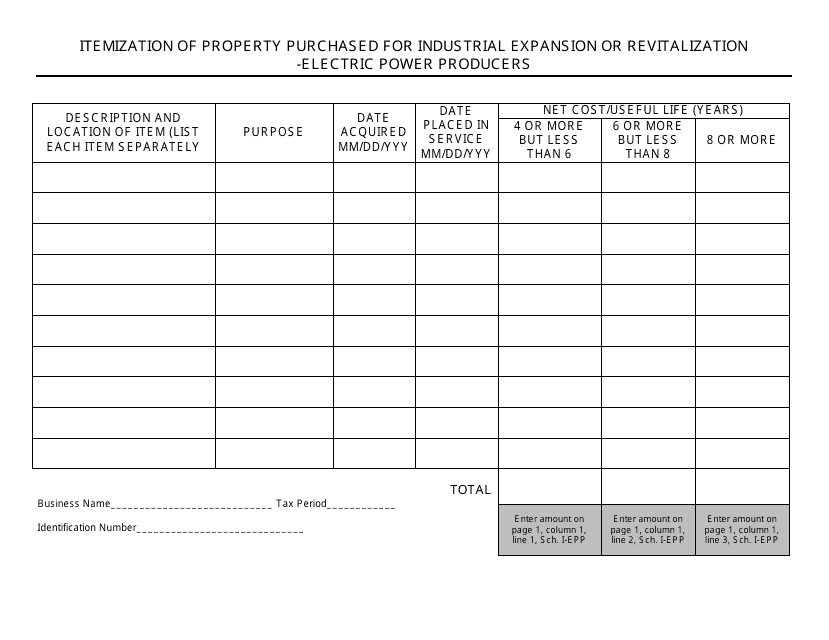

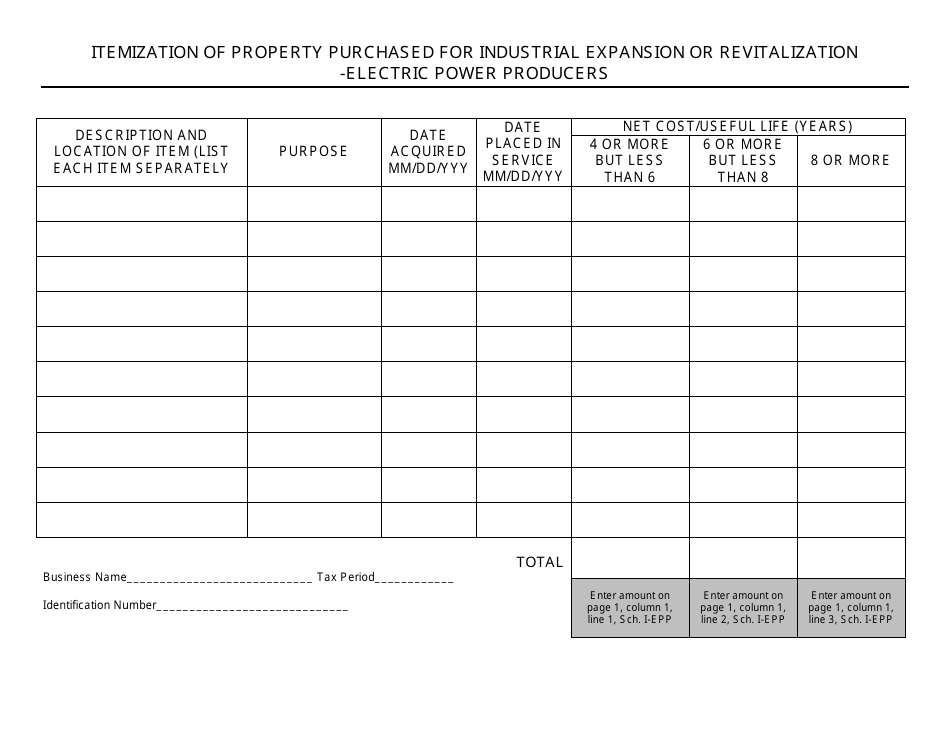

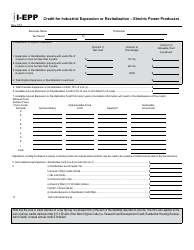

Schedule I-EPP Property List - Itemization of Property Purchased for Industrial Expansion or Revitalization - Electric Power Producers - West Virginia

What Is Schedule I-EPP?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule I-EPP Property List?

A: Schedule I-EPP Property List is an itemization of property purchased for industrial expansion or revitalization, specifically for electric power producers.

Q: What is the purpose of Schedule I-EPP Property List?

A: The purpose of Schedule I-EPP Property List is to provide a comprehensive record of property purchases made by electric power producers for industrial expansion or revitalization in West Virginia.

Q: Who is required to submit a Schedule I-EPP Property List?

A: Electric power producers in West Virginia are required to submit a Schedule I-EPP Property List if they have purchased property for industrial expansion or revitalization.

Q: What kind of property is included in Schedule I-EPP Property List?

A: Schedule I-EPP Property List includes property purchased by electric power producers for industrial expansion or revitalization purposes.

Q: What is the significance of Schedule I-EPP Property List for electric power producers?

A: Schedule I-EPP Property List helps electric power producers document their property purchases for industrial expansion or revitalization, which may have certain tax implications or incentives associated with them.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule I-EPP by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.