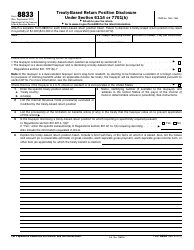

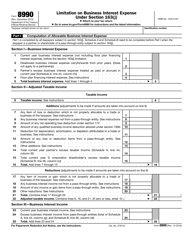

Instructions for IRS Form 8926 Disqualified Corporate Interest Expense Disallowed Under Section 163(J) and Related Information

This document contains official instructions for IRS Form 8926 , Disqualified Corporate Interest Expense Disallowed Under Section 163(J) and Related Information - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 8926?

A: IRS Form 8926 is a form used to report disqualified corporate interest expense disallowed under Section 163(J) of the tax code.

Q: What is disqualified corporate interest expense?

A: Disqualified corporate interest expense refers to interest expense that does not qualify for a tax deduction under Section 163(J).

Q: What is Section 163(J)?

A: Section 163(J) is a provision in the tax code that limits the amount of deductible interest expense for certain corporations.

Q: Who needs to file IRS Form 8926?

A: Corporations that have disqualified corporate interest expense under Section 163(J) need to file IRS Form 8926.

Q: What information is required on IRS Form 8926?

A: IRS Form 8926 requires information about the corporation, its disqualified interest expense, and related details.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.