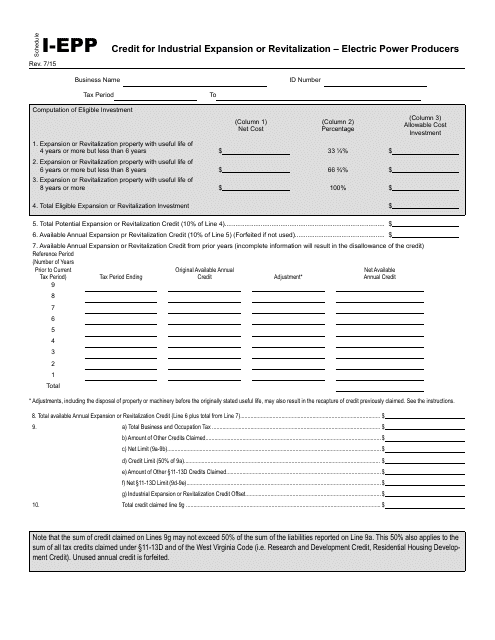

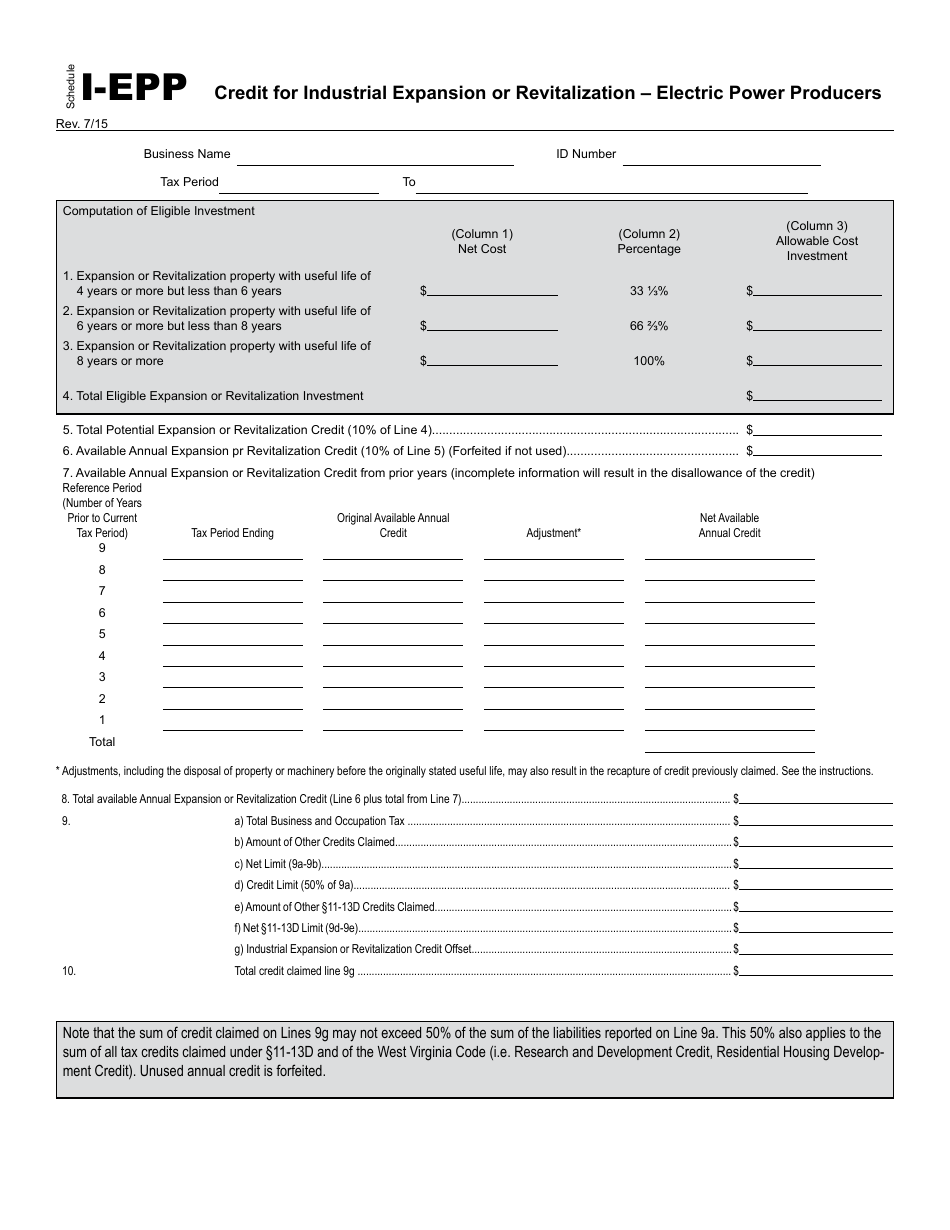

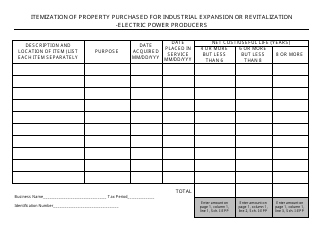

Schedule I-EPP Credit for Industrial Expansion or Revitalization - Electric Power Producers - West Virginia

What Is Schedule I-EPP?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule I-EPP Credit?

A: Schedule I-EPP Credit is a tax credit provided for electric power producers in West Virginia who are involved in industrial expansion or revitalization.

Q: Who is eligible for the Schedule I-EPP Credit?

A: Electric power producers in West Virginia who are engaged in industrial expansion or revitalization are eligible for the Schedule I-EPP Credit.

Q: What is the purpose of the Schedule I-EPP Credit?

A: The purpose of the Schedule I-EPP Credit is to incentivize electric power producers to contribute to the industrial expansion and revitalization of West Virginia.

Q: How can electric power producers claim the Schedule I-EPP Credit?

A: Electric power producers can claim the Schedule I-EPP Credit by filing the required documentation with the appropriate tax authorities.

Q: What are the benefits of the Schedule I-EPP Credit?

A: The Schedule I-EPP Credit provides tax incentives for electric power producers, which can help stimulate industrial growth and development in West Virginia.

Q: Are there any limitations to the Schedule I-EPP Credit?

A: Yes, there may be limitations or restrictions associated with the Schedule I-EPP Credit. Eligible electric power producers should consult the relevant tax laws and regulations for more information.

Q: Is the Schedule I-EPP Credit available in other states?

A: No, the Schedule I-EPP Credit is specific to West Virginia and is not available in other states.

Form Details:

- Released on July 1, 2015;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule I-EPP by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.