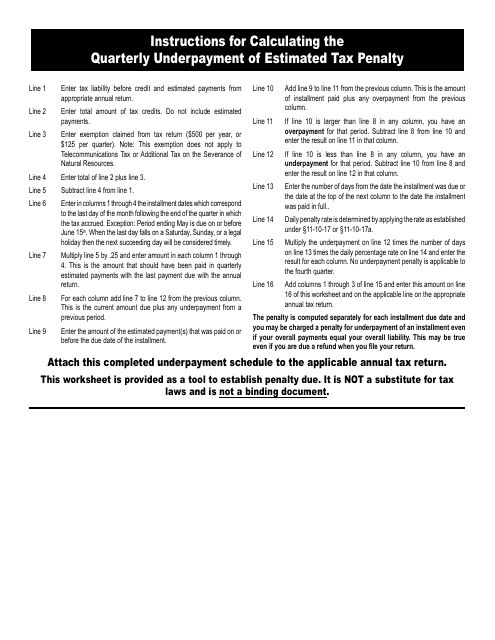

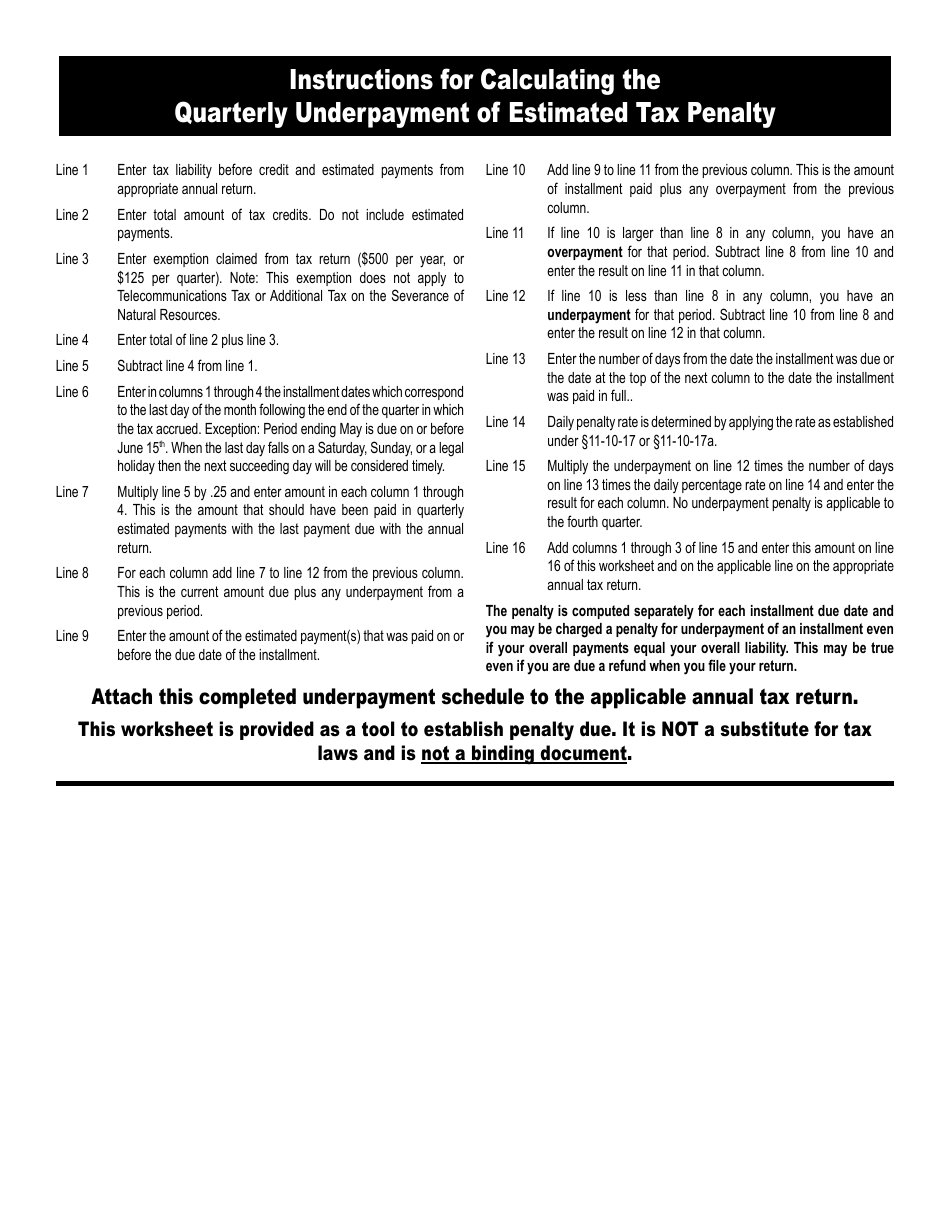

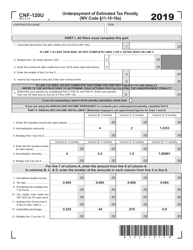

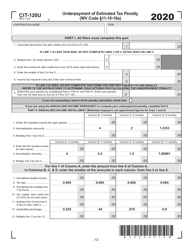

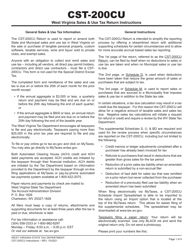

Instructions for Calculating the Quarterly Underpayment of Estimated Tax Penalty - West Virginia

This document was released by West Virginia State Tax Department and contains the most recent official instructions for Calculating the Quarterly Underpayment of Estimated Tax Penalty .

FAQ

Q: What is the Quarterly Underpayment of Estimated Tax Penalty?

A: The Quarterly Underpayment of Estimated Tax Penalty is a penalty imposed by the government for not paying enough estimated tax throughout the year.

Q: Who needs to calculate the Quarterly Underpayment of Estimated Tax Penalty?

A: Anyone who is required to pay estimated taxes and did not accurately estimate and pay enough tax throughout the year.

Q: How is the Quarterly Underpayment of Estimated Tax Penalty calculated?

A: The penalty is calculated based on the amount of underpayment and the interest rate specified by the government.

Q: When do I need to calculate the Quarterly Underpayment of Estimated Tax Penalty?

A: You should calculate the penalty when preparing your annual tax return if you did not accurately estimate and pay enough tax throughout the year.

Q: Why is the Quarterly Underpayment of Estimated Tax Penalty imposed?

A: The penalty is imposed to encourage individuals to accurately estimate and pay enough tax throughout the year to avoid a large tax bill or penalty at the end of the year.

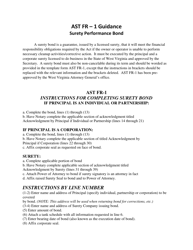

Q: Are there any exceptions or exemptions to the Quarterly Underpayment of Estimated Tax Penalty?

A: Yes, there are certain exceptions and exemptions available. You should consult the official tax regulations or a tax professional for more information.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the West Virginia State Tax Department.