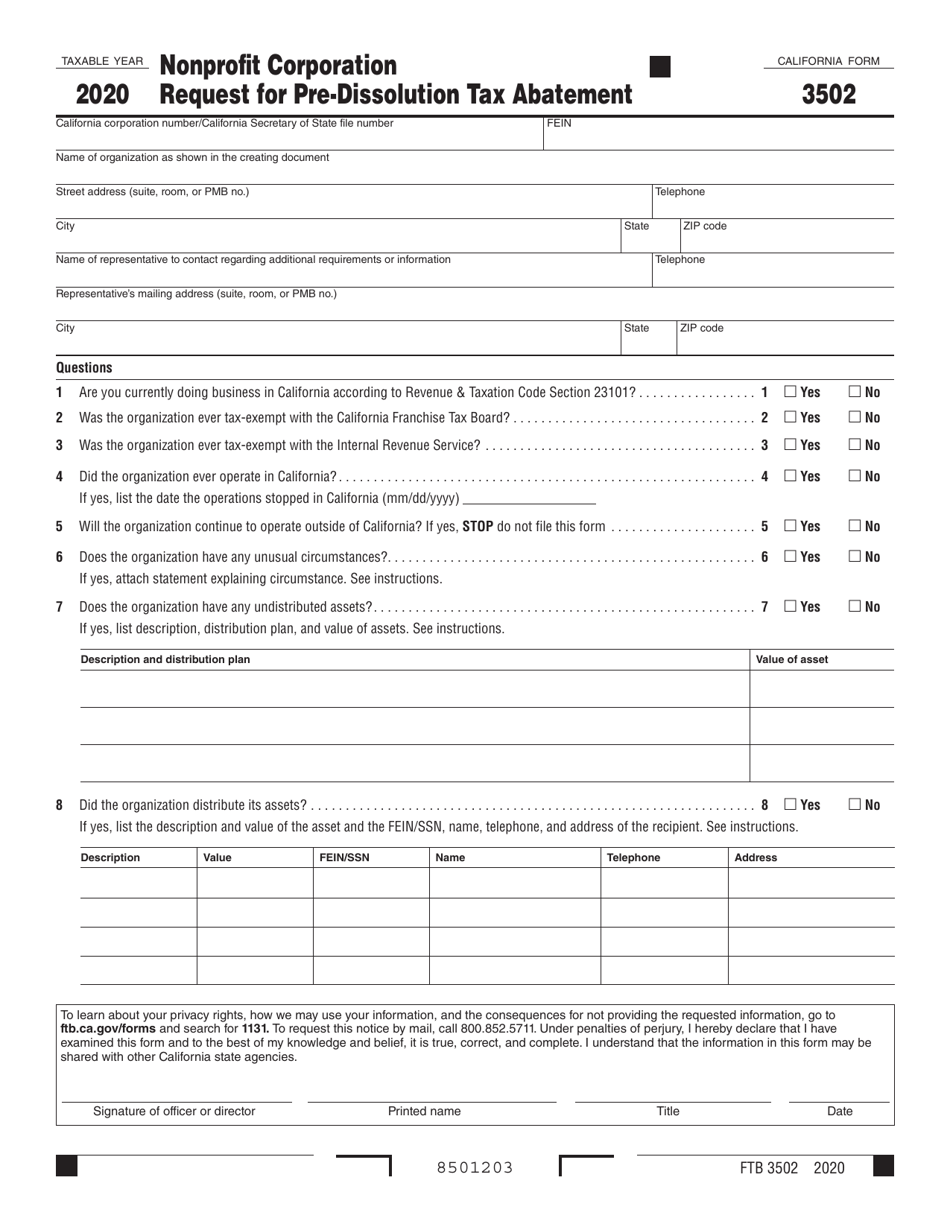

Form FTB3502 Nonprofit Corporation Request for Pre-dissolution Tax Abatement - California

What Is Form FTB3502?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3502?

A: Form FTB3502 is the Nonprofit Corporation Request for Pre-dissolution Tax Abatement form in California.

Q: Who is eligible to submit Form FTB3502?

A: Nonprofit corporations in California that are planning to dissolve their operations may be eligible to submit Form FTB3502.

Q: What is the purpose of Form FTB3502?

A: The purpose of Form FTB3502 is to request a tax abatement for the period between the effective date of dissolution and the final tax return due date.

Q: What information is required on Form FTB3502?

A: Form FTB3502 requires information about the nonprofit corporation's name, address, date of dissolution, and the reason for dissolution.

Q: When should Form FTB3502 be submitted?

A: Form FTB3502 should be submitted prior to the effective date of dissolution and before the filing of the final tax return.

Q: What are the benefits of submitting Form FTB3502?

A: Submitting Form FTB3502 allows the nonprofit corporation to request a tax exemption for the period between dissolution and the final tax return due date.

Q: Are there any fees associated with submitting Form FTB3502?

A: There are no fees associated with submitting Form FTB3502.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3502 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.