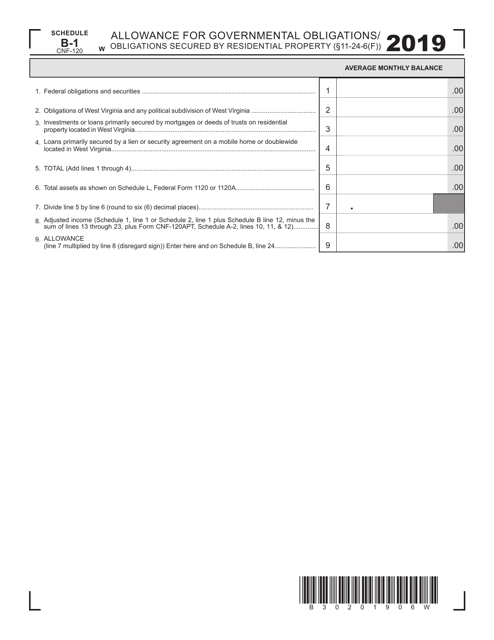

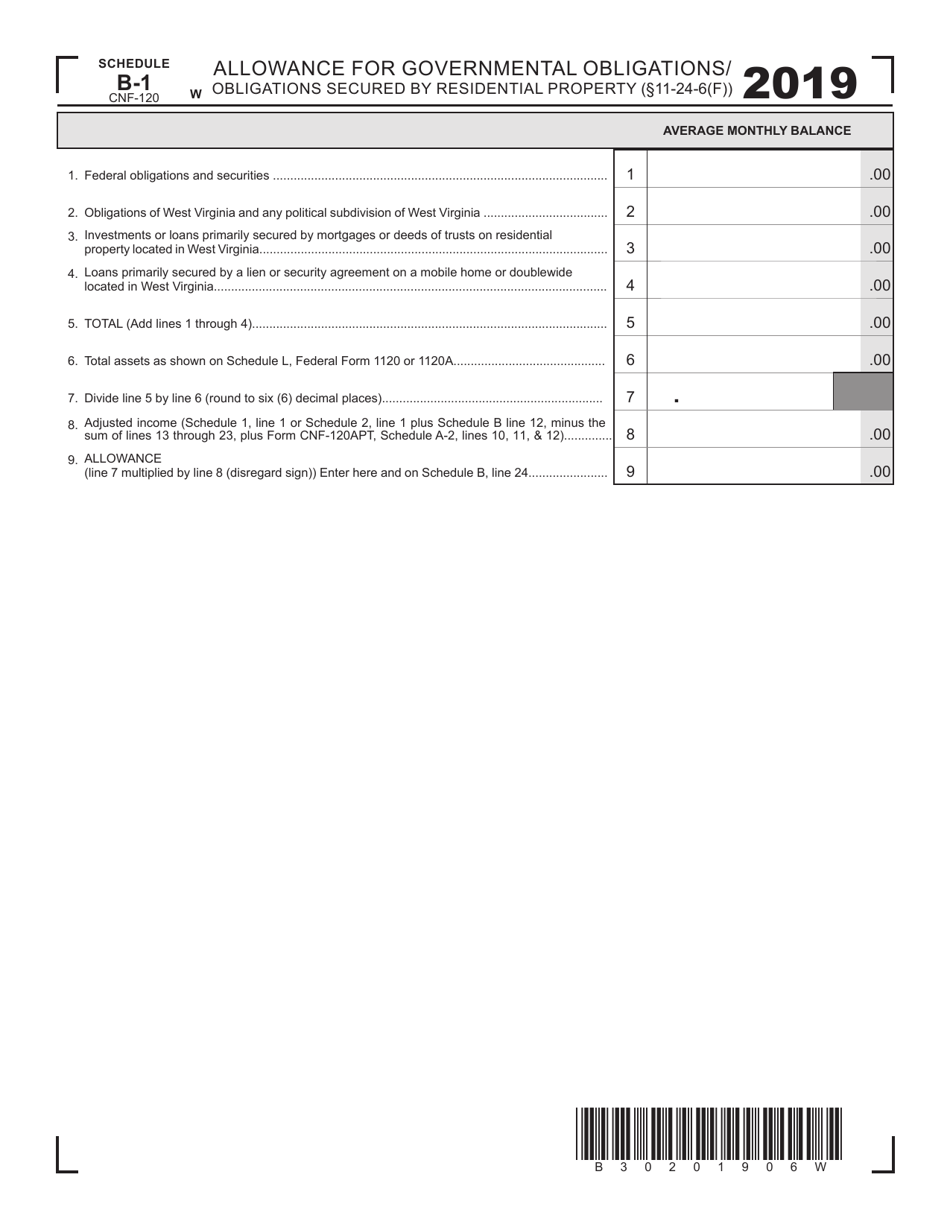

Form CNF-120 Schedule B-1 Allowance for Governmental Obligations / Obligations Secured by Residential Property - West Virginia

What Is Form CNF-120 Schedule B-1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia.The document is a supplement to Form CNF-120, Corporation Net Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CNF-120?

A: Form CNF-120 is used to report Allowance for Governmental Obligations / Obligations Secured by Residential Property in West Virginia.

Q: What is Schedule B-1?

A: Schedule B-1 is a section of Form CNF-120 used to report the details of Allowance for Governmental Obligations / Obligations Secured by Residential Property.

Q: What does Allowance for Governmental Obligations / Obligations Secured by Residential Property mean?

A: Allowance for Governmental Obligations / Obligations Secured by Residential Property refers to the funds set aside by a financial institution to cover potential losses from loans secured by residential property.

Q: What is the purpose of reporting this information?

A: The purpose of reporting Allowance for Governmental Obligations / Obligations Secured by Residential Property is to provide transparency and accountability in the financial sector.

Q: Who is required to file Form CNF-120 Schedule B-1 in West Virginia?

A: Financial institutions, such as banks and credit unions, are required to file Form CNF-120 Schedule B-1 in West Virginia.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CNF-120 Schedule B-1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.