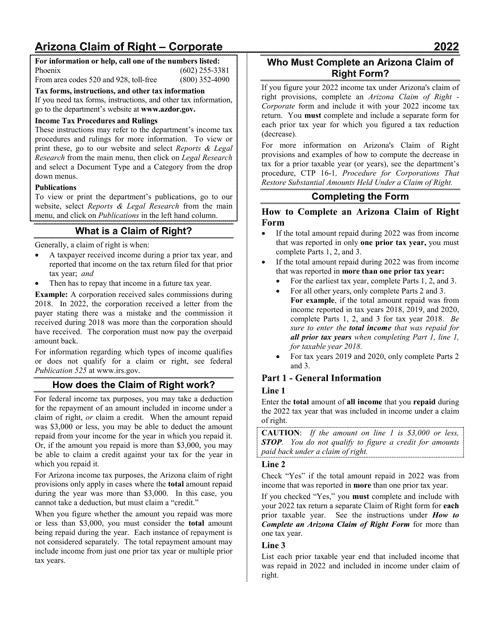

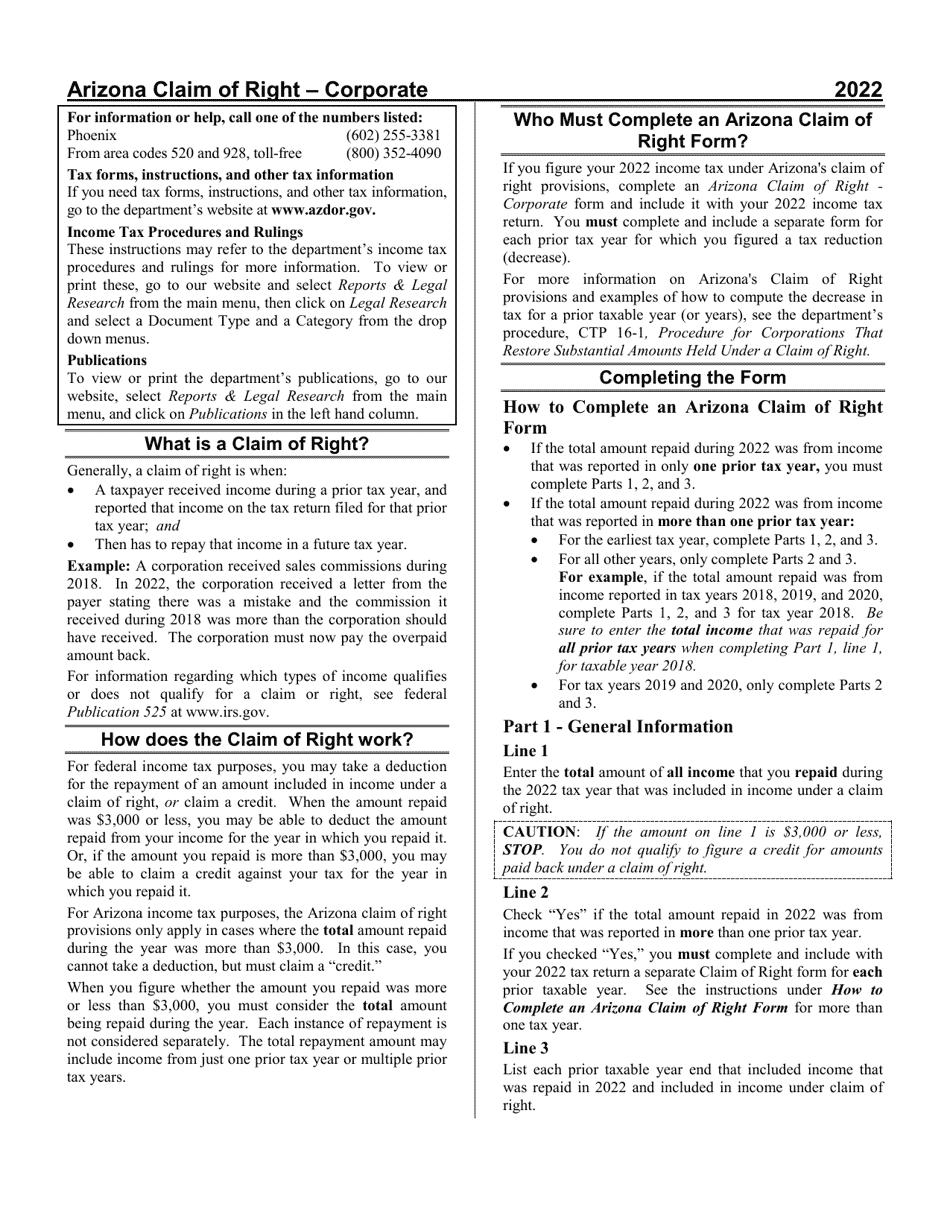

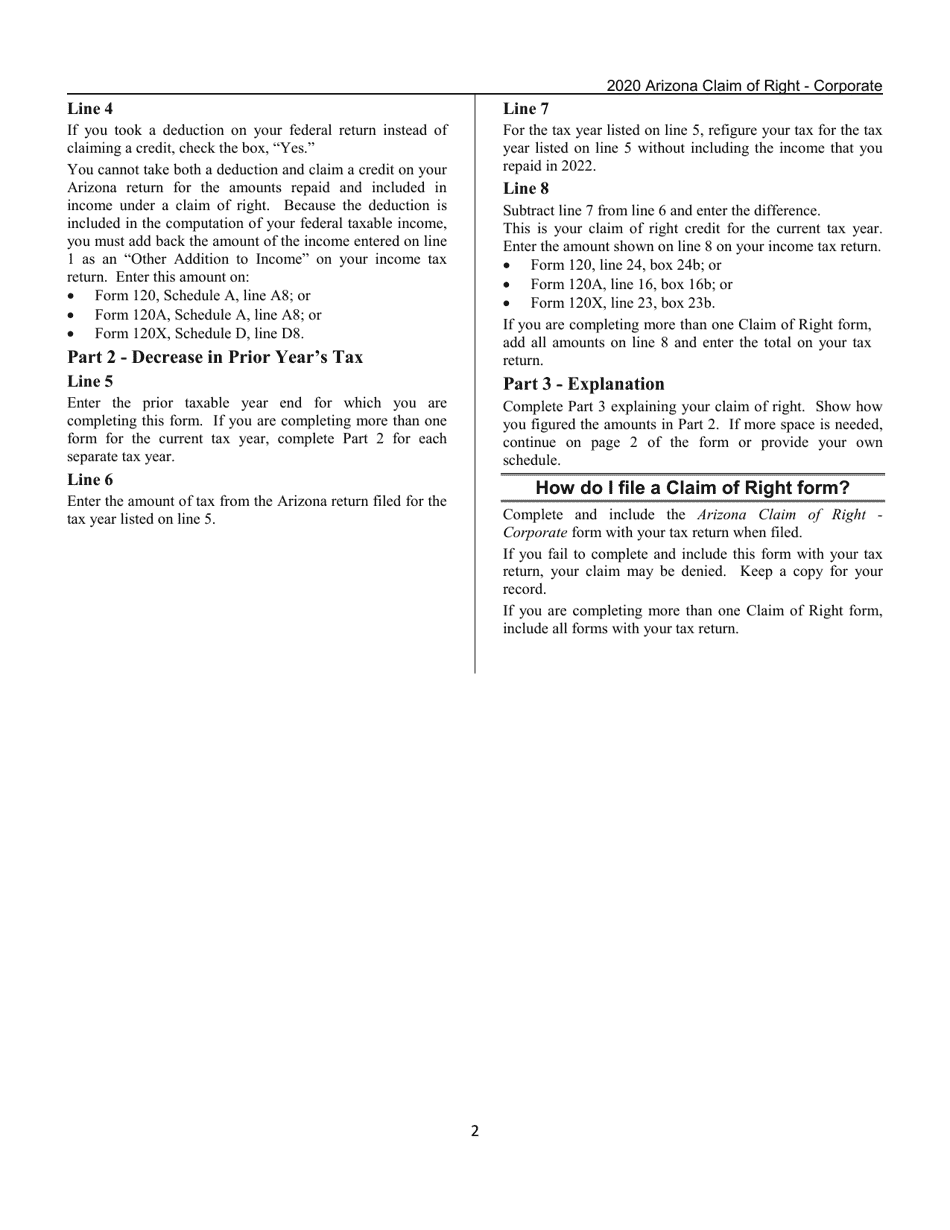

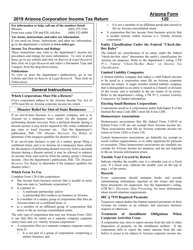

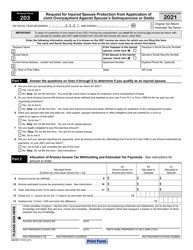

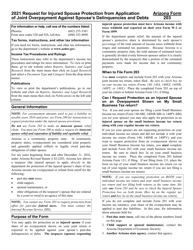

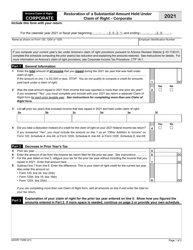

Instructions for Arizona Form CLAIM OF RIGHT - CORPORATE, ADOR11289 Restoration of a Substantial Amount Held Under Claim of Right - Corporate - Arizona

This document contains official instructions for Arizona Form CLAIM OF RIGHT - CORPORATE , and Form ADOR11289 . Both forms are released and collected by the Arizona Department of Revenue.

FAQ

Q: What is the Arizona Form CLAIM OF RIGHT - CORPORATE, ADOR11289?

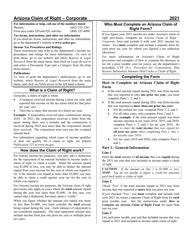

A: It is a form used for the Restoration of a Substantial Amount Held Under Claim of Right, specifically for corporations in Arizona.

Q: What is the purpose of this form?

A: The purpose of this form is to request the restoration of a substantial amount of money or property that was held under a claim of right by a corporation.

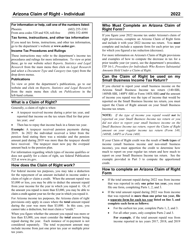

Q: Who should use this form?

A: This form should be used by corporations in Arizona who need to restore a substantial amount of money or property held under a claim of right.

Q: Are there any fees associated with filing this form?

A: No, there are no fees associated with filing this form.

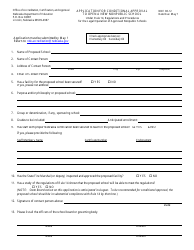

Q: Are there any specific requirements or attachments that need to be included with this form?

A: Yes, you will need to include a detailed explanation of the claim of right, copies of any relevant documents, and any supporting evidence.

Q: What should I do if I need assistance with completing this form?

A: If you need assistance with completing this form, you can contact the Arizona Department of Revenue for guidance.

Q: Is this form only applicable to corporations in Arizona?

A: Yes, this form is specifically for corporations in Arizona.

Q: Is there a deadline for submitting this form?

A: There is no specific deadline mentioned for submitting this form, but it is recommended to submit it as soon as possible.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.