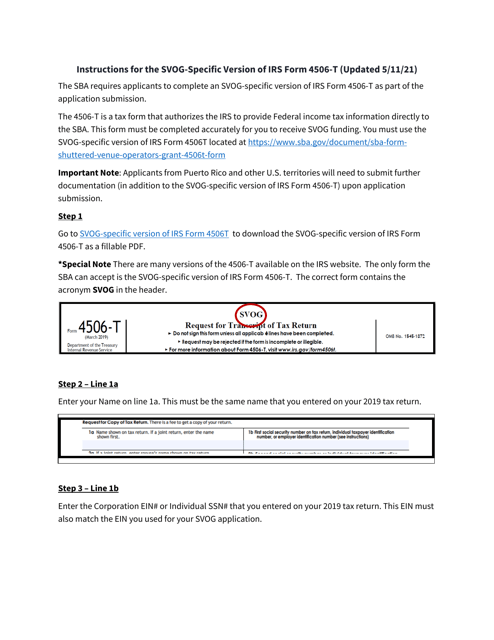

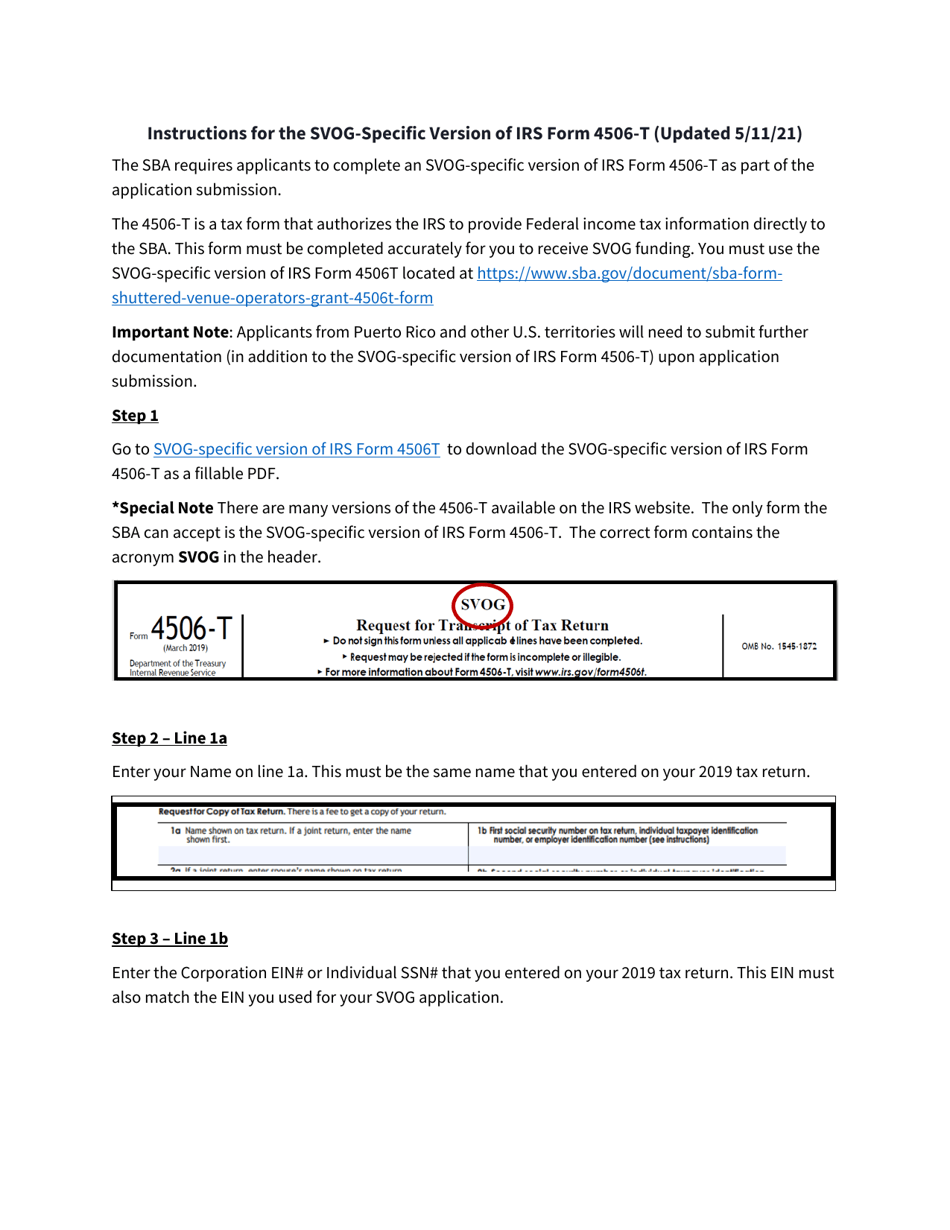

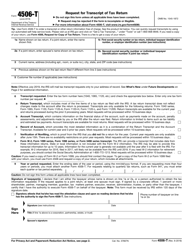

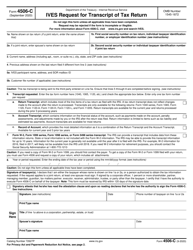

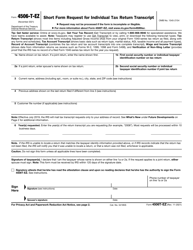

Instructions for IRS Form 4506-T Svog Request for Transcript of Tax Return

This document contains official instructions for IRS Form 4506-T , Svog Request for Transcript of Tax Return - a form released and collected by the U.S. Small Business Administration.

FAQ

Q: What is IRS Form 4506-T?

A: IRS Form 4506-T is a request form used to obtain a transcript of your tax return.

Q: Why would I need to request a transcript of my tax return?

A: You may need a transcript of your tax return for various reasons, such as applying for a loan, obtaining a mortgage, or verifying your income.

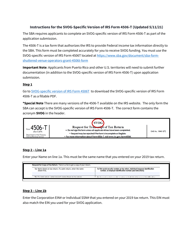

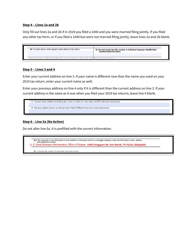

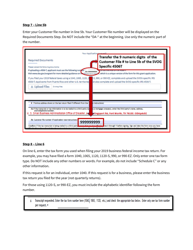

Q: What information do I need to provide on Form 4506-T?

A: You will need to provide your name, Social Security number, address, and the tax year or years for which you are requesting the transcript.

Q: Can I request a transcript for someone else?

A: Yes, you can request a transcript for someone else if you have proper authorization, such as a power of attorney or a signed consent form.

Q: How long does it take to receive a transcript?

A: It typically takes the IRS about 10 business days to process your request and mail the transcript to you.

Q: Is there a fee for requesting a transcript?

A: As of 2021, there is no fee for requesting a transcript of your tax return.

Q: Can I request a copy of my actual tax return?

A: No, Form 4506-T is used to request a transcript of your tax return, not a copy of the actual return.

Q: What should I do if I need an actual copy of my tax return?

A: You can request a copy of your tax return by filing Form 4506 with the IRS. There is a fee for this service.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the U.S. Small Business Administration.